BEFORE THE ILLINOIS POLLUTION CONTROL BOARD

AMEREN ENERGY GENERATING

COMPANY, AMERENENERGY RESOURCES

GENERATING COMPANY, AND ELECTRIC

ENERGY, INC.,

Petitioners,

v.

ILLINOIS ENVIRONMENTAL PROTECTION

AGENCY,

Respondent.

)

)

)

)

)

)

)

)

)

)

)

)

)

PCB 09-21

(Variance - Air)

NOTICE OF FILING

To:

ALL PARTIES ON THE ATTACHED SERVICE LIST

PLEASE TAKE NOTICE that we have today electronically filed with the Office

of the

Clerk

of the Pollution Control Board

MOTION FOR RECONSIDERATION

and

WAIVER

OF DECISION DEADLINE,

copies of which are herewith served up, n you.

Dated: February 19, 2009

Renee Cipriano

Kathleen

C. Bassi

SCHIFF HARDIN LLP

6600 Sears Tower

233 South Wacker Drive

Chicago, Illinois 60606

312-258-5500

Electronic Filing - Received, Clerk's Office, February 19, 2009

BEFORE THE ILLINOIS POLLUTION CONTROL BOARD

A:MEREN ENERGY GENERATING

COMPANY,AMERENENERGYRESOURCES

GENERATING COMPANY,

AND ELECTRIC

ENERGY, INC.,

Petitioners,

v.

ILLINOIS ENVIRON:MENTAL PROTECTION

AGENCY,

Respondent.

)

)

)

)

)

)

)

)

)

)

)

)

)

PCB 09-21

(Variance - Air)

MOTION FOR RECONSIDERATION

NOW COME the Petitioners, AMEREN ENERGY GENERATING COMPANY,

AMERENENERGY RESOURCES GENERATING COMPANY, and ELECTRIC ENERGY,

INC. (collectively, "Ameren," "Petitioners," or the "Company"),

by and through their attorneys,

SCHIFF HARDIN LLP, and pursuant to 35 Ill. Adm. Code

§ 101.520 move the Illinois Pollution

Control Board ("Board") for reconsideration

of its January 22,2009, Opinion and Order

("Order") denying Petitioners' request for variance from a single provision

of the Illinois Multi-

Pollutant Standard ("MPS"), 35 Ill. Adm. Code

§ 225.233, for a two-year period commencing

January 1,2013, and ending December 31, 2014. This motion is filed in accordance with the

requirements

of 35 Ill. Adm. Code § 101.520.

In

issuing its denial, the Board fundamentally

misconstrues whether such relief was "permanent" or "temporary" in nature. Ameren

respectfully requests that the Board reverse its finding that the Petition for Variance ("Petition")

was not the proper regulatory relief mechanism to obtain temporary relief from Section

225.233(e)

of the MPS. In addition, because the statutory decision deadline of 120 days from

-1-

Electronic Filing - Received, Clerk's Office, February 19, 2009

original filing has elapsed, Ameren requests that the Board consider Ameren's Petition on its

merits based on the record as incorporated under PCB 09-21

by March 25,2009. Because time

is

of the essence and the relief sought is of critical importance to Ameren, with the concurrence

of the Illinois Environmental Protection Agency ("IEPA" or "Agency") Ameren has filed within

the pending rulemaking entitled

In the Matter of. Proposed Amendments to

35

Ill. Adm. Code

225 Control

ofEmissions from Large Combustion Sources,

Docket No. R09-10 an amendment to

the MPS incorporating the emission rate revisions contemplated

by the Petition.

I.

INTRODUCTION

In

order to comply with the MPS's emission rate for sulfur dioxide

("SOz")

in 2013,

Ameren will need to construct five to six scrubbers at four

of its power stations. The design,

construction, and procurement lead times require the commencement

of such activities in early

2009. At the same time, the regulatory horizon - ranging from the off-again, on-again status

of

CAIR and the prospect of carbon legislation - could not be more murky. The economy is now in

near collapse with capital markets all but closed to most companies. Construction projects

associated with environmental requirements range in the billions

of dollars, the vast majority of

which must be financed in a practically inaccessible capital market. All of these factors drove

Ameren to seek a single revision to the MPS so that critical decision-making that potentially

impacts the long-term viability

of these generating assets can be prudently made. The revision

proposed

by Ameren will, in effect, allow the Company to defer a portion of critical capital

expenditures over a narrow two-year window during which time the regulatory framework

should become more certain and stability should return to the capital market.

At the same time,

construction projects relating to mercury control, including the completion

of three scrubbers,

will continue unabated.

-2-

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren's Petition sought temporary relief from a single S02 emission rate found within

Section 225.233(e)

of the MPS, for a limited period of time. The form of relief was chosen

because (a)

Ameren will ultimately comply with the S02 emission rate no later than January 1,

2015; and (b) most importantly, because of construction lead time, the timing of such temporary

relief is extremely critical. A variance petition was and is the most certain mechanism for

timely, temporary relief. Mindful that any changes to the MPS could be considered

controversial,

Ameren worked closely with the Agency to ensure that Ameren's request included

conditions to offset any environmental impact resulting from the temporary relief. Notably, the

Agency did not object to the form or nature

of the variance request with the inclusion of the

proposed conditions. However, since the variance conditions comprised various rates different

from those currently codified in the MPS, the Agency requested that such rates be folded into a

permanent regulation.

In

addition to still needing the temporary variance relief, Ameren agreed

to pursue an amendment to the MPS to reflect the emission limitations included in the conditions

to the variance. However, Ameren wishes to stress again, the specific relief that Ameren seeks

here and through its Petition is from the requirement to comply with the

S02 emission rate of

0.33 Ibs/mmBtu from January 1,2013, through December 31,2014.

At the regulatory decision deadline, the Board denied Ameren's Petition on procedural

grounds without considering the merits

of the Petition.! Specifically, the Board concluded that

the Petition was

"not appropriate relief for Ameren in that Ameren is seeking to be excused from

compliance and does not plan to comply with the provisions

of Section 225.233(e)(2)(A)."

See

1

Notably, this was the very first indication, of any kind, to Ameren that the Board Majority

believed the regulatory relief mechanism that Ameren pursued was not permissible. Had the Board

Majority's concern been identified in the early stages

of the proceeding, Ameren could have certainly

clarified the nature

of the relief it sought prior to the decision deadline, especially in light of the critical

nature

of the relief sought.

-3-

Electronic Filing - Received, Clerk's Office, February 19, 2009

Order at 1. Ameren respectfully suggests that the Board misconstrued the scope of Ameren's

requested relief. Ameren's request for relief has never been, and will never be, permanent in

nature because Ameren will ultimately achieve compliance with both the 0.33 Ibs/mmBtu SOz

emission rate and the more stringent 0.25 Ibs/mmBtu

SOz emission rate under Section

225.233(e)

of the MPS commencing January 1,2015, and continuing thereafter. In considering

Ameren's request for a variance, the Board effectively placed form over substance when it

determined that Ameren would never comply with the regulation underlying the request for

relief.

Ameren will

be subject to arbitrary and unreasonable hardship if it does not obtain the

relief requested in its Petition. Ameren has demonstrated that there is a net environmental

benefit that would result from its variance with the conditions proposed. Therefore, consistent

with case law and Board precedent, the Board should grant Ameren's variance. Accordingly, in

addition to this motion for reconsideration, Ameren respectfully requests that the Board examine

the merits

of the Petition and grant Petitioner temporary relief from the SOz emission rate during

the period

of January 1,2013, through December 31,2014.

II.

ARGUMENT

Ameren's Petition does not seek permanent relief from Section 225.233(e). Ameren is

not relieved from compliance with the most stringent

SOz emission rate of 0.25 Ibs/mmBtu when

it becomes effective under Section 225.233(e)(2)(B) on January 1,2015. Ameren's compliance

plan requires Ameren to take steps to meet the 0.25 Ibs/mmBtu rate by January 1,2015.

By

taking these steps, Ameren's compliance plan will ensure compliance with the 0.33 Ibs/mmBtu

rate by 2015.

-4-

Electronic Filing - Received, Clerk's Office, February 19, 2009

Moreover, the Board is not precluded from substantively ruling on Ameren'sPetition.

Ameren agrees with Board Member Johnson that the Board'smajority position, in application, is

effectively form over substance. Ameren also agrees to an extension

of the decision deadline as

reasoned

by Board Member Johnson in his dissent and hereby waives the Board'sdecision

deadline to March 25, 2009, the same date that Board Member Johnson calculated is the decision

deadline

if the Response to the Agency's Recommendation were considered an amended

petition. However, Ameren notes that a change in conditions to grant the requested relief should

not restart the 120 variance decision period. Indeed, the Board has the authority to impose

whatever conditions it believes are appropriate when it grants a variance. Accordingly, a waiver

of the decision deadline until March 25, 2009, in accordance with 35 Ill. Adm. Code § 101.308

was filed concurrently with this motion.

A.

The Requested Relief Is Temporary in Nature Because Ameren Will

Ultimately Achieve Compliance with Section 225.233(e)

i.

Regulatory

Requirement for a Variance

The Board has consistently held that the purpose of a variance is to provide a petitioner

with temporary relief from a regulation to allow the petitioner time to take steps necessary to

ultimately achieve compliance.

See, e.g., Dept. of the Army vs. [EPA,

at 2, PCB 92-107 (October

1,1992); Monterey Coal Co. vs. [EPA,

at 4, PCB 91-251 (April 9, 1992). Variances cannot be

used in "succession indefinitely

as a means of attaining de facto permanent relief."

See Dept. of

the Army,

at 2. Accordingly, ultimate compliance with the applicable regulation is the

fundamental goal

of a variance. In this instance, compliance with the 0.33 Ibs/mmBtu S02

emission rate by 2013 will cause Ameren arbitrary and unreasonable hardship because of its

current financial position and the general failure

of the global economy. Ameren has asserted

that it can comply with the 0.25Ibs/mmBtu

S02 emission rate by 2015. Obviously, compliance

-5-

Electronic Filing - Received, Clerk's Office, February 19, 2009

with the more stringent rate subsumes compliance with the less stringent rate. Therefore, under

its compliance plan, Ameren, contrary to the Board' statement at page

15 of its Order, will

comply with the 0.33 Ibs/mmBtu rate required

by Section 225.233(e) and the relief, is, indeed,

temporary.

A variance may not be

of such duration that it prevents a petitioner from ever being

required to achieve compliance with the applicable regulation.

See, generally,

D

&

B Refuse

Service, Inc.

vs. IEPA,

PCB 92-12 (Feb. 6,1992);

Land

&

Lakes Co. vs. IEPA,

PCB 91-217 (Jan.

23, 1992). Ameren'sPetition is not similar in kind to instances where the Board has denied a

variance

on this ground because the variance sought by Ameren does not preclude compliance

with, nor will it result in a continuing violation of, the applicable regulation. Thus,

by means of

comparison, the Board in D

&

B Refuse Service,

denied a petitioner's request for variance on

grounds that the variance effectively precluded the petitioner from ever having to demonstrate

compliance with the applicable regulation.

See

PCB 92-12, at 2-3.

In

D

&

B

Refuse Service,

the

petitioner requested a variance to extend the deadline under which it was allowed to close its

landfill under "old" landfill regulations. The variance effectively would have permitted the

petitioner to operate its landfill under "old" landfill regulations for a period

of time in excess of

what was permitted under the "new" regulations. However, at the end of the petitioner's

requested variance period, the proposed compliance plan did not include a requirement for the

petitioner to come into compliance with the then-effective regulation. Because the variance

precluded the petitioner from ever complying with the controlling regulation, the Board

determined that the petitioner'srequest was one

of permanent relief and thus not appropriately

addressed

by means of a variance.

Id.

at 3.

-6-

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren's compliance plan in its Petition identified meeting a 0.25 Ibs/mmBtu S02

emission rate by January 1,2015.

See

Petition at 29. Ameren chose this emission rate because it

was a rate enumerated in Section 225.233(e)

of the MPS that was more stringent than the 0.33

Ibs/mmBtu

S02 emission rate. Recognizing that Ameren was not seeking relief from, and would

in fact also comply with, the rule's requirement to achieve a 0.25 Ibs/mmBtu

S02 emission rate

in calendar year 2015, it appears that the Board might have found

Ameren'srequested relief a

proper request for a variance

if Ameren had placed a requirement in the compliance plan to

achieve a 0.33 Ibs/mmBtu

S02 emission rate on January 1,2015. Should the Board grant

Ameren's Petition, upon termination

of the variance, the controlling regulation requires Ameren

to comply with the existing 0.25 Ibs/mmBtu

S02 emission rate set forth in the MPS. Because

0.25 Ibs/mmBtu is more stringent than 0.33 mmlBtu, Ameren will not only comply with the 2015

rate but will also comply with the 2013-2014 rate. Accordingly,

Ameren's Petition is not one for

permanent relief and is appropriately addressed

by means of a variance.

H.

Ameren's Variance Request

The MPS requires compliance with declining S02 and nitrogen oxide ("NOx") emission

rates over a finite period

of time, including compliance with a final S02 emission rate beginning

in calendar year 2015. With respect to

S02emission rates, Section 225.233(e) includes a

requirement that eligible electric generating units ("EGUs") achieve a system-wide

S02 emission

rate

of0.33Ibs/mmBtu beginning on January 1,2013, and continuing through December 31,

2014, and a final

S02 emission rate ofO.25Ibs/mmBtu beginning on January 1,2015, and

continuing at that rate in each calendar year thereafter.

Ameren's Petition sought relief from

achieving only the declining S02 emission rate under Section 225.233(e) until calendar year

-7-

Electronic Filing - Received, Clerk's Office, February 19, 2009

2015. Ameren's Petition acknowledges that it will come into compliance with the final S02

emission rate, and thereby the 2013-2014 rate, in accordance with the MPS.

To address the environmental harm analysis component of a variance request, Ameren

agreed to a number of conditions that require S02 and NOx emission rates in addition to, and

more stringent than, rates otherwise required under Section 225.233(e)

of the MPS. Specifically,

Ameren agreed to achieve earlier seasonal and annual NOx emission rates in calendar years 2010

and 2011

ofO.11Ibs/mmBtu and 0.14Ibs/mmBtu, respectively, an earlier S02 emission rate of

0.50 Ibs/mmBtu in calendar years 2010 through 2013, a S02 emission rate of 0.43 Ibs/mmBtu in

calendar year 2014, and a more stringent

S02 emission rate of 0.23 Ibs/mmBtu beginning in

2017 and continuing thereafter in perpetuity. These conditions are not part of the relief

requested; they are separate and apart from the actual relief requested and provide the grounds

by

which the Board can determine that there is no net environmental harm and so grant the relief

requested.

Furthermore, these declining emission rates provided in the conditions reflect a goal

of

the MPS, which was to achieve significant reductions of S02 and NOx over the decade following

adoption

of the Illinois mercury rule. The conditions proposed in the Petition provide for

reductions beginning

in 2010, three years earlier than required by the MPS, declining to a

different rate in 2014, another rate in 2015, and a final rate in 2017. Thus these conditions

do not

violate the spirit

of the MPS and, moreover, provide environmental benefit in addition to that

provided

by the MPS, particularly through the final S02 emission limit of 0.23 Ibs/mmBtu in

2017.

Finally, to ensure clarity for the Agency and public going into the future, Ameren agreed

that it would seek to include these

new rates, properly posed to the Board in this variance

-8-

Electronic Filing - Received, Clerk's Office, February 19, 2009

proceeding only as conditions of the variance, as an amendment to Section 225.233(e) in the

mercury monitoring rulemaking proceeding (R09-10). It was not legally necessary for these

rates to

be included in a rule or to be made permanent through a separate Board rulemaking. A

Board order granting the variance with these conditions and Ameren's Certificate

of Acceptance

would have

been sufficient for these rates to apply to Ameren, to be properly included in

Ameren's operating permits, and to

be enforceable. Again, Ameren's main objective by

agreeing to pursue a separate rulemaking to make the variance conditions permanent was to

provide comfort to both the Agency and the public that conditions would be enforceable through

regulation.

iii.

The Unintended Results of the Board's Dismissal of the Petition for

Variance

As previously stated, Section 225.233(e) contains declining S02 emission rates beginning

in calendar year 2013 with an emission rate requirement

of 0.33 Ibs/mmBtu and ratcheting down

to a final emission rate

of 0.25 Ibs/mmBtu beginning in calendar year 2015. While the

requirement to achieve the 0.33 Ibs/mmBtu emission rate is found in a different regulatory

subsection (225.233(e)(2)(A» than the 0.25 Ibs/mmBtu emission rate (225.233(e)(2)(B», there

exists nothing in the regulatory language to suggest that the failure to comply with the 0.33

Ibs/mmBtu emission rate in calendar years 2013 through 2014 precludes compliance with the

0.25Ibs/mmBtu in calendar year 2015.

The Honorable

Tom E. Johnson in his Dissenting Opinion to the Board'sMajority Order,

("Dissenting Opinion") identifies the real world application

of the Board's interpretation in this

proceeding when faced with the specific circumstances

of this variance request. It is not

necessary to restate in full the legal analysis supporting the determination in the Dissenting

Opinion that a variance is an appropriate regulatory mechanism for the relief requested

by the

-9-

Electronic Filing - Received, Clerk's Office, February 19, 2009

Petitioners. However, Board Member Johnson insightfully points out the difficulty of the

Board's logic when applied to Ameren's variance request:

I

believe it requires a strained interpretation of the [Environmental

Protection] Act to find that the Board

would

have the authority to

grant the variance petition if Ameren had only proposed complying

with the 0.33 lbs/million Btu emission rate on December 31,2014,

the day before Ameren has agreed to comply with the 0.25

lbs/million Btu emission rate.

I

respectfully suggest that by the

majority's logic, this change alone would render Ameren's

requested relief "temporary" and thus a permissible matter for

variance consideration.

See

Dissenting Opinion at 3, PCB 09-21 (January 22,2009).

Ameren's requested variance

is temporary because it will ultimately achieve compliance

with the final S02 emission rate under Section 225.233(e), thereby complying

as well with the

less stringent 0.33 Ibs/mmBtu S02 emission rate. Ameren agrees with Board Member Johnson

that the Board's Order

is effectively form over substance. Ameren could commit to complying

with a 0.33 Ibs/mmBtu rate by January 1,2015, thereby rectifying the Board'sperceived

procedural defect. By doing so, however, Ameren does not seek relief from the 0.25 Ibs/mmBtu

S02 emission rate commencing January

1, 2015.

Furthermore, Ameren does not believe that it

is necessary for the Board to strain its

interpretation

of the meaning of a variance and impose a new termination date for the variance,

i.e.,

December 31,2014, rather than January 1,2015, in order to properly grant the variance as

requested. The purpose of a variance is to provide temporary relief while concurrently

encouraging and requiring future compliance.

See Monsanto Co. vs. Board,

67 Il1.2d 276, 287

(1977). Ameren's Petition clearly achieves this purpose. Ameren respectfully disagrees with the

Board'sfinding that a variance

is not appropriate because "the requirements found in Section

225.233(e)(2)(A) would be replaced completely by the proposed variance."

See

Order at 15.

-10-

Electronic Filing - Received, Clerk's Office, February 19, 2009

While the requirements of Section 225.233(e)(2)(A) are arguably "replaced" by the term of the

variance, the ultimate requirement

of Section 225.233(e) to achieve a final emission rate of 0.25

Ibs/mmBtu in 2015 and continuing on thereafter

is not and thus Ameren's compliance plan

subsumes compliance with the 0.33 Ibs/mmBtu rate.

Ameren's Petition provides temporary relief from Section 225.233(e)

of the MPS from

the requirement to achieve a 0.33 Ibs/mmBtu S02 emission rate in calendar years 2013 and 2014.

Ameren's compliance plan, included

as part of its Petition, requires compliance with Section

225.233(e) upon completion

of the term of the variance -

i.e.

commencing January 1,2015,

Ameren will comply with the 0.25Ibs/mmBtu S02 emission limit. Moreover,

as a condition to

obtaining relief from complying with less stringent S02 emission rates during calendar years

2013 and 2014, Ameren agreed to achieve an even more stringent S02 emission rate beginning

on January 1,2017. Thus, not only does the Petitioner's variance eventually achieve compliance

with the applicable regulation, it in fact exceeds it.

B.

Ameren's Petition for Variance Should Be Granted on its Merits

Should the Board reconsider its denial of Ameren's Petition and find that a variance is a

permissible regulatory mechanism to achieve the requested temporary relief, Ameren

respectfully requests that the Board consider the arbitrary and unreasonable hardship Ameren

faces

if it is unable to obtain relief from the S02 emission rate under the MPS during calendar

years 2013 and 2014. As a result

of the unforeseen and extreme financial conditions of the U.S.

and global economies,

as well as the regulatory and financial uncertainty that anticipated but

undefined greenhouse gas ("GHG") legislation presents, Ameren will suffer severe economic

hardship if the Board fails to grant Ameren relief from the

S02 emission rate under Section

225.233(e)(2)(A). Because the Board

is presented with the opportunity to review the Petition on

-11-

Electronic Filing - Received, Clerk's Office, February 19, 2009

the merits, Ameren herein summarizes and reasserts the substantial and unreasonable hardship

arguments previously made before the Board

in this proceeding.

i.

Economic Hardship

A showing of economic hardship, alone, is sufficient justification to permit the Board to

grant a variance

if no or minimal environmental impact is demonstrated.

See, e.g., Village of

Lake Zurich v. [EPA,

at 6, PCB 97-77 (Feb. 20,1997);

City ofFarmington v. [EPA,

PCB 03-6

(Nov. 7, 2002) (variance granted on grounds that a denial would impose an economic hardship

and that no adverse environmental impact will result);

General Motors Corp. v. [EPA,

PCB 88-

193 (June 4, 1992) (variance granted where additional measures to reduce emissions were not

economically feasible and no adverse environmental impact was demonstrated). The continued

deterioration

of global economic conditions and the

U.s.

capital and credit markets since the

filing

of Ameren's Petition in October 2008 has only exacerbated Ameren's economic hardship.

Ameren's poor credit and investment quality ratings brought on

by the economic downturn

negatively impact its ability to attract the long-term financing necessary for compliance with the

MPS. Faced with having to make immediate decisions regarding the installation

of costly

pollution control equipment to comply with the

S02 emission rate requirement in calendar years

2013 and 2014 in a depressed market and without a reasonable opportunity to secure the

requisite financing for such projects, compliance during 2013 and 2014 creates an arbitrary and

unreasonable hardship for Ameren.

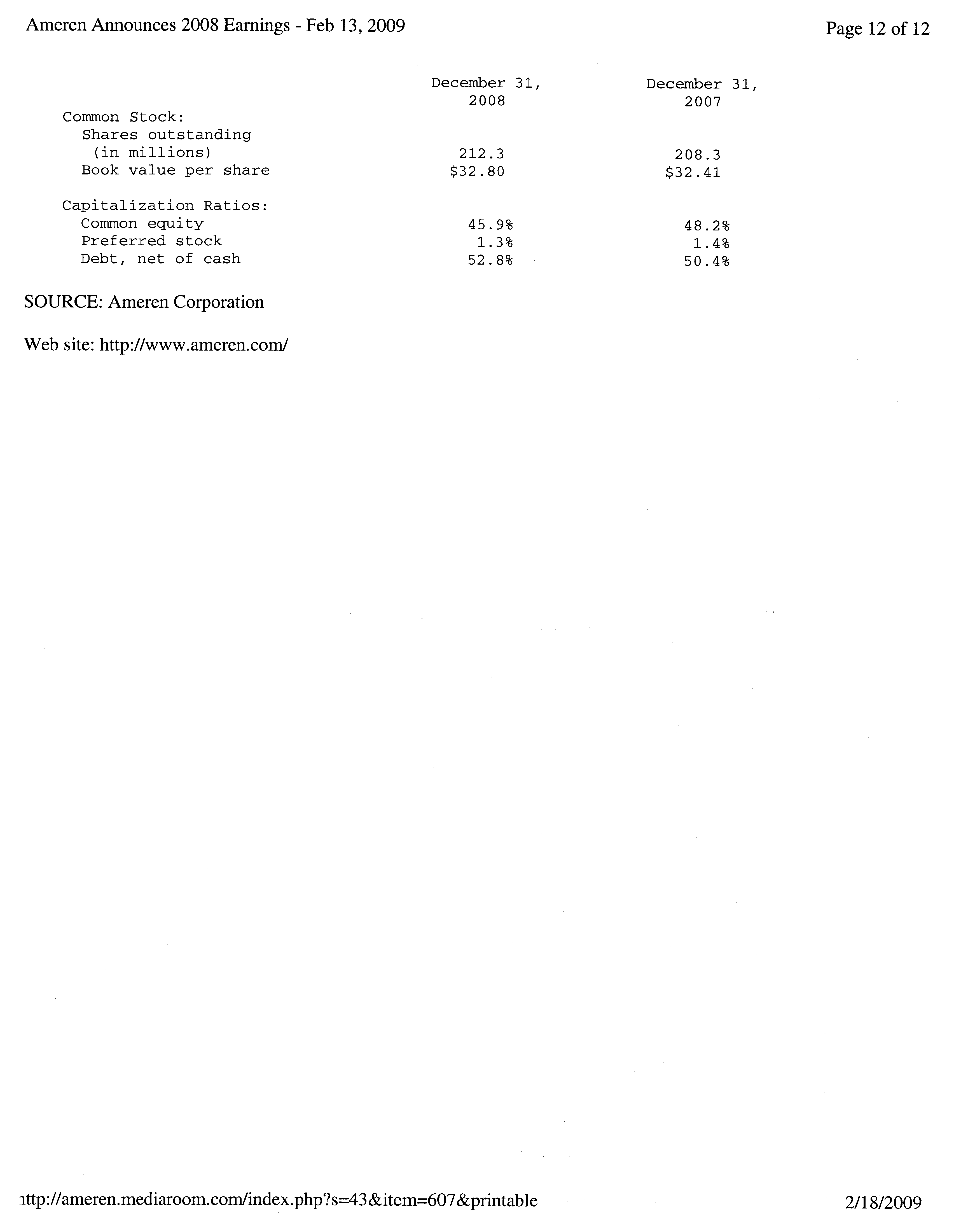

In fact, as recently

as on February 13, 2009, and in an effort to preserve cash amid a

deepening recession, Ameren Corporation slashed by 39% its common share dividends. A clear

explanation

of this decision is set forth in the

Ameren Press Release

attached hereto as

Attachment A

to this Motion. Recent credit ratings issued by the independent credit rating

-12-

Electronic Filing - Received, Clerk's Office, February 19, 2009

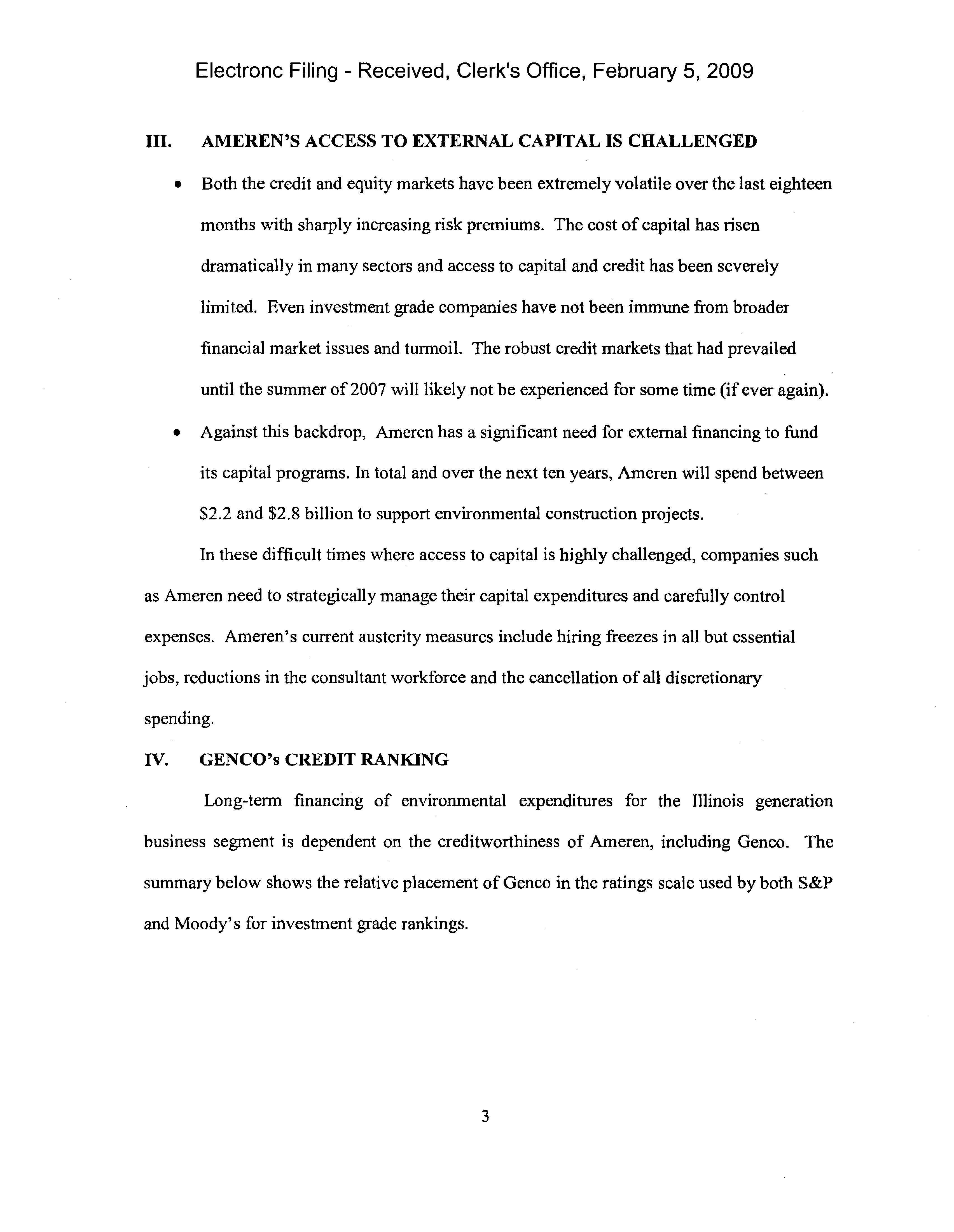

agency Moody's place Ameren Energy Generating Company2 (AEG) at "Baa3" investment

grade rating Gust above "Junk Bond" status). The creditworthiness

of AEG has a direct

correlation to its ability to secure long-term financing on a reasonably priced basis

of

environmental expenditures. According, the assignment of the lowest investment grade ratings

places AEG at a competitive disadvantage against more highly rated companies for accessing

available capital necessary to carryout large environmental capital expenditures in the immediate

future.

See

Pre-filed Testimony of Gary M. Rygh, Barc1ays Capital, Inc., R09-10 (Feb. 5, 2009),

attached hereto

as

Attachment B

to this Motion.

The pollution controls required to comply with the S02 emission rate in 2013 and 2014

are capital intensive and require a three to four year procurement period and engineering lead

time. Ameren cannot finance these projects through day-to-day operations. These costs will

need to be financed through long-term, permanent financing mechanisms. Investors' willingness

to provide long-term, permanent financing to unregulated power producers such

as Ameren's

EGUs

is based in large part on future power price expectations. In recent months, future power

prices have moved down sharply. The detrimental impacts

of this downturn can be seen in the

fact that Ameren

is aware of no long-term, permanent financings of unregulated generating

entities

of the magnitude required to finance these types of pollution control projects since the

summer

of 2008.

In sum, Ameren faces extreme economic pressures

as a result of the economic downturn

of the u.s. and global economic markets. Granting temporary relief from the S02 emission rate

from January 1,2013, through December 31,2014, would allow Ameren to defer a small portion

of its overall environmental capital commitment during a period of severe constraints on the

2 Of the Ameren operating entities and subsidiaries, only Ameren Energy Generating Company

has credit ratings.

-13-

Electronic Filing - Received, Clerk's Office, February 19, 2009

ability to finance ongoing operations.

In

addition, Ameren believes that its ability to obtain

financing and determine whether it

is appropriate to add pollution controls to units, shut down

units, or do both will become clearer within the next two years.

ii.

Stranded Costs Due to Regulatory Uncertainty

The hardship of compliance with the S02 emission rate in calendar years 2013 and 2014

of the MPS is heightened by the anticipated cost of compliance associated with a federal GHG

regulatory program. Merchant plant companies like Ameren's Illinois power stations face even

greater uncertainty because they cannot assume they will recover their

GHG compliance costs

through rates paid

by users, and yet they must also still remain competitive in the power-

providing market.

There is currently no technology that can be applied to large coal-fired power plants to

reduce or capture carbon dioxide ("C02")

on a large scale - technology that will likely be

necessary to comply with any GHG regulatory program. As a result, the options open to Ameren

to meet any near-term

C02 reduction goals would be to curtail or shut down coal-fired power

stations or to switch to natural gas. Therefore, should a GHG regulatory program become law,

Ameren risks major stranded investments in

S02 pollution control equipment installed to comply

with the

S02 emission rate in calendar years 2013 and 2014. Ameren believes it will have a

much clearer understanding

of the C02 reduction requirement facing its power stations within

the next two years, thus further supporting temporary relief from the MPS to allow Ameren more

time to make sound investment decisions.

iii.

Net Environmental Benefit

Ameren's arbitrary and unreasonable hardship is founded on the economic hardship

imposed by compliance with the

S02 emission rate in 2013 and 2014. The variance is justified

-14-

Electronic Filing - Received, Clerk's Office, February 19, 2009

based on the environmental benefit produced by Ameren's compliance with the emission rates

and conditions required under the variance. Because Ameren has agreed

to commit to early and .

more stringent S02 and NOx emission rates, the temporary relief from compliance with the 0.33

Ibs/mmBtu

S02 emission rate during calendar years 2013 and 2014 will not result in

environmental harm.

In

fact, the variance in conjunction with the conditions the variance

imposes will result in a net environmental benefit to the state. The Agency previously confirmed

that Ameren'srequested relief and associated conditions would confer a "small net

environmental benefit."

See

Agency Recommendation at 10, PCB 09-21, November 17,2008.

In exchange for relief from complying with the S02 emission rate under the MPS during

2013 and 2014, Ameren committed to a number

of conditions. These conditions require Ameren

to achieve (i) early seasonal and annual NOx emission rates beginning January

1, 2010, through

December 31,2011, ofO.11Ibs/mmBtu and 0.14Ibs/mmBtu, respectively;

(ii) an early S02

emission rate

of 0.50 Ibs/mmBtu from January 1,2010, through December 31,2013; (iii) a S02

emission rate

of 0.43 Ibs/mmBtu from January 1, 2014, through December 31, 2014 and (iv) a

more stringent S02 emission rate

of 0.23 Ibs/mmBtu beginning January 1,2017, and continuing

on thereafter. To assess the overall environmental effect

of the relief requested in the variance

and the aforementioned conditions, the Agency and Ameren evaluated projected mass emissions

under the MPS and the variance over an eleven-year period. From data derived by reports

provided by Ameren, the Agency calculated an average heat input for the Ameren MPS Group

from 2000 through 2007 and multiplied that constant value by S02 and NOx emission rates to

determine the total tons

of S02 and NOx for the given period (2010 through 2020). The total

tonnage

of S02 and NOx calculated for this time period assuming Ameren's compliance with the

MPS was then compared with the total tonnage for S02 and NOx projected under the variance in

-15-

Electronic Filing - Received, Clerk's Office, February 19, 2009

order to determine if compliance with the variance and associated conditions afforded a net

environmental benefit. This evaluation, performed in the fall

of 2008, confirmed that with the

additional emission limitations required

by the Agency, the variance had a net environmental

benefit

of 842 tons. Attached hereto as

Attachment

C, is a table depicting the annual projected

S02 and

NOx emissions and the environmental benefit of 842 tons.

In

conjunction with its testimony submitted on the mercury monitoring rulemaking, R09-

10, Ameren repeated the analysis but used updated data to include calendar year 2008. The

results confirmed Ameren's representation and the Agency's prior statement in this variance

proceeding that the proposed amendment would result in a net environmental benefit. The total

projected baseline S02 and

NOx emissions from the Ameren MPS Group under the MPS for the

period

of 2000 through 2008 was calculated at 868,138 tons? The total projected S02 and NOx

emissions for the same period, but under the variance, were calculated at 867,287 tons.

Accordingly, the emission rates set forth in Ameren'svariance and associated conditions will

reduce the total S02 and

NOx emissions for the period between 2010 and 2020 by 851 tons. A

table depicting these annual projected S02 and

NOx emissions and the environmental benefit of

851 tons is attached hereto as

Attachment

D.

It

is worth noting that while the calculations

represent mass emissions out to only 2020, should the calculations have projected further into the

future, the net environmental benefit would only have increased. This is because Ameren has

committed,

as a condition, to a more stringent S02 emission rate beginning in 2017 and

continuing thereafter than otherwise required under Section 225.233(e)

of the MPS.

3 This tonnage value represents both compliance with the MPS and the estimated emissions

occurring between 2010 and 2012 for those emission rates not yet set by the MPS.

-16-

Electronic Filing - Received, Clerk's Office, February 19, 2009

III.

CONCLUSION

Ameren respectfully requests that the Board reconsider Ameren's Petition and find that

the variance is an appropriate regulatory mechanism to provide Ameren the temporary relief it

seeks from the

S02 emission rate under the MPS from January 1,2013, through December 31,

2014. Moreover, because the Board denied Ameren'sPetition on procedural grounds rather than

on the merits, Ameren requests that the Board consider Ameren's Petition on the merits and

waives the Board's decision deadline until March 25, 2009. Ameren requests that the Board

grant the relief requested so

as to provide Ameren with additional time necessary to address the

severe economic conditions and regulatory uncertainty that make compliance with the

S02

emission rate during 2013 and 2014 an arbitrary and unreasonable hardship. The substantial

economic hardship that Ameren faces

is sufficient grounds for the Board to grant the requested

variance because Ameren has demonstrated, and the Agency also agrees, that compliance with

the terms

of the variance would provide the state with a net environmental benefit. The relief

sought

is of critical importance to Ameren. As the Board is aware, as a complement to this

proceeding, Ameren is seeking codification

of the conditions identified in the Petition through an

amendment to the MPS in the R09-1 0 rulemaking. Although Ameren'wishes for the Board to act

expeditiously to adopt the pending rulemaking proposal, incorporating Ameren's amendment,

time is

of the essence, and Ameren respectfully requests that the Board consider Ameren's

Petition on its merits and grant Ameren'srequest for temporary relief.

-17-

Electronic Filing - Received, Clerk's Office, February 19, 2009

Dated:

Renee Cipriano

Kathleen C. Bassi

SCHIFF HARDIN, LLP

6600 Sears Tower

233 South Wacker Drive

Chicago, Illinois 60606

312-258-5567

Fax: 312-258-2600

kbassi @schiffhardin.com

Respectfully submitted,

AMEREN ENERGY GENERATING

COMPANY, AMERENENERGY RESOURCES

GENERATING COMPANY, and ELECTRIC

ENERGY, INC.,

/;7

by:

1/

"

-18-

Electronic Filing - Received, Clerk's Office, February 19, 2009

ATTACHMENT A

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13,2009

Media Releases

Page 1 of 12

Ameren Announces 2008 Earnings

Feb 13,2009

ISSUES 2009 EARNINGS GUIDANCE

REDUCES DIVIDEND

RATE

- 2008 Earnings in Line with Previous Guidance

search blogs

share it

blog it

- Announces 2009 Guidance Range of GAAP $2.68 to $3.08 and Core (non-GAAP) $2.75 to $3.15 Earnings per

Share

- Common Dividend Reduced to $1.54 per Share Annualized Rate

- Company Reaffirms Commitment to Strategy of Investing in Energy Infrastructure

- Current Available Liquidity Remains Solid at Approximately $1.3 Billion

- Analyst Conference Call Tuesday, Feb. 17

at 7 AM CT (Note Date

&

Time Change)

ST. LOUIS, Feb. 13 /PRNewswire-FirstCall/ -- Ameren Corporation today announced 2008 net income in accordance

with generally accepted accounting principles (GAAP)

of $605 million, or $2.88 per share, compared to 2007 GAAP

net income

of $618 million, or $2.98 per share. Excluding certain items in each year, Ameren recorded 2008 core (non-

GAAP) net income of $622 million, or $2.95 per share, compared to 2007 core (non-GAAP) net income

of $685

million, or $3.30 per share.

2009 Earnings Guidance

Ameren also announced today it expects 2009 GAAP earnings to be in the range

of $2.68 to $3.08 per share and core

(non-GAAP) earnings to be in the range

of $2.75 to $3.15 per share. An estimated 7 cents per share negative impact in

2009 from the 2007 settlement agreement among parties in Illinois to provide comprehensive electric rate relief and

customer assistance

is excluded from core (non-GAAP) earnings guidance. Any net unrealized mark-to-market gains or

losses will impact GAAP earnings, but are excluded from GAAP and core (non-GAAP) earnings guidance because the

company

is unable to reasonably estimate the impact of any such gains or losses at this time. In addition, the effects of

a January 2009 severe winter storm, including the related impact of reduced electric margins due to the loss of

operating capacity at our Missouri regulated operation's largest customer, the Noranda Aluminum, Inc. smelter plant in

New Madrid, Missouri, are also excluded from GAAP and core (non-GAAP) earnings guidance. At this time, the

company

is unable to reasonably estimate the impact of the severe storm on earnings.

"Despite recent rate increases in Missouri and Illinois, as well

as our proactive sales of 2009 non-rate-regulated

generation in early 2008, we believe our 2009 core earnings will be relatively flat compared to our 2008 core earnings.

We believe that the weak economy, the volatile commodity markets, and unprecedented strains in the capital and credit

markets will result in lower regulated customer sales versus 2008, lower power prices for unsold non-rate-regulated

generation, and higher financing costs throughout 2009 and perhaps longer," said Gary L. Rainwater, chairman,

president and chief executive officer.

Ameren expects its business segments to provide the following contributions to 2009 core (non-GAAP) earnings per

http://ameren.mediaroom.com/index.php?s=43&item=607&printable

2/18/2009

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13,2009

share:

Missouri Regulated

Illinois Regulated

Non-rate-regulated Generation

2009 Core (Non-GAAP) Earnings Guidance Range

$1.25 - $1.35

0.40 -

0.50

1.10 - 1.30

$2.75 - $3.15

Page 2 of 12

Ameren's guidance for 2009 assumes normal weather and is subject to, among other things, regulatory decisions and

legislative actions, plant operations, energy and capital and credit market conditions, economic conditions, severe

storms, unusual or otherwise unexpected gains or losses, and other risks and uncertainties outlined, or referred to, in the

Forward-looking Statements section

of this press release.

Dividends

Today, Ameren's board

of directors declared a 38.5 cents per share quarterly dividend, payable on March 31, 2009, to

shareholders

of record on March 11, 2009. The board's action is consistent with an annualized dividend of $1.54 per

share, or a 39 percent reduction from the previous annual dividend level

of $2.54 per share.

"We recognize the importance of our common dividend to our investors, and this dividend reduction, while prudent,

was not a decision that our board took lightly," said Rainwater.

"It

was made only after implementing many other less

painful steps.

We put in place plans to significantly reduce 2008 and projected 2009 capital and operating expenditures

by approximately $800 million. We reduced executive management salaries and incentive compensation opportunities,

and placed firm controls on headcount and other operating expenditures.

"Several factors contributed to our decision to reduce the dividend. First and foremost was the desire to enhance

Ameren's financial strength and flexibility

as we manage our company through the dramatically weakened state of the

economy and the continued uncertainties in the capital, credit, and commodity markets. Financial strength and

flexibility are critical to providing long-term benefitsto our shareholders and customers. Specifically, this dividend

reduction will allow Ameren to retain approximately $215 million

of cash annually, which will provide incremental

funds to enhance reliability, meet our customers' expectations and grow our regulated businesses, reduce our reliance

on dilutive equity financings, enhance our access to the capital and credit markets to fund our operations and drive solid

long-term earnings per share growth from our strong, regulated asset base.

"In making this decision, the board was not only mindful

of the dramatic changes that have taken place

in

the economy

and the capital, credit, and commodity markets over the last few months, but also the company's current business mix.

Federal and state environmental expenditure requirements have increased,

as have costs to invest in our energy

infrastructure to meet our customers' reliability needs. Upon considering these challenges and others facing our

company, our industry, and in certain respects, our country, our board made a prudent decision to reduce our dividend

for the long-term benefit of all our stakeholders.

"We remain committed to our straightforward, long-term business strategy

of investing in Missouri and Illinois in order

to deliver safe, reliable, and affordable energy to our customers in an environmentally responsible manner and

achieving solid returns in our regulated businesses, optimizing our existing non-rate-regulated generation assets, and

delivering solid long-term value to our shareholders. This same strategy will also be a critical factor in helping create

jobs and provide long-term growth in Missouri and Illinois during this difficult economic period."

Ameren's dividend level has historically been among the highest

of its utility peers and, in fact, of all large U.S.

companies. In 2008, Ameren paid out

88 percent of its GAAP earnings in dividends versus 50 to 60 percent for peer

companies. Rainwater noted that Ameren's new dividend rate will put it squarely within the payout range

of similar

companies and that, coupled with the company's long-term annual earnings per share growth target

of at least 5 percent,

would provide competitive long-term total return potential for shareholders.

"Our adjusted dividend level provides Ameren with a more sustainable dividend payout ratio based upon earnings from

our regulated businesses and better aligns our dividend payout ratio with industry peers," said Rainwater. "Looking

htto://ameren.mediaroom.com/index.php?s=43&item=607&printable

2/18/2009

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13, 2009

Page 3

of 12

ahead, our goal would be to grow the dividend level as our earnings from rate-regulated operations increase and our

overall cash flow profile improves."

2008 Earnings

As noted above, Ameren Corporation today announced 2008 net income in accordance with generally accepted

accounting principles (GAAP)

of $605 million, or $2.88 per share, compared to 2007 GAAP net income of $618

million, or $2.98 per share. Excluding certain items in each year, Ameren recorded 2008 core (non-GAAP) net income

of $622 million, or $2.95 per share, compared to 2007 core (non-GAAP) net income of $685 million, or $3.30 per

share.

For the fourth quarter

of 2008, Ameren recorded GAAP net income of $57 million, or 27 cents per share, compared to

$108 million, or 52 cents per share, for the fourth quarter

of 2007. Excluding certain items in each period, Ameren

recorded fourth quarter 2008 core (non-GAAP) net income

of $97 million, or 45 cents per share, compared to fourth

quarter 2007 core (non-GAAP) net income

of $125 million, or 60 cents per share.

The decline in core (non-GAAP) earnings per share in 2008 versus 2007 was principally due to higher fuel and related

transportation prices, higher plant operations and maintenance costs, increased spending on utility distribution system

reliability, and milder weather, among other things. These items more than offset the positive impacts

of improved

generating plant output and higher realized margins from non-rate-regulated generation operations,

as well as net

increases in electric and natural gas rates, among other things.

The following items are excluded from 2008 and 2007 core (non-GAAP) earnings:

• Net unrealized mark-to-market losses reduced 2008 net income by $17 million

as compared to net unrealized

gains

of $7 million in 2007.

• A lump-sum settlement payment in 2008 from a coal supplier for expected higher fuel costs in 2009

as a result of

the premature closure of a mine and termination of a contract. This payment benefited 2008 net income by $16

million, but the contract termination will result in higher fuel costs for non-rate-regulated generation in 2009.

• A 2008 benefit reflecting Missouri accounting and electric rate orders directing our Missouri utility to record a

regulatory asset for the January 2007 severe ice storm costs and authorizing amortization and recovery

of these

costs over five years. These orders increased 2008 net income by $16 million, offsetting virtually the entire

Missouri portion

of Ameren-wide net costs of $18 million recorded in 2007 for the January 2007 severe ice

storm.

• A 2008 benefit to net income

of $7 million related to a Missouri rate order directing our Missouri utility to record

a regulatory asset for previously incurred costs pursuant to a 2007 Federal Energy Regulatory Commission

(FERC) order. The Missouri order authorizes amortization and recovery

of these costs over two years. The 2007

PERC order retroactively reallocated certain Midwest Independent Transmission System Operator (MISO) costs

among MISO market participants resulting in a 2007 Ameren-wide net charge to earnings

of $12 million.

• The net costs associated with the Illinois comprehensive electric rate relief and customer assistance settlement

agreement reached in 2007, which reduced 2008 net income by $27 million

as compared to a 2007 reduction of

$44 million.

• Asset impairment charges primarily related to the Indian Trails cogeneration plant

as a result of the suspension of

operations by the plant's only customer. These charges reduced 2008 net income by $12 million.

1\

reconciliation of GAAP to non-GAAP earnings per share is as follows:

GAAP earnings per share

Net unrealized mark-to-market

(gain)/loss

Coal contract settlement - 2009

Portion

Fourth

Quarter

Year

2008

2007

2008

2007

$0.27

$0.52

$2.88

$2.98

0.16

(0.01)

0.07

(0.04)

(0.08)

lttp://ameren.mediaroom.comJindex.php?s=43&item=607&printable

2/18/2009

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13, 2009

2007 severe storms & related MO

Orders

FERC order & related MO order

Illinois electric rate relief

settlement, net

Asset impairment charges

Core (non-GAAP) earnings per share

(0.03)

(0.04)

0.03

0.06

$0.45

0.01

0.08

$0.60

(0.07)

0.09

(0.04)

0.06

0.13

0.21

0.06

$2.95

$3.30

Page 4 of 12

"Despite a very challenging economic environment,

as well as volatile and uncertain capital, credit, and commodity

market conditions, we were able to report 2008 core earnings in line with our expectations," said Rainwater. "As

important, we were able to execute on key aspects of our long-term strategic plan,

as well as take prudent actions to

address the unprecedented economic and capital market conditions we are facing today. In 2008, we were granted

much needed electric and natural gas rate increases in our regulated operations in Illinois. We also recently received

approval

of an electric rate increase in our Missouri regulated operations, which is expected to be effective March 1,

2009. The Missouri order authorized fuel and purchased power cost recovery and vegetation management and

infrastructure inspection cost-tracking mechanisms. These mechanisms improve our ability to continue to invest in our

infrastructure so that we will be able to meet our customers' expectations for safe and reliable service.

"In addition, we took timely, prudent actions

to increase liquidity and enhance our financial flexibility in light of very

difficult capital and credit market conditions and a weakening economy. These actions included accessing the capital

markets,

as well as making significant reductions in our 2008 and 2009 spending plans, while still meeting our

reliability, environmental and safety objectives. As a result, our current available liquidity, which represents our cash

on hand and amounts available under our credit facilities, remains solid at approximately $1.3 billion."

2008 Earnings at Missouri Regulated Operations

Core (non-GAAP) earnings in 2008 were $236 million, down from $302 million in 2007. The decline in core (non-

GAAP) earnings was primarily due to higher fuel and related transportation costs and near normal summer weather in

2008 compared to very hot weather in the year-ago summer. Other factors contributing to the decline included higher

plant operations and maintenance costs and higher other labor and employee benefits costs. The above negatives were

partly offset by the positive impact

of a full year of the 2007 rate increases, among other things. Missouri regulated

operations recorded GAAP earnings in 2008

of $234 million, $47 million lower than in 2007. In addition to the items

noted above, this GAAP earnings decrease was also due to net unrealized mark-to-market losses in 2008 versus net

unrealized mark-to-market gains in 2007.

2008 Earnings at Illinois Regulated Operations

Core (non-GAAP) earnings in 2008 were $51 million compared with $77 million in 2007. The decline in core (non-

GAAP) earnings was primarily due to higher costs for infrastructure reliability efforts, higher financing costs reflecting

difficult capital market conditions, higher storm-related expenses, milder weather, and higher bad debt expenses. These

negatives were partly offset by the positive impact

of the 2008 Illinois net increase in electric and natural gas rates and

lower other labor and employee benefits costs, among other things. Illinois regulated operations recorded GAAP

earnings in 2008

of $32 million, down $15 million from the 2007 level. In addition to the items noted above, this

GAAP earnings decrease was also due to net unrealized mark-to-market losses.

2008 Earnings at Non-rate-regulated Generation Operations

Core (non-GAAP) earnings in 2008 were $336 million versus $304 million in 2007. The increase in core (non-GAAP)

earnings was primarily driven by improved generating plant output and higher realized margins. These positives were

partly offset by higher fuel and related transportation prices and higher plant operations and maintenance costs, among

other things. Non-rate-regulated generation GAAP earnings in 2008 were $352 million compared to $281 million in

2007. In addition to the items noted above, this increase in GAAP earnings was also driven by net unrealized mark-to-

market gains and the previously discussed 2009 portion

of the lump-sum settlement payment received in 2008 related

to a terminated coal contract, partially offset by the majority of the previously discussed asset impairment charges.

http://ameren.mediaroom.com/index.php?s=43&item=607&printable

2/18/2009

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13, 2009

Analyst Conference Call

Page 5 of 12

Ameren will conduct a conference call for financial analysts at 7:00 a.m. Central Time on Tuesday, Feb. 17, to discuss

2008 earnings, 2009 earnings guidance, the dividend, and other matters. Investors, the news media and the public may

listen to a live Internet broadcast

of the call at www.ameren.com by clicking on "Q4 2008 Ameren Corporation

Earnings Conference Call," followed by the appropriate audio link.

An accompanying slide presentation will be

available on Ameren's Web site. This presentation will be posted in the "Investors" section of the Web site under

"Presentations." The analyst call will also be available for replay on the Internet for one year. In addition, a telephone

playback

of the conference call will be available beginning at approximately noon Central Time, from Feb. 17 through

Feb. 24, by dialing, U.S. (800) 405-2236; international (303) 590-3000 and entering the number: 11125672#. The

conference call on Tuesday, Feb. 17 replaces the previously scheduled Wednesday, Feb. 18 conference call for

financial analysts. There will

be no call on Feb. 18.

About Ameren

With assets

of approximately $23 billion, Ameren serves approximately 2.4 million electric customers and almost one

million natural gas customers in a 64,000-square-mile area

of Missouri and Illinois. Ameren owns a diverse mix of

electric generating plants strategically located in its Midwest market with a generating capacity of more than 16,400

megawatts.

Regulation

G

Statement

Ameren has presented certain information in this release on a diluted cents per share basis. These diluted per share

amounts reflect certainfactors that directly impact Ameren's total earnings

per share. The core (non-GAAP) earnings

per share and core (non-GAAP) earnings

per share guidance excludes one or more ofthe following: costs related to

severe January 2007 storms, the effects

ofa January 2009 storm, including the related impact on our Missouri

regulated operation's largest customer, the Noranda Aluminum, Inc. smelter plant in New Madrid, Missouri, the

earnings impact

ofthe settlement agreement among parties in Illinoisfor comprehensive electric rate reliefand

customer assistance, a March 2007 Federal Energy Regulatory Commission order and 2009 Missouri Public Service

Commission rate order relating to prior years' regional transmission organization costs, net mark-to-market gains

or

losses from nonqualifying hedges, the benefit ofaccounting and rate orders from the Missouri Public Service

Commission associated with 2007 storm costs, an asset impairment charge primarily related to the shutdown

of the

Indian Trails cogeneration plant, and the 2008 lump-sum paymentfrom a coal supplier

for expected higherfuel costs

in 2009 as a result

ofthe premature closure ofa mine and termination ofa contract. Ameren uses core (non-GAAP)

earnings internally

for financial planning and for analysis ofperformance. Ameren also uses core (non-GAAP)

earnings as primary performance measurements when communicating with analysts and investors regarding our

earnings results and outlook, as the company believes it allows it to more accurately compare the company's ongoing

performance across periods.

In providing consolidated and segment core (non-GAAP) earnings guidance, there could be differences between core

(non-GAAP) earnings and earnings prepared in accordance with GAAP

for certain items, such as those listed above.

Ameren is unable to estimate the impact,

if

any, on future GAAP earnings ofsuch items.

Forward-looking Statements

Statements in this release not based on historical facts are considered ''forward-looking''and, accordingly, involve

risks and uncertainties that could cause actual results to differ materiallyfrom those discussed. Although such

forward-looking statements have been made in goodfaith and are based on reasonable assumptions, there is no

assurance that the expected results will be achieved. These statements include (without limitation) statements as to

future expectations, beliefs, plans, strategies, objectives, events, conditions, andfinancial performance. In connection

with the "safe harbor" provisions

of the Private Securities Litigation Reform Act of

1995,

we are providing this

cautionary statement to identify importantfactors that could cause actual results to differ materially from those

anticipated. The following factors,

in addition to those discussed elsewhere in this release and in ourfilings with the

httn://ameren.mediaroom.com/index.oho?s=43&item=607&orintable

2/18/2009

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13,2009

Page 6

of 12

Securities and Exchange Commission, could cause actual results to differ materiallyfrom management expectations

suggested in such forward-looking statements:

• regulatory

or legislative actions, including changes in regulatory policies and ratemaking determinations and

future rate proceedings orfuture legislative actions that seek to limit

or reverse rate increases;

• uncertainty as to the continued effectiveness

of the Illinois power procurement process;

• changes in laws and other governmental actions, including monetary

andfiscal policies;

• changes in laws

or regulations that adversely affect the ability ofelectric distribution companies and other

purchasers

ofwholesale electricity to pay their suppliers, including Union Electric Company and Ameren

Energy Marketing Company;

• enactment

oflegislation taxing electric generators, in Illinois or elsewhere;

• the effects

ofincreased competition in the future due to, among other things, deregulation ofcertain aspects of

our business at both the state andfederal levels, and the implementation ofderegulation, such as occurred when

the electric rate freeze and

power supply contracts expired in Illinois at the end of2006;

• increasing capital expenditure and operating expense requirements

and our ability to recover these costs in a

timely fashion in light

of regulatory lag;

• the effects

ofparticipation in the Midwest Independent Transmission System Operator, Inc.;

• the cost

and availability offuel such as coal, natural gas, and enriched uranium used to produce electricity; the

cost and availability

ofpurchased power and natural gas for distribution; and the level and volatility offuture

market prices

for such commodities, including the ability to recover the costs for such commodities;

• the effectiveness

ofour risk management strategies and the use offinancial and derivative instruments;

• prices

for power in the Midwest, including forward prices;

• business and economic conditions, including their impact on interest rates,

bad debt expense, and demand for

our products;

• disruptions

ofthe capital markets or other events that make the Ameren Companies'access to necessary capital,

including short-term credit, more difficult

or costly;

• our assessment

ofour liquidity and the effect of regulatory lag on our available liquidity sources;

• the impact

ofthe adoption ofnew accounting standards and the application ofappropriate technical accounting

rules and guidance;

• actions

ofcredit rating agencies and the effects ofsuch actions;

• weather conditions and other natural phenomena;

• the impact

ofsystem outages caused by severe weather conditions or other events;

• generation plant construction, installation

and performance, including costs associated with Union Electric

Company's Taum Sauk pumped-storage hydroelectric plant incident and the plant'sfuture operation;

• recoverability through insurance

ofcosts associated with Union Electric Company's Taum Sauk pumped-storage

hydroelectric plant incident;

• operation

of Union Electric Company's nuclear powerfacility, including planned and unplanned outages, and

decommissioning costs;

• the effects

ofstrategic initiatives, including acquisitions and divestitures;

• the impact

ofcurrent environmental regulations on utilities and power generating companies and the expectation

that more stringent requirements, including those related to greenhouse gases, will be introduced over time,

which could have a negative financial effect;

• labor disputes, future wage and employee benefits costs, including changes in discount rates

and returns on

benefit plan assets;

• the inability

ofour counterparties and affiliates to meet their obligations with respect to contracts, credit

facilities

andfinancial instruments;

• the cost and availability

oftransmission capacity for the energy generated by the Ameren Companies'facilities

or required to satisfy energy sales made by the Ameren Companies;

• legal and administrative proceedings;

and

• acts ofsabotage, war, terrorism or intentionally disruptive acts.

Given these uncertainties, undue reliance should

not be placed on these forward-looking statements. Except to the

extent required by the federal securities laws, we undertake no obligation to update

or revise publicly any forward-

looking statements to reflect new information

orfuture events.

http://ameren.mediaroom.com/index.php?s=43&item=607&printable

2/18/2009

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13,2009

Page 7 of 12

AMEREN CORPORATION (AEE)

CONSOLIDATED BALANCE SHEET

(Unaudited, in millions)

December 31, December 31,

2008

2007

ASSETS

$92

$355

502

570

427

359

292

262

842

735

207

35

153

146

2,515

2,462

16,567

15,069

239

307

831

831

167

198

1,732

1,158

606

703

3,575

3,197

TOTAL ASSETS

$22,657

$20,728

Current Assets:

Cash and cash equivalents

Accounts receivable - trade, net

Unbilled revenue

Miscellaneous accounts and notes

receivable

Materials and supplies

Mark-to-market derivative assets

Other current assets

Total current assets

Property and Plant, Net

Investments and Other Assets:

Nuclear decommissioning trust fund

Goodwill

Intangible assets

Regulatory assets

Other assets

Total investments and other assets

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Current maturities of long-term debt

Short-term debt

Accounts and wages payable

Taxes accrued

Mark-to-market derivative liabilities

Other current liabilities

Total current liabilities

Long-term Debt, Net

Preferred Stock of Subsidiary Subject

to Mandatory Redemption

Deferred Credits and Other Liabilities:

Accumulated deferred income taxes, net

Accumulated deferred investment

tax credits

Regulatory liabilities

Asset retirement obligations

Accrued pension and other

postretirement benefits

Other deferred credits and liabilities

Total deferred credits and other

liabilities

Preferred Stock of Subsidiaries Not

Subject to Mandatory Redemption

Minority Interest in Consolidated

Subsidiaries

Stockholders' Equity:

Common stock

Other paid-in capital, principally

premium on common stock

Retained earnings

Accumulated other comprehensive income

Total stockholders' equity

$380

1,174

813

54

155

487

3,063

6,554

2,131

100

1,291

406

1,495

438

5,861

195

21

2

4,780

2,181

6,963

$223

1,472

687

84

24

414

2,904

5,689

16

2,046

109

1,240

562

839

354

5,150

195

22

2

4,604

2,110

36

6,752

http://ameren.mediaroom.com/index.php?s=43&item=607&printable

2/18/2009

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13,2009

TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY

$22,657

$20,728

Page 8 of 12

AMEREN CORPORATION (AEE)

CONSOLIDATED STATEMENT OF INCOME

(Unaudited, in millions, except per share amounts)

Three Months

Ended

December 31,

2008

2007

Year Ended

December 31,

2008

2007

Operating Revenues:

Electric

Gas

Total operating revenues

Operating Expenses:

Fuel

Purchased power

Gas purchased for resale

Other operations and maintenance

Depreciation and amortization

Taxes other than income taxes

Total operating expenses

Operating Income

$1,423

485

1,908

372

246

360

497

171

93

1,739

169

$1,428

384

1,812

303

281

278

439

167

86

1,554

258

$6,367

1,472

7,839

1,275

1,210

1,057

1,857

685

393

6,477

1,362

$6,283

1,279

7,562

1,167

1,387

900

1,687

681

381

6,203

1,359

Other Income and Expenses:

Miscellaneous income

Miscellaneous expense

Total other income

Interest Charges

Income Before Income Taxes, Minority

Interest, and Preferred Dividends of

Subsidiaries

Income Taxes

Income Before Minority Interest and

Preferred Dividends of Subsidiaries

Minority Interest and Preferred

Dividends of Subsidiaries

Net Income

Earnings per Common Share -

Basic and Diluted

Average Common Shares Outstanding

19

22

(8)

(4)

11

18

109

107

71

169

8

51

63

118

6

10

$57

$108

$0.27

$0.52

211.5

208.1

80

(31)

49

440

971

327

644

39

$605

$2.88

210.1

75

(25)

50

423

986

330

656

38

$618

$2.98

207.4

AMEREN CORPORATION (AEE)

CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited, in millions)

httn://ameren.mediaroom.com/index.oho?s=43&item=607&orintable

2/18/2009

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13,2009

Cash Flows From Operating Activities:

Net income

Adjustments to reconcile net income to

net cash provided by operating activities:

Gain on sales of emission allowances

Gain on sale of noncore properties

Loss on asset impairments

Net mark-to-market gain on derivatives

Depreciation and amortization

Amortization of nuclear fuel

Amortization of debt issuance costs

and premium/discounts

Deferred income taxes and

investment tax credits, net

Minority interest

Other

Changes in assets and liabilities:

Receivables

Materials and supplies

Accounts and wages payable

Taxes accrued, net

Assets, other

Liabilities, other

Pension and other postretirement benefit

obligations

Counterparty collateral, net

Taum Sauk costs, net of insurance

recoveries

Net cash provided by operating activities

Cash Flows From Investing Activities:

Capital expenditures

Proceeds from sales of noncore

properties, net

Nuclear fuel expenditures

Purchases of securities - nuclear

decommissioning trust fund

Sales of securities - nuclear

decommissioning trust fund

Purchases of emission allowances

Sales of emission allowances

Other

Net cash used in investing activities

Cash Flows From Financing Activities:

Dividends on common stock

Capital issuance costs

Short-term debt, net

Dividends paid to minority

interest holder

Redemptions, repurchases, and maturities:

Long-term debt

Preferred stock

Issuances:

Common stock

Long-term debt

Net cash provided by financing activities

Net change in cash and cash equivalents

Cash and cash equivalents at beginning of year

lttp://ameren.mediaroom.com/index.php?s=43&item=607&printable

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13, 2009

Cash and cash equivalents at end of year

AMEREN CORPORATION (AEE)

CONSOLIDATED OPERATING

STATISTICS

$92

$355

Page 10 of 12

Three Months

Ended

December 31,

2008

2007

Twelve Months

Ended

December 31,

2008

2007

Electric Sales - kilowatt-hour

Missouri Regulated

Residential

Commercial

Industrial

Other

Native load subtotal

Interchange sales

Subtotal

(in millions) :

3,337

3,485

2,266

179

9,267

1,926

11,193

3,135

3,486

2,431

182

9,234

3,798

13,032

13,904

14,690

9,256

785

38,635

10,457

49,092

14,258

14,766

9,675

759

39,458

10,984

50,442

Illinois Regulated

Residential

Generation and delivery service

Commercial

Generation and delivery service

Delivery service only

Industrial

Generation and delivery service

Delivery service only

Other

Native load subtotal

Non-rate-regulated Generation

Non-affiliate energy sales

Affiliate native energy sales

Subtotal

2,949

1,609

1,592

351

2,733

149

9,383

6,835

1,416

8,251

2,720

1,580

1,254

223

2,447

145

8,369

6,757

1,633

8,390

11,667

6,095

6,147

1,442

11,300

555

37,206

26,395

6,055

32,450

11,857

7,232

5,178

1,606

11,199

576

37,648

25,196

7,296

32,492

Eliminate affiliate sales

(1,416) (1,633)

Eliminate Illinois Regulated/Non-rate-

regulated Generation common customers (1,283) (1,312)

(6,055 )

(4,939)

(7,296)

(5,800)

Ameren Total

Electric Revenues (in millions) :

Missouri Regulated

Residential

Commercial

Industrial

Other

Native load subtotal

Interchange sales

Subtotal

Illinois Regulated

Residential

Generation and delivery service

Commercial

Generation and delivery service

Delivery service only

Industrial

26,128

$192

165

77

11

445

81

$526

$287

154

21

26,846

$179

165

82

12

438

181

$619

$247

134

17

107,754

$948

838

372

108

2,266

490

$2,756

$1,112

616

77

107,486

$980

839

390

93

2,302

484

$2,786

$1,055

666

54

bttp://ameren.mediaroom.com/index.php?s=43&item=607&printable

2/18/2009

Electronic Filing - Received, Clerk's Office, February 19, 2009

Ameren Announces 2008 Earnings - Feb 13,2009

Page

11

of 12

Generation and delivery service

25

17

102

105

Delivery service only

8

7

30

24

Other

55

77

285

372

Native load subtotal

$550

$499

$2,222

$2,276

Non-rate-regulated Generation

Non-affiliate energy sales

$332

$339

$1,389

$1,310

Affiliate native energy sales

132

110

441

461

Other

22

(3)

106

41

Subtotal

$486

$446

$1,936

$1,812

Eliminate affiliate revenues

(139)

(136)

(547)