| | - I. Dominion Resources, Inc. (“Dominion”) owns and operates electric generating facilities in eleven states, including the 1250 megawatt coal-fired Kincaid Generation L.L.C. power plant, located in Kincaid, Illinois. Dominion also owns a 50% interest in the 1400-megawatt natural gas-fired Elwood Energy, L.L.C. combustion turbine plant, located in Elwood, Illinois.

- II. Subparts D (CAIR NOx Annual Trading Program) and E (CAIR NOx Ozone Season Trading Program) of the Illinois CAIR proposal deviate significantly from EPA’s model rule and could jeopardize EPA approval of the Illinois CAIR SIP.

- III. The IEPA should justify any “beyond CAIR” NOx reductions with a thorough modeling demonstration.

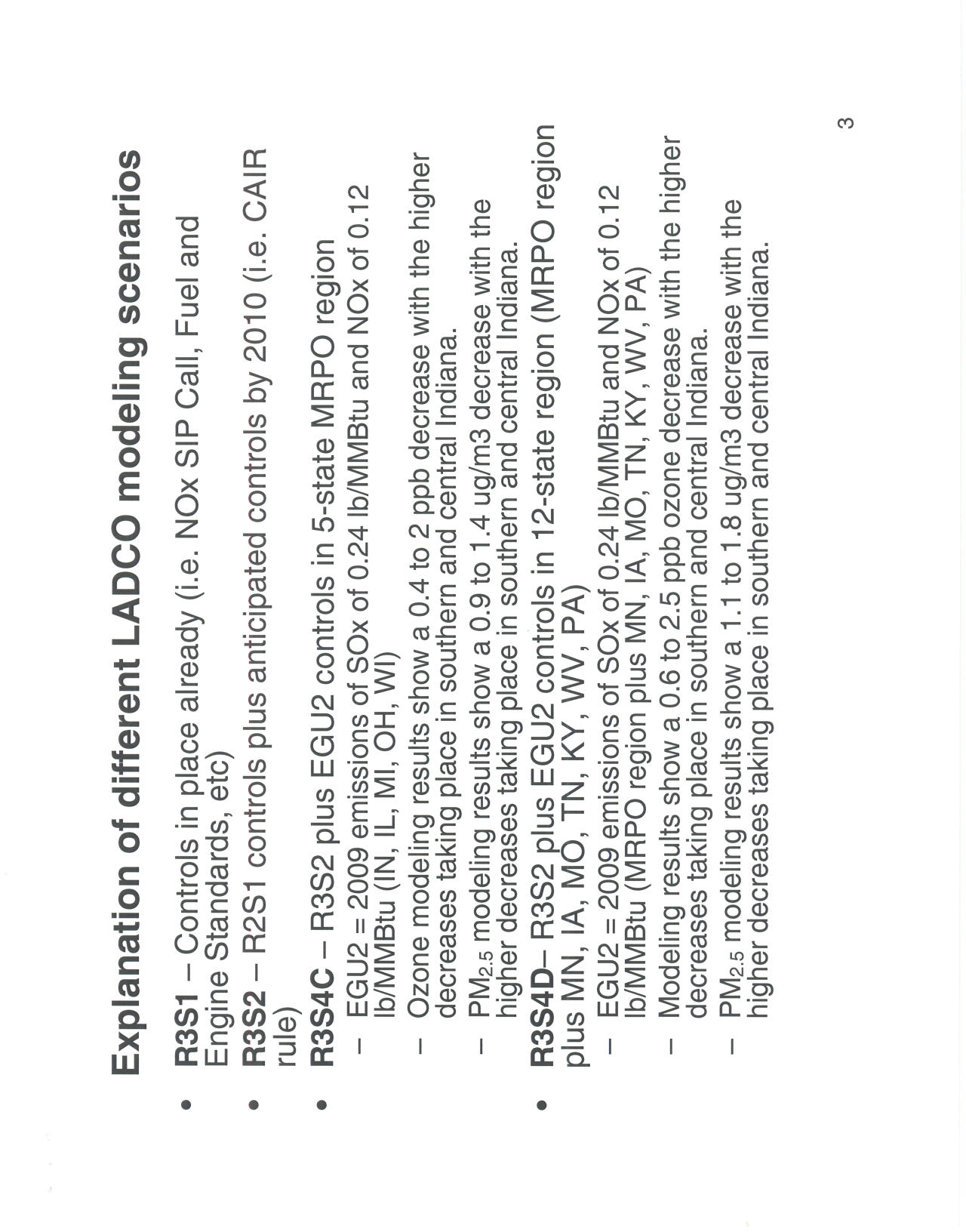

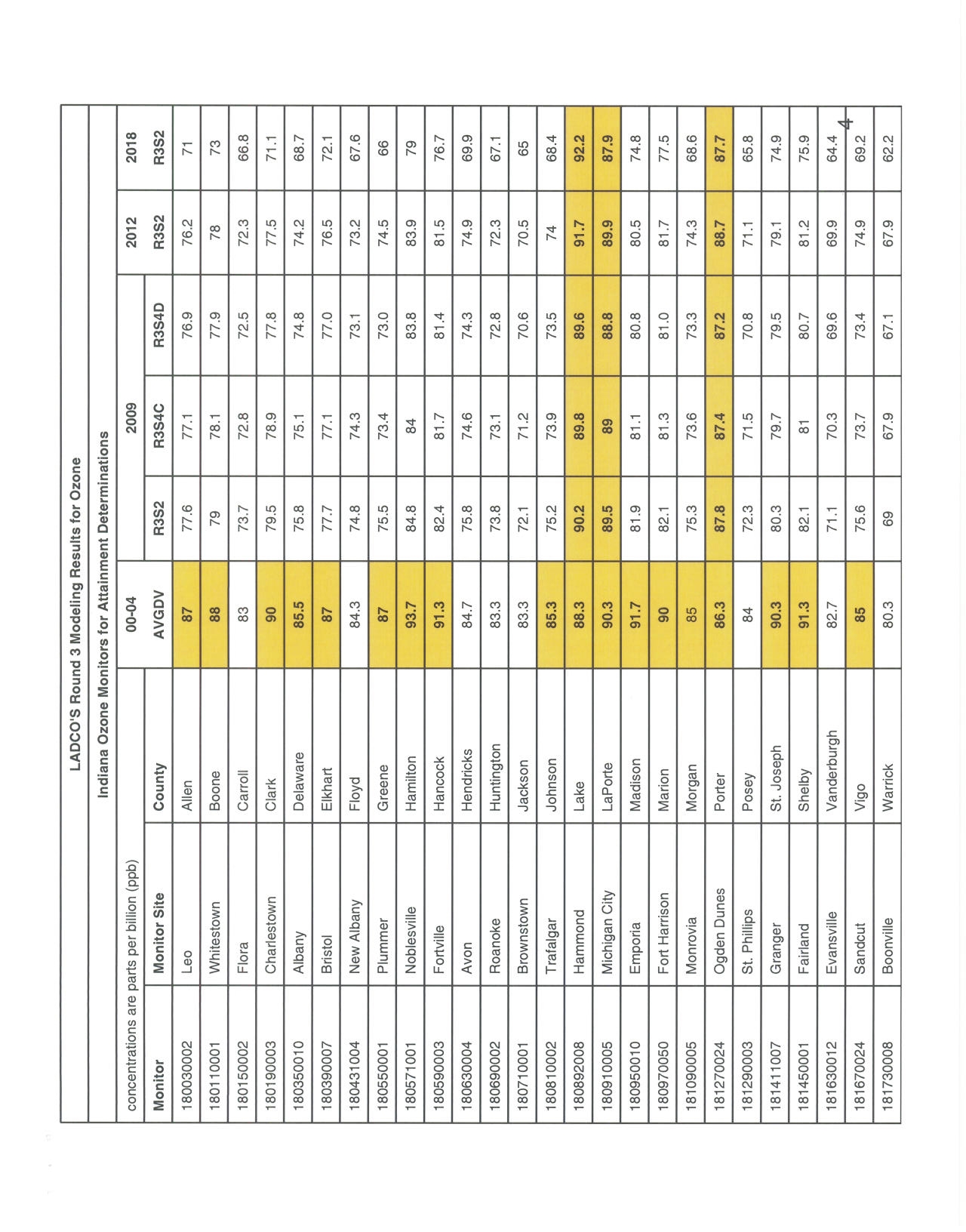

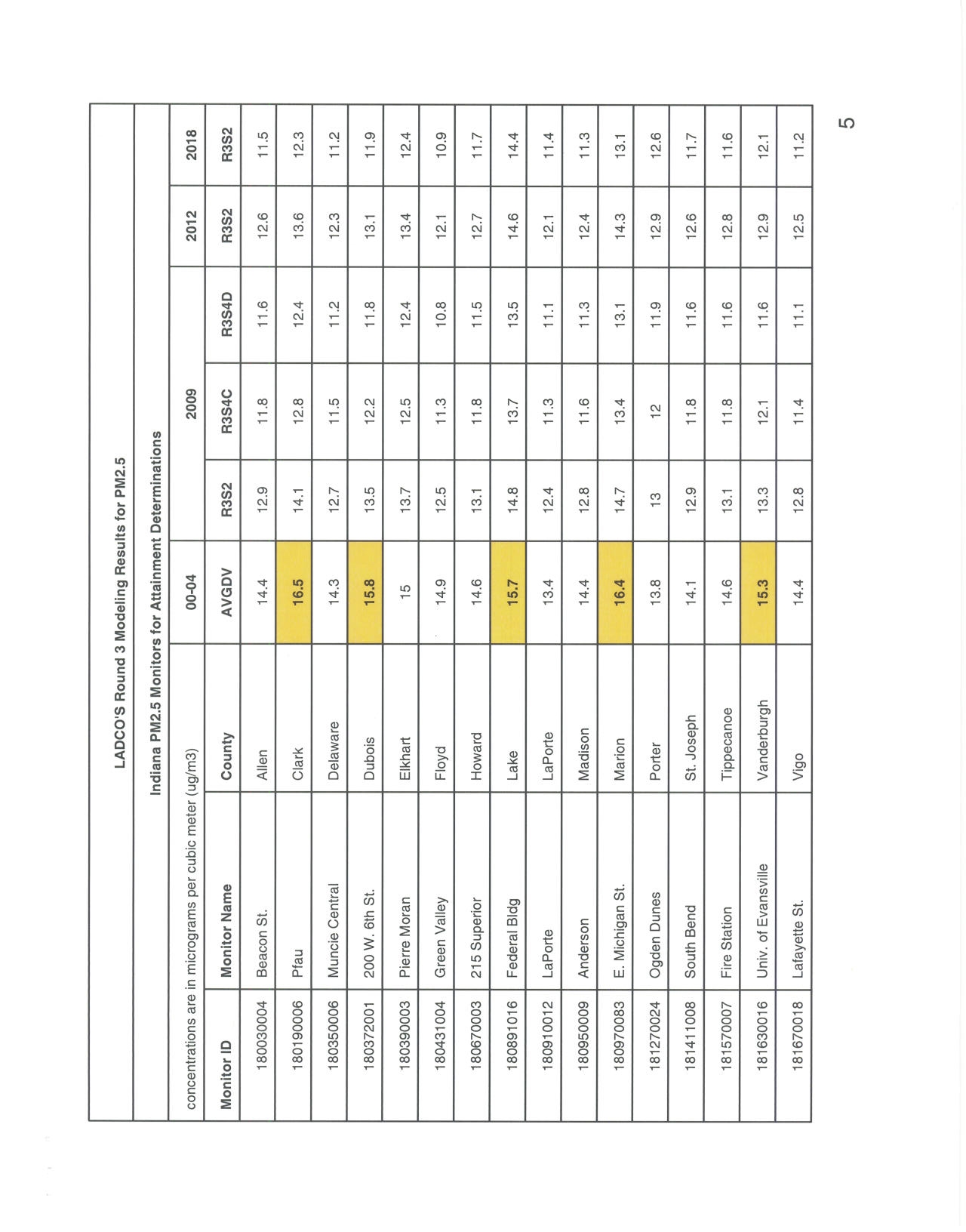

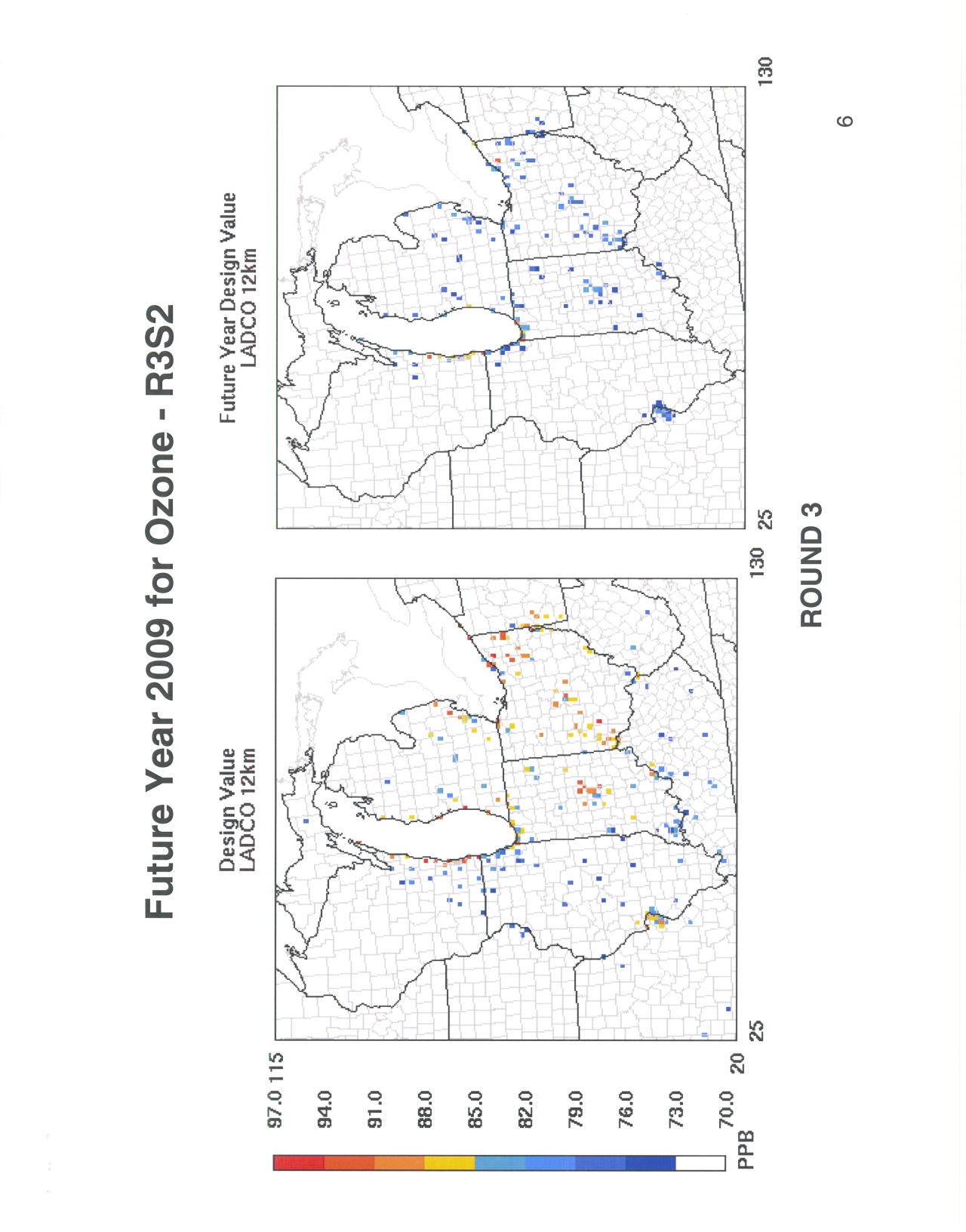

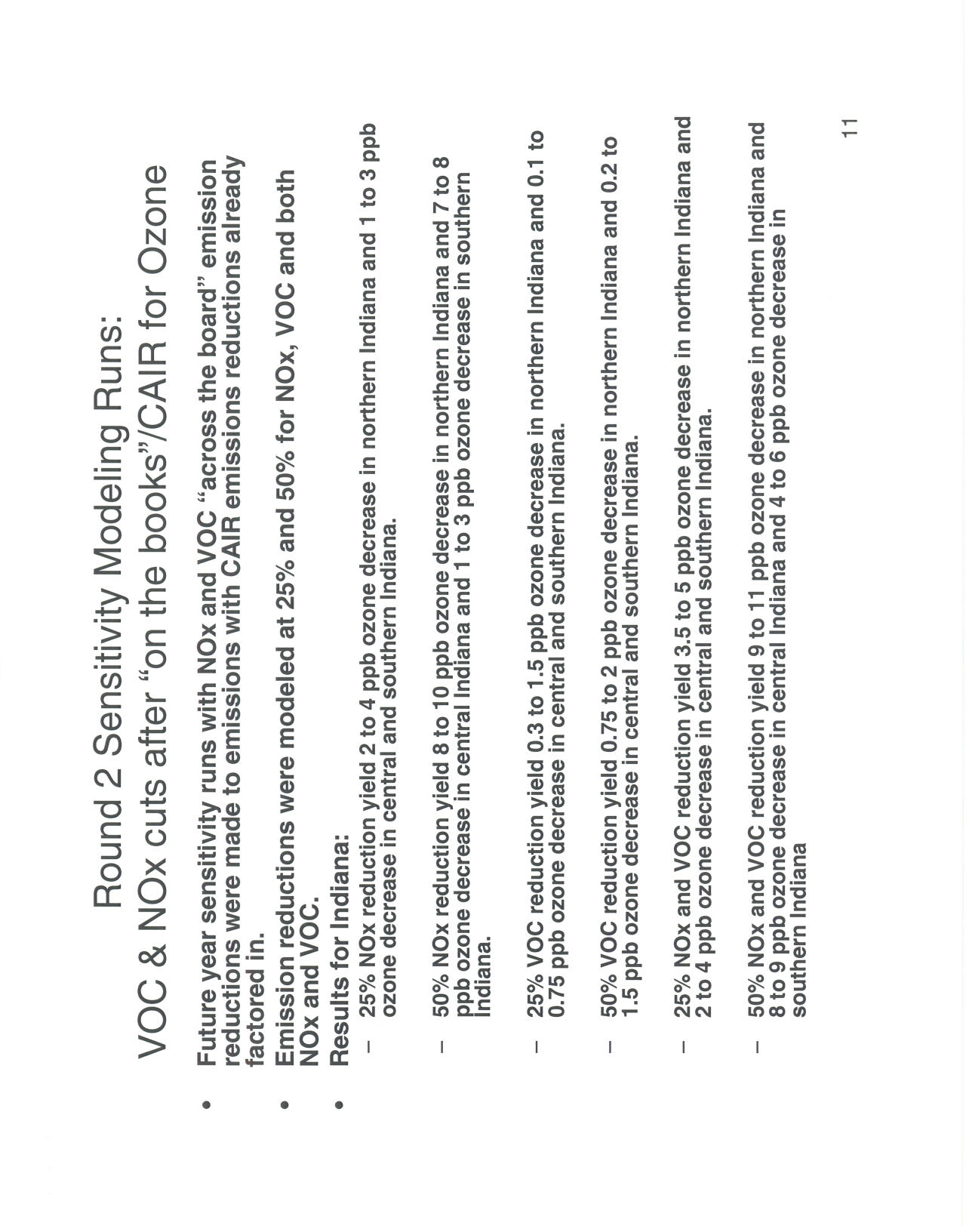

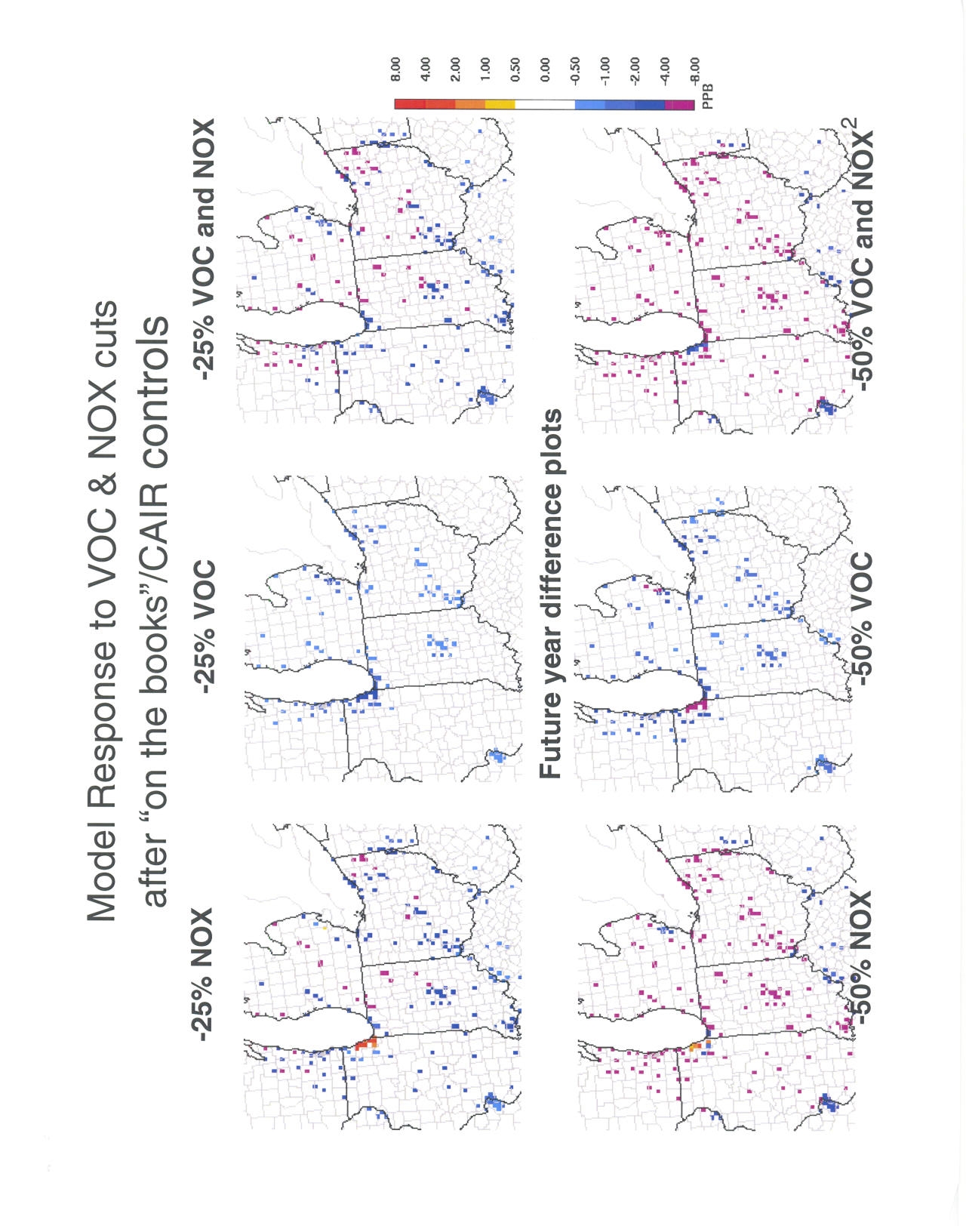

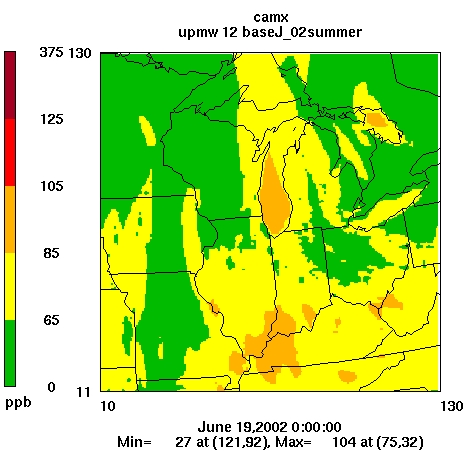

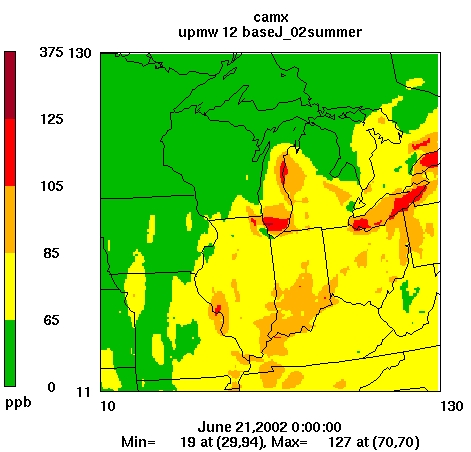

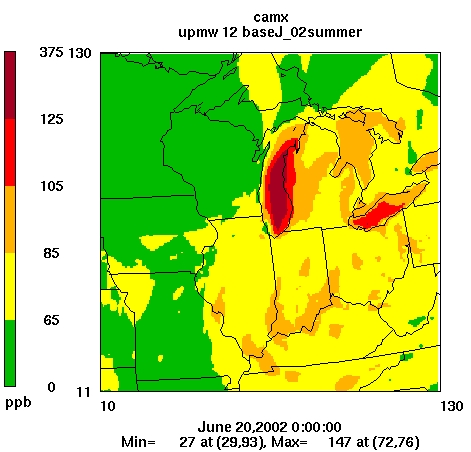

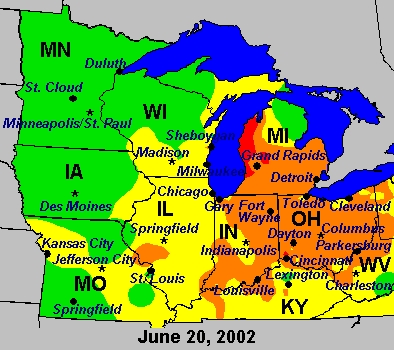

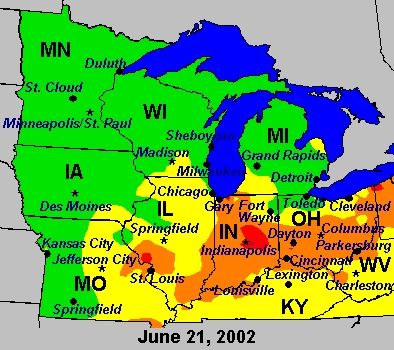

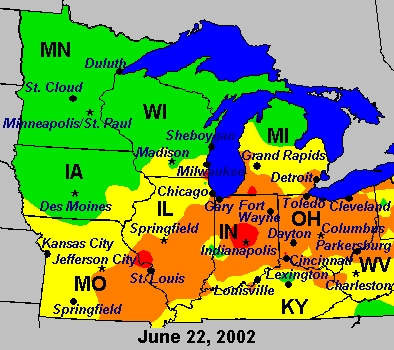

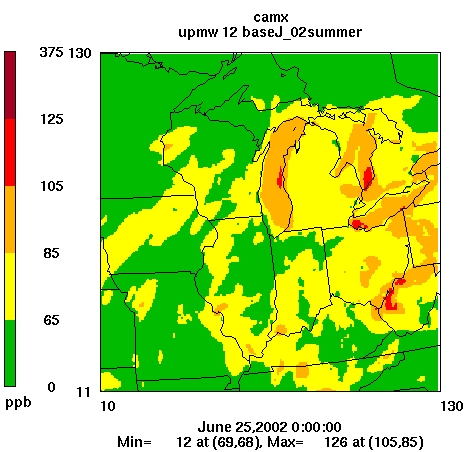

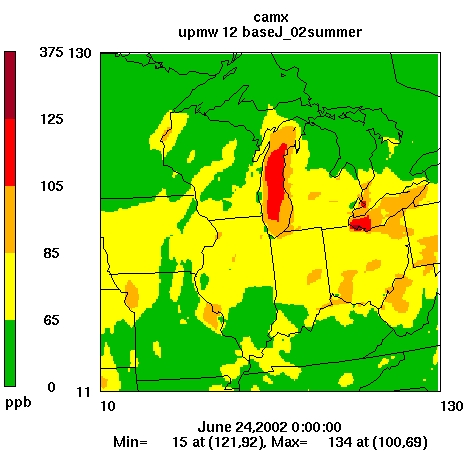

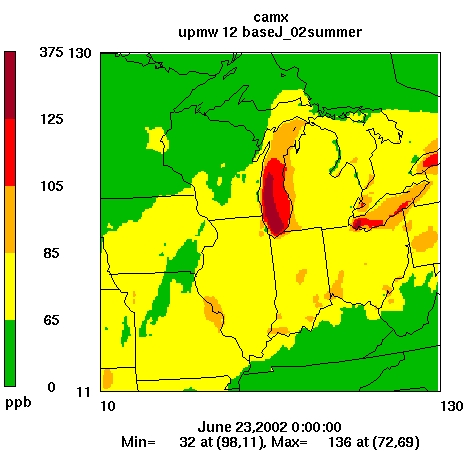

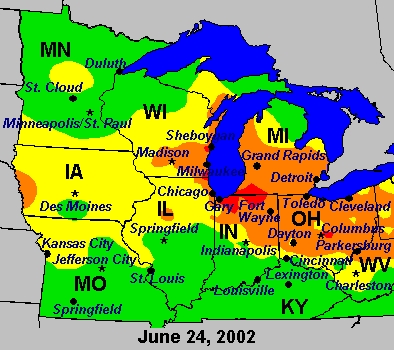

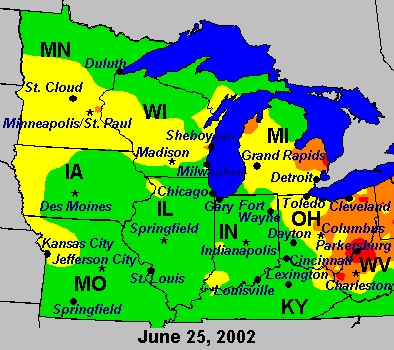

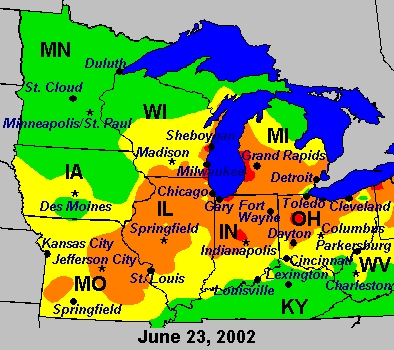

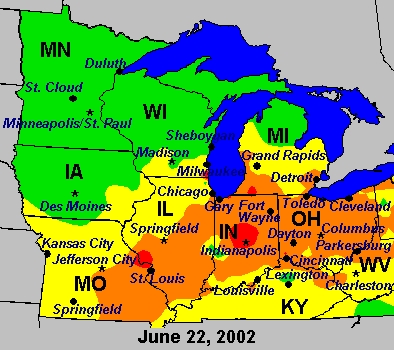

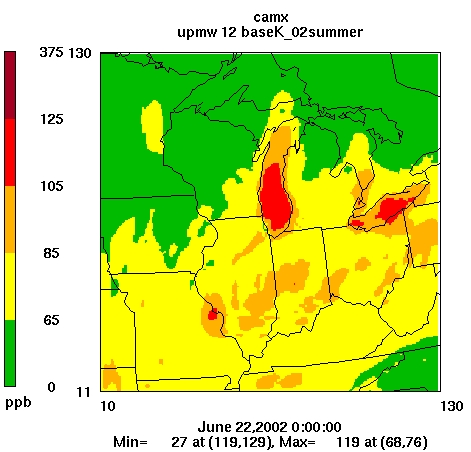

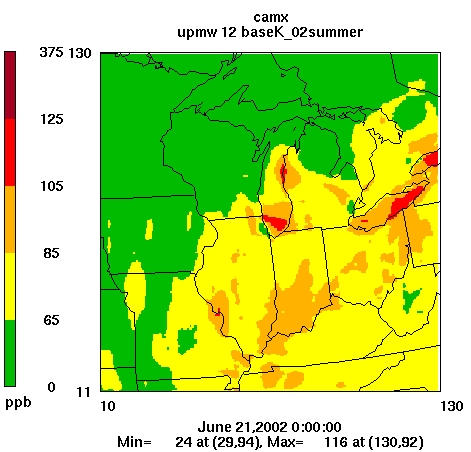

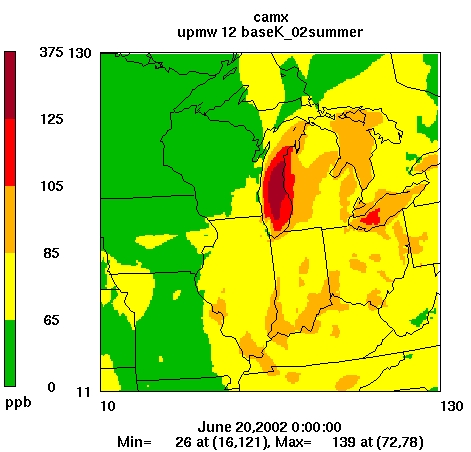

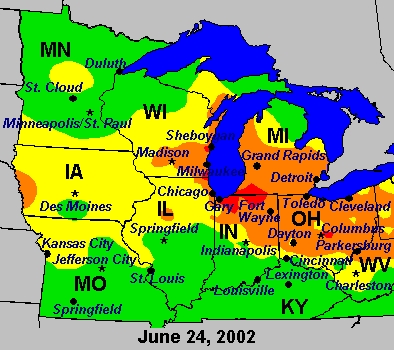

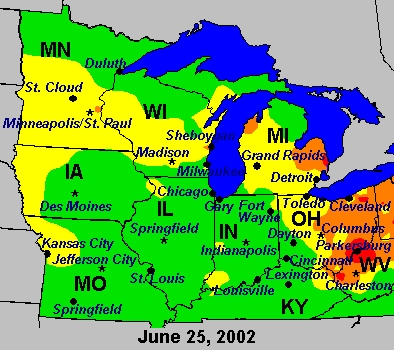

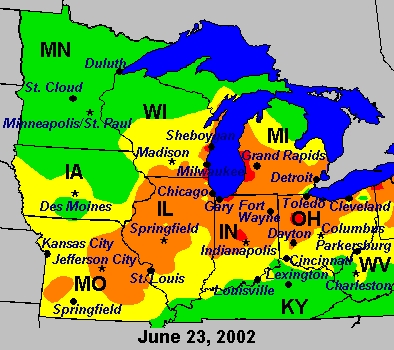

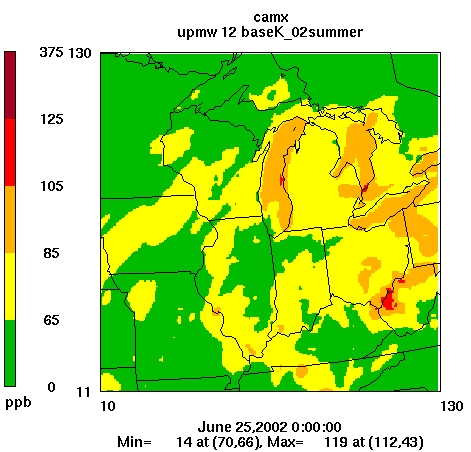

- IV. Recent air quality modeling by Lake Michigan Air Directors Consortium (“LADCO”) suggests additional NOx reductions from the electric generating unit (“EGU”) sector beyond the reductions expected from the federal CAIR program will not solve the residual ozone and PM2.5 non-attainment problem in the Chicago area. A comprehensive attainment plan should be thoroughly researched and fully developed that clearly and conclusively demonstrates the level of emissions reductions needed and the source categories for which the most efficient and effective reductions can be achieved. Only when this plan has been fully developed will IEPA have the justification to proceed with “beyond CAIR” reductions.

- V. The IEPA proposal to adopt “beyond CAIR” NOx reductions through a proposed set-aside program that far surpasses that of any surrounding state places Illinois electricity consumers at a severe economic disadvantage.

- VI. Kincaid supports IEPA’s proposal under Title 35, Part 225, Subpart C to adopt the federal CAIR provisions for SO2.

- VII. Kincaid supports a longer baseline period for determining NOx allocations than proposed by IEPA.

- VIII. Withholding NOx allowances from existing sources, like Kincaid, that have already installed expensive pollution controls to reduce NOx emissions, amounts to a “penalty” for those sources that have opted for this approach. Further, any unclaimed allowances left over in the Energy Efficiency and Conservation/Renewable Energy (“EEC/RE”) set-aside should be returned to the EGUs.

- IX. Kincaid supports USEPA’s position that the CAIR rulemaking does not require states to prepare an attainment SIP to comply with CAIR and the attendant emission reductions are not designed to result in attainment of the NAAQS.

- X. The Board has failed to evaluate the combined impact of CAMR and CAIR.

|

ILLINOIS POLLUTION CONTROL BOARD

In The Matter of:

Proposed New Clean Air Interstate Rule

(CAIR) SO2, NOx Annual and NOx Ozone

Season Trading Programs, 35 Ill. Adm.

Code 225. Subparts A, C, D and E

)

)

)

)

)

No. R06-26

(Rulemaking – Air)

NOTICE OF FILING

TO:

See attached Service List

PLEASE TAKE NOTICE that on January 5, 2007, I caused to be filed electronically with

the Office of the Clerk of the Pollution Control Board, on behalf of KINCAID GENERATION,

L.L.C., the attached KINCAID GENERATION, L.L.C.’S FINAL COMMENTS with

corresponding exhibits, copies of which are hereby served upon you.

By:

/s/ Katherine M. Rahill

Katherine M. Rahill

Bill S. Forcade

Katherine M. Rahill

JENNER & BLOCK LLP

Attorneys for Kincaid Generation, LLC

One IBM Plaza

Chicago, IL 60611

(312) 222-9350

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

CERTIFICATE OF SERVICE

I, Katherine M. Rahill, an attorney, hereby certify that I served copies of the foregoing

documents via first class mail upon the parties on the attached Service List this 5th day of

January, 2007.

By:

/s/ Katherine M. Rahill

Katherine M. Rahill

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

SERVICE LIST:

Dorothy Gunn, Clerk

Illinois Pollution Control Board

James R. Thompson Center

100 W. Randolph St., Suite 11-500

Chicago, IL 60601-3218

John Knittle

Hearing Officer

Illinois Pollution Control Board

James R. Thompson Center

100 W. Randolph, Suite 11-500

Chicago, Illinois 60601

John J. Kim

Rachel L. Doctors

Division of Legal Counsel

Illinois Environmental Protection Agency

1021 North Grand Avenue East

P.O. Box 19276

Springfield, IL 62794-9276

William A. Murray

Special Assistant Corporation Counsel

Office of Public Utilities

800 East Monroe

Springfield, Illinois 62757

Kathleen C. Bassi

Sheldon A. Zabel

Stephen J. Bonebrake

Schiff Hardin LLPP

6600 Sears Tower

233 South Wacker Drive

Chicago, Illinois 60606

Matthew Dunn, Chief

Division of Environmental Enforcement

Office of the Attorney General

188 West Randolph St., 20th Floor

Chicago, IL 60601

Virginia Yang, Deputy Legal Counsel

Illinois Department of Natural Resources

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

One Natural Resources Way

Springfield, IL 62702-1271

Sasha Reyes

Steven Murawski

Baker & McKenzie

One Prudential Plaza, Suite 3500

Chicago, IL 60601

David Rieser

James T. Harrington

Jeremy R. Hojnicki

McGuire Woods LLP

77 West Wacker, Suite 4100

Chicago, Illinois 60601

Faith E. Bugel

Environmental Law and Policy Center

35 East Wacker Drive, Suite 1300

Chicago, Illinois 60601

Keith I. Harley

Chicago Legal Clinic

205 West Monroe Street, 4th Floor

Chicago, Illinois 60606

S. David Farris

Manager, Environmental, Health and Safety

Office of Public Utilities, City of Springfield

201 East Lake Shore Drive

Springfield, Illinois 62757

Bruce Nilles

Sierra Club

122 W. Washington Ave., Suite 830

Madison, WI 53703

Daniel McDevitt

Midwest Generation

440 S. LaSalle Street

Suite 3500

Chicago, IL 60605

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

BEFORE THE ILLINOIS POLLUTION CONTROL BOARD

In The Matter of:

Proposed New Clean Air Interstate Rule

(CAIR) SO2, NOx Annual and NOx Ozone Season

Trading Programs, 35 Ill. Adm. Code 225.

Subparts A, C, D and E.

)

)

)

)

)

No. R06-26

(Rulemaking -Air)

FINAL COMMENTS OF KINCAID GENERATION, L.LC.

NOW COMES Participant KINCAID GENERATION, L.L.C. (“Kincaid”), by and

through its attorneys, JENNER & BLOCK LLP, and respectfully submits its final comments to

this rulemaking. Kincaid appreciates this opportunity to comment again on these important new

rules. Kincaid has been an active participant throughout this long rulemaking process –

attending all the “outreach” meetings convened by the Illinois Environmental Protection Agency

(“IEPA”) in Springfield in January and February, participating in the Board hearings both in

Springfield and Chicago, providing comment on the proposal on two separate occasions, and

providing testimony at the Chicago hearing.

I.

Dominion Resources, Inc. (“Dominion”) owns and operates electric generating

facilities in eleven states, including the 1250 megawatt coal-fired Kincaid

Generation L.L.C. power plant, located in Kincaid, Illinois. Dominion also owns a

50% interest in the 1400-megawatt natural gas-fired Elwood Energy, L.L.C.

combustion turbine plant, located in Elwood, Illinois.

Over the past eight years, Dominion’s Kincaid station has been installing pollution controls,

switching fuels and making other changes to ensure compliance with the increasingly more

stringent air quality emissions limitations. To reduce sulfur dioxide emissions in order to

comply with Phase II of the federal Acid Rain program, Kincaid switched in 1999 to the much

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

2

lower sulfur Powder River Basin (“PRB”) coal. In 2001, Kincaid began construction of two

selective catalytic reduction (“SCR”) systems to control nitrogen oxides (“NO

x

”) emissions as

part of the Illinois NO

x

requirements under the new IEPA Subpart W regulations. These massive

control devices began operation in 2003 and have been very effective, reducing ozone season

NO

x

emissions by more than 85% from previous levels.

Kincaid supports the adoption of state regulations that embrace the federal Clean Air Interstate

Rule (“CAIR”). Kincaid appreciates the IEPA’s efforts to address the individual electric

companies’ particular problems associated with implementation of these important new

regulations and also appreciates this opportunity to comment on the proposed regulations.

II.

Subparts D (CAIR NO

x

Annual Trading Program) and E (CAIR NO

x

Ozone Season

Trading Program) of the Illinois CAIR proposal deviate significantly from EPA’s

model rule and could jeopardize EPA approval of the Illinois CAIR SIP.

Kincaid does not support the IEPA proposal under Subparts D and E. Specifically, we do not

support the 25% set-aside of NO

x

allowances under proposed Sections 225.455 and 225.555, the

so-called “Clean Air Set-Aside” (“CASA”). First, the agency has provided no justification that

the level of the proposed set-aside is necessary from an air quality perspective. Second, these

provisions will significantly increase compliance costs for Illinois sources and competitively

disadvantage the state relative to surrounding states. Furthermore, this approach also could

jeopardize USEPA approval of the Illinois CAIR SIP, and perhaps the ability of Illinois sources

to participate in the federal trading program. It may also deny Illinois the economic advantages

of the USEPA trading program that many other surrounding states will realize through their

adoption of the USEPA rule.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

3

In addition, we do not support the proposed withholding of allowances from the compliance

supplement pool (“CSP”) under Section 225.480 of the CAIR NO

x

Annual Trading Program

proposal. These additional NOx allowances have been provided in the federal rule to encourage

early reductions during 2007 and 2008. Illinois included early reduction provisions in its rules

implementing the NO

x

SIP Call. These early reduction incentives not only provide companies

added compliance flexibility that eases the burden once the requirements take effect, but benefit

the environment as well by providing real emission reductions sooner. Given this past success, it

seems counterintuitive for the agency to consider eliminating such an incentive by withholding

allowances from the CSP.

III.

The IEPA should justify any “beyond CAIR” NO

x

reductions with a thorough

modeling demonstration.

Should there remain local areas in Illinois that fail to meet the air quality standards following

implementation of the CAIR regional reductions, the IEPA should thoroughly evaluate the

amount of additional air quality improvement needed and the amount of emission reductions

needed in the more localized nonattainment area in order to achieve the needed air quality

improvements in the most cost-effective manner. Requiring all Illinois sources subject to CAIR

to implement “beyond CAIR” reductions across-the-board for the purpose of resolving local

problems is not reasonable or environmentally justified. Kincaid urges IEPA to conduct a

thorough modeling demonstration to determine the level of reductions that may be necessary to

resolve any residual non-attainment problems following implementation of the CAIR reductions.

The 25% NO

x

“set-aside” is unreasonably burdensome to Illinois generators and their customers

and has not been demonstrated to be necessary to achieve attainment with the ambient air quality

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

4

standards. As USEPA has stated, the program is designed “to balance the burden for achieving

attainment between regional-scale and local-scale control programs.”

1

Therefore, for the purposes of implementation of CAIR, Kincaid does not believe it is necessary

for IEPA to propose the “beyond CAIR” NO

x

reductions and urges the Board to reject the IEPA

proposal and, instead, approve full adoption of USEPA’s federal “model rule” on the same

schedule established by USEPA.

IV.

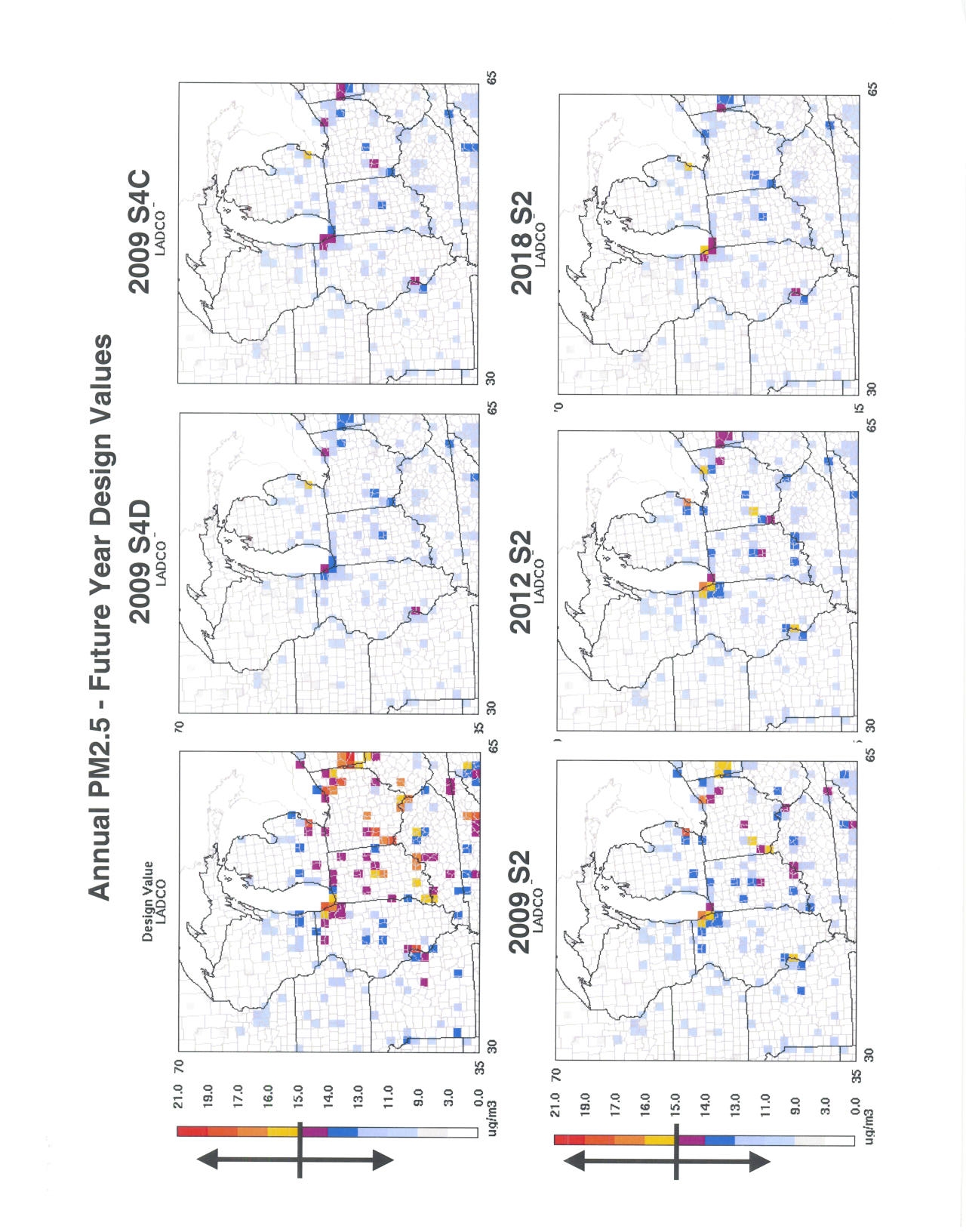

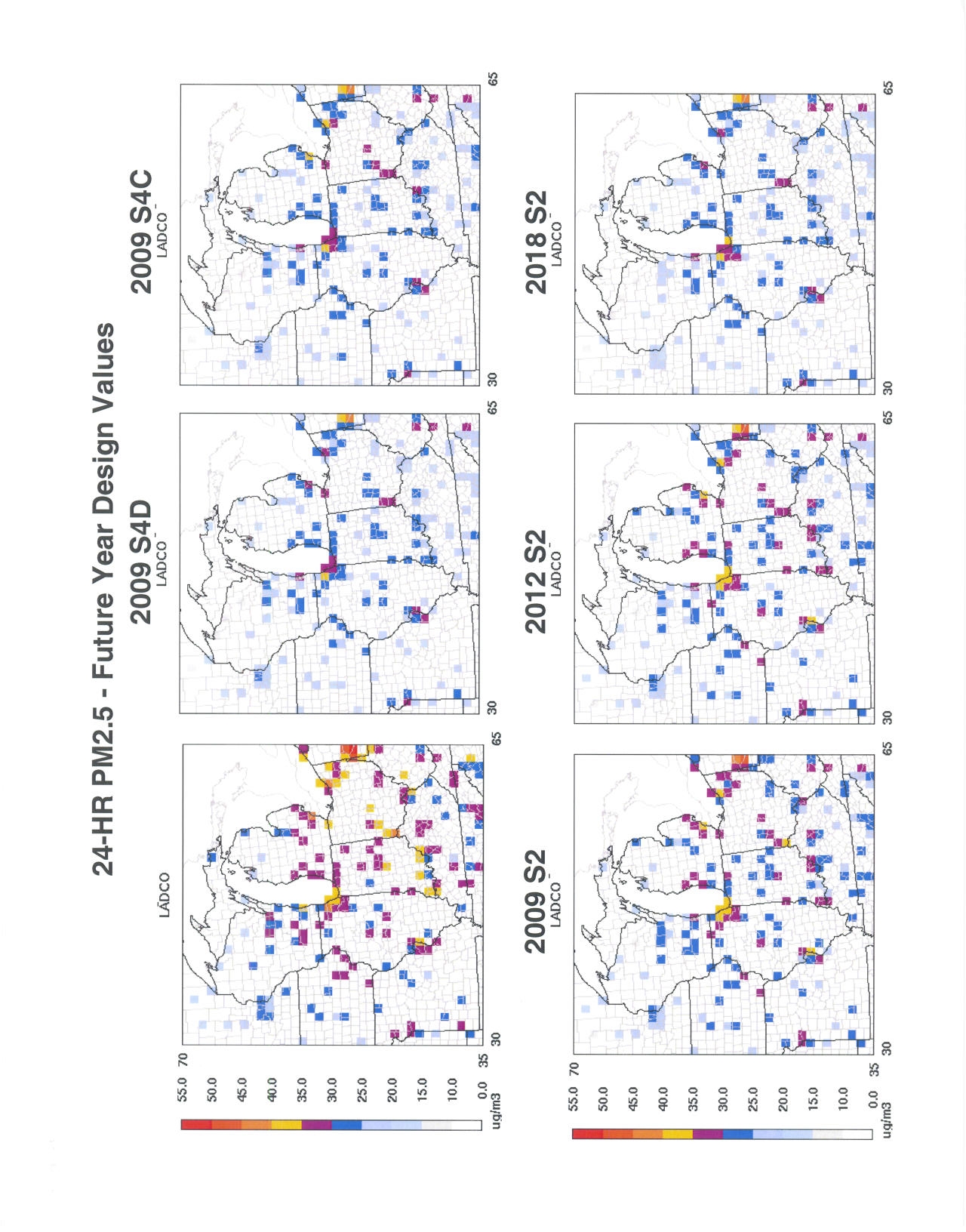

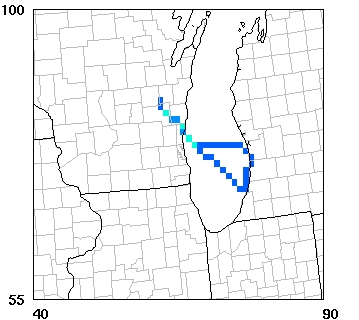

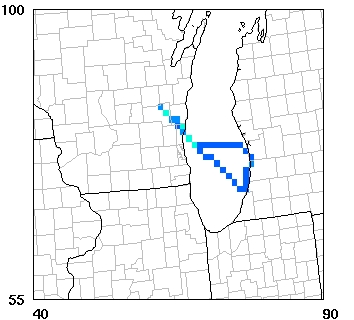

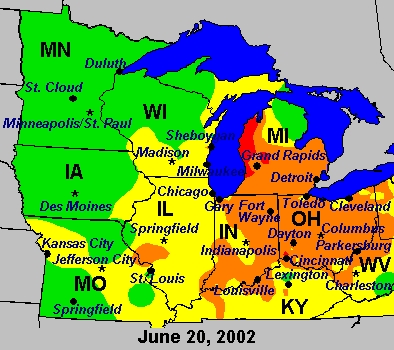

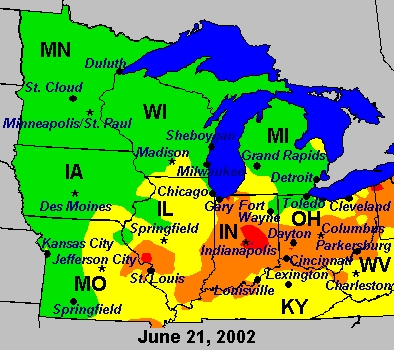

Recent air quality modeling by Lake Michigan Air Directors Consortium

(“LADCO”) suggests additional NO

x

reductions from the electric generating unit

(“EGU”) sector beyond the reductions expected from the federal CAIR program

will not solve the residual ozone and PM

2.5

non-attainment problem in the Chicago

area. A comprehensive attainment plan should be thoroughly researched and fully

developed that clearly and conclusively demonstrates the level of emissions

reductions needed and the source categories for which the most efficient and

effective reductions can be achieved. Only when this plan has been fully developed

will IEPA have the justification to proceed with “beyond CAIR” reductions.

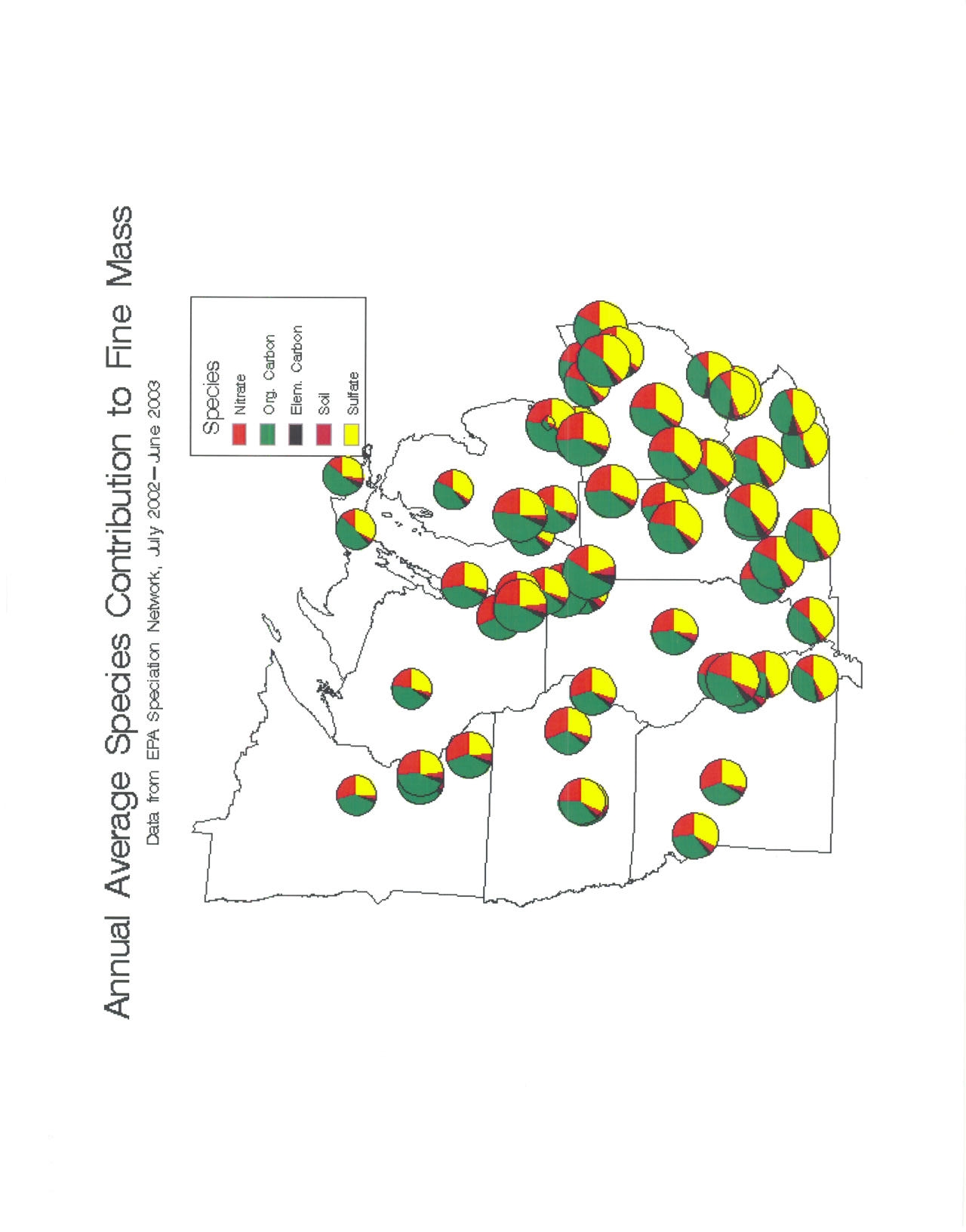

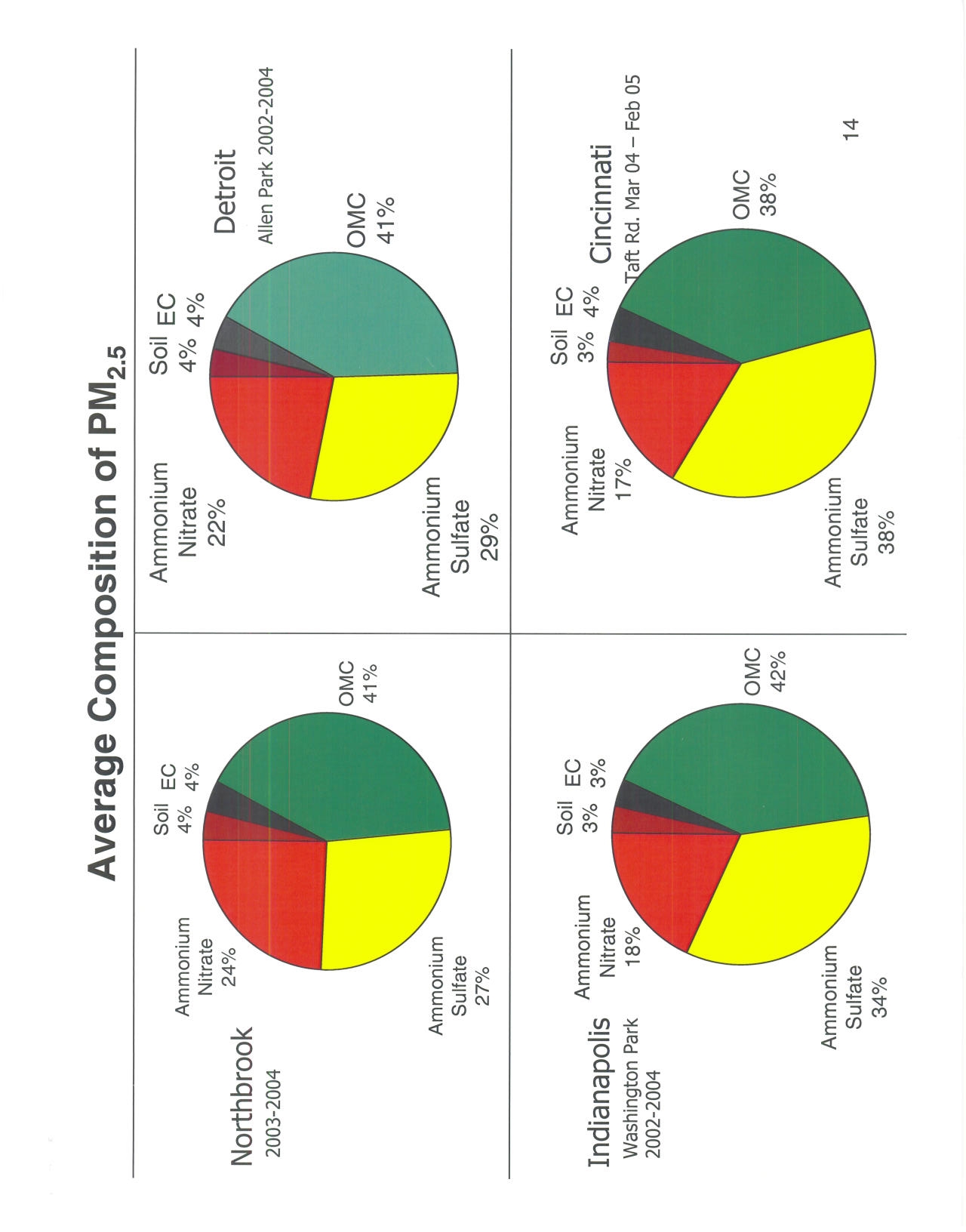

Further EGU reductions of SO

2

and NO

x

are not likely to impact PM

2.5

concentrations

sufficiently to achieve attainment in any residual PM

2.5

nonattainment areas in Illinois or in other

states. Accordingly, mandated beyond-CAIR EGU reductions of SO

2

and NO

x

may not be

necessary, cost effective or even have any beneficial effect on reducing the particle concentration

of monitored PM

2.5

. The PM

2.5

particle composition may well be driven by mobile sources in

winter. Another source mix may drive the PM

2.5

composition in summer. Until additional

speciated monitoring data is available, it is premature to require “beyond CAIR” SO

2

or NO

x

reductions from EGUs because the absolute value of PM

2.5

concentrations measured in the field

may not be driven by SO

2

or NO

x

reductions.

1

70 Fed. Reg. 25166 (May 12, 2005)

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

5

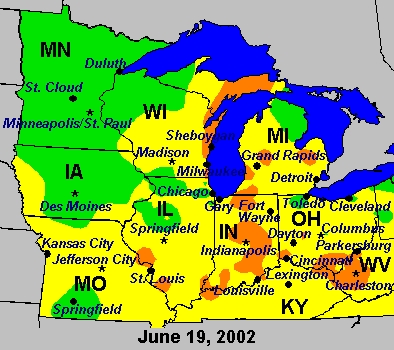

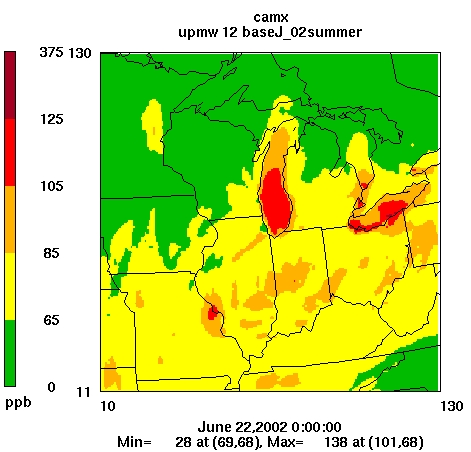

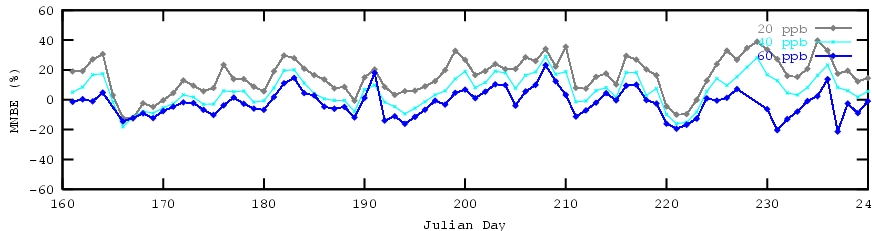

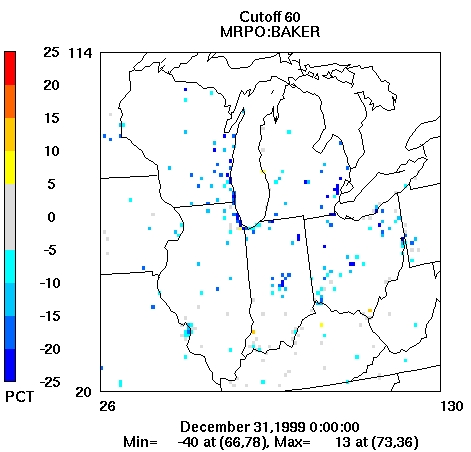

Kincaid recognizes that several areas, including the Chicago MSA, may not achieve one or both

of these standards following the implementation of Phase 2 of CAIR in 2015. Although the

Chicago MSA, while closer to attainment, still may not reach attainment for ozone or PM

2.5

, it

appears that further regional reductions in the utility sector do not make a significant difference

in the attainment status of the Chicago MSA. Indeed, based on one analysis presented at the

October 18, 2005 Indiana Department of Environmental Management Utility Rules Workgroup

meeting, further reductions in the utility sector actually cause ozone levels to increase in the

Chicago MSA. Kincaid therefore supports the approach to implement CAIR essentially as

established by USEPA, and then work with sources in local nonattainment areas to determine the

appropriate mix of reductions needed to resolve the remaining local nonattainment area issues.

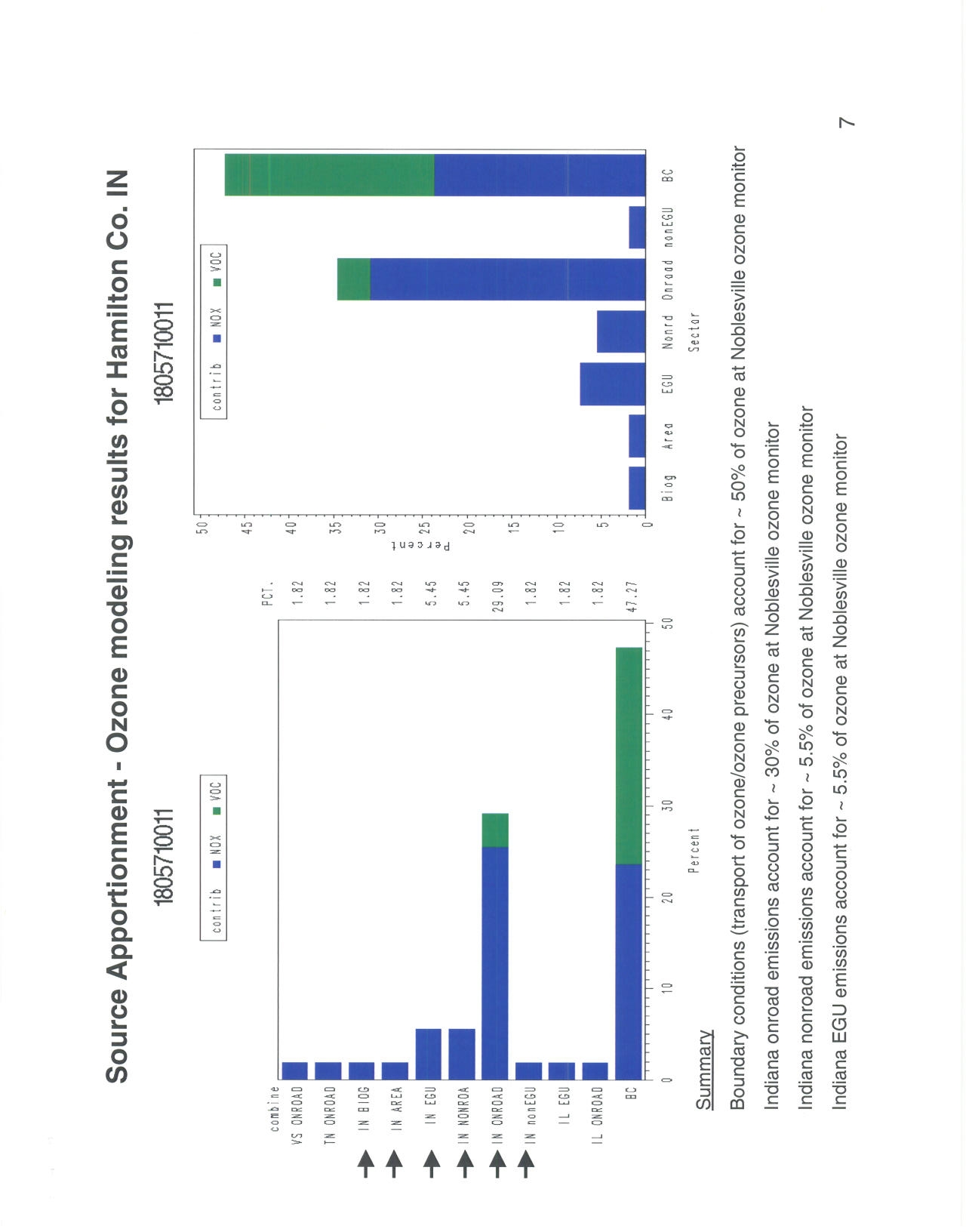

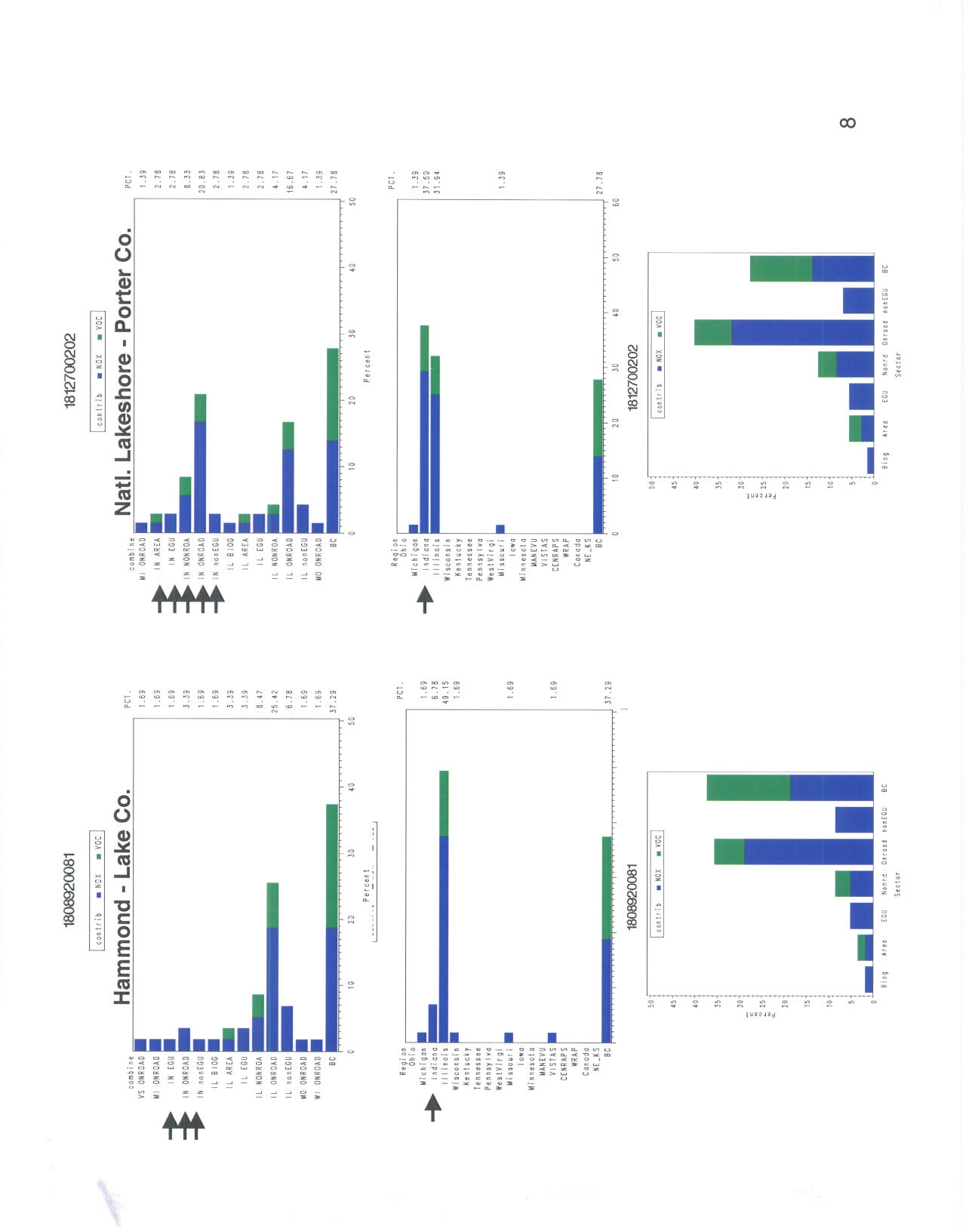

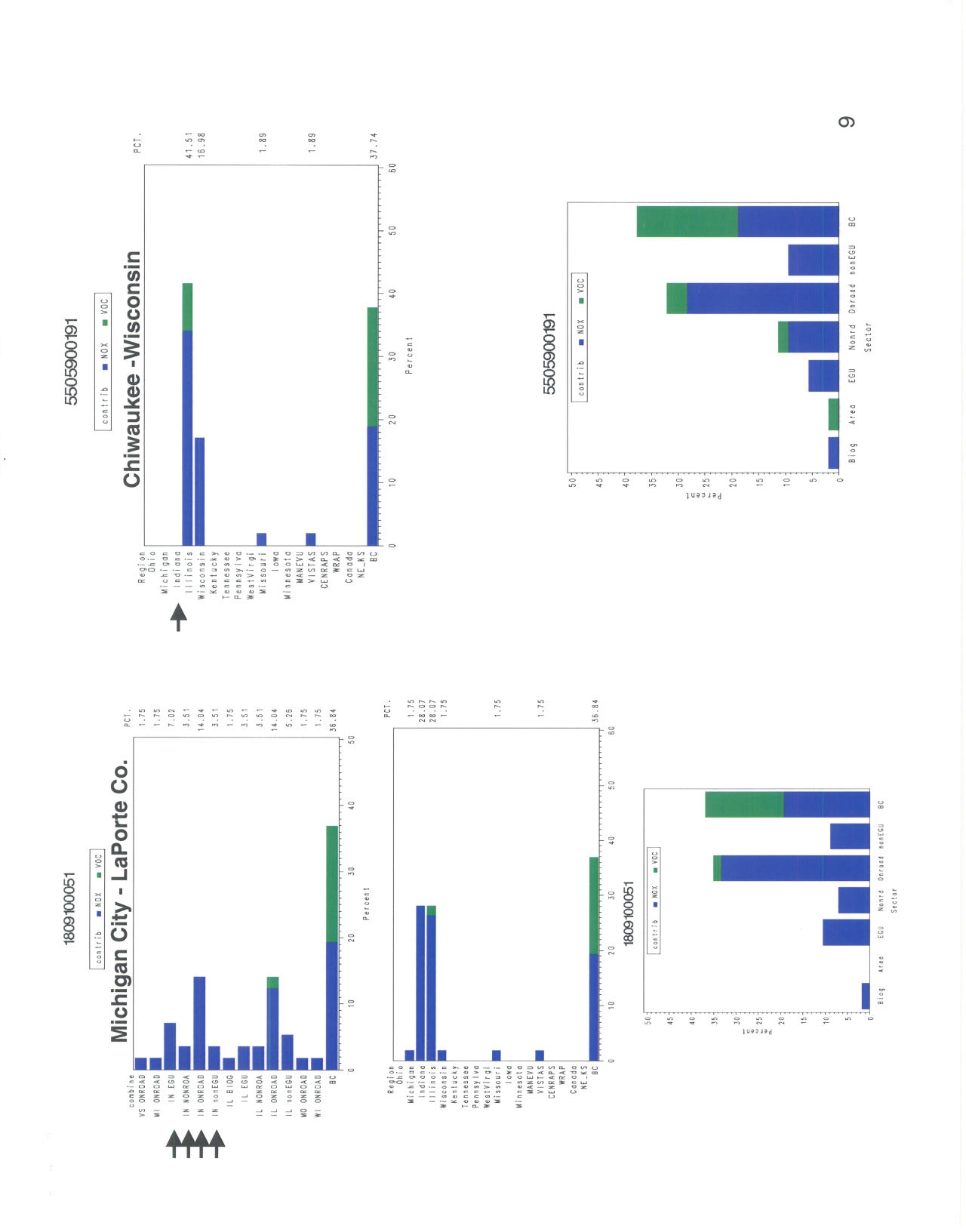

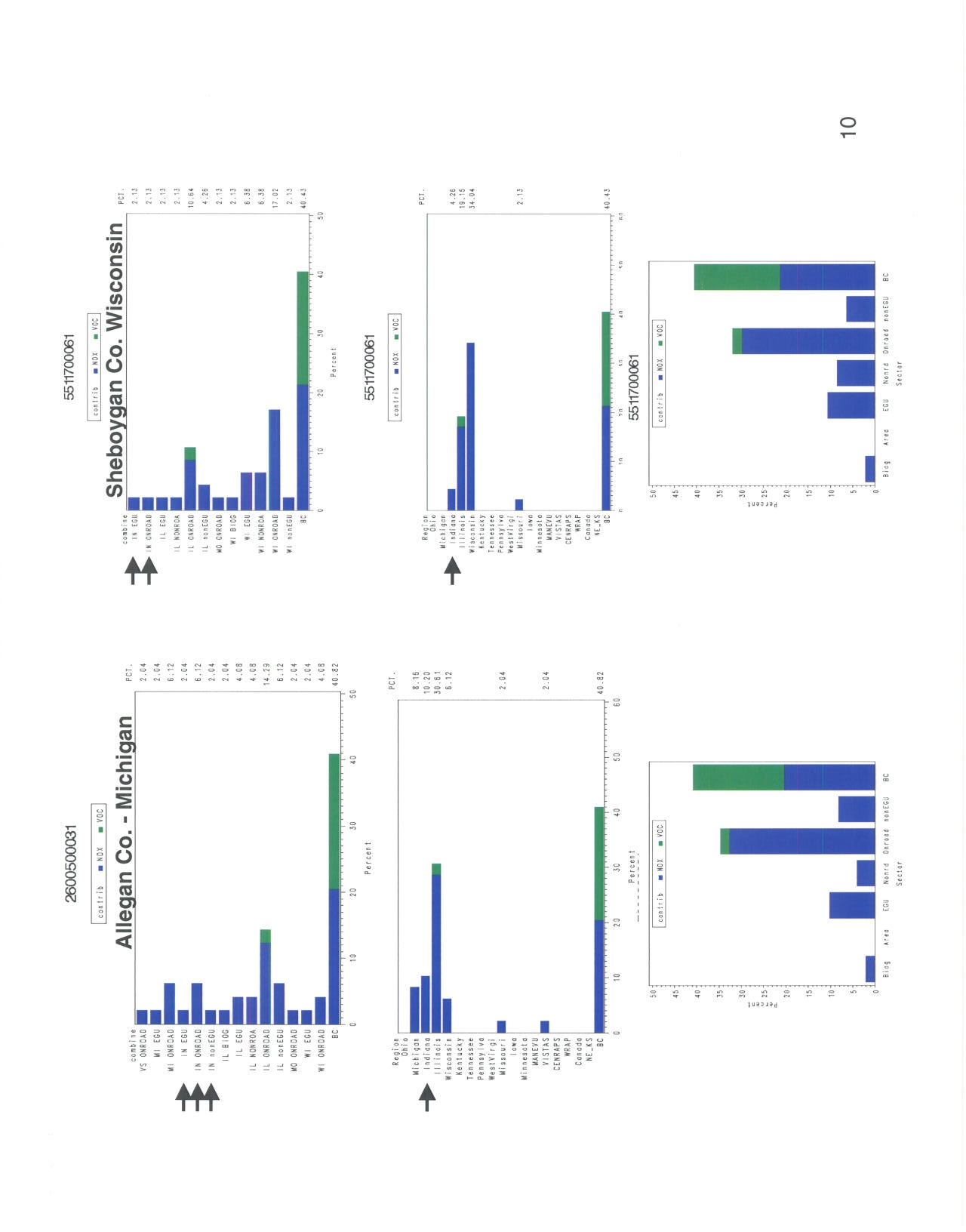

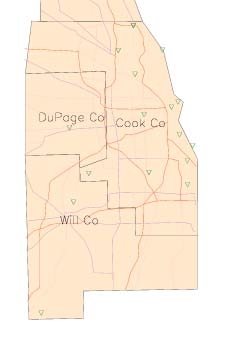

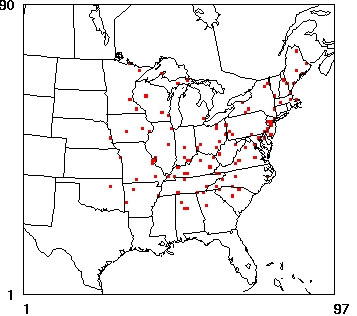

Source apportionment data provided by LADCO bears this reasoning out. Data presented at the

October 18, 2005 Indiana Utility Rules Workgroup meeting clearly indicates that Illinois EGUs

make up only a small part of the ozone non-attainment problem in Chicago MSA. The data

indicate that 38% of the ozone comes from NO

x

and VOC emissions from “Boundary

Conditions” or sources outside the five-state Midwest region. More important, 26% of the ozone

problem appears to come from “Illinois On-road” or mobile sources. Illinois EGU NO

x

emissions make up only about 4% of the ozone contribution, behind “Illinois Non-road,”

“Illinois Non-EGU,” and “Indiana On-road” sources.

2

2

Mark Derf, “Photochemical Modeling Update: Round 3 – 8 Hour Ozone and PM

2.5

,” Presentation for the Utility

Rules Workgroup, Indiana Department of Environmental Management, October 18, 2005, attached as Exhibit A.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

6

V.

The IEPA proposal to adopt “beyond CAIR” NO

x

reductions through a proposed

set-aside program that far surpasses that of any surrounding state places Illinois

electricity consumers at a severe economic disadvantage.

The proposal to allocate 25% of Illinois’ annual NO

x

budget as “set-asides” for the CASA

allowances will severely restrict NO

x

allocations for affected units. There appears to be little

chance that these allowances will ever be returned to the EGUs since the proposal calls for any

NO

x

allowances that remain unclaimed from the four CASA allowance pools (Energy Efficiency

and Conservation/Renewable Energy; Air Pollution Control Equipment Upgrades; Clean Coal

Technology; and Early Adopters) to be used to replenish each of the four CASA pools. Once the

allowances in each of these pools are replenished to a level twice the amount originally

designated for that pool, proposed section 225.475 (and section 225.575 of the Ozone Season

rule) indicates “the Agency may elect to retire the CAIR NOx allowances that have not been

distributed…” Thus, the 25% set-aside essentially becomes a 25% reduction beyond the NO

x

limits in the federal CAIR rule. The equivalent NO

x

limit is very close to the NO

x

limit

suggested by LADCO as modeling scenario “EGU1.”

Recent studies have evaluated the economic impacts that the imposition of broad-based “beyond-

CAIR” model rule reductions on EGU sources would have on the State of Illinois. An August

26, 2005 report prepared by BBC Research & Consulting (“BBC”) of Denver, Colorado, for the

Midwest Ozone Group and the Center for Energy and Economic Development indicates that

imposition of “beyond-CAIR” control strategies, such as the ones described in the white paper

prepared by LADCO on additional control scenarios for EGUs, could have a significant negative

impact on the economies of several Midwestern states. The paper examined two scenarios

referred to as “EGU1” and “EGU2.” The BBC results indicate that imposition of these “beyond

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

7

CAIR” requirements on EGUs will result in the mandatory requirement of installation of controls

on very small units.

3

BBC estimated the electric rate impacts of the proposed LADCO controls and the corresponding

impact of higher electric rates on the case study industries and on household spending in the five

states within the LADCO region. Rate impacts were estimated by comparing the projected

annual electric utility revenue requirements, including costs of compliance with the LADCO

controls, with projected annual electric utility revenue requirements after compliance with

CAIR. BBC examined several scenarios of LADCO controls, including with and without

replacement power to compensate for early generating unit retirements under EGU1 and EGU2.

BBC quantified overall effects on regional output and employment arising from the direct

impacts on the case study industries and from the impacts of higher electric rates on household

disposable income. Impacts were quantified using partial equilibrium analyses of each case

study industry along with the IMPLAN economic input-output model. The focus of the study

was on the direct and secondary (or “multiplier”) effects on ten case study industries and on the

portions of the economy supported by household spending. The findings of BBC are

conservative, i.e., are underestimated, because impacts of higher electric rates on other industries

and the commercial sector (which together account for about one-third of all electricity sales)

were not included. Health- and visibility-related economic benefits of emissions reductions and

the potential short-term economic effects on the construction industry from building and

installing pollution control equipment were also outside the scope of the BBC study. It should

3

“Midwest Electric Rate Impact Study,” BBC Research and Consulting, Denver, Colorado, August 26, 2005,

attached as Exhibit B.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

8

be noted that the BBC study has evaluated economic impacts of the LADCO EGU1 and EGU2

scenarios that includes tighter SO

2

emissions limits, which make up the majority of these costs.

Key findings of the BBC report are as follows:

1. From a regional standpoint, electric rates in the year 2013 would be about 11 percent

higher under EGU1 and 16 percent higher under EGU2 than under the CAIR Rule.

Electric rates would increase in Illinois by about 9 percent under EGU1 and about 15

percent under EGU2.

2. Demand for coal mined in Illinois, Indiana and Ohio is expected to decline by 48 percent

under EGU1 and 54 percent under EGU2.

3. Annual economic output in the five-state region is projected to be reduced by between

$6.9 billion and $10.4 billion under EGU1 and between $9.0 billion and $14.1 billion

under EGU2. The economic output of Illinois could fall by up to $2.0 billion in the year

2013.

4. Employment in the five-state region is projected to be reduced by approximately 51,000

to 69,000 jobs under EGU1 and 69,000 to 94,000 under EGU2. In Illinois, the estimated

job loss ranges from 9,300 to 12,100 under EGU1 and between 13,400 and 17,600 under

EGU2.

Kincaid has attempted to separate the estimated costs presented in the BBC report for

compliance with only the NO

x

provisions of an EGU1 scenario. While Kincaid cannot at this

time provide a breakdown of the state-specific costs associated with the EGU1 NO

x

reductions

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

9

expected for Illinois, Kincaid can provide an estimated cost for the five-state Midwest region

(Illinois, Indiana, Ohio, Michigan and Wisconsin). Kincaid consulted the analysts that provided

the cost data that BBC used as input to their report and their projection for the NO

x

portion of the

EGU1 scenario was estimated at $865 million per year.

4

Illinois’ share of these costs will be

borne by the citizens and industries of Illinois – costs that states adopting the federal CAIR

program will not have to bear.

VI.

Kincaid supports IEPA’s proposal under Title 35, Part 225, Subpart C to adopt the

federal CAIR provisions for SO

2

.

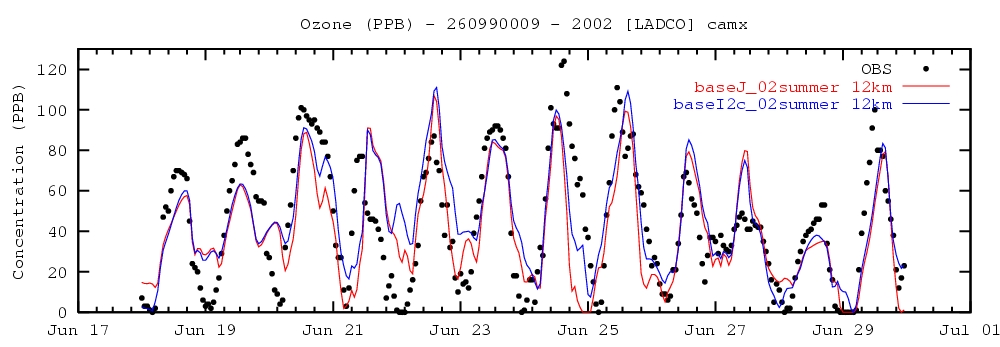

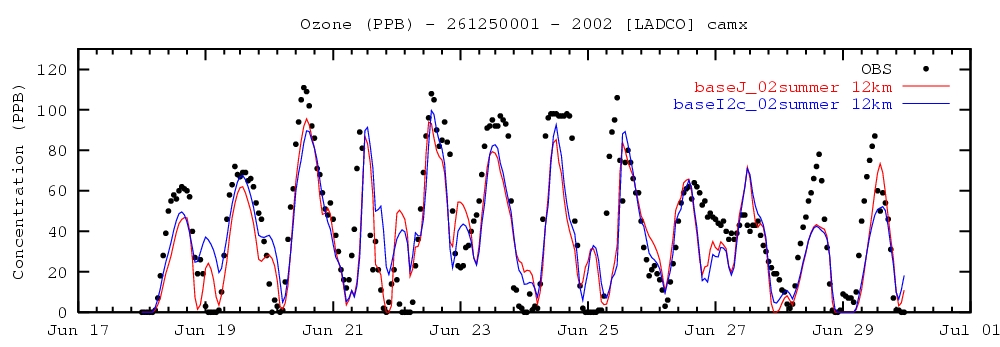

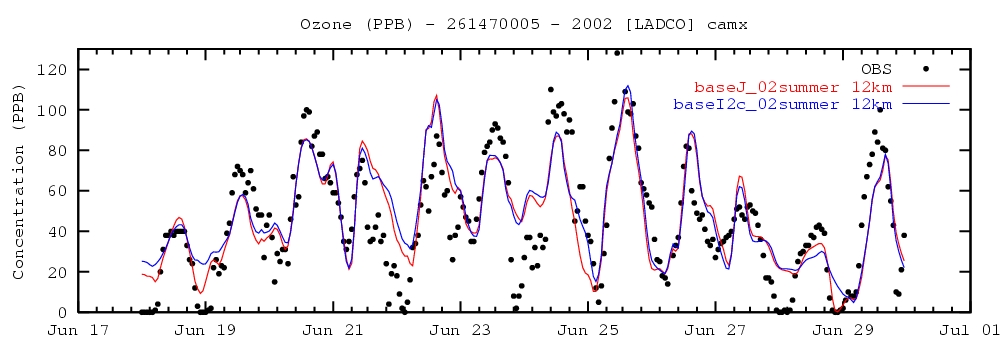

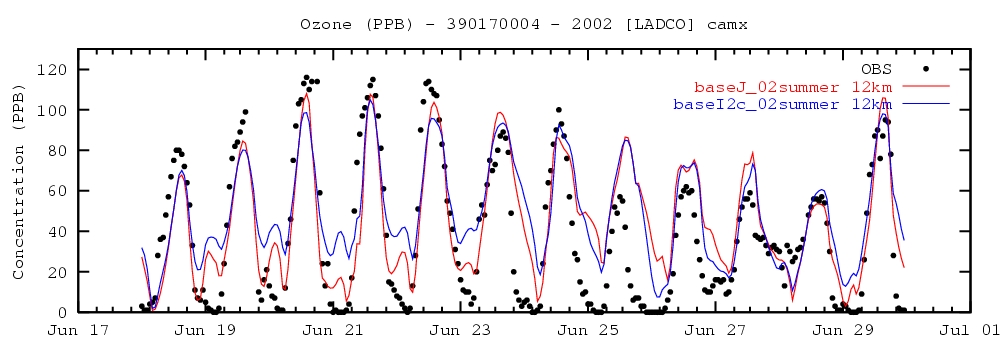

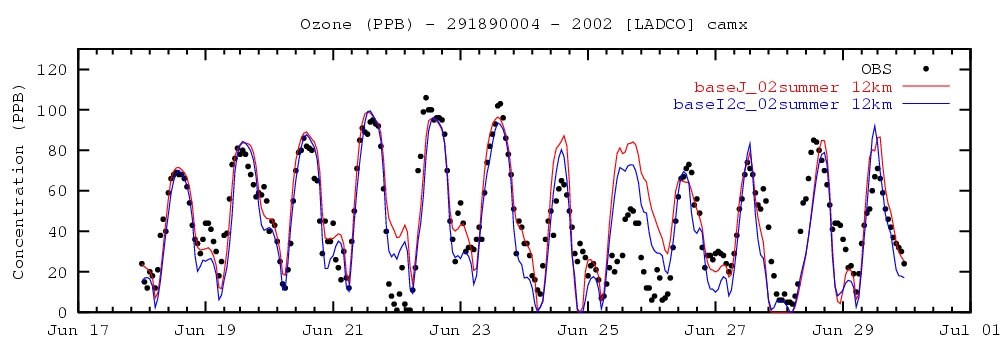

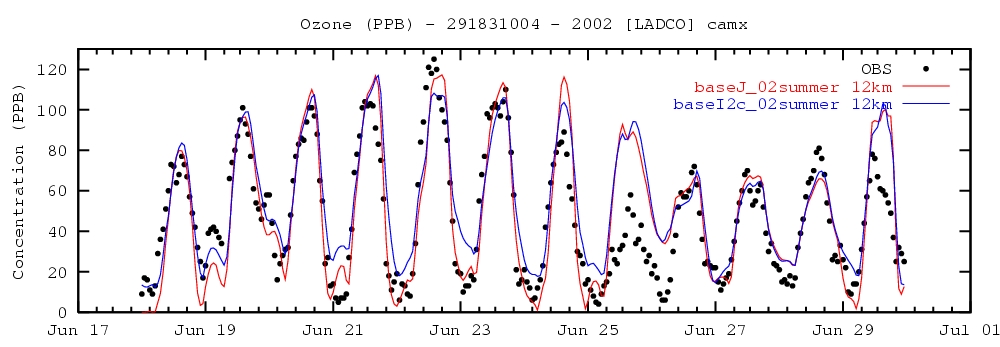

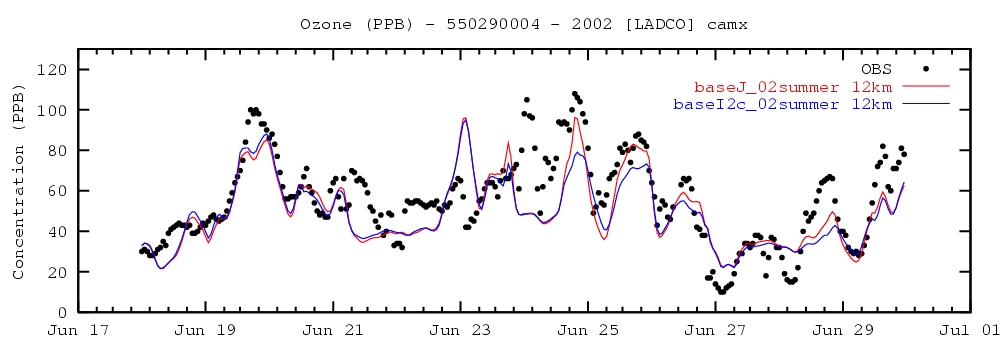

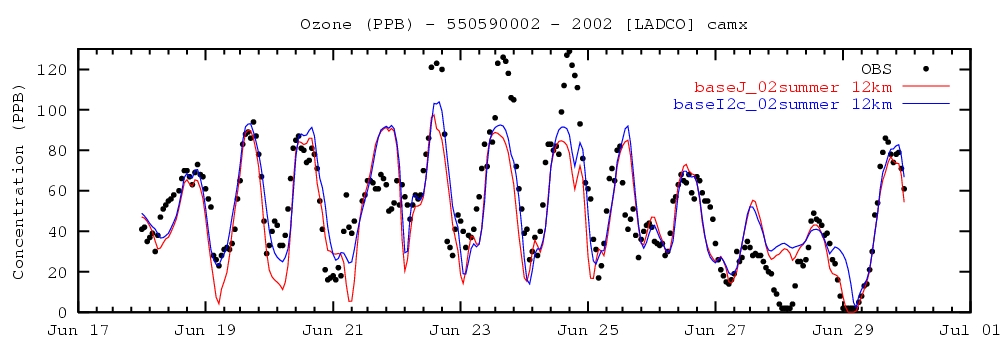

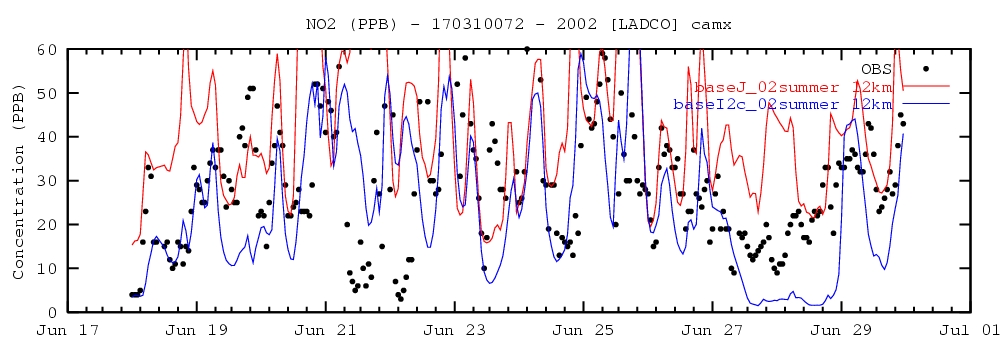

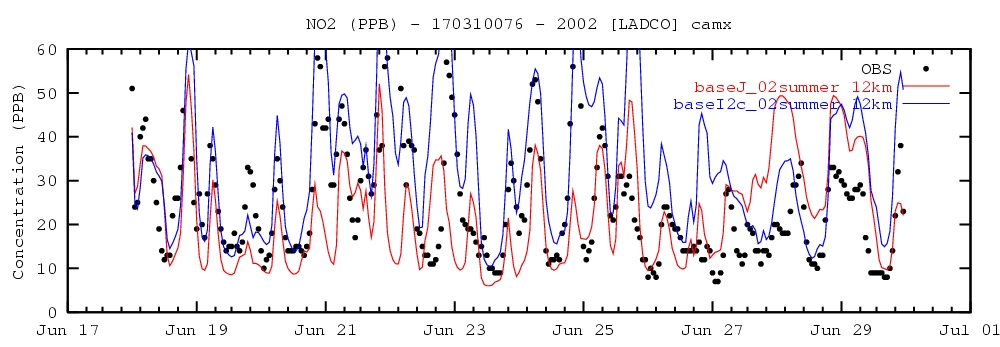

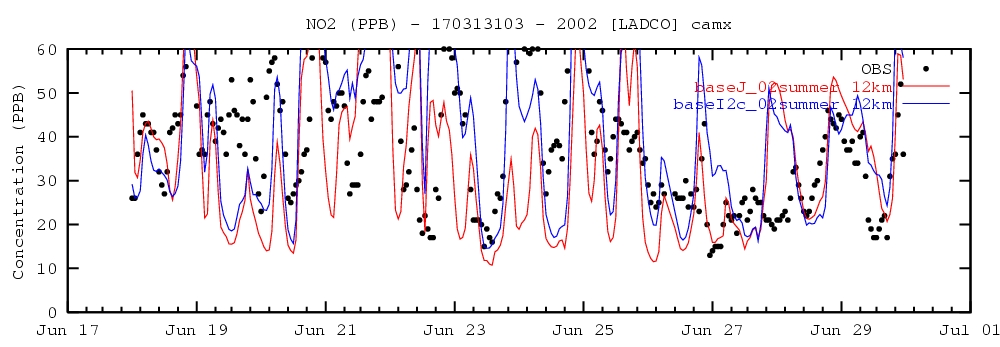

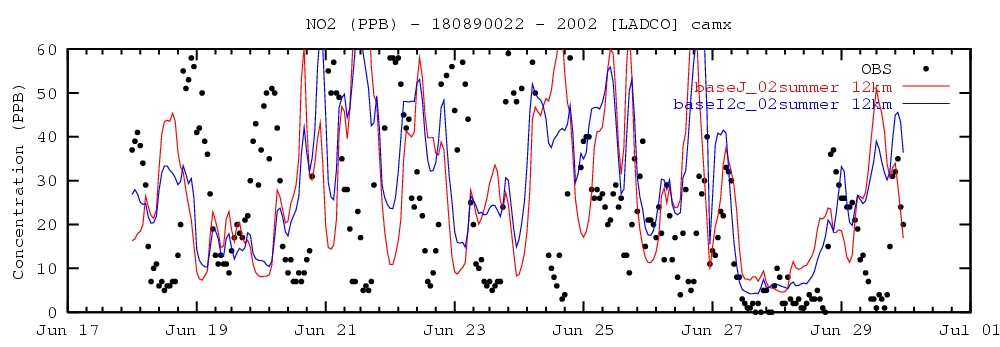

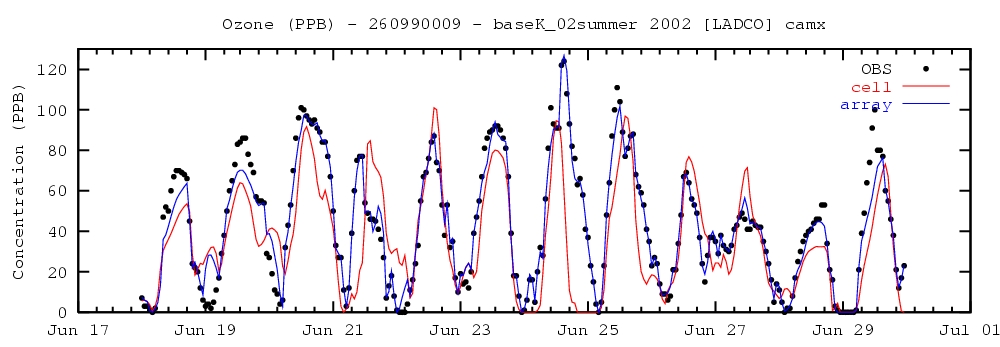

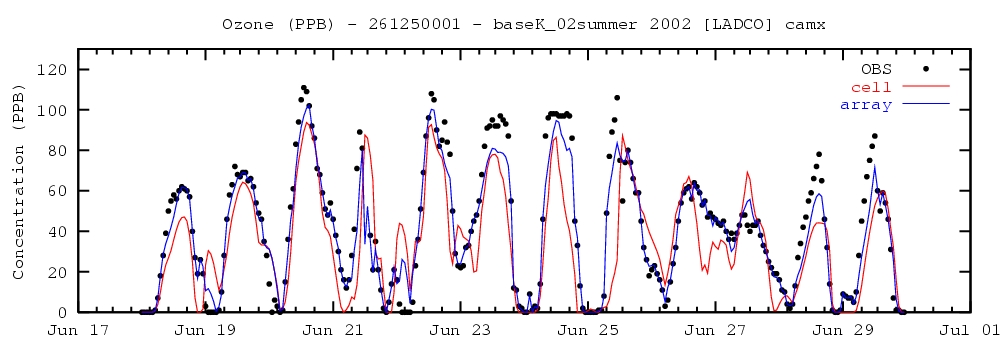

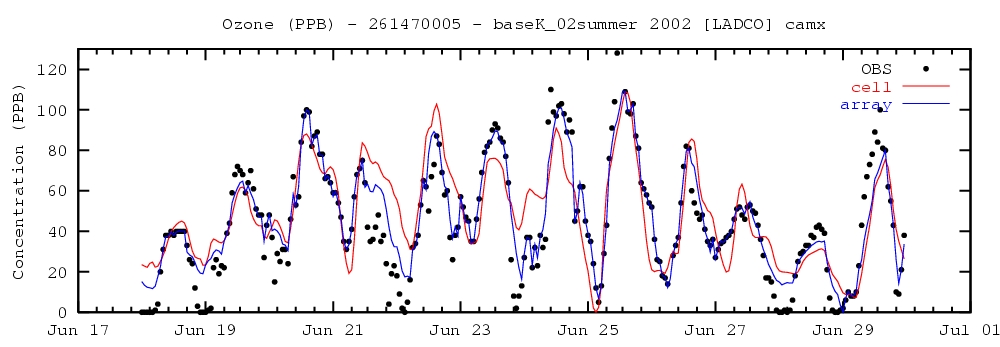

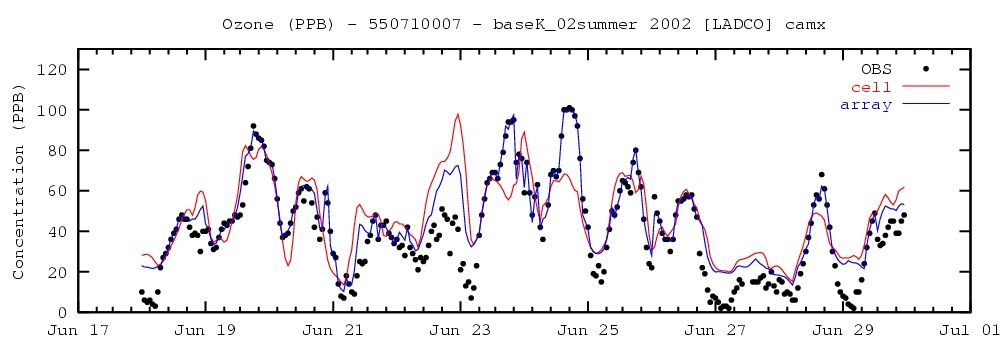

Kincaid supports the IEPA proposal to adopt the federal CAIR SO

2

Trading Program as part of

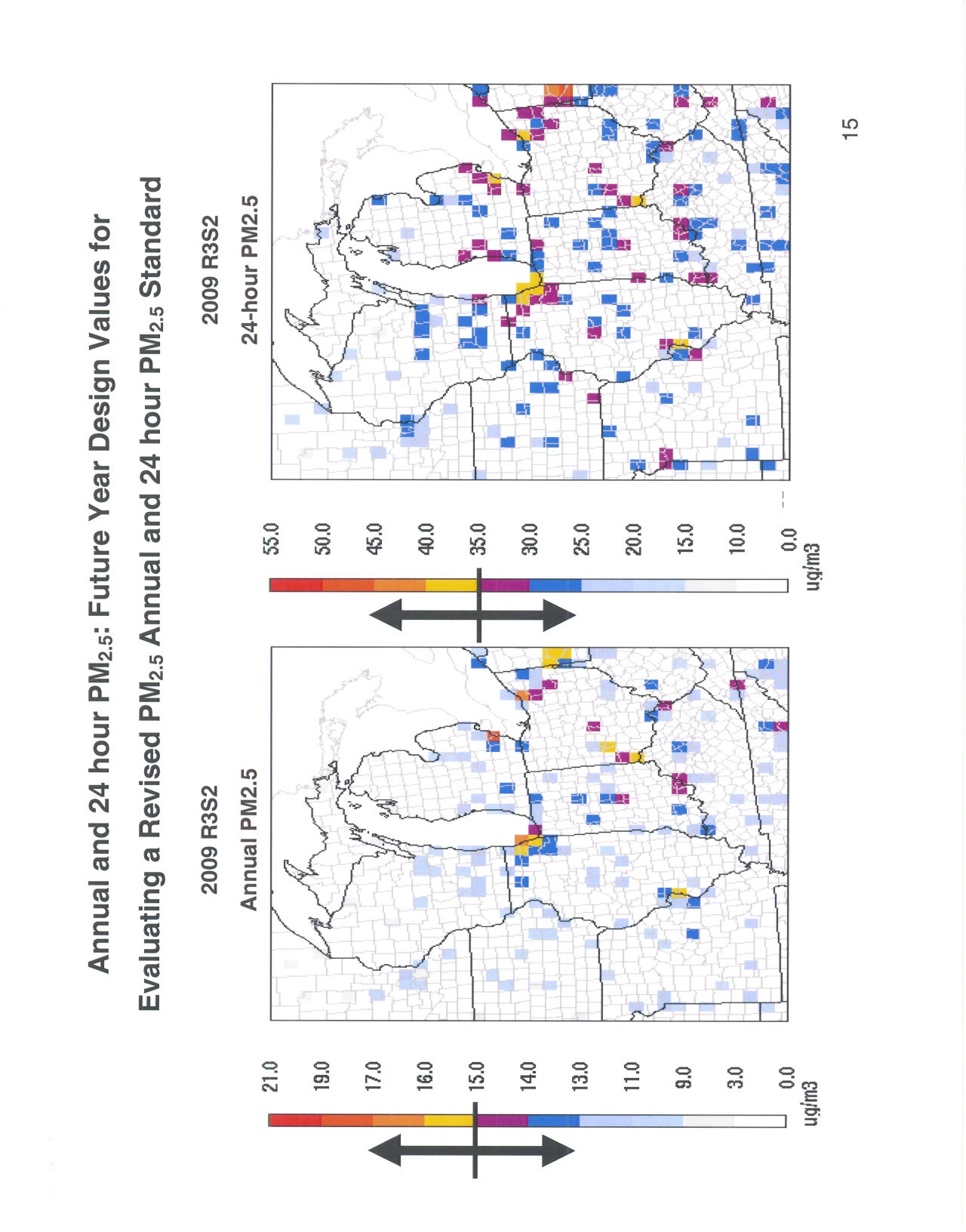

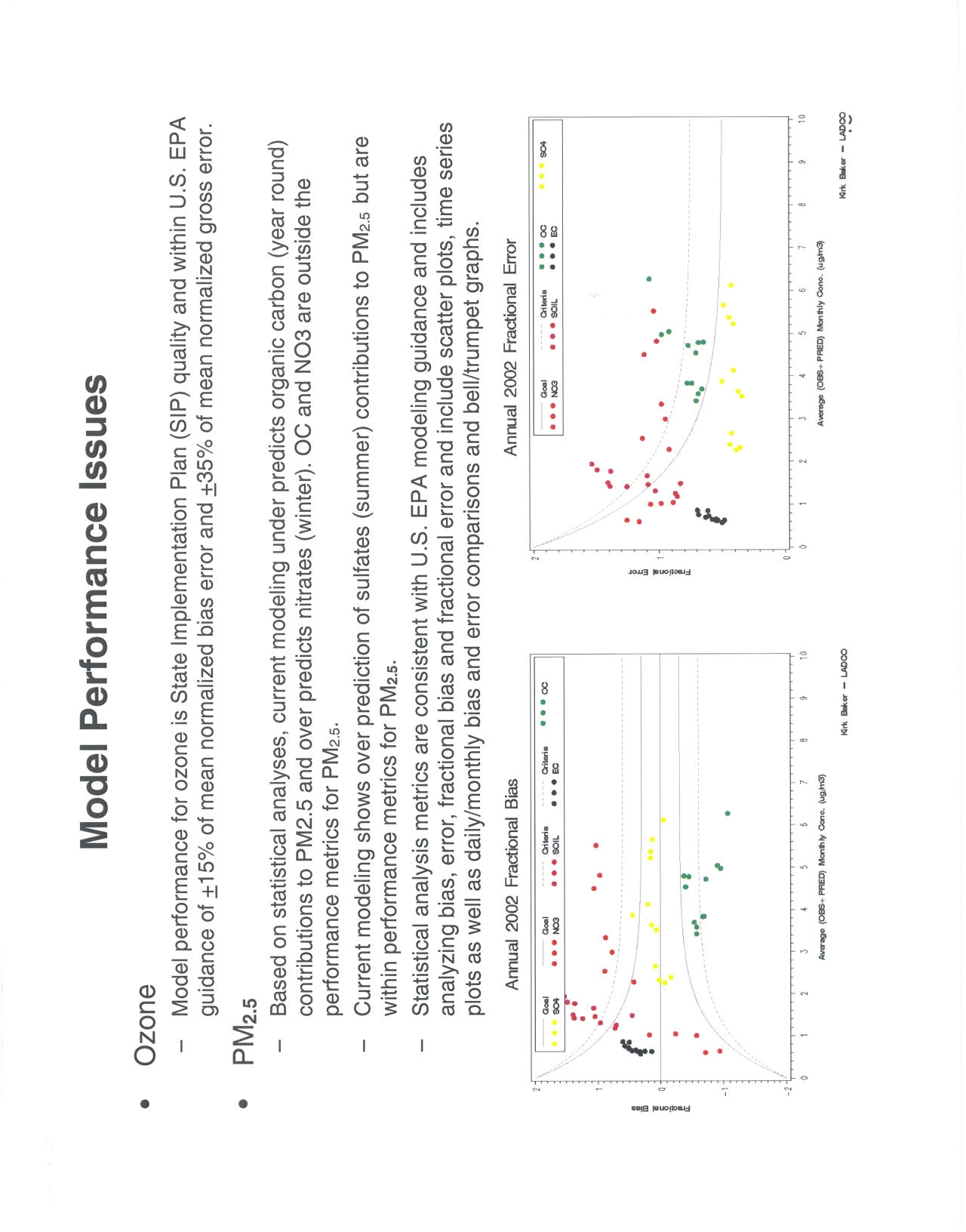

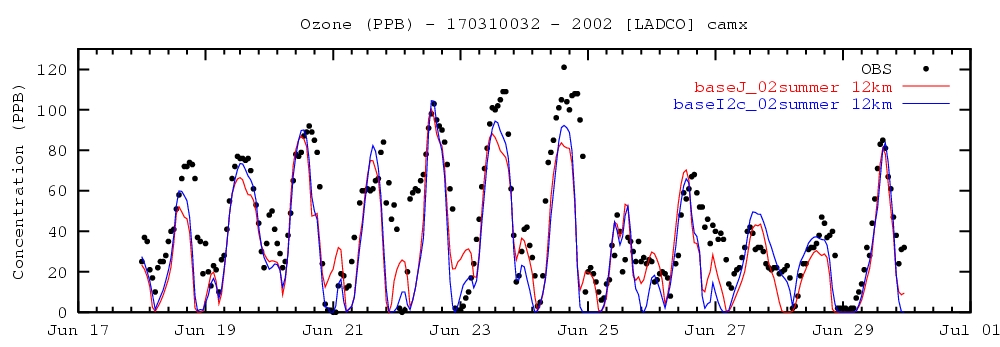

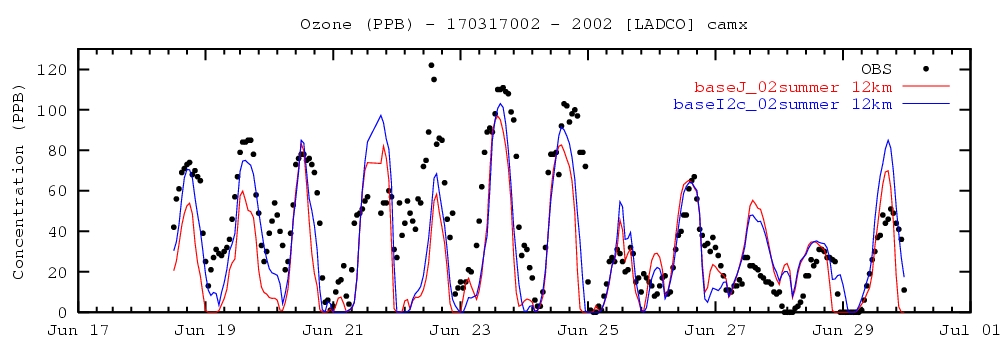

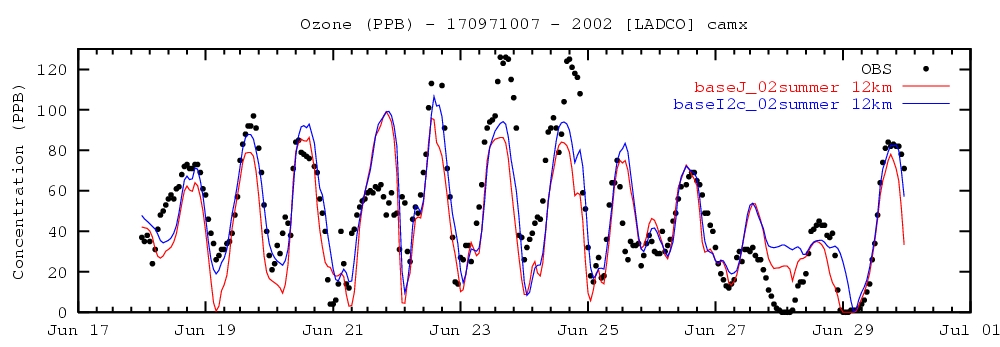

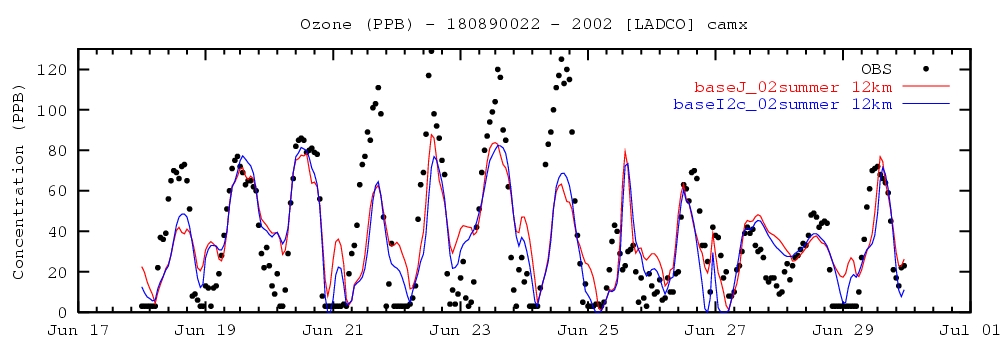

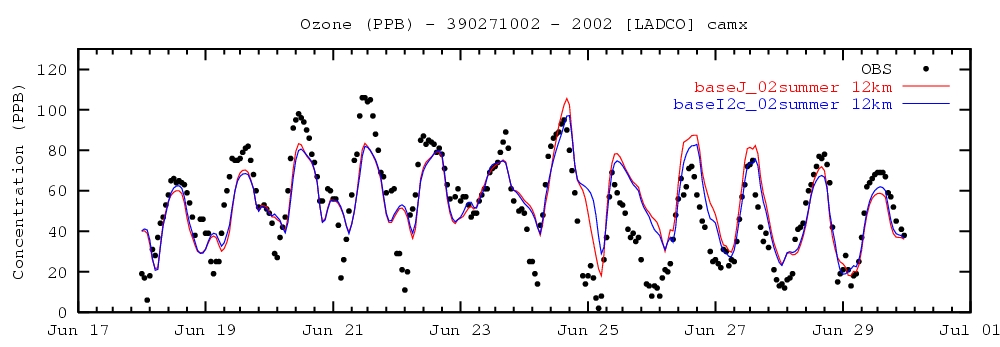

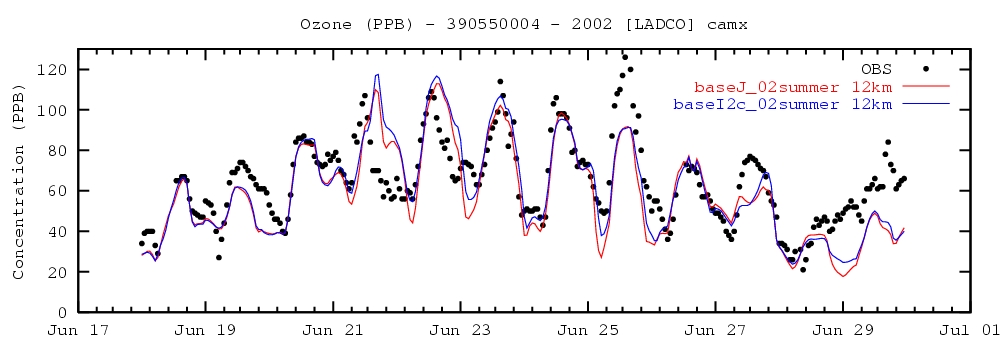

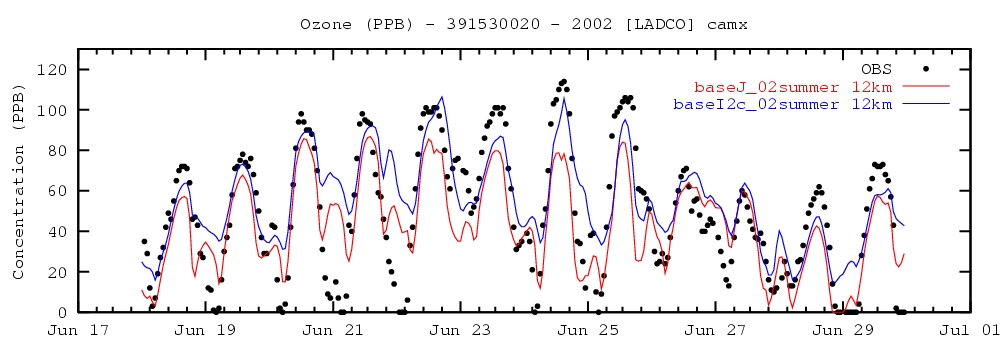

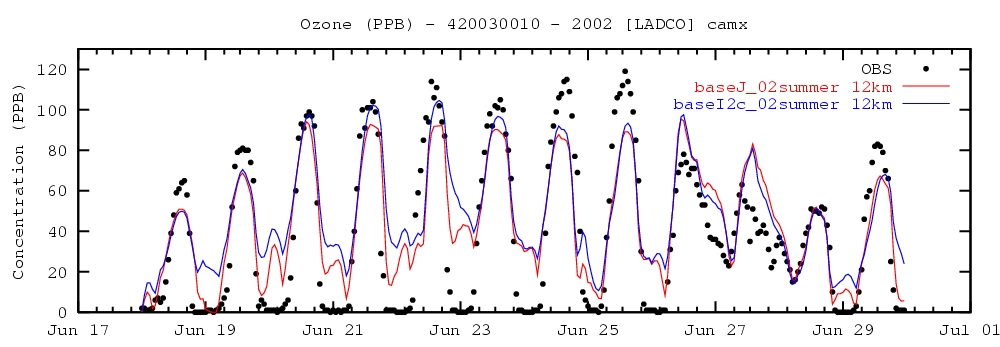

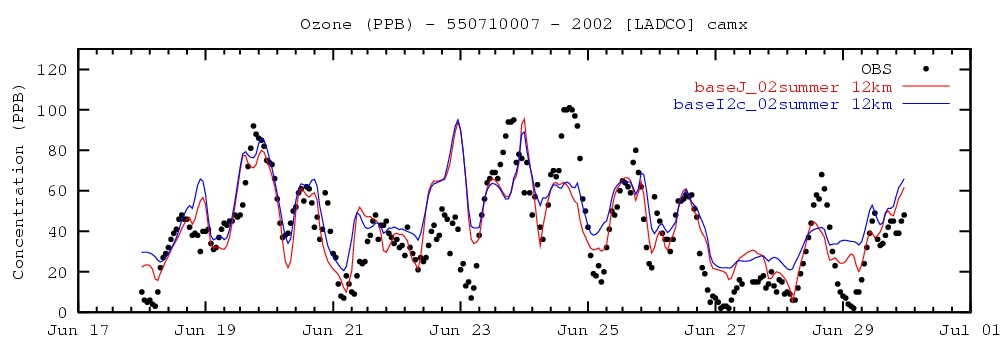

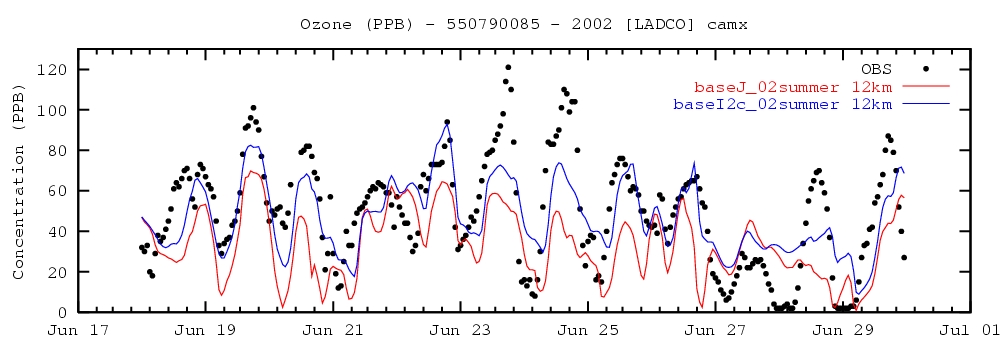

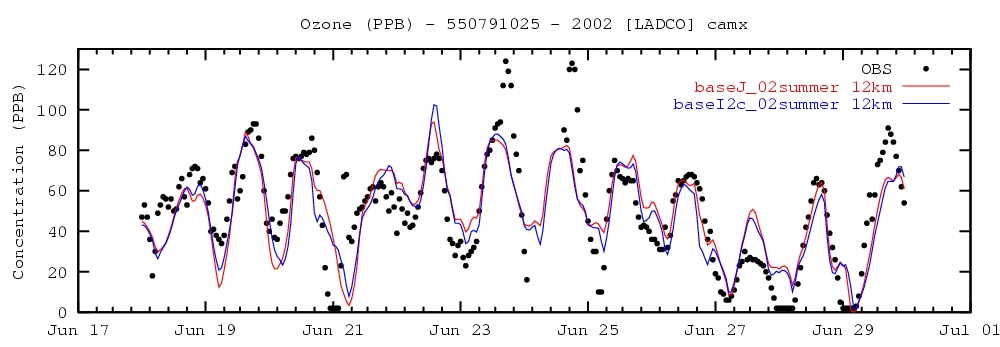

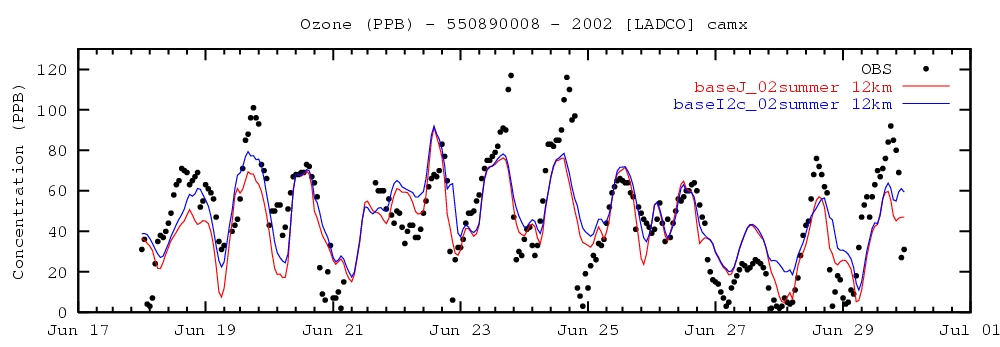

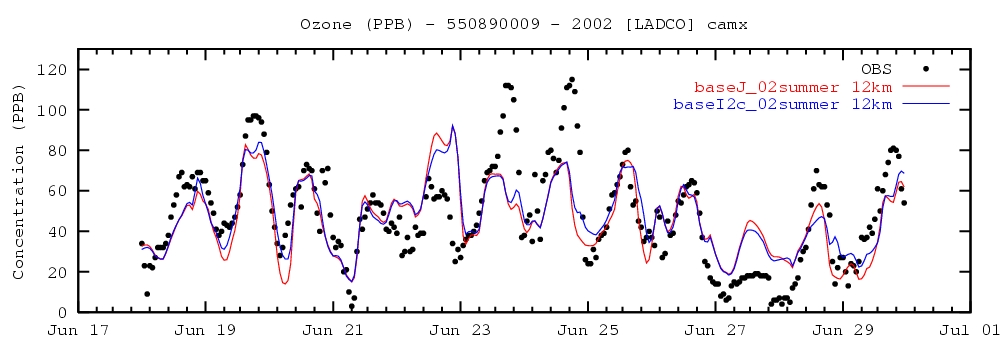

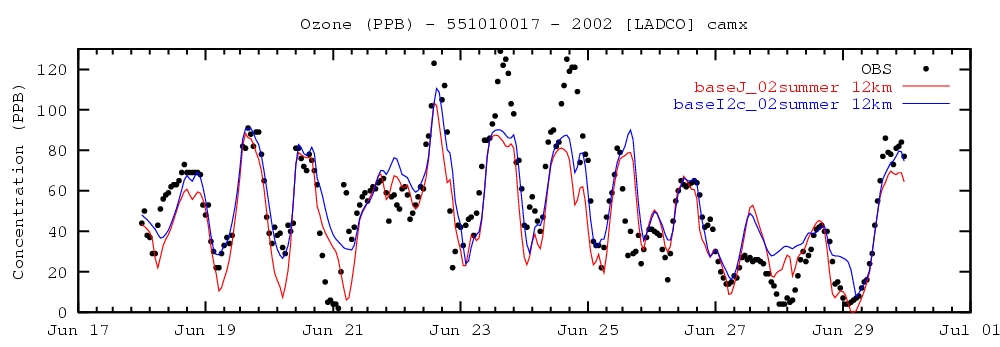

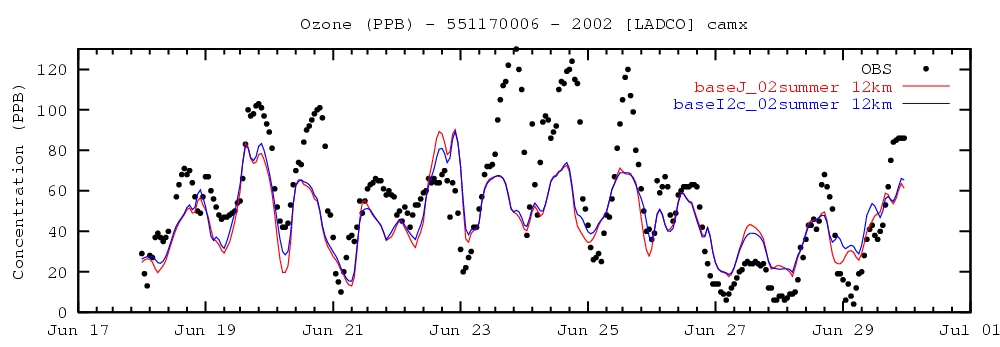

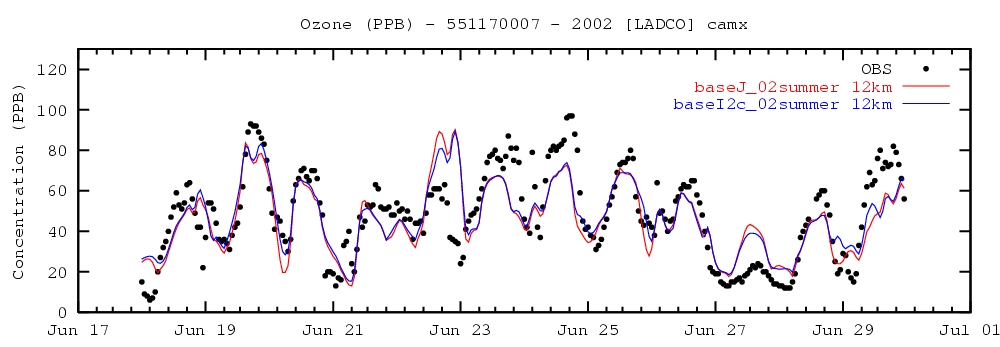

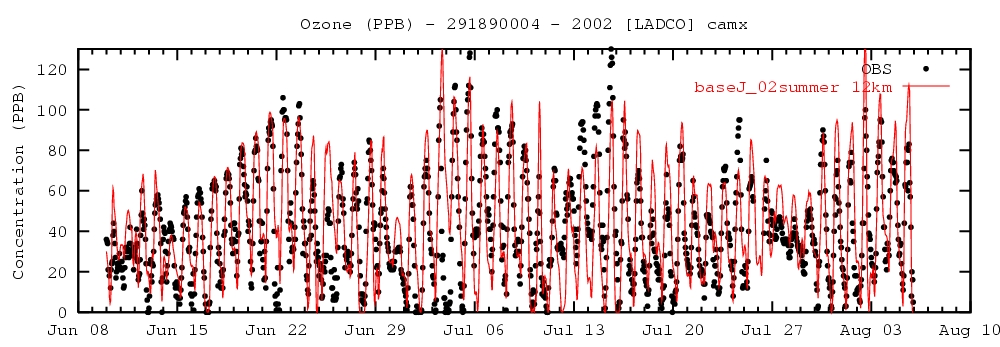

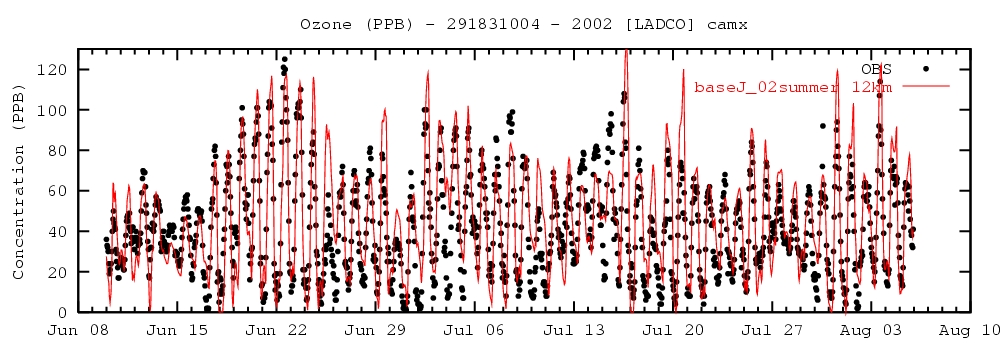

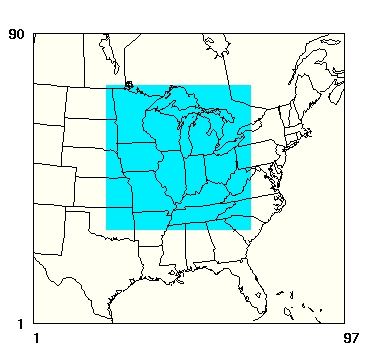

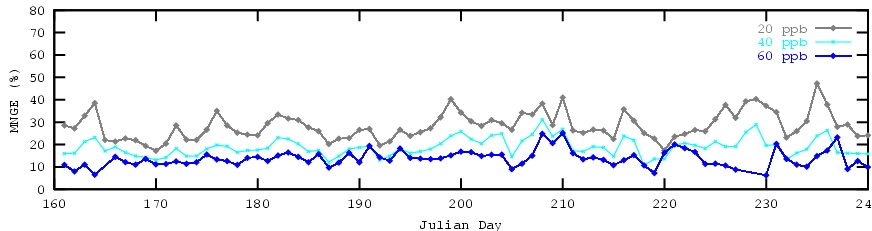

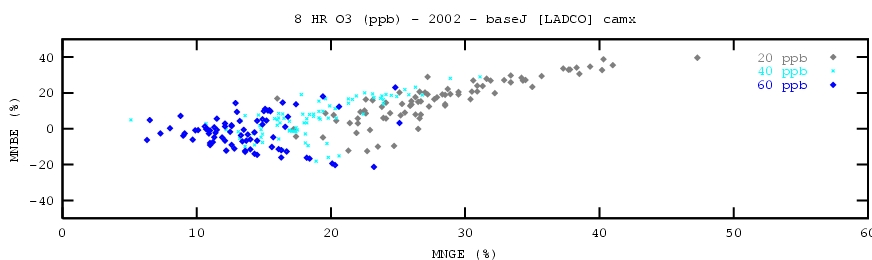

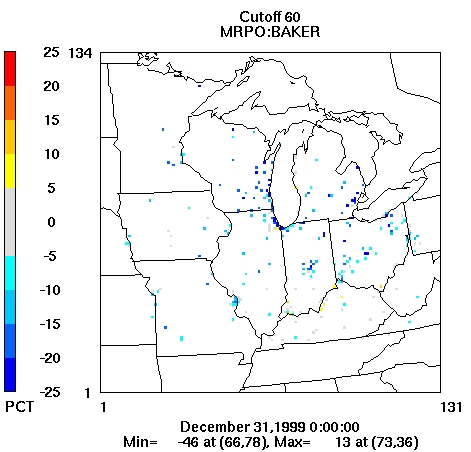

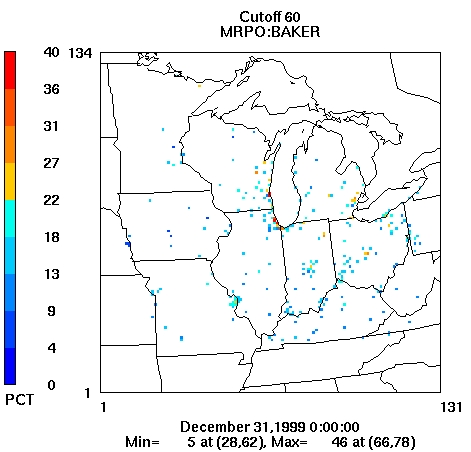

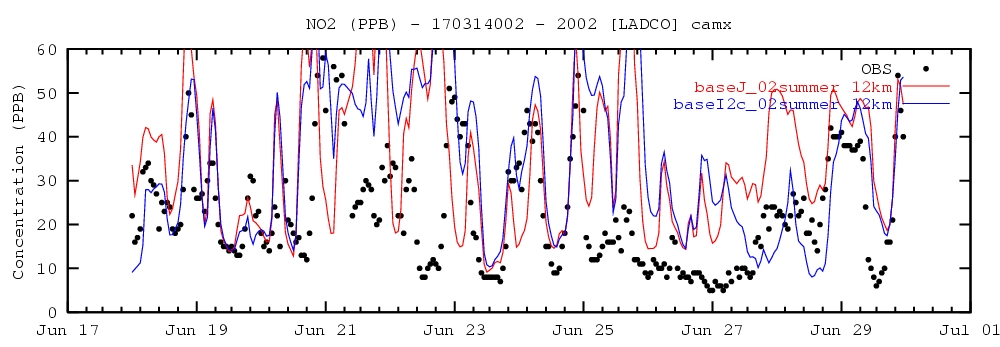

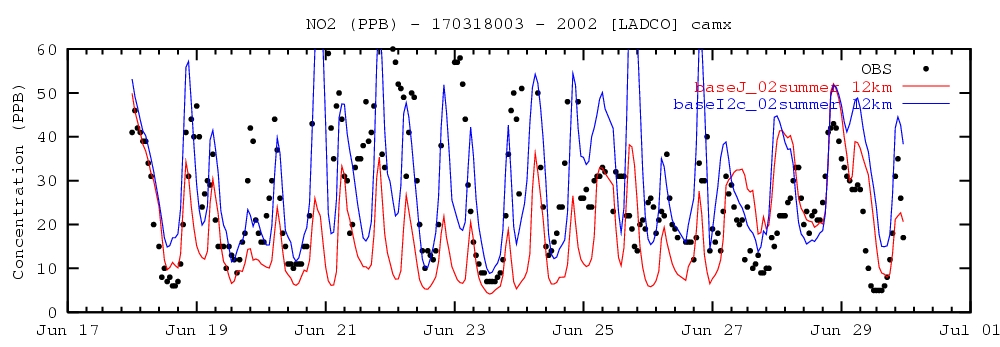

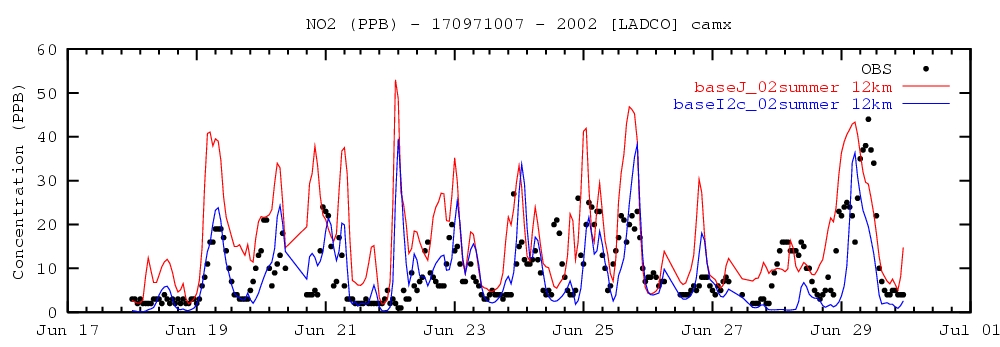

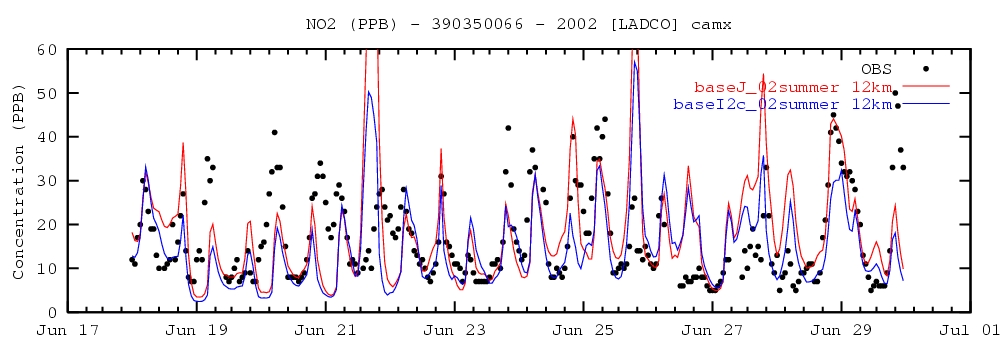

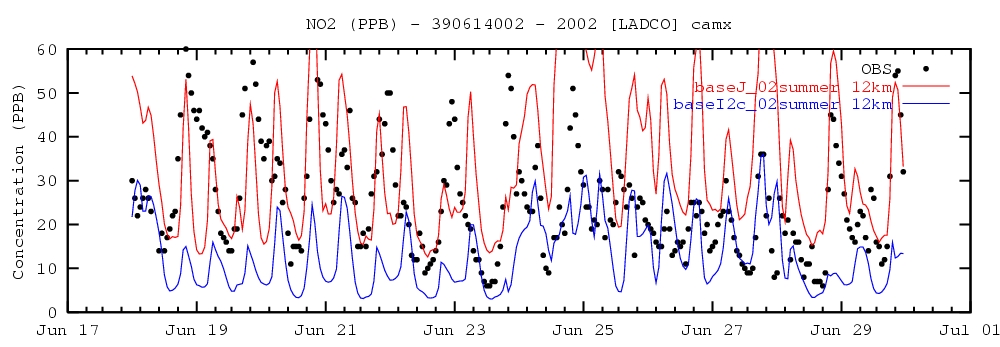

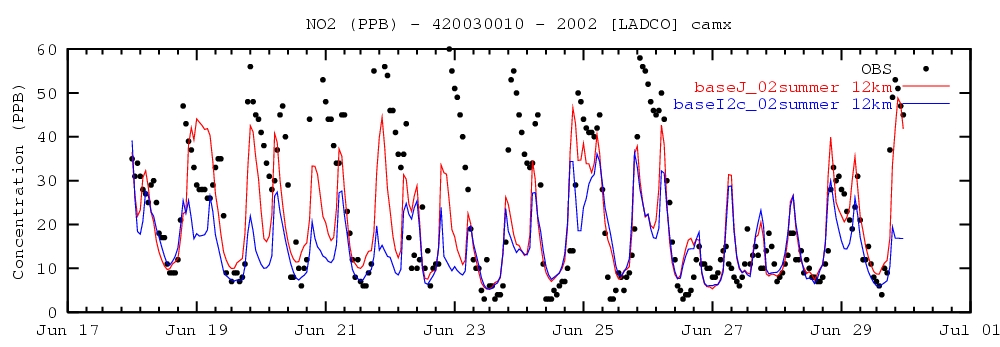

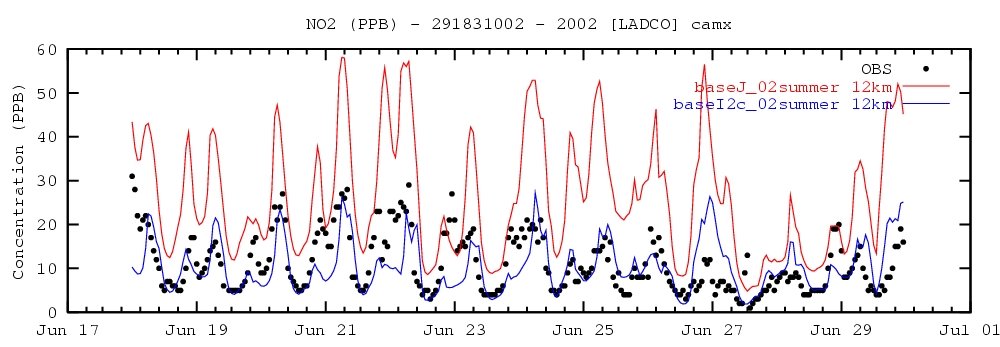

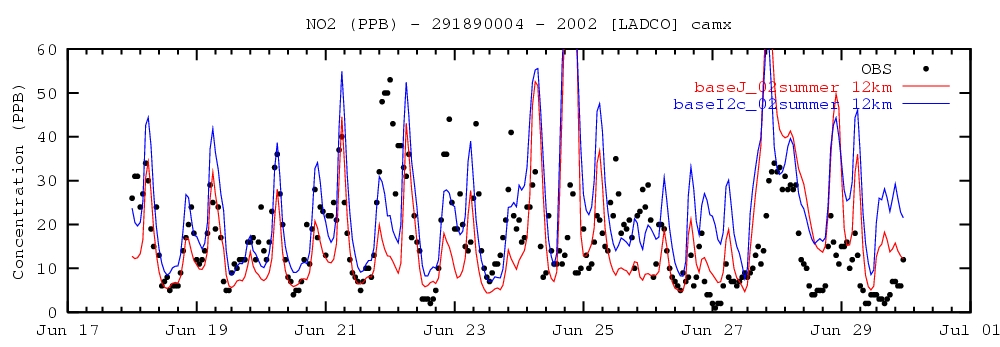

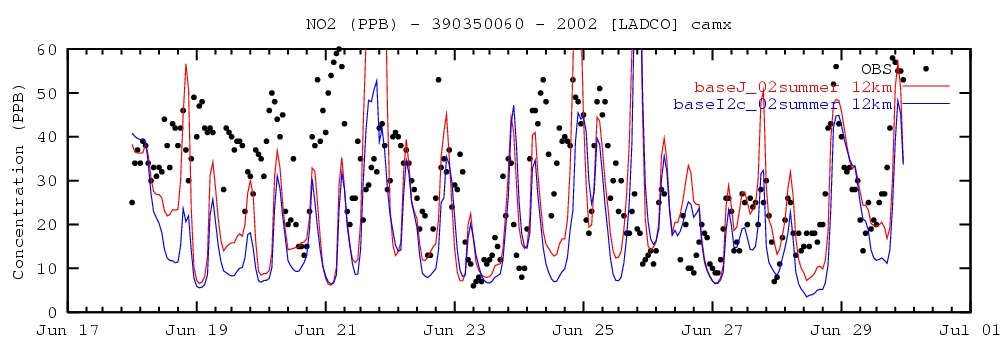

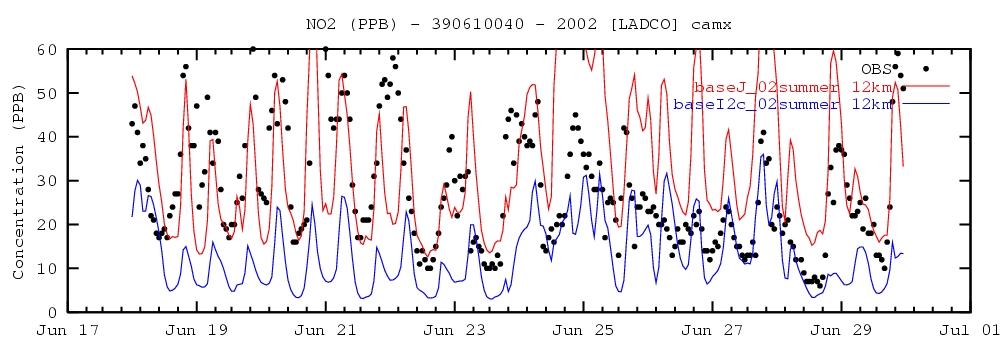

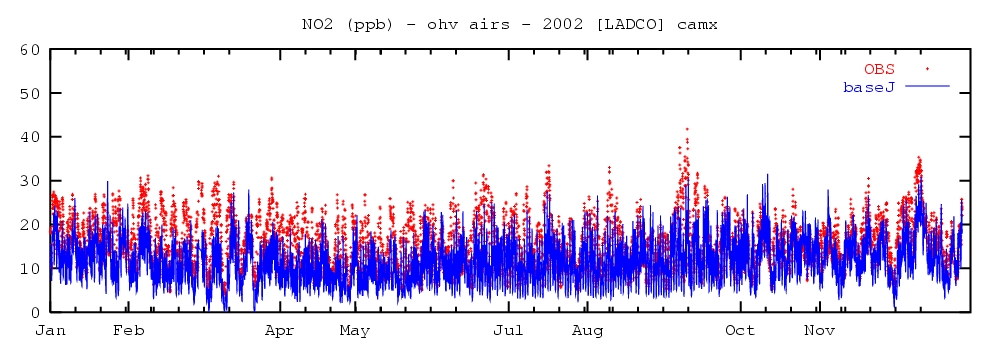

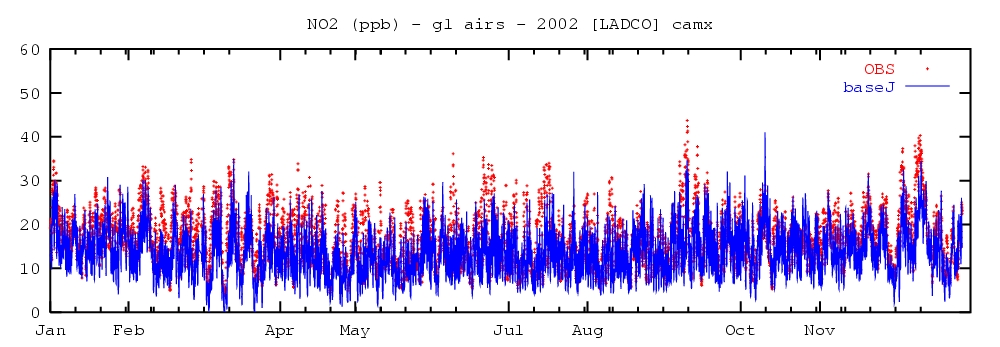

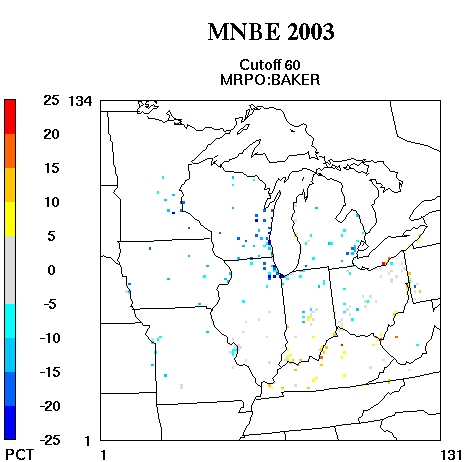

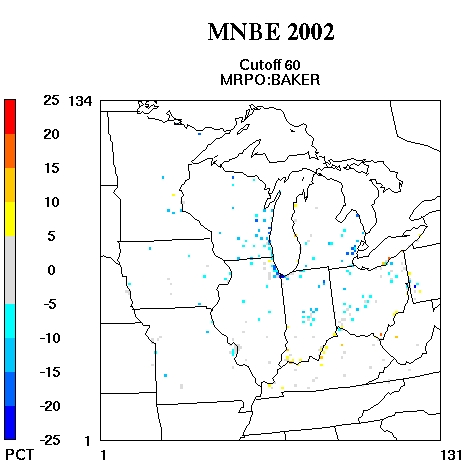

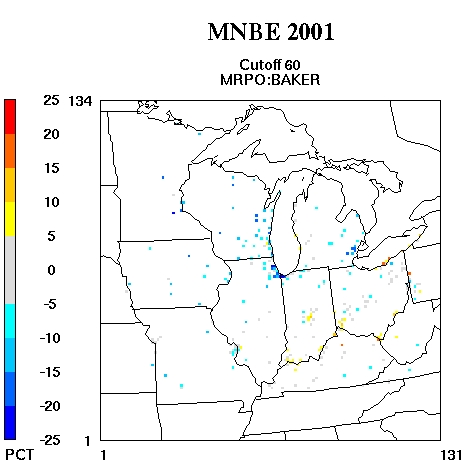

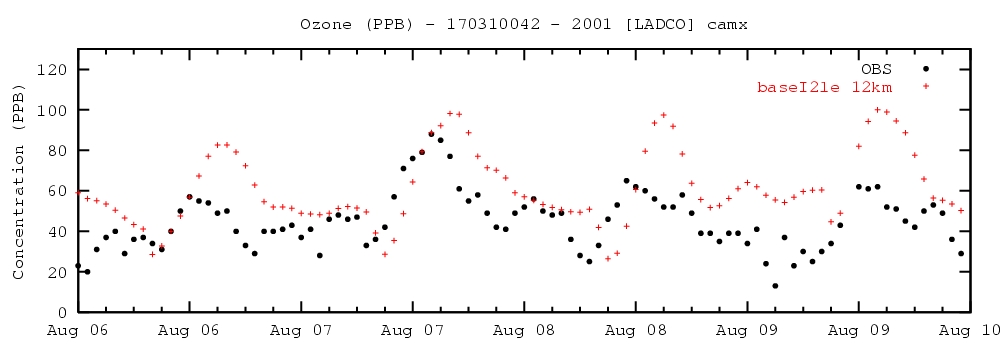

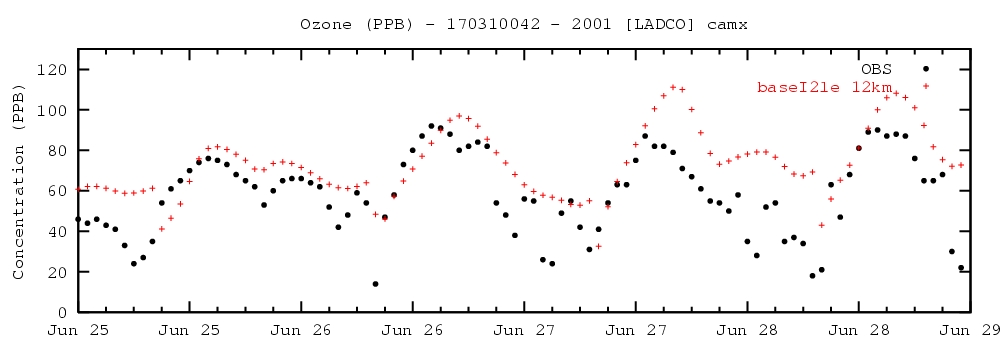

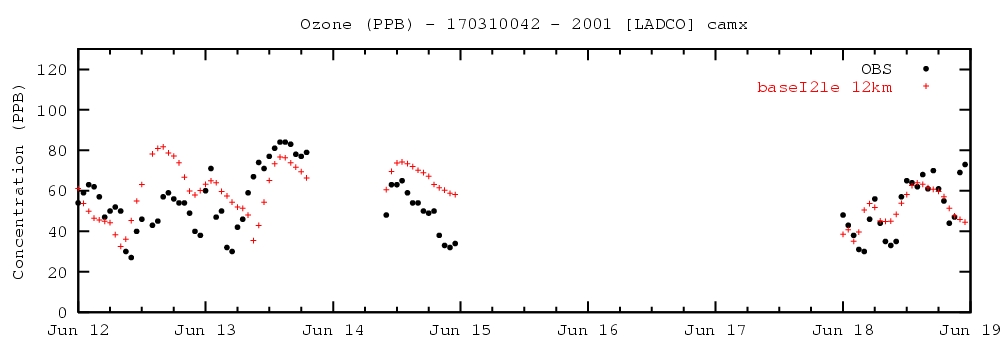

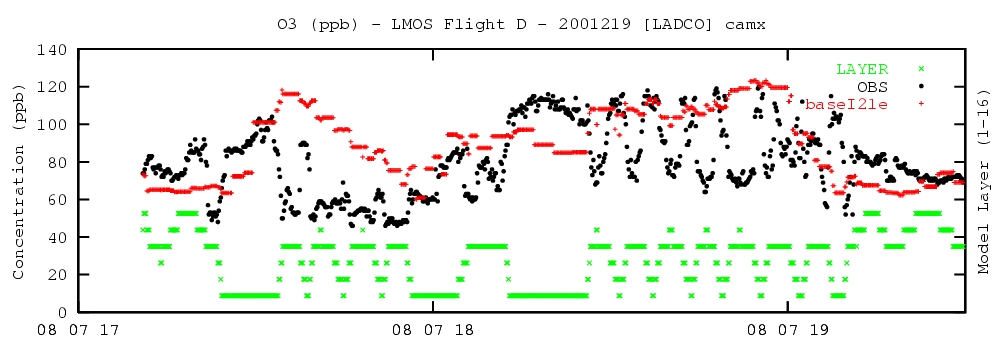

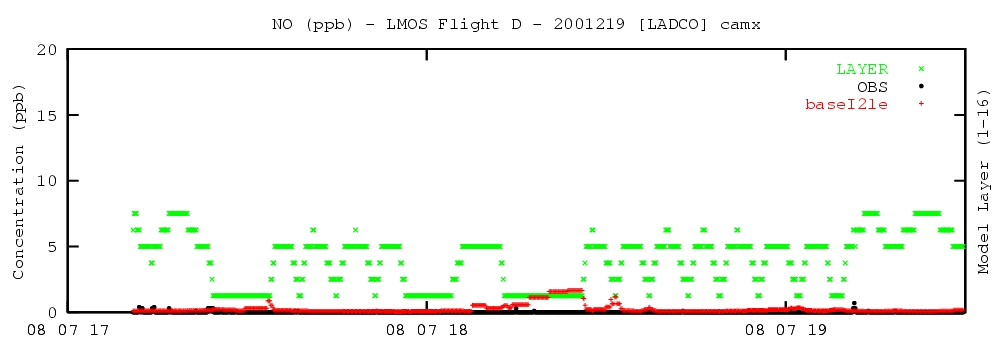

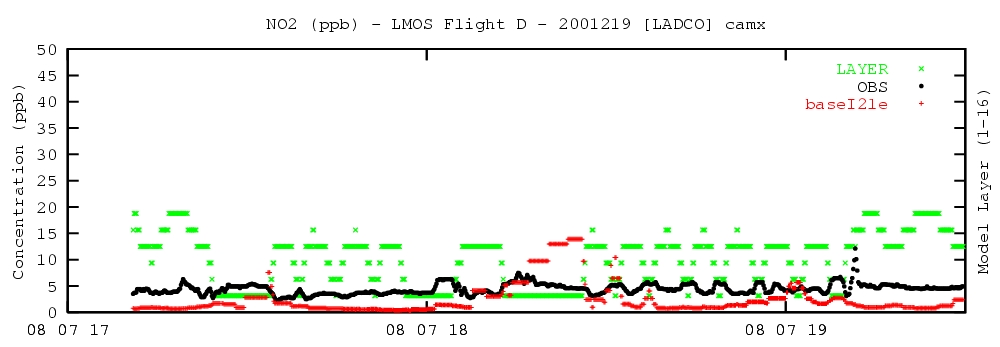

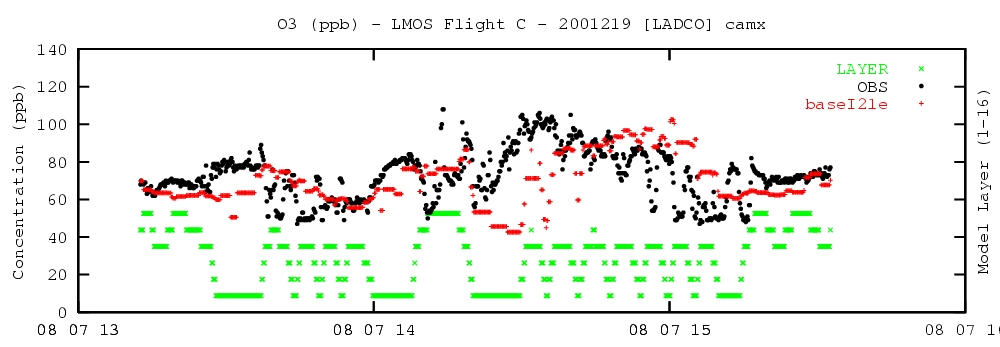

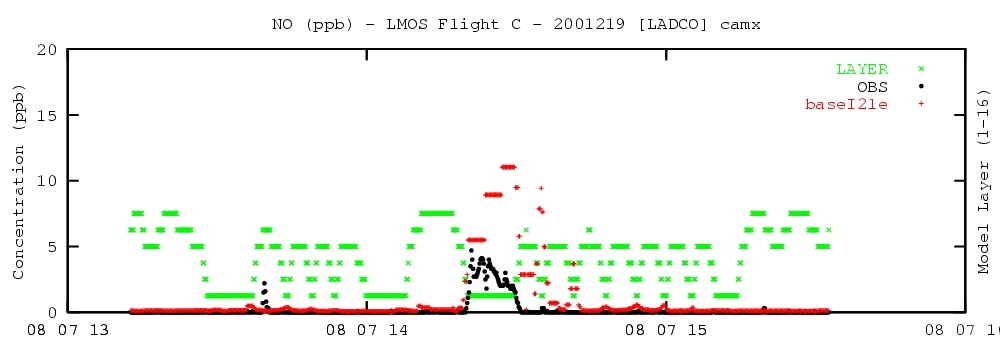

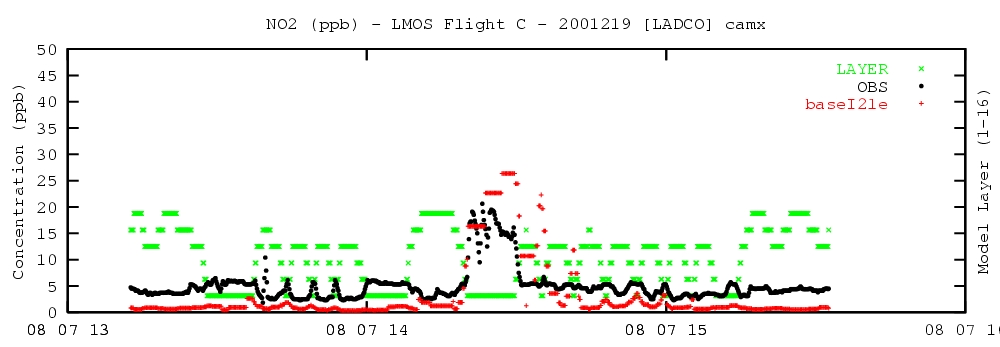

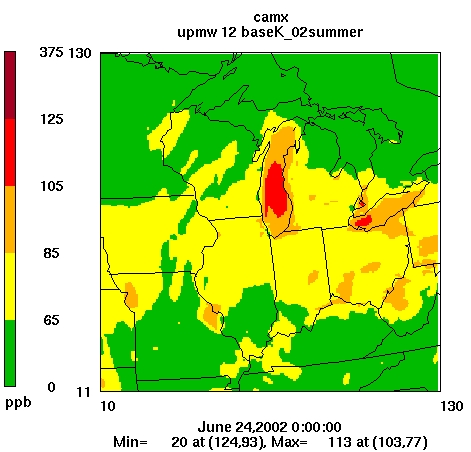

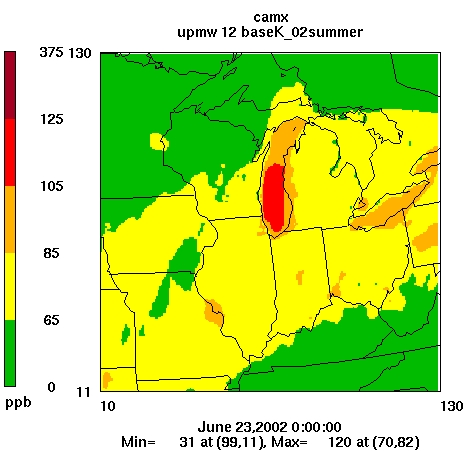

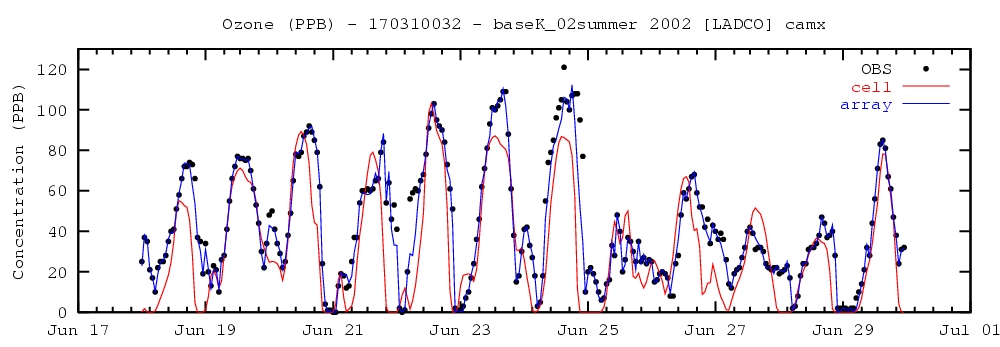

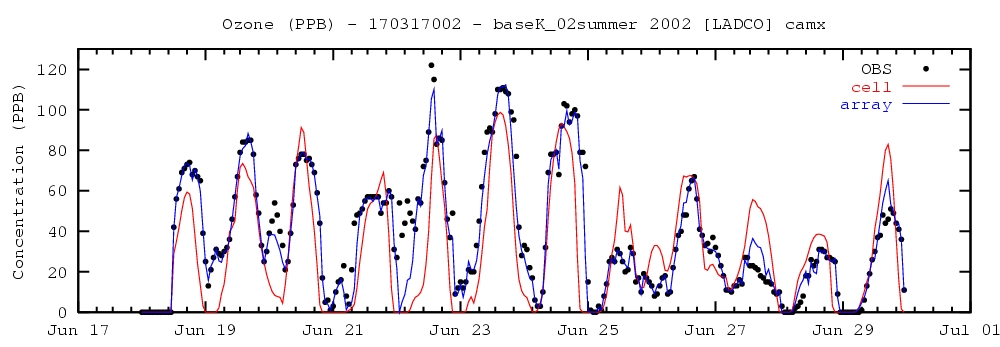

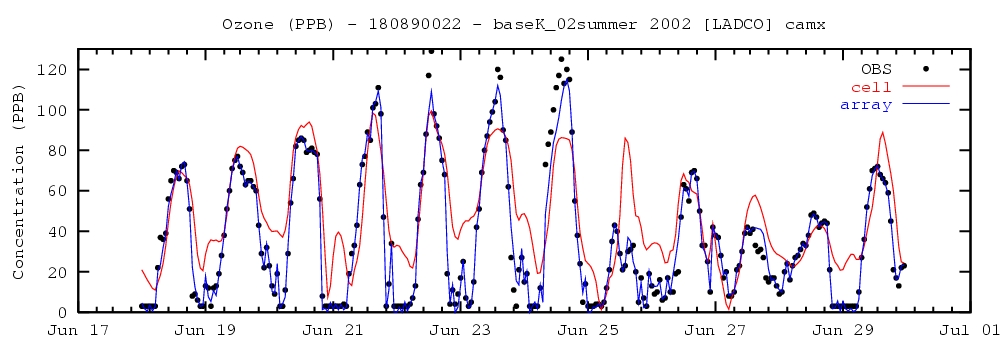

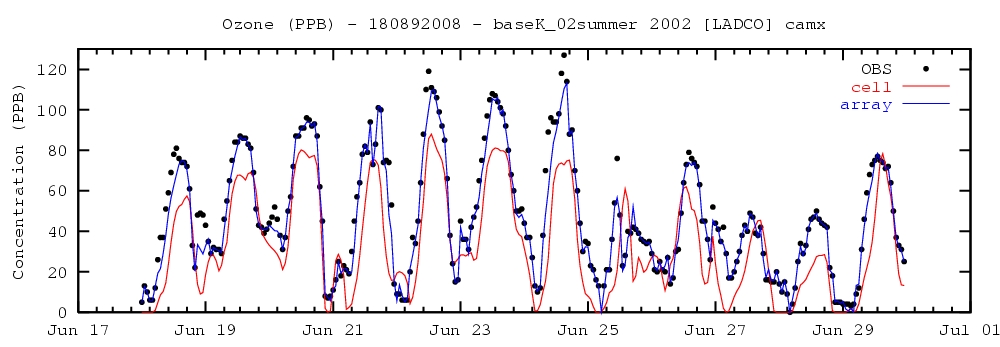

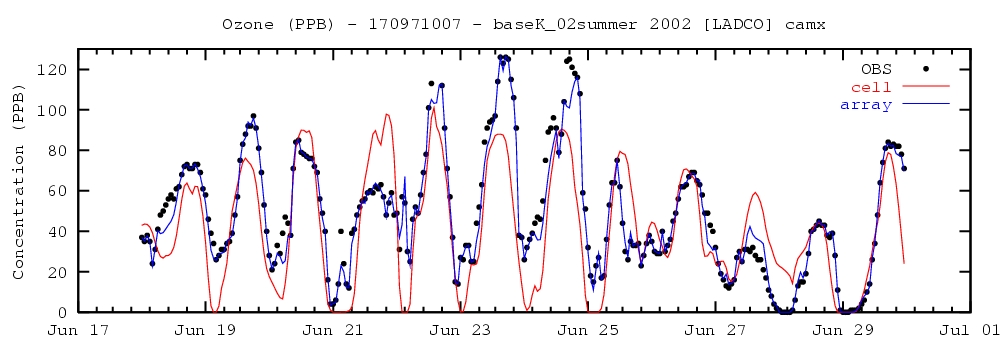

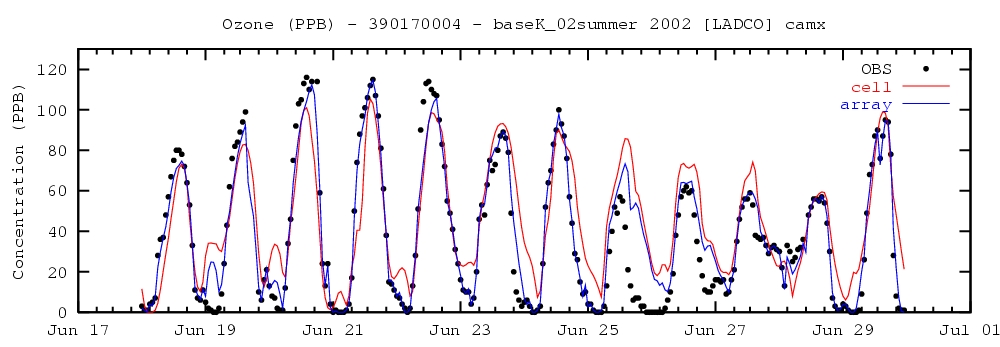

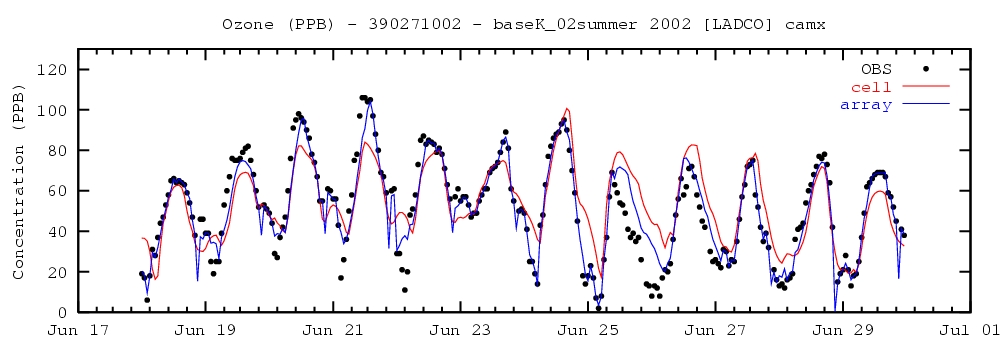

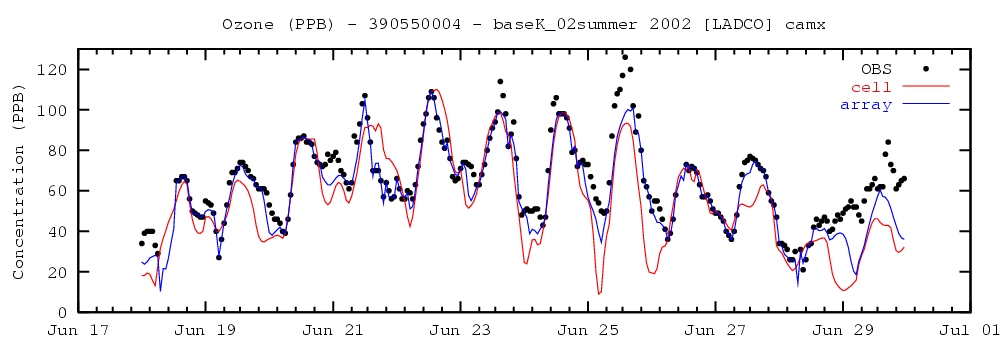

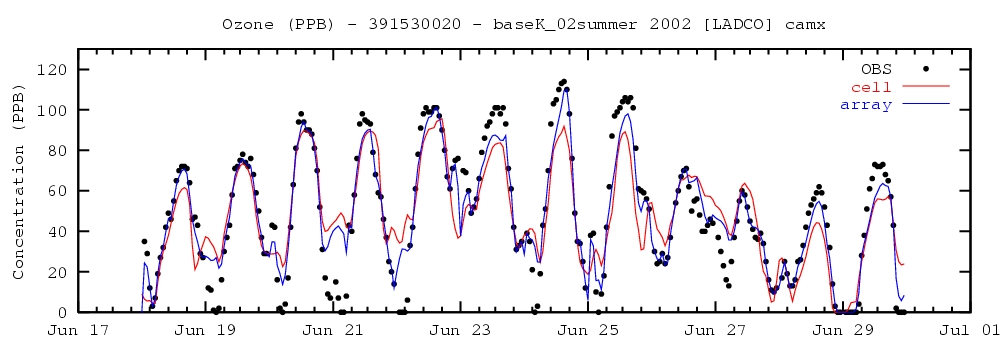

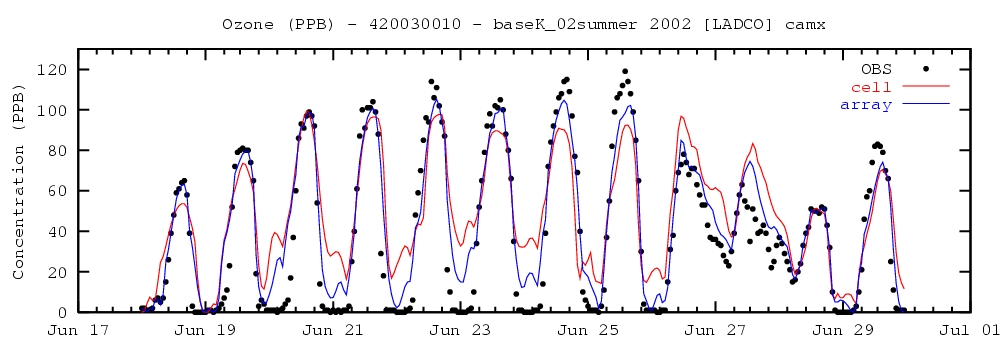

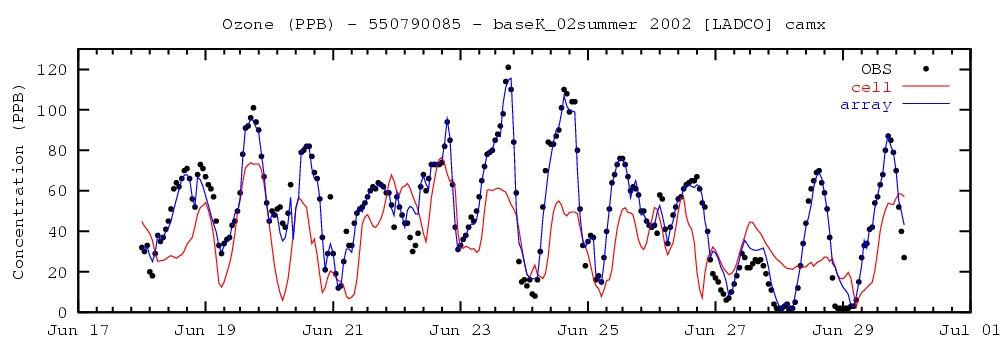

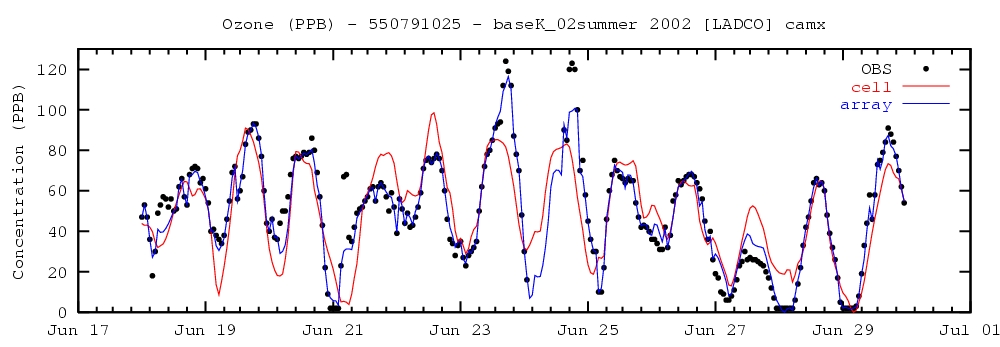

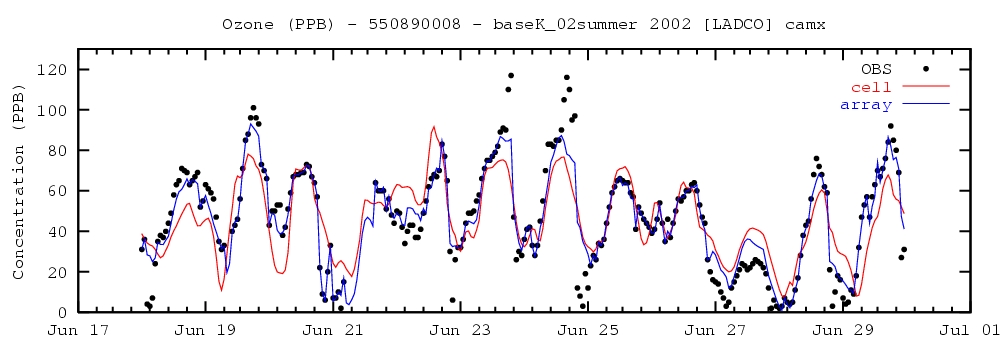

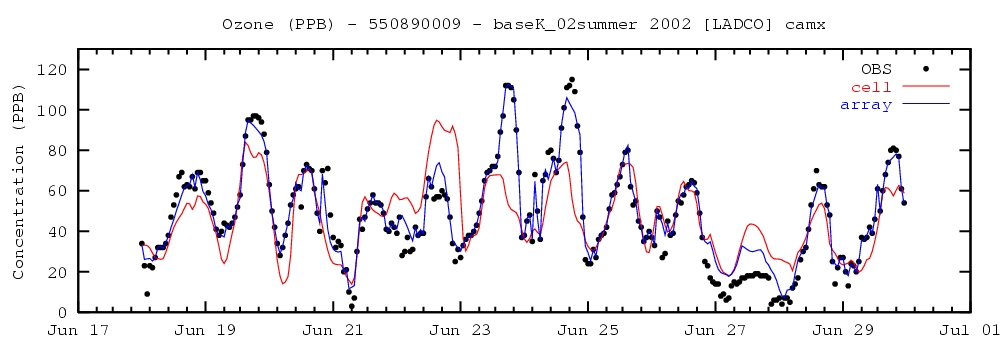

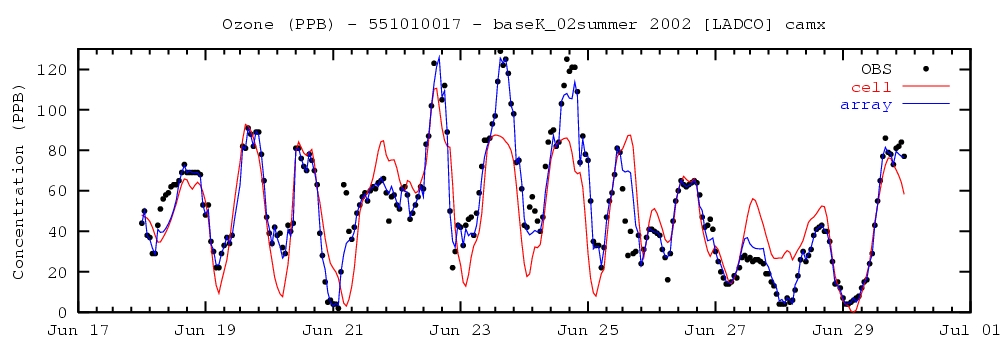

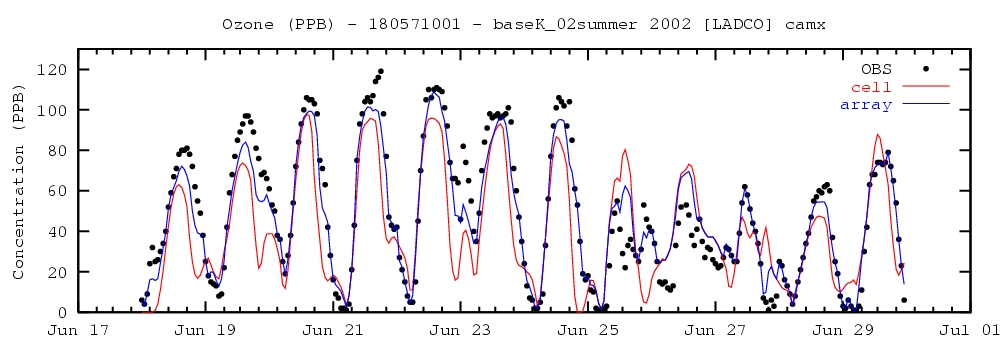

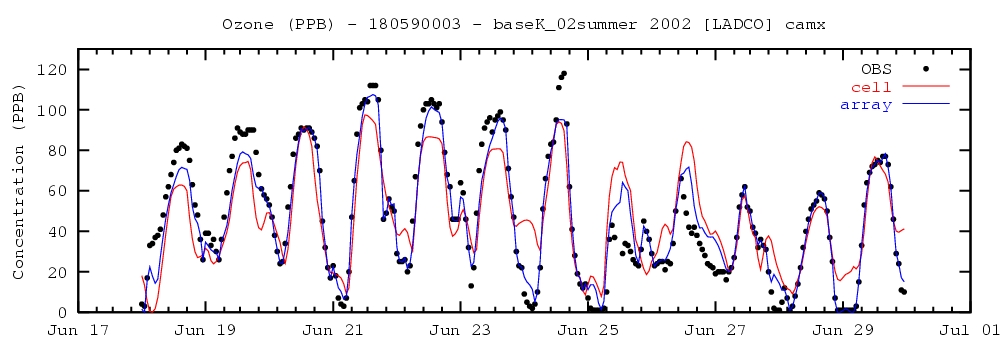

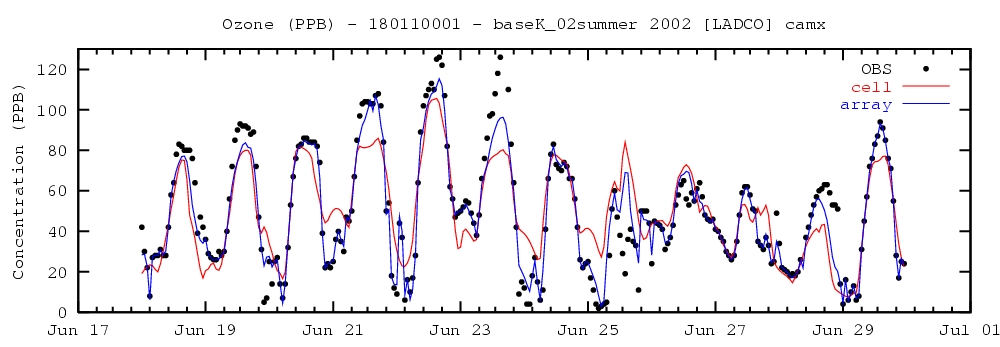

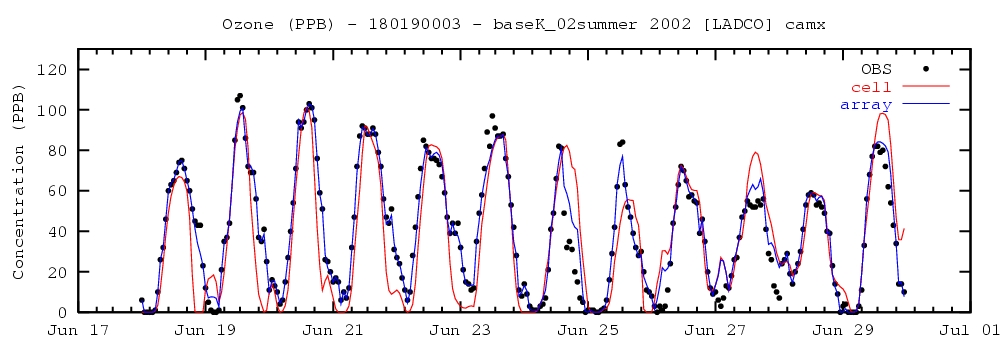

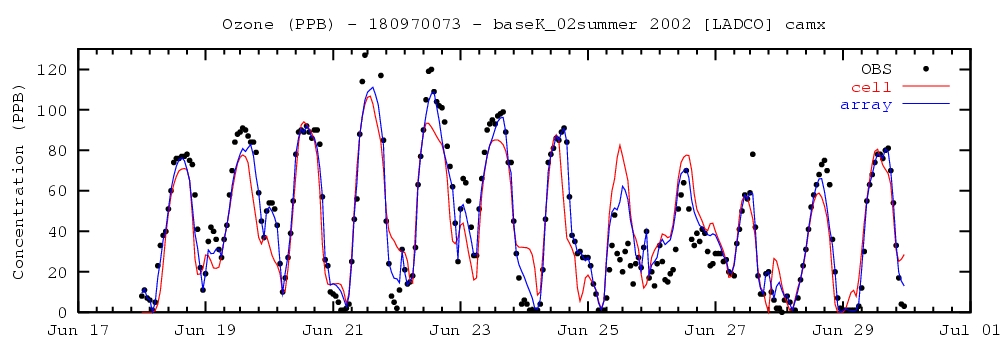

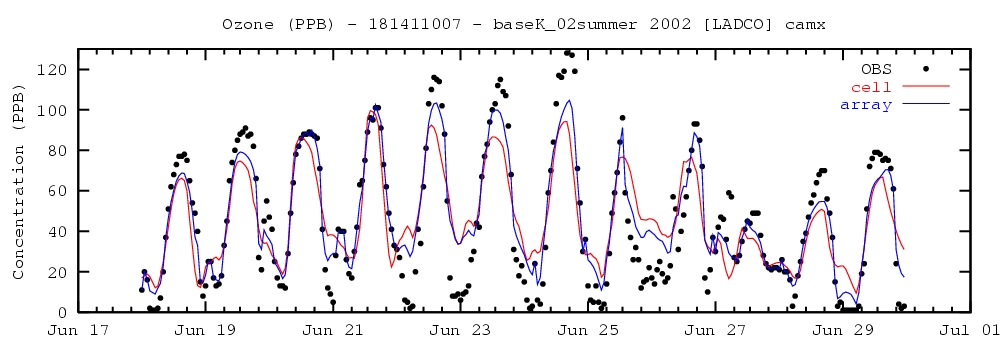

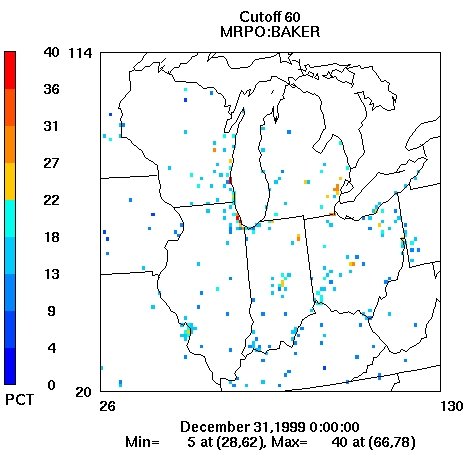

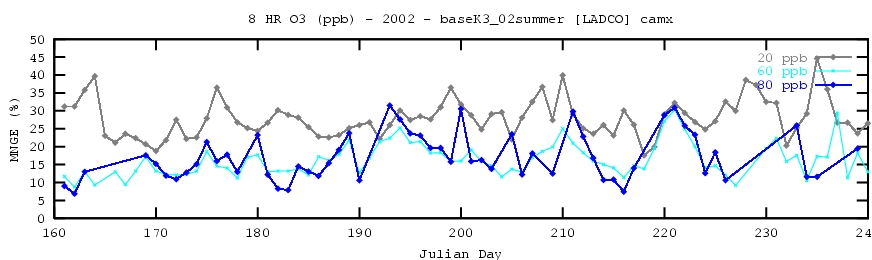

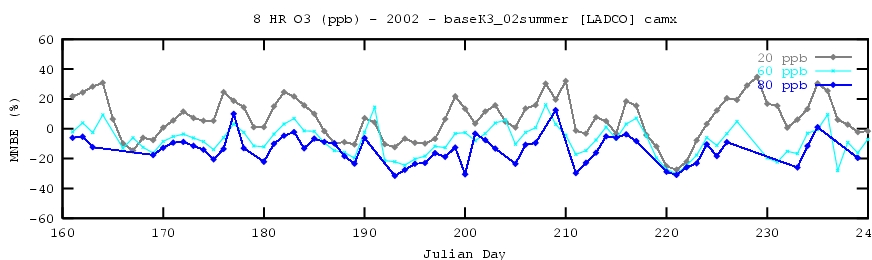

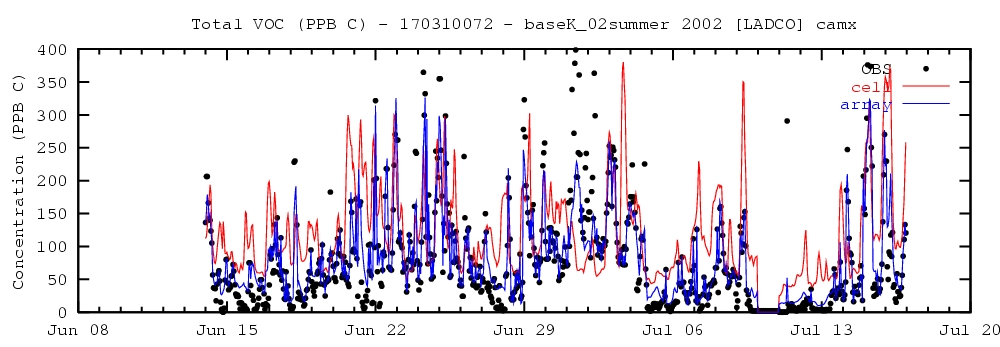

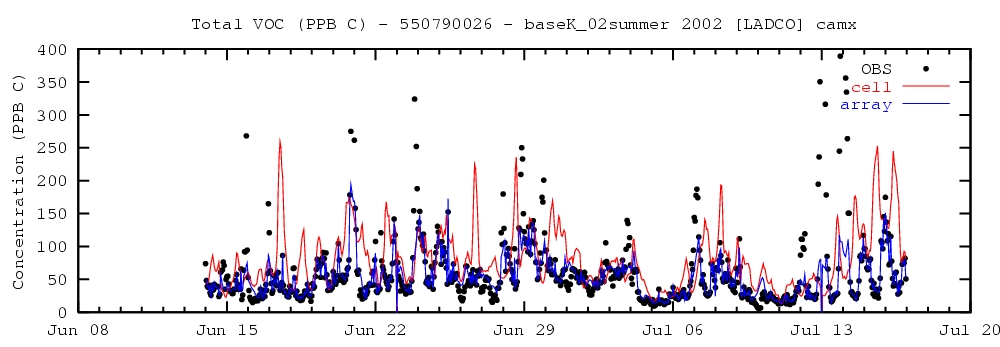

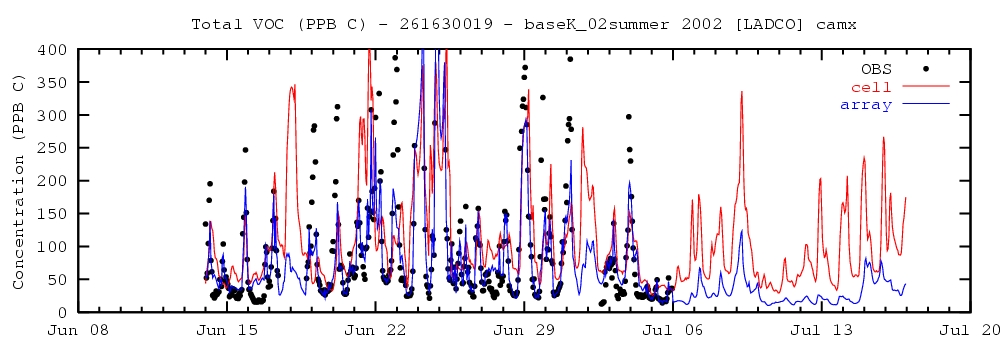

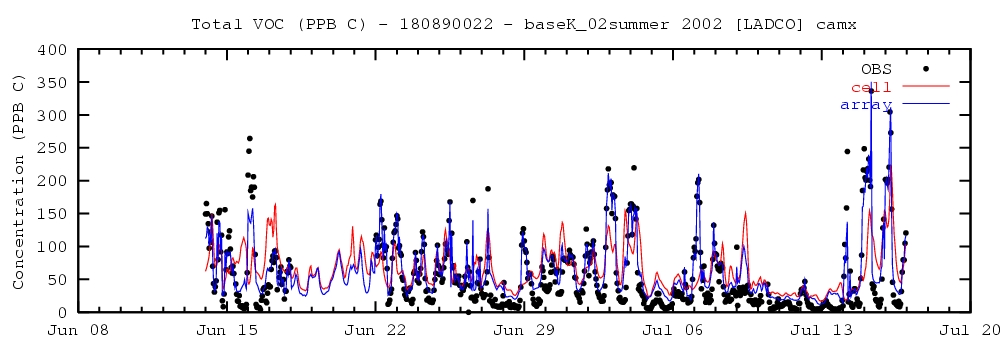

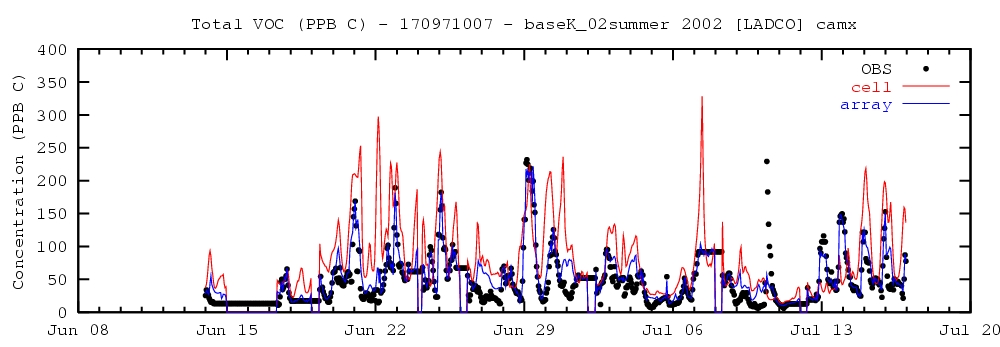

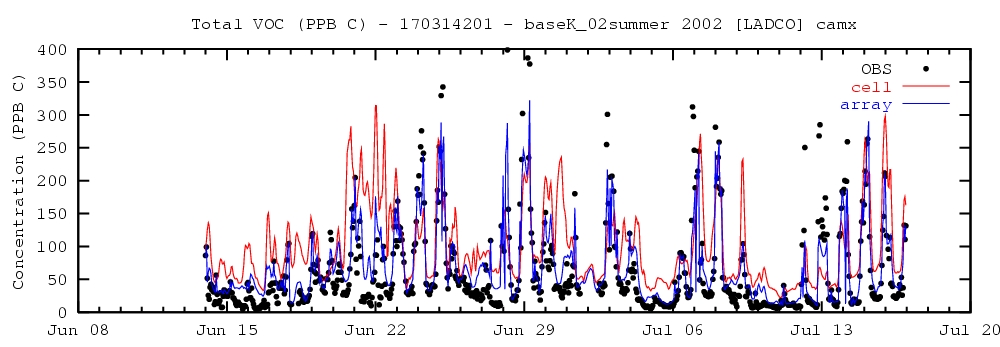

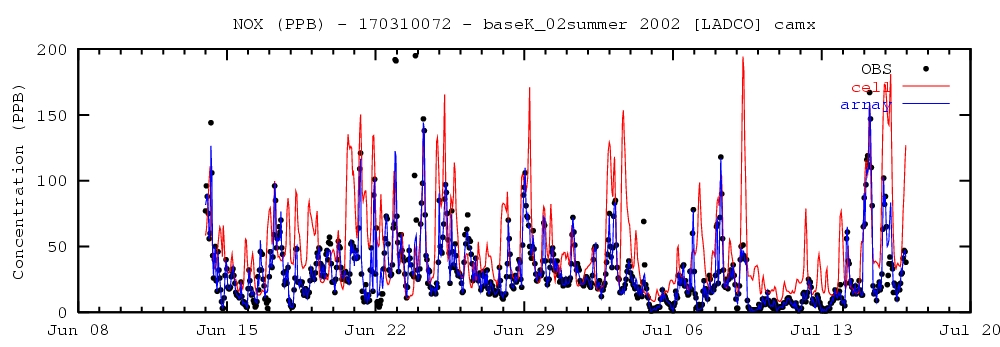

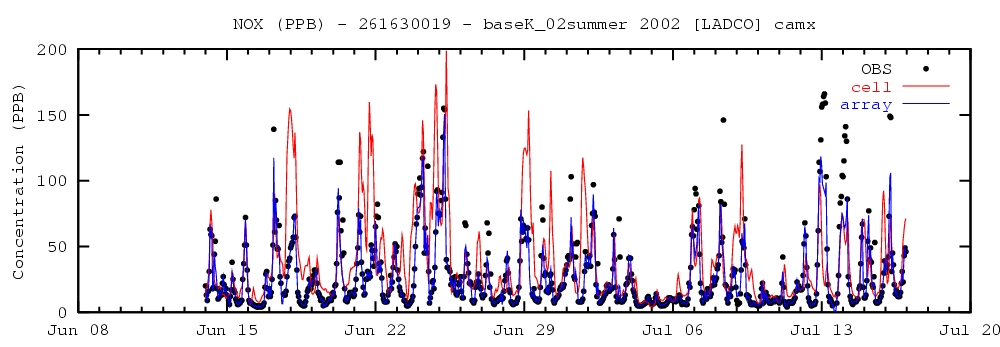

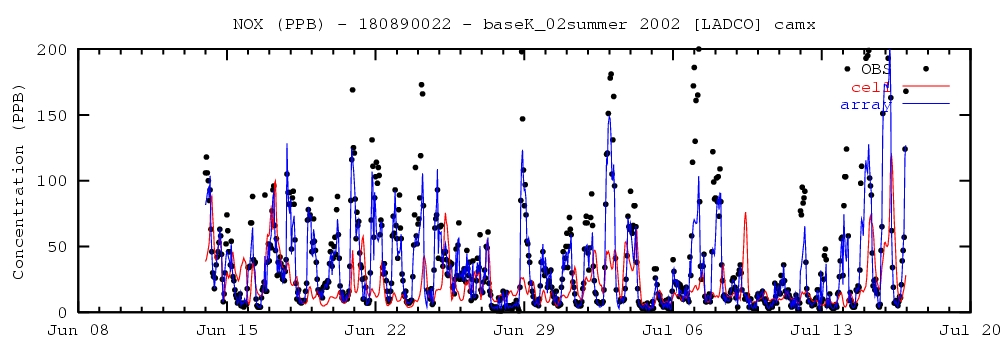

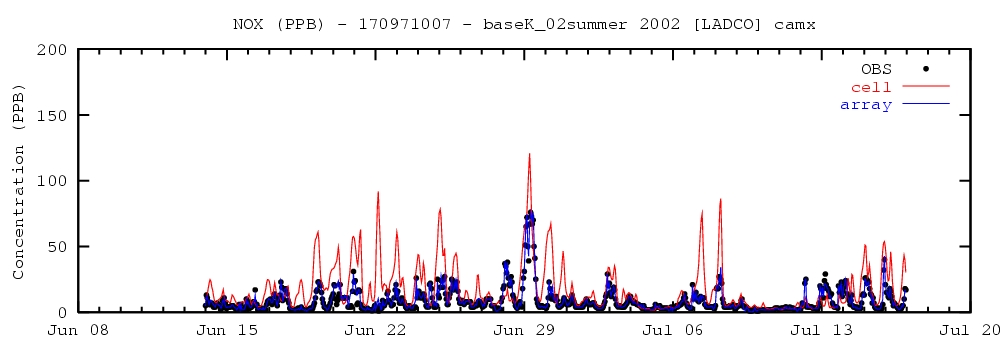

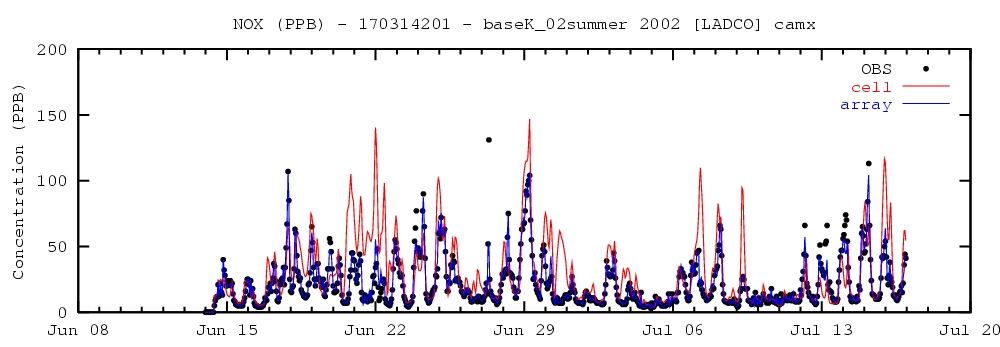

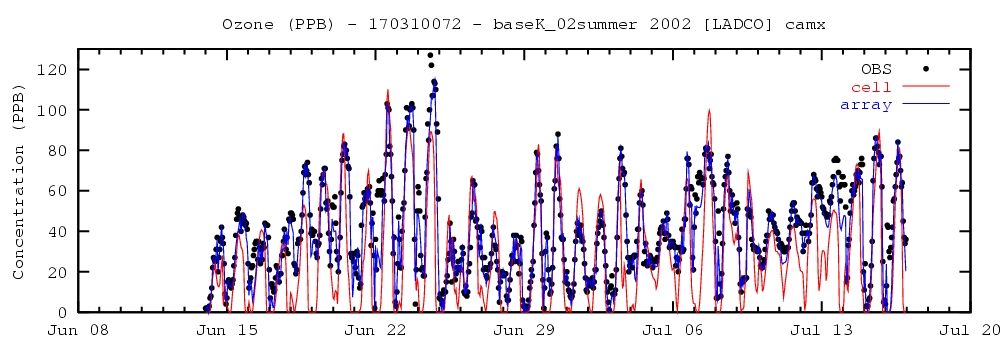

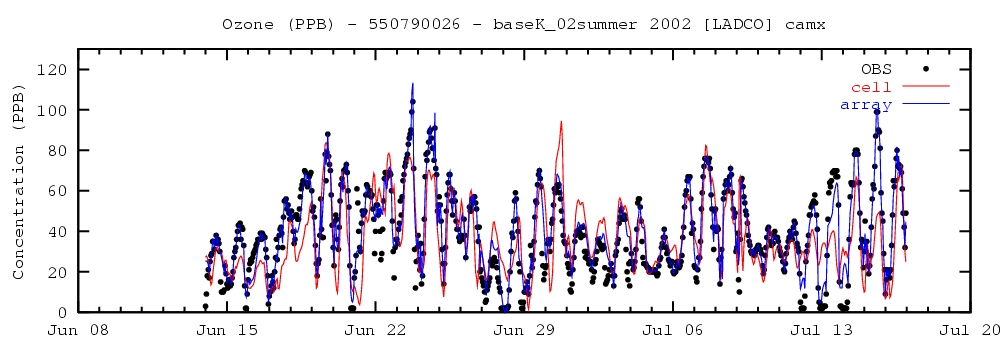

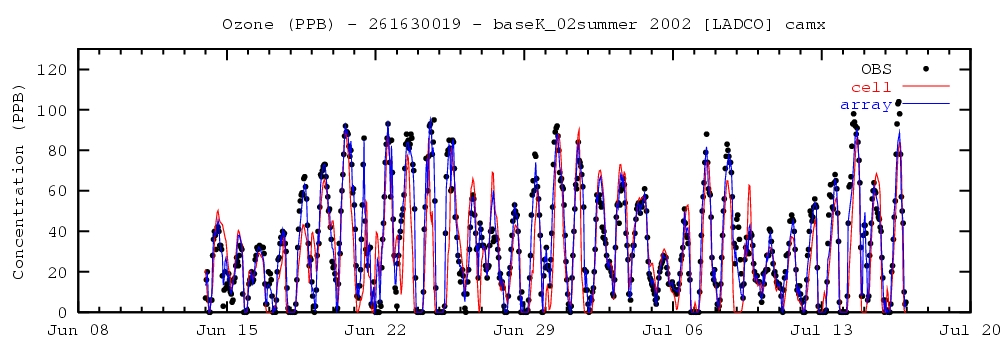

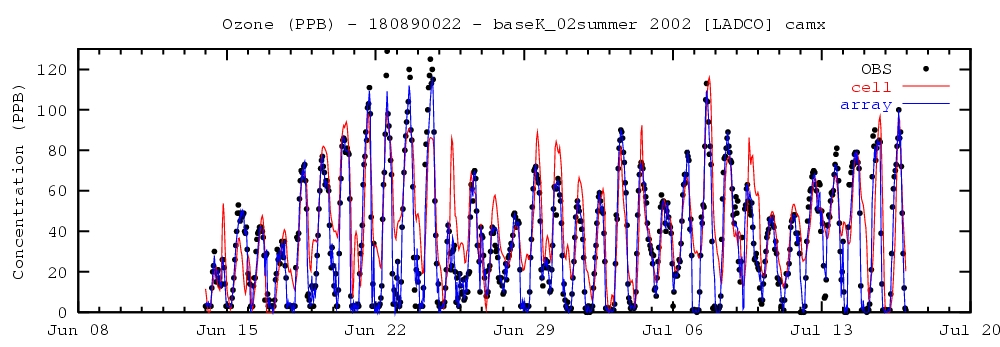

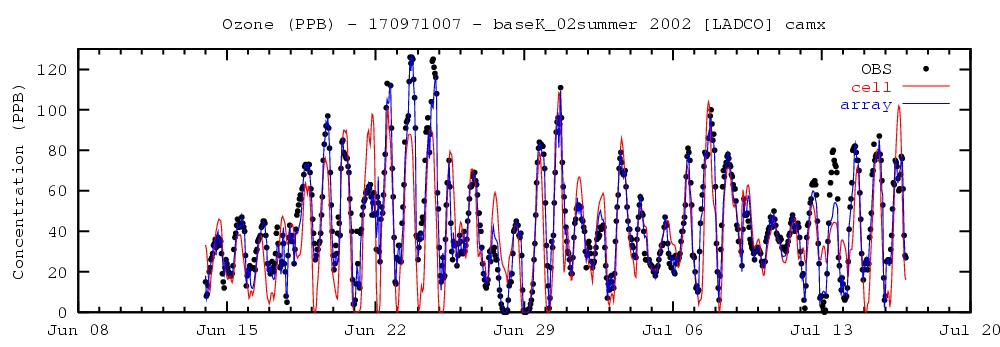

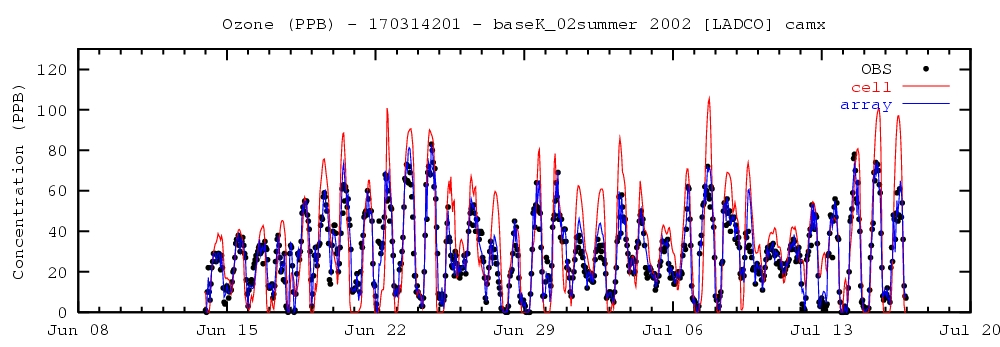

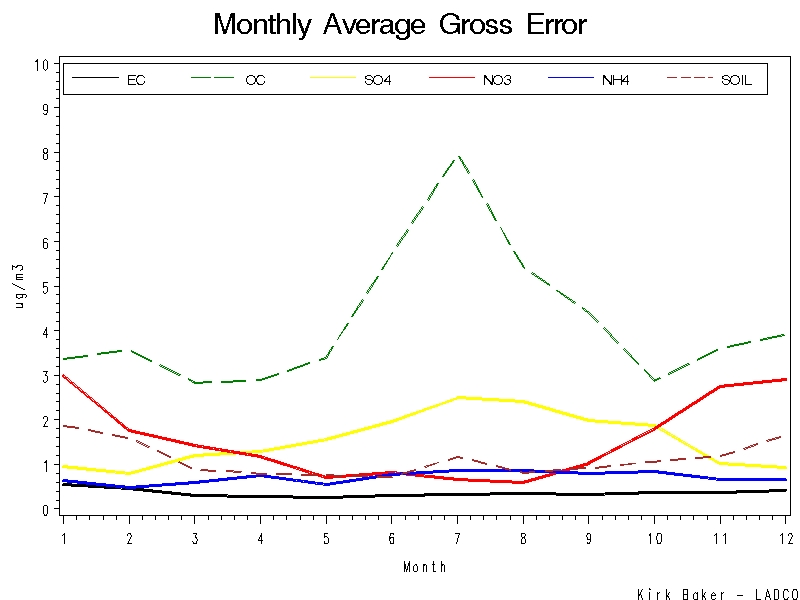

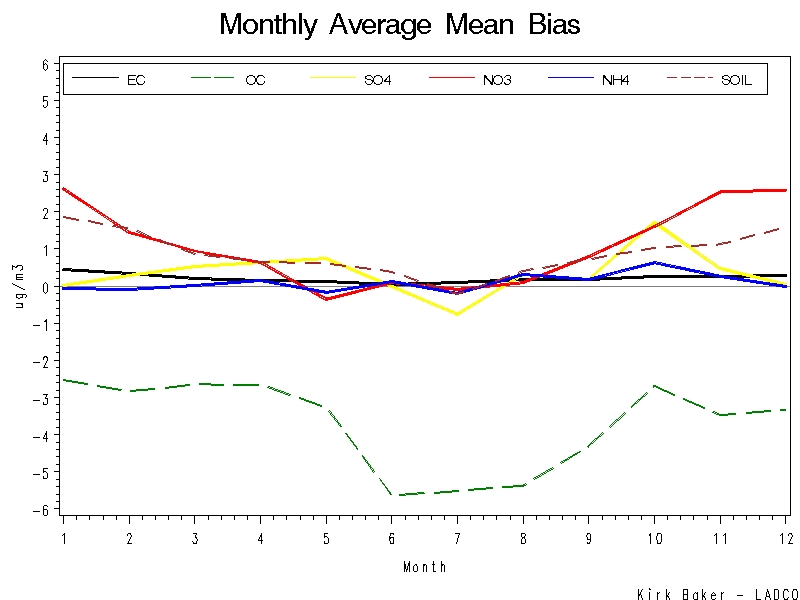

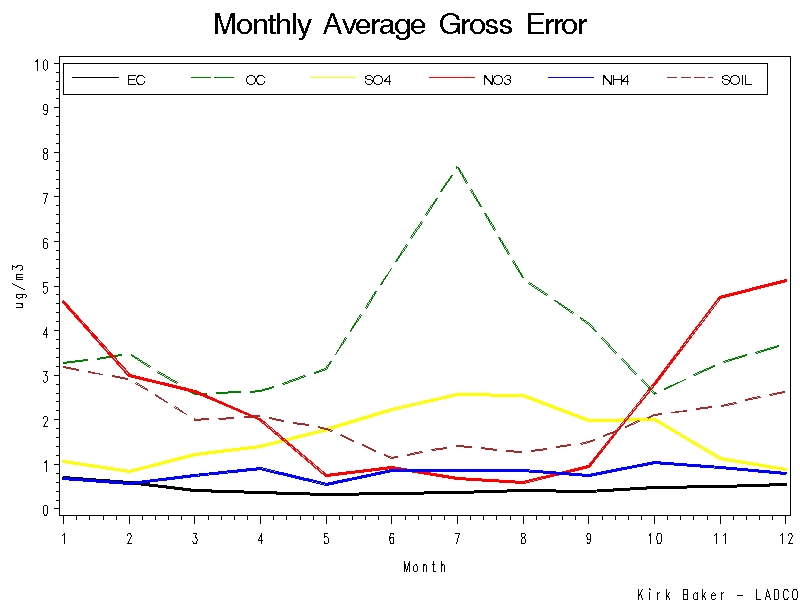

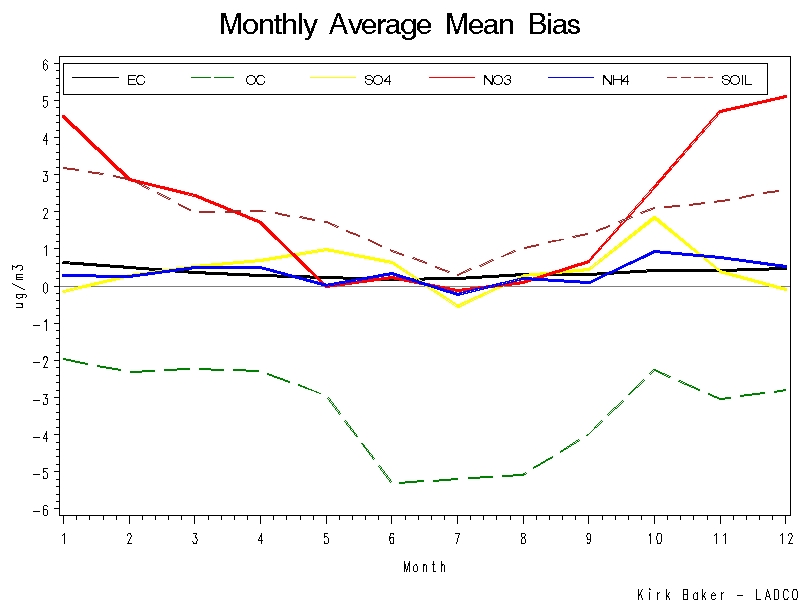

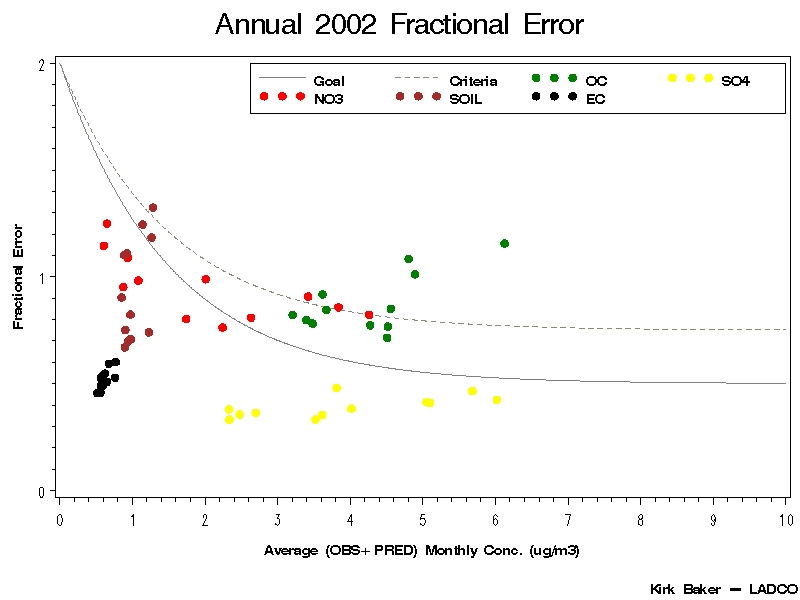

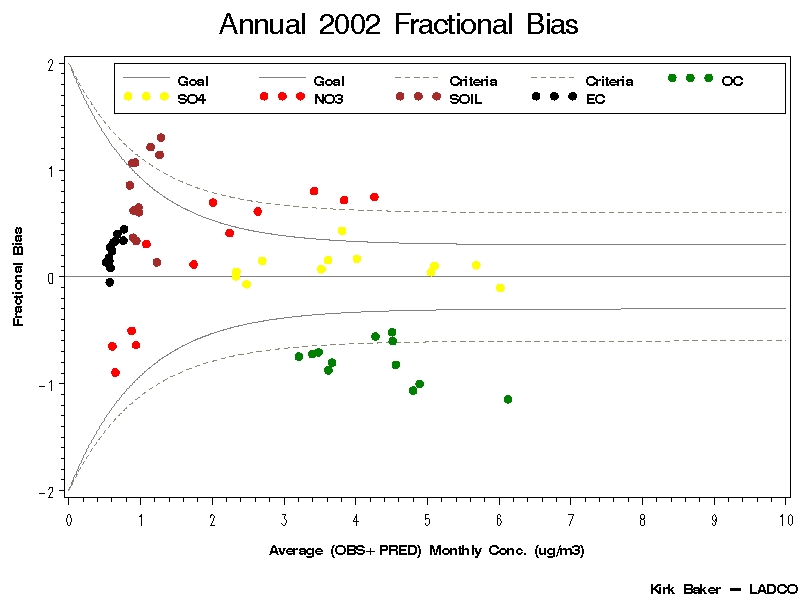

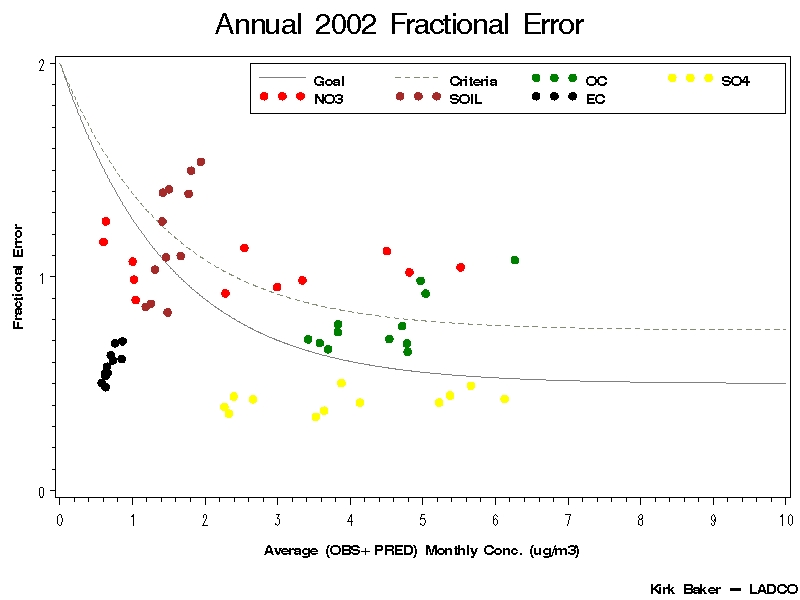

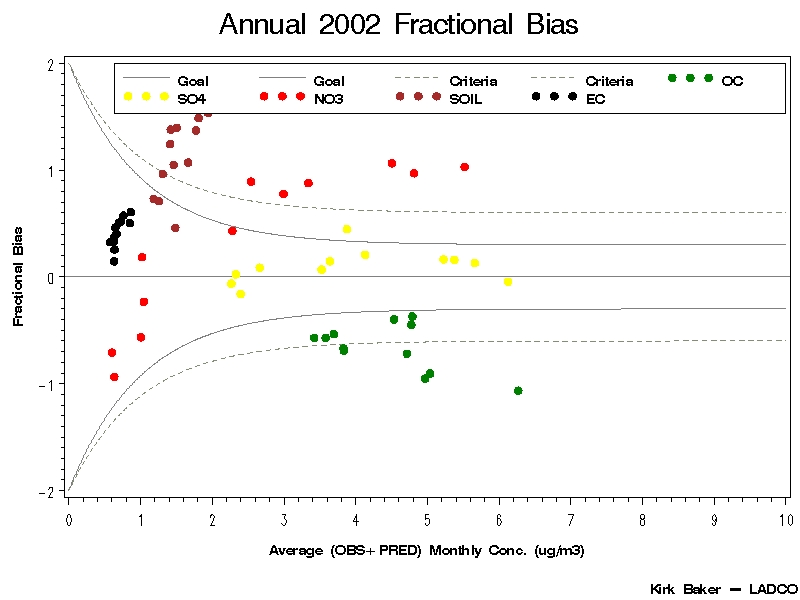

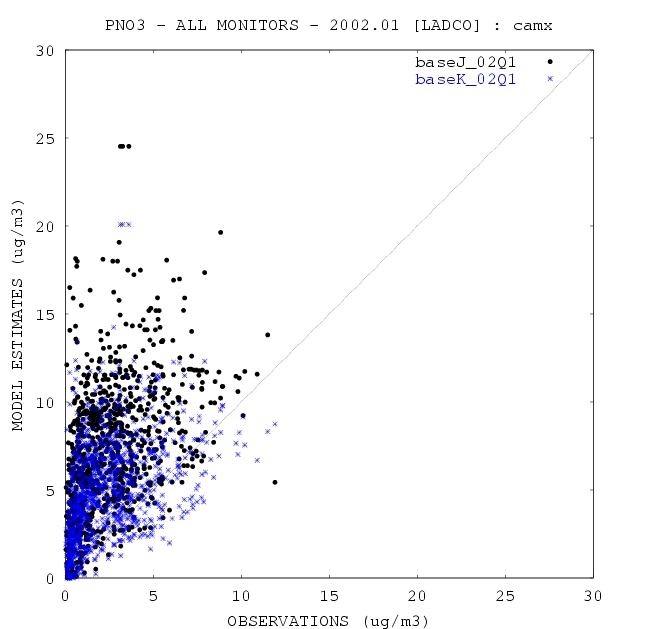

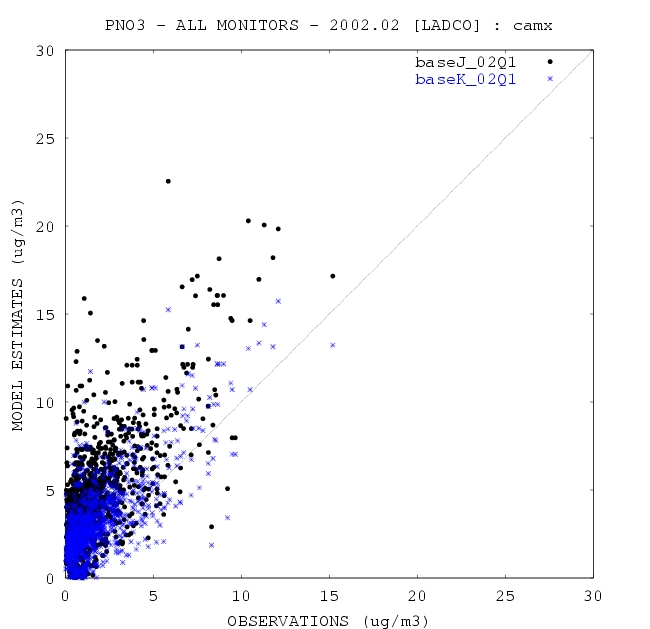

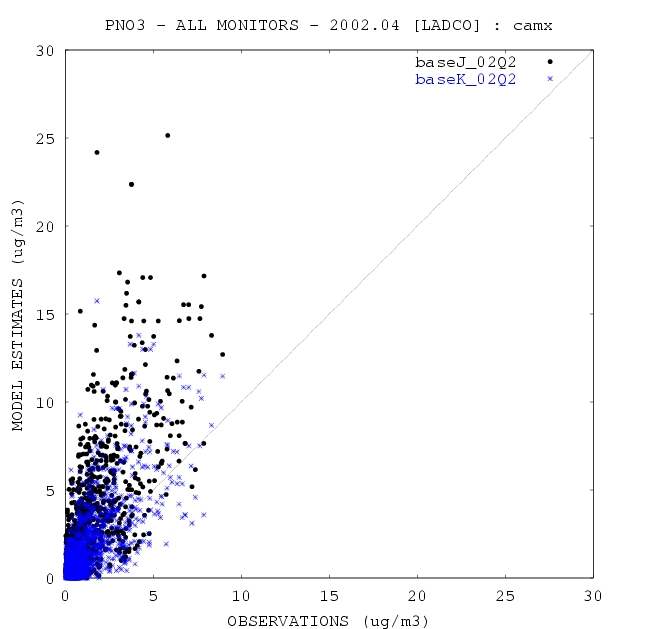

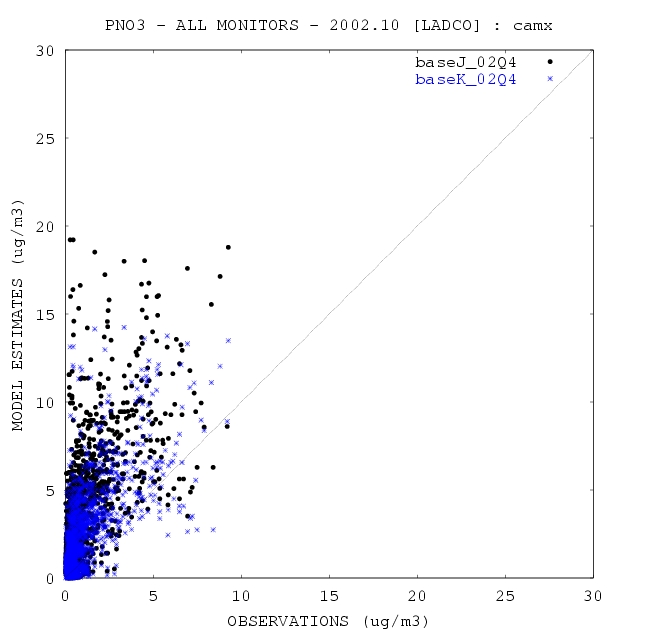

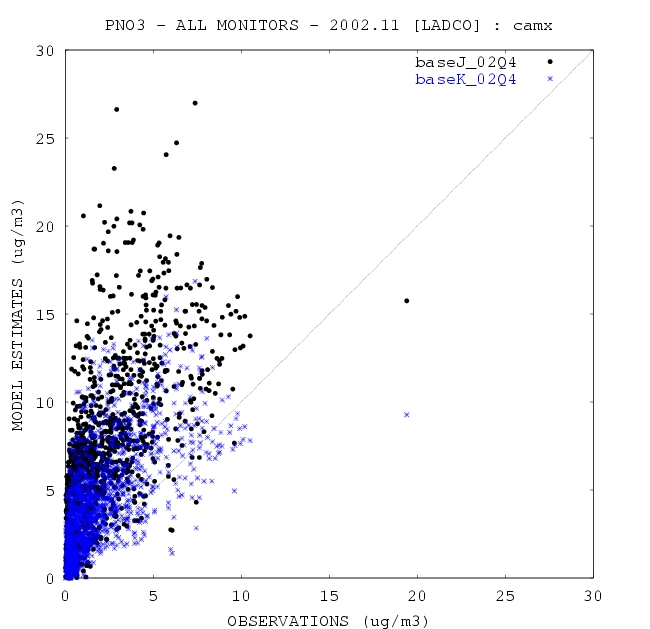

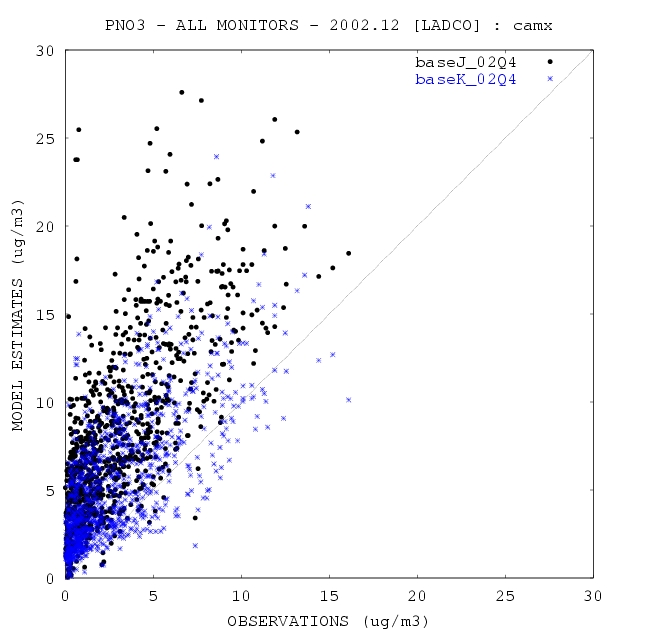

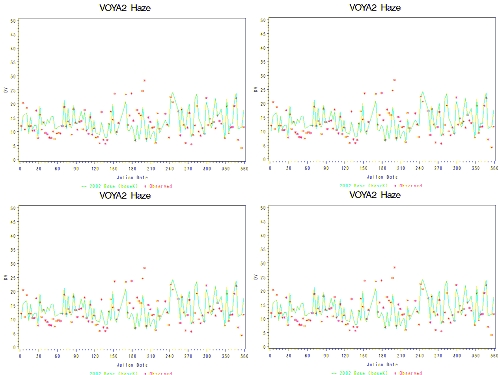

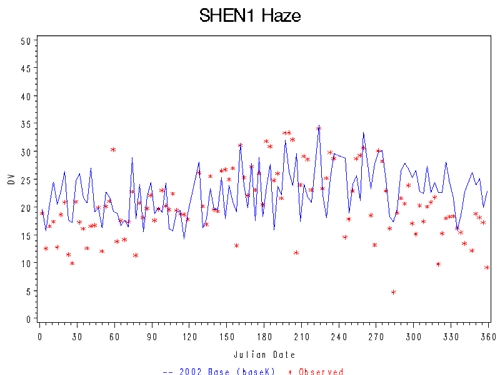

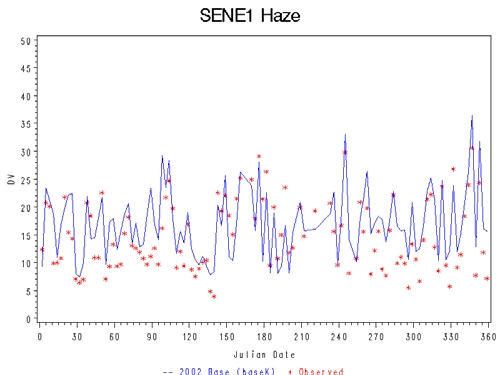

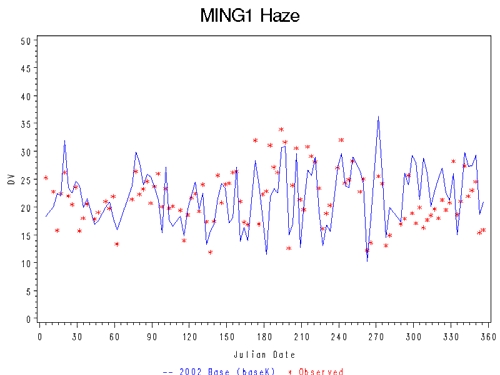

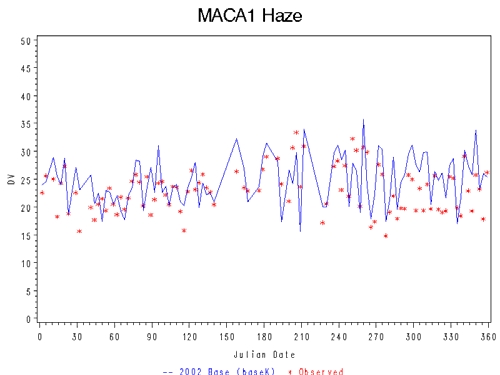

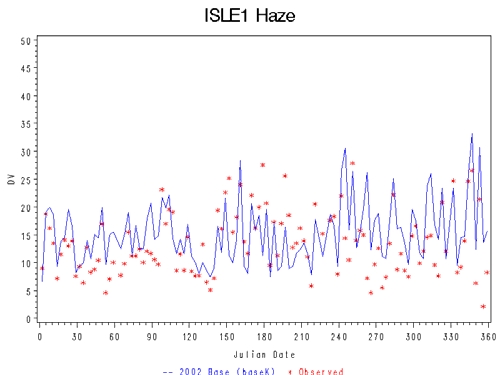

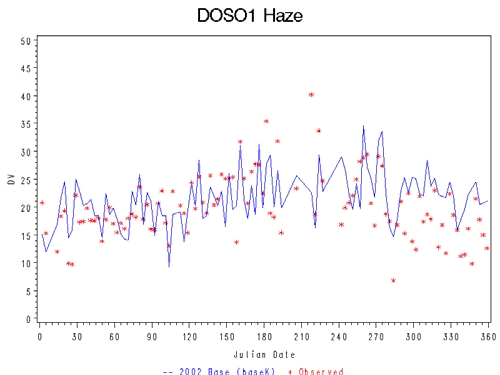

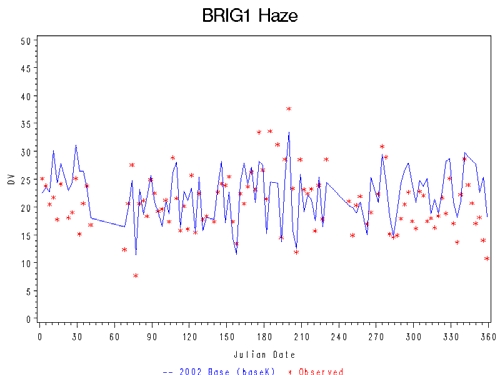

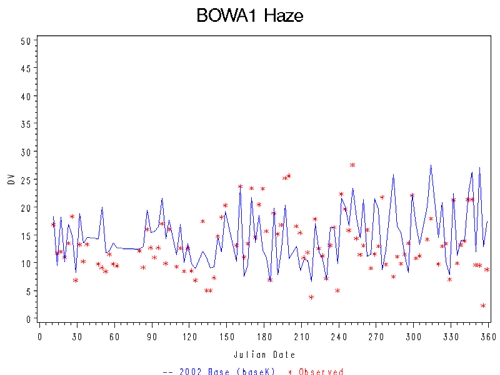

the Illinois CAIR rule. Modeling conducted by LADCO in the fall of 2005 suggests the current

PM

2.5

models are not yet sufficiently accurate to base regulatory decisions on. LADCO indicates

the model “over predicts” the contribution of sulfates to PM

2.5

concentrations and “under

predicts” the contribution from organic carbon.

5

The organic carbon contribution continues to

be a problem with the most recent LADCO PM

2.5

model performance, described by LADCO as

“very poor.”

6

4

James Marchetti, Michael Hein and J. Edward Cichanowicz, “Evaluation of the Midwest RPO Interim Measures

and EGU1 and EGU2” – presented at the June 28, 2005 Midwest Regional Planning Organization Regional

Workshop, attached as Exhibit C.

5

Kirk Baker, LADCO Round 3 (Base J) Model Performance, September 2005, attached as Exhibit D.

6

Kirk Baker, LADCO Round 4 (Base K) Model Performance, April 2006, attached as Exhibit E.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

10

VII.

Kincaid supports a longer baseline period for determining NO

x

allocations than

proposed by IEPA.

Kincaid supports the five-year baseline proposed at Part 225, Subparts D and E, Sections

225.435a and 225.535a for the initial annual and ozone season allocation of NO

x

allowances for

the years 2009, 2010 and 2011. Kincaid does not support the proposed use of the “two most

recent years of control period gross electrical output” for determining NO

x

allocations for the

year 2012 and after (Sections 225.435b and 225.535b). Kincaid urges IEPA to use a five-year

baseline, with an average of the three highest years, throughout the annual and seasonal NO

x

trading rules with periodic revisions every five or six years. This way, the allocations will be

fairly distributed among affected facilities, taking into account market swings, prolonged

maintenance breaks and lengthy outages to install the extensive control equipment needed to

comply with these rules as well as the recently finalized mercury rules at Part 225, Subpart B.

VIII. Withholding NO

x

allowances from existing sources, like Kincaid, that have already

installed expensive pollution controls to reduce NO

x

emissions, amounts to a

“penalty” for those sources that have opted for this approach. Further, any

unclaimed allowances left over in the Energy Efficiency and

Conservation/Renewable Energy (“EEC/RE”) set-aside should be returned to the

EGUs.

As Kincaid emphasized at the Pollution Control Board hearing in Chicago, the Illinois Part 217,

Subpart W NO

x

rule, based on the federal NO

x

SIP Call rules, is a “cap and trade” program, i.e.,

Illinois affected sources must meet a federal NO

x

“budget” or “cap” on emissions during each

ozone season (May 1 through September 30). Sources are allocated a discrete number of NO

x

allowances for each ozone season and the affected sources must make up any shortfall in the

number of allowances they hold versus the number of tons of NO

x

the sources emitted during the

ozone season. Affected sources have three options to make up any shortfall: reduce NO

x

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

11

emissions to levels below the number of eligible allowances they hold, use allowances they have

“banked” through purchase or over-compliance in previous ozone seasons, or purchase/trade

allowances held by other affected sources throughout the 19 eastern states under the federal NO

x

SIP Call region. The Kincaid plant chose to reduce NO

x

emissions at the stack rather than to

rely on extra allowances purchased from other sources.

The Illinois Subpart W rules at Part 217.770 also included an opportunity for affected sources to

obtain “early reduction credits” by reducing NO

x

emissions to specified levels before the rules

were fully effective in the ozone season of 2004.

Kincaid clearly could have relied on the purchase or trade of NO

x

allowances from other

facilities to comply with the Illinois Subpart W rules, including allowances from the more than

100 Dominion-owned generating units allocated NO

x

allowances under the NO

x

SIP Call

program. Instead, both units at the Kincaid facility were equipped in 2002 with the most

effective NO

x

controls available – SCR. While this was certainly a business decision, it was

brought about in part by the incentives presented by the early reduction credits available under

Part 217.770 of the Subpart W rules. The bottom line is that emissions were reduced earlier than

required and the benefits to the environment were delivered faster – a real “win-win” for

Kincaid, the IEPA and the environment.

Nevertheless, the IEPA CAIR proposal summarily withdraws this important incentive for early

reductions with no other explanation than “for public health and air quality improvements.”

7

7

Section 225.480 of the proposed rule: Part 225 – Control of Emissions from Large Combustion Sources, May 30,

2006.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

12

Kincaid urges the Board to restore the allowances for the CSP in order to promote early

compliance that will provide environmental benefits to accrue and allow affected facilities to

properly plan and implement compliance strategies. Withdrawing these early reduction

provisions removes the incentive for sources to reduce NOx emissions in the non-ozone season

in 2007 and 2008 (by operating SCRs year-round).

At the October Illinois Pollution Control Board hearings in Springfield, the IEPA maintained

that the 25% CASA does not restrict the allowance market:

“It is very important to note that a set-aside is not the equivalent of lowering the

overall budget because the allowances usually remain in the market. While the

recipients of the set-aside allowances are free to hold, sell, or retire the

allowances as they see fit, it is far more likely that they would offer to sell the

allowances in the market in order to realize a financial benefit. As a result, the

recipients have an additional source of funding for their projects, and existing

sources continue to have a pool of allowances they can utilize if needed to meet

their requirements, and the total amount of emissions remains at or below the

budgeted amount.”

8

This explanation gives no consideration of the impact withdrawing these allowances have on the

market-based principles of the federal CAIR rule. Withholding the additional 25% of the NO

x

allowance budget significantly impacts the economics of the rule for EGUs. Under the federal

model rule, the allowances are allocated to affected sources based on the highest three years of

heat input over of the course of a five year period. Set-asides are presented in the model rule as

an option states may adopt, but nowhere suggests such a dramatic set-aside. Indiana, for

example, has recently finalized its CAIR rule with a 4½% set-aside for new sources and a ½%

set-aside for energy efficiency/renewable energy projects. For Kincaid, the 30% set-aside

equates to an annual allowance surrender of 1625 annual trading program allowances and 601

8

Testimony of James Ross, Manager-Division of Air Pollution Control, IEPA, October 10, 2006.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

13

ozone season trading program allowances or, in today’s market, about $2.5 million per year.

Under the IEPA proposal, if Kincaid needed to purchase back these allowances (which under the

federal model rule would have been directly allocated to Kincaid), the net financial impact

would be $5 million per year.

The unfortunate final result will ultimately fall on the businesses, factories and institutions that

use electricity in Illinois, thereby, disproportionately impacting Illinois competitively with

surrounding states that are adopting CAIR rules that more closely resemble the federal approach.

IEPA has suggested in its testimony in Springfield that the allowances will remain available in

the market for developers as “an additional source of funding for their projects,” and that

“existing sources continue to have a pool of allowances they can utilize if needed to meet their

requirements.” The IEPA proposal then establishes the largest single set-aside of the five

regulatory proposals discussed for EEC/RE projects, with 12%. Under the NOx SIP Call,

several states (including neighboring Indiana and Ohio) found that many of the EEC/RE

allowances were left unclaimed and eventually returned to the utilities. The IEPA proposal

states that the agency “may elect to retire” the unclaimed allowances. Since the largest pool of

CASA allowances in the IEPA proposal is designated for the EEC/RE set-aside, which has

historically been under-subscribed under the NO

x

SIP Call experience, we expect many of the

CASA set-asides for EEC/RE projects to go unclaimed.

Kincaid urges the Board to reject the 30% NO

x

set-aside in favor of a set-aside consistent with

the federal model rule or some other more reasonable approach, and, regarding the EEC/RE set-

aside, to adopt provisions that would return any allowances not claimed by EEC/RE projects to

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

14

the EGUs. This approach would free up some allowances that may go unclaimed but still offer

incentives for these projects. To effect this change, Kincaid suggests section 225.475(b)(4) of

the proposed Subpart D: CAIR NO

x

Annual Trading Program be amended as follows:

“If allowances still remain undistributed after the allocations and distributions in

the above subsections are completed, the Agency may elect to retire any CAIR

NO

x

allowances

, with the exception of allowances assigned to the Energy

Efficiency and Conservation/Renewable Energy set-aside,

that have not been

distributed to any CASA category, to continue progress toward attainment or

maintenance of the National Ambient Air Quality Standards pursuant to the CAA.

Allowances from the Energy Efficiency and Conservation/Renewable Energy

set-aside that remain undistributed shall be distributed to each CAIR NO

x

unit in accordance with section 225.440.”

Kincaid suggests similar changes in section 225.575(b)(4) of the proposed Subpart E: CAIR NO

x

Ozone Season Trading Program:

“If allowances still remain undistributed after the allocations and distributions in

the above subsections are completed, the Agency may elect to retire any CAIR

NO

x

allowances

, with the exception of allowances assigned to the Energy

Efficiency and Conservation/Renewable Energy set-aside,

that have not been

distributed to any CASA category, to continue progress toward attainment or

maintenance of the National Ambient Air Quality Standards pursuant to the CAA.

Allowances from the Energy Efficiency and Conservation/Renewable Energy

set-aside that remain undistributed shall be distributed to each CAIR NOx

Ozone Season unit in accordance with section 225.540.”

As we have stated, Kincaid installed SCRs on both units at Kincaid in 2002. SCR is widely

accepted as the most effective control for NO

x

emissions from coal-fired utility boilers. This

equipment has provided up to a 90% reduction in NO

x

emissions during the past five ozone

seasons of 2002 through 2006, enabling Kincaid to over-comply with the Illinois Subpart W

rules. Kincaid is expecting that this equipment will provide the year-round NO

x

reductions

needed to comply with the upcoming CAIR reductions. However, the current Illinois CAIR

proposal, with the 25% CASA, allocates 5% of the Illinois NO

x

budget for both the annual and

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

15

ozone season trading program for “air pollution control equipment upgrades” including

“installation of selective catalytic reduction.”

9

Because the eligibility to apply to this “air pollution control equipment upgrade” set-aside

apparently hinges on installation of new controls on an existing source, it appears the SCRs at

Kincaid would not be eligible for these allowances. This is unfair. Operation of the Kincaid

SCRs on a year-round basis will require a dramatic expansion of the operations of this

equipment, increasing significantly the costs for ammonia, catalysts, and other variable costs for

operating the SCRs. Kincaid expects the year-round SCR operation to significantly increase

“parasitic” loads on the plant, as well, primarily from increased fan loads.

Allowances were intended to help companies offset these economic burdens, and Kincaid does

not believe that Illinois should disproportionately burden its electric generators.

Excluding existing air pollution control equipment that must be operated on a year-round basis

following adoption of the proposed rule from applying for allowances from the “air pollution

control equipment upgrade” set-aside is unfair and Kincaid urges the Board to change the

eligibility so that these existing controls are included. Kincaid suggests the proposed rule be

amended at §225.460(c)(1) as follows:

“Air pollution control equipment upgrades at existing coal-fired electric

generating units, as follows: installation of flue gas desulfurization (FGD) for

control of SO

2

emissions; installation of a baghouse for control of particulate

matter emissions; and installation of

or extended operation of existing

selective

catalytic reduction (SCR), selective non-catalytic reduction (SNCR), or other add-

on control devices for control of NO

x

emissions.”

9

Section 225.460(c)(1)of the proposed rule: Part 225 – Control of Emissions from Large Combustion Sources, May

30, 2006.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

16

IX.

Kincaid supports USEPA’s position that the CAIR rulemaking does not require

states to prepare an attainment SIP to comply with CAIR and the attendant

emission reductions are not designed to result in attainment of the NAAQS.

As EPA noted in its CAIR preamble:

“The EPA's CAIR and the previously promulgated NO

X

SIP Call reflect EPA's

determination that the required SO

2

and NO

X

reductions are sufficient to

eliminate upwind States' significant contribution to downwind nonattainment.

These programs are not designed to eliminate all contributions to transport, but

rather to balance the burden for achieving attainment between regional-scale and

local-scale control programs.”

10

X.

The Board has failed to evaluate the combined impact of CAMR and CAIR.

The Board has failed to evaluate the technical feasibility and economic reasonableness of

simultaneous compliance with two contemporaneously adopted regulations (CAIR and CAMR),

where both regulations impose unique impacts on a specific industrial sector: coal-fired electric

generating units. There is no evidence in the record of either regulatory proceeding that it is

technically feasible and economically reasonable for the affected facilities to comply

simultaneously with both regulations. Kincaid has provided information in both regulatory

proceedings that the economic impact of the individual and combined regulations is

unreasonable. The Board’s failure to evaluate the simultaneous impact of both rules is not

consistent with Illinois law. Commonwealth Edison Company, v. Pollution Control Board, 25

Ill.App.3d 271, 323 N.E.2d 84 (First District, 1975), (aff’d 62 Ill.2d 494, 343 N.E.2d 4 (1976));

and Illinois State Chamber Of Commerce, v. Pollution Control Board 67 Ill.App.3d 839, 384

N.E.2d 922 (First District, 1978).

10

70 Fed. Reg. 25166

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

17

Kincaid supports implementation of the federal CAIR and urges the Illinois Pollution Control

Board to adopt regulations that follow the CAIR principles.

Respectfully submitted,

Kincaid Generation, L.L.C.

by:

/s/ Bill S. Forcade

One of Their Attorneys

Dated: January 5, 2007

Bill S. Forcade

Katherine M. Rahill

Jenner & Block LLP

330 N Wabash Ave.

Chicago, IL 60611-7603

(312) 222-9350

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Final Report

Midwest Electric

Rate Impact Study

BBC Research and Consulting

August 26, 2005

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Final Report

August 26, 2005

Midwest Electric Rate Impact Study

Prepared for

Center for Energy and Economic Development;

Midwest Ozone Group; and

NiSource

Prepared by

BBC Research & Consulting

3773 Cherry Creek N. Drive, Suite 850

Denver, Colorado 80209-3827

303.321.2547 fax 303.399.0448

www.bbcresearch.com

bbc@bbcresearch.com

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Table of Contents

i

ES.

Executive Summary

I.

Introduction

Background .............................................................................................................................................................I–1

Scenarios..................................................................................................................................................................I–2

Overview of Analysis ................................................................................................................................................I–3

Limitations ...............................................................................................................................................................I–4

Data Sources............................................................................................................................................................I–5

Terminology Definitions...........................................................................................................................................I–6

II.

Case Study Industries

Selection .................................................................................................................................................................II–1

2002 Employment ..................................................................................................................................................II–2

Competitiveness in U.S. ..........................................................................................................................................II–3

International Competitiveness.................................................................................................................................II–4

Coal Mining............................................................................................................................................................II–5

III.

Midwest Electricity Rates

Control Costs .........................................................................................................................................................III–1

Baseline Revenues ..................................................................................................................................................III–2

Percentage Impacts................................................................................................................................................III–3

Household Impacts ................................................................................................................................................III–4

Relative Affordability ..............................................................................................................................................III–5

IV.

Impacts on Case Study Industries

Approach ...............................................................................................................................................................IV–1

IM1 .......................................................................................................................................................................IV–4

IM2 .......................................................................................................................................................................IV–5

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Table of Contents

ii

IV.

Impacts on Case Study Industries (continued)

EGU1/EGU2 Without Replacement Power Costs.....................................................................................................IV–6

EGU1 .....................................................................................................................................................................IV–7

EGU2 .....................................................................................................................................................................IV–8

V.

Impacts for Higher Costs for Households

Output....................................................................................................................................................................V–1

Input.......................................................................................................................................................................V–2

VI.

Regional Economic Impact

Total Output ..........................................................................................................................................................VI–1

State Output ..........................................................................................................................................................VI–2

Total Jobs...............................................................................................................................................................VI–3

State Jobs...............................................................................................................................................................VI–4

Labor Income.........................................................................................................................................................VI–5

Appendices

A. Industry Profiles

A1. Food Industry

Introduction ..................................................................................................................................A1–1

Employment Trends.......................................................................................................................A1–2

Largest Employers..........................................................................................................................A1–3

Share of U.S. Employment .............................................................................................................A1–4

Global Competition .......................................................................................................................A1–5

Employment Forecasts ...................................................................................................................A1–6

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Table of Contents

iii

A. Industry Profiles (continued)

A2. Paper Industry

Introduction ..................................................................................................................................A2–1

Employment Trends.......................................................................................................................A2–2

Largest Employers..........................................................................................................................A2–3

Share of U.S. Employment .............................................................................................................A2–4

Global Competition .......................................................................................................................A2–5

Employment Forecasts ...................................................................................................................A2–6

A3. Chemical Industry

Introduction ..................................................................................................................................A3–1

Employment Trends.......................................................................................................................A3–2

Largest Employers..........................................................................................................................A3–3

Share of U.S. Employment .............................................................................................................A3–4

Global Competition .......................................................................................................................A3–5

Employment Forecasts ...................................................................................................................A3–6

A4. Plastics and Rubber Industry

Introduction ..................................................................................................................................A4–1

Employment Trends.......................................................................................................................A4–2

Largest Employers..........................................................................................................................A4–3

Share of U.S. Employment .............................................................................................................A4–4

Global Competition .......................................................................................................................A4–5

Employment Forecasts ...................................................................................................................A4–6

A5. Computer Industry

Introduction ..................................................................................................................................A5–1

Employment Trends.......................................................................................................................A5–2

Largest Employers..........................................................................................................................A5–3

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Table of Contents

iv

A. Industry Profiles (continued)

A5. Computer Industry (continued)

Share of U.S. Employment .............................................................................................................A5–4

Global Competition .......................................................................................................................A5–5

Employment Forecasts ...................................................................................................................A5–6

A6. Primary Metal Industry

Introduction ..................................................................................................................................A6–1

Employment Trends.......................................................................................................................A6–2

Largest Employers..........................................................................................................................A6–3

Share of U.S. Employment .............................................................................................................A6–4

Global Competition .......................................................................................................................A6–5

Employment Forecasts ...................................................................................................................A6–6

A7. Fabricated Metal Industry

Introduction ..................................................................................................................................A7–1

Employment Trends.......................................................................................................................A7–2

Largest Employers..........................................................................................................................A7–3

Share of U.S. Employment .............................................................................................................A7–4

Global Competition .......................................................................................................................A7–5

Employment Forecasts ...................................................................................................................A7–6

A8. Machine Industry

Introduction ..................................................................................................................................A8–1

Employment Trends.......................................................................................................................A8–2

Largest Employers..........................................................................................................................A8–3

Share of U.S. Employment .............................................................................................................A8–4

Global Competition .......................................................................................................................A8–5

Employment Forecasts ...................................................................................................................A8–6

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Table of Contents

v

A. Industry Profiles (continued)

A9. Transportation Equipment

Introduction ..................................................................................................................................A9–1

Employment Trends.......................................................................................................................A9–2

Largest Employers..........................................................................................................................A9–3

Share of U.S. Employment .............................................................................................................A9–4

Global Competition .......................................................................................................................A9–5

Employment Forecasts ...................................................................................................................A9–6

A10. Coal Mining Industry

Introduction ................................................................................................................................A10–1

Largest Employers........................................................................................................................A10–2

Production and Consumption......................................................................................................A10–3

Coal Origin and Destination ........................................................................................................A10–4

Employment Projections ..............................................................................................................A10–5

A11. Electric Power Industry

Introduction ................................................................................................................................A11–1

Retail Sales of Electricity ...............................................................................................................A11–2

Net Generation of Electricity ........................................................................................................A11–6

Projected State Population...........................................................................................................A11–7

Projected Nameplate Capacity.....................................................................................................A11–8

Projected Net Generation ............................................................................................................A11–9

Sales and Generation .................................................................................................................A11–10

Employment Trends...................................................................................................................A11–11

Employment Forecasts ...............................................................................................................A11–12

B. Industry Impacts by State

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

EXECUTIVE SUMMARY

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Executive Summary

EXECUTIVE SUMMARY, PAGE 1

BBC Research & Consulting (BBC) was retained by the Center for Energy

& Economic Development (CEED), the Midwest Ozone Group (MOG)

and NiSource to examine the impacts of electric utility emission controls

identified in the “LADCO EGU White Paper” on the Midwest economy.

LADCO is considering two levels of utility emission reductions (EGU1 and

EGU2) and two intermediate levels of control (IM1 and IM2). The

proposed emission reductions under these controls are approximately 50

percent to 75 percent greater than the reductions required by EPA’s 2005

Clean Air Interstate Rule (CAIR).

BBC studied the effects of additional emission controls in Illinois, Indiana,

Michigan, Ohio and Wisconsin. Nine case study industries in those states

were selected for study based on their intensive use of electricity. These

industries included manufacturers of primary metals, transportation

equipment, chemicals, food products, plastics and rubber, fabricated metals,

paper, machinery and computers/electronic equipment. Coal mining was

selected as the tenth case study industry because it is a major supplier to

Midwestern electric generation.

BBC estimated the electric rate impacts of the proposed LADCO controls

and the corresponding impact of higher electric rates on the case study

industries and on household spending in the five states within the LADCO

region. Rate impacts were estimated by comparing the projected annual

electric utility revenue requirements, including costs of compliance with the

LADCO controls, with projected annual electric utility revenue

requirements after compliance with CAIR. BBC examined several scenarios

of LADCO controls, including with and without replacement power to

compensate for early generating unit retirements under EGU1 and EGU2.

1

BBC quantified overall effects on regional output and employment arising

from the direct impacts on the case study industries and from the impacts of

higher electric rates on household disposable income. Impacts were

quantified using partial equilibrium analyses of each case study industry

along with the IMPLAN economic input-output model.

The focus of the study was on the direct and secondary (or “multiplier”)

effects on the case study industries and on the portions of the economy

supported by household spending. The findings here are conservative

because impacts of higher electric rates on other industries and the

commercial sector (which together account for about one-third of all

electricity sales) were not included. Health and visibility-related economic

benefits of emissions reductions and the potential short-term economic

effects on the construction industry from building and installing pollution

control equipment were also outside the scope of this study.

1

Annual costs of compliance, including both technology costs and replacement power to

compensate for early retirement of older generating units, were provided by James

Marchetti, Michael Hein and Edward Cichanowicz. Baseline electric utility revenues for

2012 and 2013 were projected by BBC based on current revenues, Energy Information

Administration projections and EPA’s Regulatory Impact Analysis of the CAIR Rule.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Executive Summary

EXECUTIVE SUMMARY, PAGE 2

Key findings are as follows:

1. From a regional standpoint, electric rates in the year 2013 would be

about 11 percent higher under EGU1 and nearly 16 percent higher

under EGU2 than under the CAIR Rule. Electric rates would increase

the most in Indiana (29% increase under EGU2) and the least in

Michigan (12% increase under EGU2).

2. Demand for coal mined in Illinois, Indiana and Ohio is expected to

decline by 48 percent under EGU1 and 54 percent under EGU2.

3. Economic output in the five-state region is projected to be reduced by

$9.0 billion to $14.1 billion under EGU2 in 2013. Under EGU1, the

reduction in annual state economic output is estimated to be between

$6.9 billion and $10.4 billion.

2

4. Employment in the five-state region is projected to be reduced by

between 69,000 and 94,000 jobs under EGU2. Under EGU1,

approximately 51,000 to 69,000 jobs would be lost.

Exhibit ES-1 summarizes the projected impacts on regional employment on

a state-by-state basis.

2

Output and employment impact estimates include direct impacts on the case study

industries, impacts on the suppliers and employees of those industries, and impacts on

the economy due to reduced disposable income of residential consumers as a result of

electric rate increases.

Exhibit ES-1.

Projected job reductions under

proposed LADCO EGU control measures

Note:

Totals may not add due to rounding.

Source: BBC Research & Consulting, 2005.

Illinois

Indiana

Michigan

Ohio

Wisconsin

Total

2012

2013

Without Replacement Power

With Replacement Power

EGU1/EGU2

9,300 –12,110

17,680 –24,330

6,630 – 9,290

16,410 –21,120

2,870 – 4,330

52,910 –71,200

EGU2

13,400 – 17,610

22,280 – 31,140

10,050 – 14,090

18,300 – 23,660

5,290 – 7,950

69,330 – 94,460

EGU1

8,800 –11,410

17,510 –24,150

6,270 – 8,730

16,190 –20,780

2,560 – 3,830

51,340 –68,890

IM2

4,660 – 6,350

7,590 –11,730

5,440 – 7,660

5,960 – 8,600

2,280 – 3,420

25,930 –37,750

IM1

1,020 – 1,370

5,380 – 8,180

3,270 – 4,520

5,510 – 7,800

1,540 – 2,280

16,720 – 24,140

Illinois

Indiana

Michigan

Ohio

Wisconsin

Total

2012

2013

Without Replacement Power

With Replacement Power

EGU1/EGU2

9,300 –12,110

17,680 –24,330

6,630 – 9,290

16,410 –21,120

2,870 – 4,330

52,910 –71,200

EGU2

13,400 – 17,610

22,280 – 31,140

10,050 – 14,090

18,300 – 23,660

5,290 – 7,950

69,330 – 94,460

EGU1

8,800 –11,410

17,510 –24,150

6,270 – 8,730

16,190 –20,780

2,560 – 3,830

51,340 –68,890

IM2

4,660 – 6,350

7,590 –11,730

5,440 – 7,660

5,960 – 8,600

2,280 – 3,420

25,930 –37,750

IM1

1,020 – 1,370

5,380 – 8,180

3,270 – 4,520

5,510 – 7,800

1,540 – 2,280

16,720 – 24,140

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

SECTION I.

Introduction

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Introduction — Background

SECTION I, PAGE 1

BBC Research & Consulting (BBC) was retained by the Center for Energy

& Economic Development (CEED), the Midwest Ozone Group (MOG)

and NiSource to examine the impacts of electric utility emission controls

identified in the “LADCO EGU White Paper

1

” on the Midwest economy.

The Lake Michigan Air Directors Consortium (LADCO) was established in

1990 by the states of Illinois, Indiana, Michigan and Wisconsin. Ohio

became a member of the consortium in 2004. LADCO’s purpose is to

provide technical assessments and assistance to its member states on regional

air quality issues.

In January 2005, LADCO produced an “interim white paper” describing

candidate control measures, beyond the mandatory controls already on the

books, that might be considered by the LADCO states. LADCO is

considering two levels of utility emission reductions — EGU1 and EGU2

— and two intermediate levels of control — IM1 and IM2. Allowable

emission rates for electric generating units would be considerably lower

under the LADCO strategies than under the EPA’s 2005 Clean Air

Interstate Rule (CAIR). For example, the regional budget for annual SO2

emissions would be reduced from about 1 million tons under CAIR to

about 570,000 tons under IM2 and about 240,000 tons under EGU2.2

If

enacted, the intermediate levels of control would be in force in 2012. EGU1

and EGU2 standards would begin in 2013.

1

This is the popular name for a study by Mac Tec consulting group entitled “Interim

White Paper–Midwest RPO Candidate Control Measures.” The Midwest Regional

Planning Organization is composed of and managed by LADCO, the Lake Michigan Air

Directors Consortium.

2

“Evaluation of the Midwest RPO Interim Measures and EGU1 and EGU2,”

Marchetti, Hein and Cichanowicz, June 28, 2005.

BBC was asked to examine the impacts of the LADCO scenarios on electric

rates in the LADCO states and the impacts of potential electric rate

increases on electricity intensive industry, Midwestern households and the

Midwestern economy. BBC’s analysis includes CAIR in the baseline and

only examines impacts beyond what will result from CAIR. BBC studied

impacts on Illinois, Indiana, Michigan, Ohio and Wisconsin.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Introduction — Scenarios

SECTION I, PAGE 2

This analysis examines the EGU1 and EGU2 scenarios with and without

the costs of “replacement power.” These scenarios are expected to lead to

early retirements of certain coal fired generating units and a corresponding

reduction in regional generation capacity. The “with replacement power”

scenarios consider the net additional cost of replacing the power that these

units would have generated through additional use of existing natural gas-

fired generation units, construction of new gas generating units and

purchases of replacement power from outside the region.

Exhibit I-1 summarizes the control scenarios studied by BBC. The EGU1

and EGU2 scenarios with no purchases of replacement power yield similar

results. Therefore BBC combined these two control scenarios into one in

this analysis.

BBC’s economic impact analysis is based on an assessment of the Midwest

electric utility industry’s response to the different control scenarios prepared

by James Marchetti, Michael Hein and Edward Cichanowicz.

3

3

Ibid.

Exhibit I-1.

Summary of LADCO pollution control scenarios examined in this study

Central Scenario

IM1

2012

Not needed

IM2

2012

Not needed

EGU1/EGU2 without replacement power

2013

Excluded

EGU1 with replacement power

2013

Included

EGU2 with replacement power

2013

Included

Purchase of

Year

replacement power

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Introduction — Overview of Analysis

SECTION I, PAGE 3

Midwest utilities would respond to the proposed control measures by

investing in pollution control equipment, increasing their use of existing

natural gas-fired generating units, building new gas units, switching from

Midwest coal to low sulfur Wyoming coal (“fuel switching” in Exhibit I-2),

and early retirement of Midwest generating units, which could lead to more

power purchases from outside the region. Each of these responses will

increase the cost of electricity for Midwest customers.

BBC’s economic analysis begins with the projected annual cost impacts on

the electricity industry. BBC then calculated rate impacts on Midwest

electricity customers. These rate impacts are discussed in Section III of this

report.

Because BBC could not conduct a comprehensive assessment of the rate

impacts on all sectors of the Midwest economy, nine electricity-intensive

industries and coal mining were selected as “case studies” for this analysis.

Section II of this report introduces the case study industries.

The direct impact of increased electricity rates on case study industries is

reduced output in each industry. As a result, each case study industry will

reduce purchases from sectors providing key inputs. For example, cost

increases for the transportation equipment industry will lead to reductions

in demand for steel (“backward linkages” in Exhibit I-2). Job losses in these

industries will also have a ripple effect through the Midwest economy.

These effects are examined in Section V. BBC also modeled impacts on the

Midwest coal industry from fuel switching.

Finally, residential electricity customers will spend more of their income on

electricity and less on other items. BBC modeled these effects as well.

Results are presented in Section V.

Exhibit I-2.

Factors included and not included in the economic study

Rate

Increases

LADCO Control Scenarios

Added

EGU Costs

EGU

Operating

Changes

Emission

Control

Construction

Reduced

Emissions

Fuel

Switching

Case Study

Manufacturing

Industries

Other

Industries &

Commercial

Residential

Consumers

Backward

Linkages

Backward

Linkages

Backward

Linkages

Forward

Linkages

Forward

Linkages

Reduced

Midwest Coal

Production

Backward

Linkages

Early

Retirement

Cost of

Replacement

Power

Note:

Shaded items were included in study; unshaded items were not.

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Introduction — Limitations

SECTION I, PAGE 4

It is also important to note the economic effects that BBC did not examine.

Reduced air pollution in the Midwest may improve the health of local

residents, enhance visibility and have other benefits. Each of these outcomes

could have positive economic effects on the region. As shown in Exhibit I-2,

effects of “reduced emissions” were not a part of BBC’s study.

Because BBC analyzed long-term economic effects of the pollution control

measures, short-term effects were not included. The short-term jobs created

from installing the pollution control equipment required under the

LADCO proposals were not estimated.

To be able to clearly examine the future economic conditions with and

without the control scenarios, BBC assumed that residential customers

would not change their use of electricity in response to higher prices.

Without this assumption, power consumption in the Midwest would be

lower, likely resulting in larger rate impacts, as the capital costs of pollution

controls would be spread over a smaller volume of sales. Attempting to

estimate the many iterations of these effects was beyond the scope of this

study.

There are also several reasons why the analysis presented here could

understate the negative economic effects of the pollution control strategies.

Only nine case study industries, plus the coal industry, were examined when

assessing direct effects of the pollution control measures. Increases in case

study industry costs may lead to higher prices for their output — and

correspondingly higher costs for other industries. BBC did not examine

these effects (“forward linkages” in Exhibit I-2). Other reasons are noted in

Exhibit I-3.

Exhibit I-3.

Reasons why the analysis may understate or overstate actual impacts

Reasons why analysis may understate actual impacts

Rate impacts limited to case study industries and households; one-third of

electricity sales ignored

Did not analyze lost utility jobs due to early power plant retirements in Midwest

or lost railroad jobs due to reduced coal transportation.

Forward linkages not included (e.g., effects of higher steel costs on rest of

Midwest economy)

Reasons why analysis may overstate actual impacts

Did not analyze any health or visibility benefits

Did not analyze short-term employment created from installing pollution control

equipment

Assumed no reductions in power use by residential customers due to

higher rates

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, JANUARY 5, 2007

* * * * * PC #10 * * * * *

Introduction — Data Sources

SECTION I, PAGE 5

BBC modeled the economic impacts of the LADCO pollution control

scenarios using the IMPLAN input-output model. This tool is widely used

throughout the U.S. for regional economic impact analysis.

As much as possible, BBC relied on accepted state or federal data sources for

the inputs to the IMPLAN model and other elements of the analysis. For

example, inputs regarding industry responsiveness to cost increases

(“elasticities,” which are further discussed in Section IV of this report)