Argus Air Daily

US Emissions Market Prices, News and Analysis

Daily Market Assessments

SO, Allowances

2006

Bid

975.00

Ask

1,025.00

Price

1,000.00

$/ton

Change

+50.00

Assessment Averages

Executive Briefin

Georgia air regulators have proposed joining the growing list of

states looking to opt out of the Clean Air Mercury Rule by adopt-

ing more stringent mercury limits for coal-fired generators

.

EPA has revealed the level of restriction to be placed on the

use of banked allowances in the federal nitrogen oxide trading

market this ozone season

.

Leaders of the Senate Energy and Natural Resources Commit-

tee yesterday announced they will hold an April 4 conference

on climate change and requested responses to key questions

about designing a mandatory cap-and-trade system to regulate

greenhouse gases

.

Consol Energy will supply Northern Appalachian coal to Duke

Power under a multi-year, multimillion-ton coal agreement for

scrubbed Duke facilities in North Carolina, the first of what could

be many Northern Appalachian or Illinois Basin sales to the

Southeast's newly scrubbed generators

.

argus

www.argusonline.com

Volume 13, 036, February 23, 2006

Georgia proposes CAMR alternative

Georgia air regulators have proposed joining the growing list

of states looking to opt out of the Clean Air Mercury Rule by

adopting more stringent mercury limits for coal-fired gen-

erators.

The Georgia Environmental Protection Division (EPD) issued

a proposal for comment yesterday that seeks to require existing

units greater than 25MW to achieve 80 pct or 85 pct average

capture efficiency by 2010, followed by a 90 pct capture rate

sometime between 2012 and 2015. The capture efficiency would

be determined by comparing output emissions of mercury with

either the mercury content of coal or the inlet mercury concentra-

tion upstream from any pollution controls

.

The proposal would allow only intrastate trading of mercury

allowances. The program would allow banking to encourage ear-

ly reductions. It may also include a compliance supplement pool

to provide additional flexibility for compliance

.

New units in operation after Jan. 31, 2004, would be subject

to a best available control technology standard, although EPD

could still decide to include new units in the overall program

.

The proposal is one of two options for which EPD is seeking

comment. The second option would be to join the Clean Air Mer-

cury Rule (CAMR) trading program.

CAMR would require the generators to reduce emissions from

about 1 .89 tons in 2004 to 1 .227 tons/yr from 2010 and 0.484

tons/yr from 2018. The EPD proposal would limit emissions

to either 0.38 tons/yr or 0.51 tons/yr in the first phase and 0 .26

tons/yr in the second phase. The date of the second phase will be

set after EPD receives public comment. There are also plans to

consider a new round of emission cuts five years after phase 2 is

in place .

Continuedon page 2

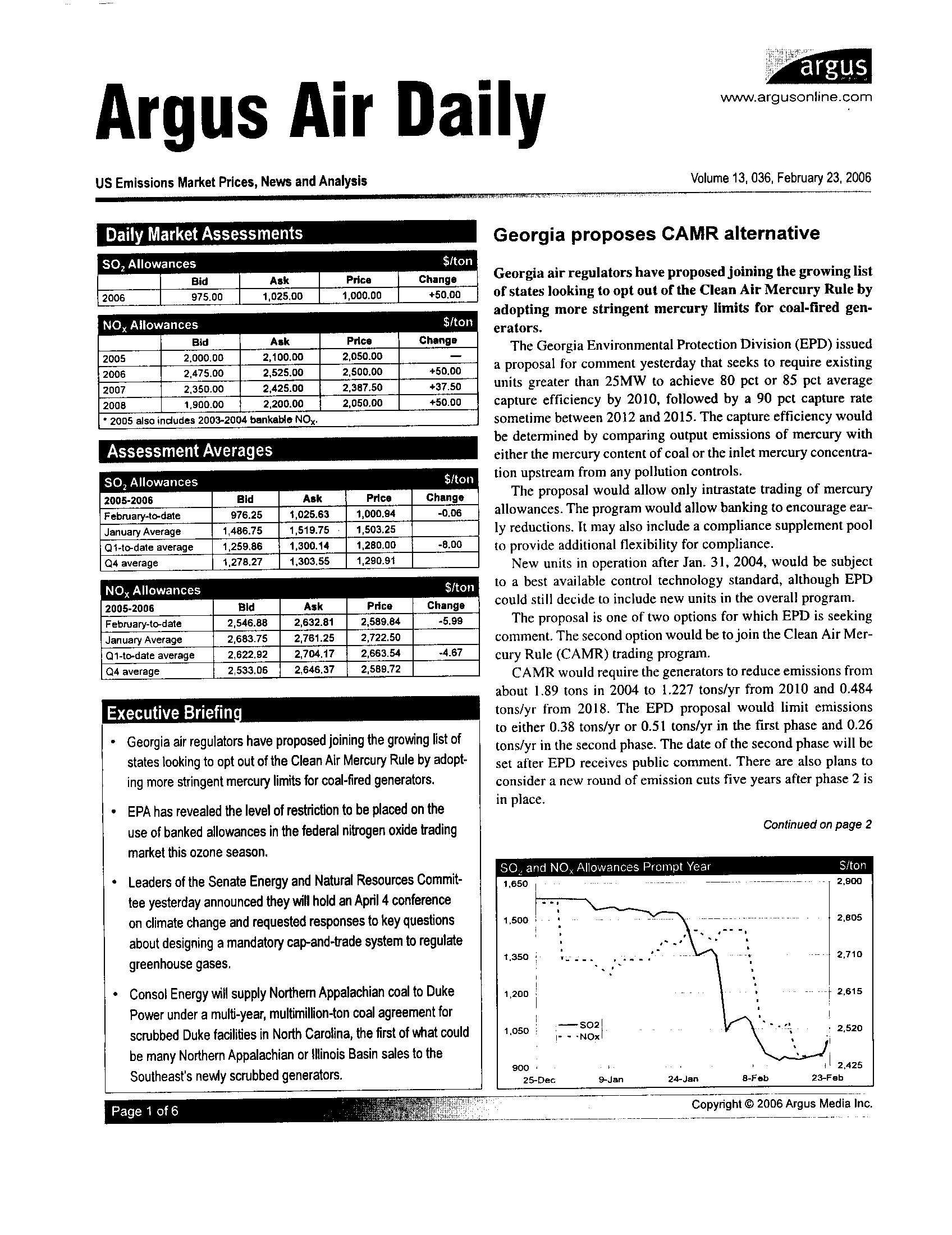

SO_ and NO, Allowances Prompt Year

S/ton

Copyright O 2006 Argus Media Inc .

$/ton

NO. Allowances

Bid

Ask

Price

Change

2005

2,000.00

2,100.00

2,050.00

-

2006

2,475.00

2,525.00

2.500.00

+50.00

2007

2,350.00

2,425.00

2,387.50

+37.50

2008

1,900.00

2.200.00

2,050.00

+50.00

- 2005

also includes

2003-2004

bankable

NO

s

.

$/ton

SO, Allowances

2005-2006

Bid

Ask

Price

Change

February-to-date

976.25

1,025.63

1,000.94

-0.06

January Average

1,486.75

1,519.75

1,503.25

O1-to-date average

1,259.86

1,300.14

1,280.00

-8.00

Q4

average

1,278.27

1,303.55

1,290.91

$Iton

NOx Allowances

2005-2006

Bid

Ask

Price

Change

February-to-date

2,546.88

2,632.81

2,589.84

-5.99

January Average

2,683.75

2,761.25

2,722.50

01-to-date average

2,622.92

2,704.17

2,663.54

-4.67

04

average

2,533.06

2,646.37

2,589.72

Argus

Air

Daily

Market Overview

•

SO2

prices

jumped $100

intraday to a high

of $1,050

before easing back to close around $1,000 . The activity oc-

cured in a midday flurry and quickly fizzled out

.

•

EPA announced the

NO, flow

control ratio for

2006

at

0.27, meaning

that facilities can use

27

pct of their banked

allowances at parity this year.

•

The flow control level was expected and had little impact

on the market, and no trades were reported .

Weekly

SO, vs PRB 8.800 prompt quarter

S/ton

I-0

800 Prwnpl Quaver

- -

sq;w..xy

.

.

1

1,100

00o

700

5

2005-08

200$-18

2005-28

2005.38

00548

2006-06

Page 2 of 6

www.argusmediagroup.com

Volume 13, 036,

February

23, 2006

Continued from page I

While similar to a model rule issued last year by national regu-

lators groups STAPPA/ALAPCO, the proposal was developed

by EPD's Air Protection Branch after an extensive analysis of

EPA

Toxics Release Inventory data and issues

such

as

the cost-

effectiveness of

requiring stricter reductions,

said

Jim

Kelly,

planning and regulatory development

manager for the Air Pro-

tection Branch .

Allowance

NO,

Transfers

22-Feb-06

Transferor

Transferee

Vintage

Tons

American Electric Power

FirstEnergy

2006

200

Cinergy

Dominion

2006

Cinergy

Dominion

2007

0

State of MA

Cinergy

2005

22

See methodology at end of report.

NO, Allowances Assessment Averages (Cont'd)

$/ton

Year

Bid

Ask

Price

2005

February-to-date

2,045.31

2,154.69

2,100.00

JanuaryAverage

2.060.00

2,160.00

2,110.00

0140-date average

2,053.47

2,157.64

2,105.56

04 average

1,925.40

2,068.55

1,996.98

2006

February-to-date

2,546.88

2,632.81

2,589.84

JanuaryAverage

2.683.75

2,761.25

2,722.50

01-to-date average

2,622.92

2,704.17

2,663.54

04 average

2,533.06

2,646.37

2,589.72

2007

February-to-date

2,320.31

2,407.81

2,364.06

January Average

2,318.75

2,448.75

2,403.75

01-to-date average

2,319.44

2,430.56

2,386.11

04 average

2,498.79

2,635.48

2,567.14

2008

February-to-date

1,837.50

2,106.25

1,971.88

JanuaryAverage

1,758.75

1,898.75

1,828.75

0140-date average

1,793.75

1,990.97

1,892.36

04 average

2,262.90

2,439.92

2,351 41

S0

2

Allowance Transfers

Transferor

Transferee

Vintage

22-Feb-06

Tons

Allegheny Energy

Morgan Stanley

2009

12 400

Amerex USA

Lumberton Power

_

2004

28

American Electric Power

Amerex USA

2004

28

American Electric Power

MidAmedcan Energy Holdings

2004

375

BP

JP Morgan

2005

66

BP

JP Morgan

2006

934

BP

Kochindustries

2005

6549

BP

Koch Industries

2006

4 151

BP

Koch Industries

2007

5 000

BP

Koch Industries

2008

2 500

8P

Koch Industries

2009

1 000

BP

Ohio Valley Electric

2005

585

BP

Ohio Valley Electric

2006

4 4 5

Credit Suisse

BP

2006

000

Credit Suisse

Edison International

200

5

Credit Suisse

Edison International

2006

2 495

Dominion

East Kentucky Power Coop

2006

2 500

FPL Energy

Southern

200

579

Great River Energy

Dairyland Power Coop

2003

Great River Energy

Dairyland Power Coop

2005

2 510

Morgan Stanley

Allegheny Energy

2007

10 000

Northeast Utilities

Koch Industries

2000

400

Northeast Utilities

Koch Industries

200

796

Northeast Utilities

Koch Industries

2002

289

Northeast Utilities

Koch Industries

2004

Northeast Utilities

American Electric Power

2000

Northeast Utilities

American Electric Power

200

949

NRG

Natsource

2005

PPL

JP Morgan

2006

2000

See methodology at end of report .

Deals Done

$/ton

Date

Type

Transaction

Vintage

Tons

Price

23-Feb

SO,

Trade

2006

1 .000

950.00

23-Feb

SO,

Trade

2006

1,000

990.00

23 eb

SO,

Trade

2006

000

1,000.00

23 eb

SO,

Trade

2006

1,025

1,000.00

23-Feb

SO,

Trade

2006

1.050

1,000.00

23-Feb

SO

Trade

2006

_

025

2,500.00

23-Feb

SO

Trade

2006

1 025

2,500.00

Year

NO,Allowances

- Spread

Year

To Prompt

Price

$/ton

Change

2005

450.00

-50.00

2007

-112.50

-12.50

2008

450.00

-

Argus Air Daily

Emissions-adjusted and Delivered Coal

$/mmBtu

280

4.25

3.57

I'-

-

- Nymex-spec OTC -

- -. ~ PRB 8,800OTC

22-Nov

15-Dec

7-Jan

30-Jan

The STAPPA/ALAPCO rule calls for a 90 pct to 95 pct cap-

ture rate by 2012, with no interstate trading but some intracom-

pany trading .

EPD developed the proposal after meeting with stakeholders

last year, but not all are on board. Southern Co. subsidiary Geor-

gia Power continues to support CAMR. "We feel that it would

be most effective," Georgia Power spokeswoman Lolita Jackson

said .

Georgia Power operates 29 coal-fired units

.

EPD will hold a stakeholder meeting March 6 to discuss the

proposal and receive public comment . States have until Nov. 17

to submit alternative plans to CAMR

.

The proposal comes as 15 other states have adopted or are

considering state-specific mercury plans . Pennsylvania unveiled

plans yesterday to require 80 pct mercury removal by 2010 and

90 pct by 2015 (AAD 2/22/06) . Connecticut, Massachusetts,

New Jersey and Wisconsin have state-specific plans in place . Il-

linois, Indiana, Maryland, Michigan, Minnesota, Montana, New

Hampshire, New York, North Carolina, Ohio and Virginia all

have regulatory actions or legislation pending

.

2006 flow control ratio set at 0.27

EPA has revealed the level of restriction to be placed on the

use of banked allowances in the federal nitrogen oxide trad-

ing market this ozone season

.

The use of banked allowances in the NO, SIP Call is restricted

by progressive flow control (PFC) if the bank exceeds 10 pct of

the baseline allocation for the current year. EPA confirmed today

that the PFC ratio for 2006 is 0.27. This means that 27 pct of

banked allowances can be used to cover one ton of emissions,

and the rest will be discounted two-for-one if used

.

The ratio is almost unchanged from last year as so few allow-

ances were drawn down from the bank . Despite last year's hot

summer and high generation levels, utilities were able to keep

NO, emissions in check thanks to pollution control equipment

and tine-tuning of operations .

According to preliminary data released last year, 2005 ozone

Page 3 of 6

www.argusmediagroup.com

Volume 13, 036, February 23, 2006

2006 NO x vs PJM Summer 2006

118

2,900

2,800

2,700

2,600

2,500 j

104

w

97

2,400

, -

.

-,.

_-

. - -

83

22-Nov

15-Dec

7-Jan

30-Jan

22-Feb

season NO, emissions were 530,272 tons, only 14,272 over the

baseline allocation of 516,000 tons. Sources had a bank of around

200,000 allowances left over from 2003 and 2004, thanks to the

shortened compliance season and a generous supply of additional

allowances to ease transition into the scheme. Complete informa-

tion will be published in the 2005 Progress Report, expected in

May .

The PFC level was in line with most expectations and should

have little impact on the market, one broker said . Current vintage

NO, remains at around $2,500/ton . But with no signs of any sig-

nificant depletion of the large bank, consultants are beginning to

question the market value of allowances

.

"We're starting to think allowance prices are way too high,"

said John Blaney of ICF Consulting. "There appears to be a fair

amount of combustion optimization getting emissions below

where one would think by just looking at the controls that are go-

ing in," he said. Fair market value should be well below $2,000/

ton, he added. "You can't run coal plants much harder than last

year. So what will drive [the bank] down more?"

But the market is not efficient, and does not necessarily be-

have as fundamentals would suggest. Although the total draw-

down from the bank was less than 25 pct, some facilities still

had to surrender two allowances for one ton of emissions, said a

source at EPA .

Although allowances can be banked forward into the Clean

Air Interstate Rule seasonal NO, program, initial modeling sug-

gests that the price will be low, Blaney said . So there is little

incentive to hold onto NO, allowances beyond 2009 .

Panel seeks climate change answers

Leaders of the Senate Energy and Natural Resources Com-

mittee yesterday announced they will hold an April 4 confer-

ence on climate change and requested responses to key ques-

tions about designing a mandatory cap-and-trade system to

regulate greenhouse gases

.

Committee Chairman Pete Domenici

(R-N.M .) and rank-

ing member Sen. Jeff Bingaman (D-N.M.), in announcing the

Argus Air Daily

conference, solicited responses to a committee staff white paper

issued on Feb. 2 that outlines the major issues to be addressed

as the senators work on legislation to reduce GHG emissions in

the US (AAD 02/02/06). The 14-page paper, available on the

committee's Web site, raises numerous issues that the committee

hopes to address in the coming weeks .

The paper hones in on four main questions regarding key de-

sign elements of a market-based regulatory scheme : which en-

tities should be regulated and should regulations be placed up-

stream or downstream; how should allowances be distributed ;

should any eventual trading system be designed to be compatible

with existing trading programs, such as the EU emissions trading

scheme; and whether legislation should be designed to require

reciprocal action by other nations for each step taken by the US

.

There are 31 clarifying questions, all investigating the design of a

"mandatory market-based system," as considered by the Sense of

the Senate Resolution that passed in June 2005 (AAD 6/28/05)

.

"This is a joint, bipartisan approach to addressing climate

change legislation," Bingaman spokesman Bill Wicker said

.

"We are casting a big net .

. . as long as [responders] follow the

guidelines

.

.

. answer the questions asked and not those unasked

.

.

. anyone can respond," he said . Wicker said the release of the

guidelines and the announcement of the date of the conference

were not pitched to any particular interest group

.

The guidelines for submitting responses announced yesterday

are very detailed, and if a responder fails to follow the rules their

submission may not be reviewed by the committee .

All responses must be submitted via the committee's Web site

.

Responders must address one or more of the four main questions

in separate "Question documents," which must then be accompa-

nied by a one-page explanation of which questions they address

and summarizing their answers. Submittals must be emailed to

the April conference staff by March 13 . All submissions will be

reviewed by the committee, but only some will be selected to

present their proposals for how to design a GHG cap-and-trade

scheme at the April 4 conference . Participants for the conference

will be notified March 28, and their proposals will be made avail-

able prior to the conference on the committee's Web site .

Duke to take Consol Northern App coal

Consol Energy will supply Northern Appalachian coal to

Duke Power under a multi-year, multimillion-ton coal agree-

ment for scrubbed Duke facilities in North Carolina, the first

of what could be many Northern Appalachian or Illinois Ba-

sin sales to the Southeast's newly scrubbed generators

.

Deliveries under the new agreement will commence in 2007,

when Duke's Marshall Steam Station's scrubber comes online

.

Consol has pinned sales growth hopes to rollout of new

scrubbed capacity in the Southeast, arguing that its high-heat

Pittsburgh Seam coal represents good value to units newly

equipped with flue-gas desulfurization technology

.

Page 4 of 6

www.argusmediagroup.com

"This is an important contract, not because of its size, but be-

cause it is a further indication that demand for our Northern Ap-

palachia coal will grow as power generators in the United States

invest in scrubber technologies," Consol Chief Executive Brett

Harvey said. "In particular, we see the southeastern United States

as a growth market for us ."

Consol said the scrubbed capacity in coal-fired electric gen-

eration east of the Mississippi River should more than double in

the next five years, creating opportunity for the high-sulfur, high-

heat Northern Appalachian coal producer.

Construction started in 2004 on Duke's Marshall Steam

Station's FGD installation, and the 2,090MW station will be

scrubbed in 2007. Scrubber construction at Duke's 1,120MW

Belews Creek station started in May 2005 and is slated to come

on line in 2008, the second station in Duke's North Carolina fleet

to be scrubbed

.

Sierra Club faults Mirant order

A Bush administration order to bring a near-dormant power

plant near the nation's capital back into service late last year

overlooks an increase in fine particulate pollution that could

come from a new emissions control system at the facility, Si-

erra Club has claimed

.

The dispute over the emissions profile of the Mirant-owned

facility in Alexandria, Va., has focused on its sulfur dioxide

output. The company says it can bring the plant's SO, output

into compliance with National Ambient Air Quality Standards

(NAAQS) through a combination of limited generation and the

injection of trona, an alkali, into its boilers

.

The company is installing the trona injection system under the

terms of a Dec. 20 order from Energy Secretary Samuel Bod-

man, which followed a dispute with state air regulators that all

but shuttered the 482MW facility. Bodman ordered the facility

into limited service so it would be ready to provide backup power

to Washington, DC, in the event of a major transmission line out-

age. To date, the plant has not fired up more than three of its five

boilers at any given time, but DC-area power officials expect the

plant to be ready to surge to its full capacity if two 230kV trans-

mission lines serving the nation's capital were to fail

.

Bodman has given tentative approval for Mirant to install the

trona injection system, pending an air quality impact assessment

.

Bodman's order says the DC area needs reliable power, but oper-

ations at the Mirant facility should be managed to keep NAAQS

breaches to a minimum .

But in a Feb. 20 filing, Sierra Club says trona injection has the

potential to increase the plant's fine particulate (PM, .,) output. Both

Alexandria and nearby Washington are affected by PM,, emissions

from the plant, and Mirant should be required to do stack tests to

prove it meets the NAAQS for this pollutant, Sierra Club said

.

If the plant must remain in service, Department of Energy

should develop a plan to reduce electricity demand in Washing-

Volume 13, 036, February 23, 2006

Argus Air Daily

ton, so the plant is not required to surge to its full capacity during

a transmission line outage, the filing said .

"We are rather troubled that

.

.

. electrical reliability appears to

be taking precedence over public health," Sierra Club's Virginia

Chapter Vice Chair Bruce Parker wrote in the filing

.

Wisc. Senate takes on AG

A proposed law aimed at cutting the number of government-

sponsored public nuisance lawsuits in Wisconsin is a step

closer to passing the state legislature.

A Republican majority in the state Senate passed the Fairness

in Litigation Act (SB 425) Feb. 21 and the bill will now go before

the GOP-controlled state Assembly

.

The bill's sponsors accuse Wisconsin Attorney General Peg

Lautenschlager (D) of abusing her authority to launch public nui-

sance lawsuits, citing her involvement in a mufti-state court ac-

tion against utilities on carbon dioxide emissions as the most re-

cent example. Lautenschlager and attorneys general from seven

other states -California, Connecticut, Iowa, New Jersey, Rhode

Island, New York and Vermont- claim CO2 emissions from

power plants contribute to global warming and so endanger pub-

lic health, the economy and the environment (AAD 7/21/04)

.

A federal judge recently sided with utilities AEP, Cinergy,

Southern Co., the Tennessee Valley Authority and Xcel Energy

and dismissed the case, but the states have filed an appeal

.

The bill passed the state Senate in a 19-14 vote, with the entire

Republican majority in favor of the proposed law and the Demo-

cratic minority against it . If passed, SB 425 would require the attor-

ney general to obtain the permission of the governor, and in some

cases the state legislature, before starting a public nuisance action

.

Last month, Lautenschlager told lawmakers the bill was a

,'mufti-million dollar give away of public rights to polluters," but

her spokesman said today the attorney general was unavailable to

comment on the Senate vote

.

A spokeswoman for Gov. Jim Doyle (D), who faces re-elec-

tion this year, was unable to comment before press time

.

Judge faults Calif. for pesticide regs

A federal judge ruled yesterday that California violated the

Clean Air Act by not issuing regulations to reduce emissions

of ozone precursors from pesticides

.

Judge Lawrence Karlton said the state violated federal law

when it failed to carry out obligations under its state implemen-

tation plan (SIP) to adopt regulations to reduce volatile organ-

ic compounds from pesticides. Instead, the state merely asked

manufacturers to reformulate some products to reduce emissions

after it decided regulations were not needed.

The state argued that it had committed to passing the regula-

tions only if it determined they were necessary after reviewing

Page 5 of 6

www.argusmediagroup.com

Volume 13, 036, February 23, 2006

and revising emissions data. But, "the SIP called for a commit-

ment on the part of DPR [Department of Pesticide Regulation]

and CARB [California Air Resources Board] to look at the emis-

sions data before it and to promulgate regulations it thought

would allow it to meet attainment dates," Karlton ruled in a law-

suit filed by environmental groups

.

If the state felt the data no longer supported enforceable mea-

sures, as required by the SIP, it should have submitted a revised

SIP to EPA, Karlton said . DPR said it was reviewing the court

decision. Lawyers for both sides are expected to file briefs in 20

days proposing what steps the court should take next .

Wyo. tax bill would promote gasification

The Wyoming House of Representatives has approved a mul-

timillion-dollar tax break for the construction of coal gasifi-

cation and liquefaction facilities in the state

.

The legislation, JIB 61, drafted by the joint House-Senate

Minerals, Business and Economic Development Committee,

would exempt equipment used to build a gasification or liquefac-

tion facility from state excise tax

.

The Wyoming Department of Revenue estimates that the tax

break could cost the state between $9 .4 million and $62.4 mil-

lion per plant, based on estimated construction costs of $300 mil-

lion-$2 billion. A single plant could generate local governments

about $14 million/yr in property taxes, according to the Revenue

Department fiscal note on the bill .

Wyoming, the US' most prolific coal-mining state, is expected

to compete to be the host state for the proposed $1 billion Future-

Gen power plant, which could be eligible for the tax breaks . A

coalition of energy companies and the Department of Energy are

coordinating a competitive bidding process to develop an experi-

mental zero-emissions plant by 2012. The FutureGen Alliance

has said it will set a May deadline for siting proposals, so a list of

finalists can be compiled by summer

.

Wyoming joins Montana, Pennsylvania and West Virginia

among coal states lobbying hard for gasification and liquefaction

plants, with state governments in all four states offering some

combination of tax breaks, regulatory flexibility and public-private

partnership to attract the multibillion refineries to their regions

.

Anglo joins zero-emissions project

Mining company Anglo American has joined the FutureGen

Industrial Alliance, which is aiming to develop the world's

first "zero emissions" coal-fueled power plant .

Construction of the FutureGen plant is scheduled to start in

three years time and work is currently under way to find a suit-

able site in the US . Construction, plant start-up and testing are

due to take an additional three years with the plant to be fully

operational by 2012

.

Argus Air

Daily

Methodology

Argus publishes daily NO, allowance prices for current vintage (spot),

forward market prices for three additional years and previous year (banked)

allowances. Ii also publishes spreads between the spot and forward and

banked allowances . Argus publishes daily SO, allowance prices for current

vintage (spot). Each Friday on a weekly basis . Argus publishes forward

market prices for seven additional years. The forward SO, prices reflect the

value on the Friday assessed, not a value representative of the entire week

.

The Argus prices published daily are intelligent assessments of the bid/

ask range at the timestamp of 5:00pm Eastern Time. The "price" represents

the midpoint between the assessed bid and ask . The assessed range takes

into account deals done, bids, offers, spreads between current and future

vintages, and other assessments of the market gathered through a wide sur-

vey of participants. The assessment represents the range within which deals

traded or could have traded at the close of the trading day for that particular

vintage . Argus holds as a guiding principle that our assessments should be

the product of intelligence, skill, and diligent investigation

.

Each week on Friday, Argus publishes a Weekly Index far SO, and NO

N

.

These indices are the arithmetic average of the daily

'Price'

published for

current vintage allowances for each day on which prices were published

during that week. On the last business day of each calendar month, Argus

publishes a Monthly Index for SO, and NO.. These indices are the arith-

metic average of the daily "Price" published for current vintage allowances

for each day on which prices were published during that month. Monthly

indices for forward and previous year vintages are also published . Argus

publishes a monthly Broker Index as well, based on a methodology sug-

gested by the Emissions Marketing Association

.

The US Environmental Protection Agency (EPA) publishes transfers of

SO, and NO, allowances every business day . Argus publishes details on

daily transfers between non-affiliated companies or organizations . Separate-

ly, Argus collects details on transactions completed in the over-the-counter

market for emission allowances and publishes them in the "Deals Done"

table in Argus Air Daily each business day . These transactions are typically

completed two weeks or more before they are finalized and processed

through the EPA's allowance tracking system. Therefore volume and type

of trades in the "Deals Done" table will not match up with the same day's

transfers in the EPA tables

.

For more information, go to http://www.argusonline.com

Page 6 of 6

www.argusmediagroup.com

Volume

13, 036,

February

23, 2006

The nominal

275MW

prototype FutureGen power plant will gas-

ify coal through a process that converts carbon to a synthesis gas

composed of hydrogen and carbon monoxide . The hydrogen will be

used as a clean fuel for electricity generation in turbines, fuel cells or

hybrid combinations of these technologies, Anglo American said

.

"Our participation is complementary to our existing projects

in China and through Monash Energy in Australia, and represents

a further step in our commitment to participating in the develop-

ment of clean coal technologies that ensure that coal remains an

important and sustainable energy source for the future," Anglo

Chief Executive Tony Trahar said

.

FutureGen is made up of eight major energy and mining com-

panies that intend to contribute up to $250 million to the project

over its lifetime. It will partner (he

US

Department of Energy to

design, construct and operate FutureGen

.

The captured carbon dioxide from the planned plant will be

separated from the hydrogen and permanently

stored under-

ground, where it will be monitored over time . "The project hopes

to prove the effectiveness, safety and permanence of

COz

capture

and storage by testing the technology under real working condi-

tions," Anglo American said .

Anglo American Coal is a major coal producer and operates

mines in South Africa, Australia and South America .

February

24 Federal Register

Rules

Air pollution; standards of

performance for new station-

ary sources: Stationary gas tur-

bines; performance standards,

06-01743 [FRL-8025-9]

Proposed Rules

Air pollution ; standards of

performance for new station-

ary sources : Stationary gas tur-

bines; performance standards,

06-01742 [FRL-8025-8]

Argus Air Daily

alrdaily@argusmedlagroup.com

Senior Editor: Caroline Gentry

Editors: Mike Ball, Came Sisto, Simon Lomax

Production Editors: Andrew Sutton,

Yuri German

Contributing Editors : Ross Allen,

Abby Caplan, Jamie Webster, Peter Garden,

Steve Campbell, Carli Flippen,

Christopher Newman, Martin Skomial,

Milena Yordanova, Elizabeth Rosenberg,

Funds Saygin, Stefan Stoynov.

Washington Bureau Chief :

Peter Rosenthal

Business Development:

Daniel Massey, Miles Weigel

Publisher and CEO :

Adrian Sinks

Argus Media Inc.

1012 14th Street, N,W, Suite 1500

Washington, D.C. 20005

(202) 775-0240 (202) 872-8045 fax

www.argusmediagroup.com

Subscriptions: For information on multiple

subscription rates or site licensing contact

Robin Saikin at (713) 968-0000 x121

.

Customer Service: For questions regarding

subscriptions or circulation, please contact

Zach Rhonheimer at (202) 775-0240 x255

.

© Copyright 2006 by Argus Media Ltd

.

All rights reserved (ISSN 0732-8397) .

Reproduction, retransmission or storage of

this publication in any form is forbidden with-

out prior written permission from Argus Media

.

argus