ILLINOIS POLLUTION CONTROL BOARD

December 20,

2001

THE AMERICAN COAL COMPANY

-

)

GALATIA (Perimeter Ditch) (Property

)

Identification Numbers

11-1-083-01,

1-1-088-

)

01,

1-1-088-03,

1-1-088-04,

11-1-093-01,

11-)

1-093-02,

11-1-093-03,

11-1-093-05,

11-1-

)

093-06, 11-1-093-07,

11-1-095-01,

11-1-095-

)

02),

)

)

Petitioner,

)

)

v.

)

PCB 02-76

)

(Tax Certification)

ILLINOIS ENVIRONMENTAL

)

PROTECTION AGENCY,

)

)

Respondent.

)

ORDER OF THE BOARD

(by C.A.

Manning):

On December

12,

2001,

the Illinois

Environmental Protection Agency

(Agency) filed a

recommendation on whether the Board

should certify certain facilities of The American Coal

Company (American Coal) as

“pollution control facilities” for preferential tax treatment under

the Property Tax Code

(35

ILCS

200/11-5

et seq.

(2000)).

The Agency filed the

recommendation under Part 125

of the Board’s procedural rules

(35

Iii.

Adm.

Code

125).

The

Agency recommended that the Board issue

a tax certificate for the perimeter ditch of American

Coal’s

new 472-acre coal cleaning refuse

landfill (perimeter ditch), but deny a tax certificate

for the 472-acre coal cleaning refuse

landfill and

addition of agricultural lime

(landfill).

The Board is

not ruling today on whether American Coal’s landfill is

a pollution control

facility under the Property Tax Code

(35

ILCS

200/11-10 (2000)).

Instead, in a separate

order,

the Board is

opening docket PCB 02-83 to address the Agency’s recommendation on the

landfill.

In this

order,

the Board first describes the legal framework for tax certifications,

discusses the Agency’s recommendation on the perimeter ditch,

and certifies that the perimeter

ditch is

a pollution control facility.

LEGAL FRAMEWORK

Under the Property

Tax Code,

“~itis the policy of this

State that pollution control

facilities should be

valued, at

33

1/3

of the fair cash value of their economic productivity to

2

their owners.”

35

ILCS 200/11-5

(2000);

see also

35

Iii.

Adm.

Code

125.200(a)(2).

“For tax

purposes, pollution control facilities shall be certified as such by the Pollution Control Board

and shall be assessed by the Department of

Revenue.”

35

ILCS 200/11-20 (2000);

see also

35

Iii.

Adm.

Code

125.200(a).

Under Section

125.202 of the Board’s procedural

rules,

a person may submit an

application for tax certification to the Agency.

35

Iii.

Adm.

Code

125.202.

If the Agency

receives a tax certification application,

the Agency must file with the Board a recommendation

on the application,

unless the applicant withdraws the application.

35

Iii.

Adm.

Code

125.204(a).

Among other things,

the Agency’s filing must recommend that the Board issue or

deny tax certification.

35

Iii.

Adm.

Code

125 .204(a)(4).

If the Board finds

“that the claimed

facility or relevant portion thereof is

a pollution control facility

.

.

.,

the Pollution Control

Board

.

.

.

shall enter a fmding and issue

a certificate to that effect.”

35 ILCS 200/11-25

(2000);

see also

35

Ill.

Adm.

Code

125.216(a).

AGENCY RECOMMENDATION

The Agency states that it received a tax certification application

from American Coal on

January

31,

2001.

Agency Recommendation (Agency Rec.) at

1.

On December

12,

2001,

the

Agency

filed a recommendation on the application with the Board.

The Board attaches the

Agency’s recommendation

and makes it part of this order.

The Agency’s recommendation

identifies the facility at issue:

“~the

perimeter ditch of the new 472-acre coal cleaning refuse

landfill.”

Id.

at 2.

The Agency’s recommendation further describes the facility:

the perimeter

ditch “is

conveying water back to a pond

system” which

“collects all water at the site and is

used as slurry water.”

Id.

at

2.

The Agency’s recommendation also

identifies the location of

the facility:

“SW

1/4 of Section

17,

E

1/2 of the NE 1/4 of Section

19

and NW 1/4 and the N

1/2 of the

SW

1/4 of Section 20 Township

8

South-Range 6 East of the 3rd P.M.” in Saline

County.

Id.

at

1-2, Exhibit A.

The Agency recommends

that the Board

certify that the perimeter ditch

is

a pollution

control facility as defined in Section

11-10 of the Property Tax Code

(35

ILCS 200/11-10

(2000)) because the primary purpose ofthe facility is

“eliminating,

preventing, or reducing

water pollution.”

Agency

Rec. at 2-3.

TAX CERTIFICATE

The Board finds

and certifies that American Coal’s perimeter ditch identified in this

order

is

a pollution control facility under the Property Tax Code (35 ILCS

200/11-10 (2000)).

Under Section 11-25 of the Property Tax Code,

the effective date of this certificate is

“the date

of application for the certificate or the date of the construction of the facility, which ever is

later.”

35

ILCS 200/11-25

(2000);

see also

35

Iii.

Adm.

Code

125.2 16(a).

Section

125.216(d) of the Board’s procedural rules

states that the Clerk

“will provide the applicant and

the Agency

with a copy of the Board’s order setting

forth

the Board’sfindings and

certificate,

3

ifany.”

35

Iii.

Adm.

Code

125.216(d) (quoting in italics

35

ILCS 200/11-30

(2000)).

The

Clerk therefore will provide American Coal and

the Agency with a copy of this

order.

IT IS SO

ORDERED.

Section 41(a) of the Environmental Protection Act provides that final Board orders may

be

appealed directly to the Illinois Appellate Court within 35

days after the Board

serves the

order.

415

ILCS

5/41(a) (2000);

see also 35

Iii.

Adm.

Code

101.300(d)(2),

101.906,

102.706.

Illinois

Supreme Court Rule

335

establishes filing

requirements that apply when the

Illinois Appellate Court, by statute,

directly reviews administrative orders.

172

Iii. 2d R.

335.

The Board’s procedural

rules provide that motions for the Board to reconsider or modify its

final orders may be filed with the Board within 35

days after the order

is received.

35 Iii.

Adm.

Code

101

.520; see also

35 Ill.

Adm.

Code

101 .902,

102.700,

102.702.

I,

Dorothy M. Gunn,

Clerk of the Illinois

Pollution Control Board,

certify that the

Board adopted the above order on December

20,

2001,

by

a vote of 7-0.

‘7

A

~4

Dorothy M. Gunn, Clerk

Illinois Pollution Control Board

RECEIVED

CL~RR’SOFF~

DEC

1

2

2001

STATE OF JWNOIS

Pollution Control Board

BEFORE THE

iLLINOIS

POLLUTION CONTROL BOARD

The American Coal Company-Galatia

)

(Property Identification Numbers

)

11-1-083,

1-1-088-01,1-1-088-03, 1-1-088-04,

)

11-1-093-01,

11-1-093-02,

11-1-093-03,

)

PCB Q2-7~’

11-1-093-05,

11-1-093-06,

11-1-093-07,

)

(Tax Certification)

11-1-095-01

and

11-1-095-02

)

RECOMMENDATION

Now Comes the

Illinois Environmental Protection Agency (“Illinois EPA”) by Connie

L. Tonsor, one oUts attorneys,

and pursuant to Section 125.204 of the

Illinois Pollution

Control ~Biard’s (Board) regulations files the following Recommendation regarding the

tax certification ofwater pollution control facilities

pursuant to 35

Ill

Adm

Code

125204

1.

On January 31, 2001, the

Illinois EPA received

a request from The American

Coal Company for an

Illinois EPA

recommendation regarding the tax certification

of water~polIution

control

facilities, pursuant to 35

Ill. Adm. Code

125.204, and

noted the request as log number TC-06-01. (Exhibit A)

2.

The applicant’s address is:

Ms. Linda Carlton

The American Coal Company

Post

Office Box 727

Harrisburg, Illinois 62946

3.

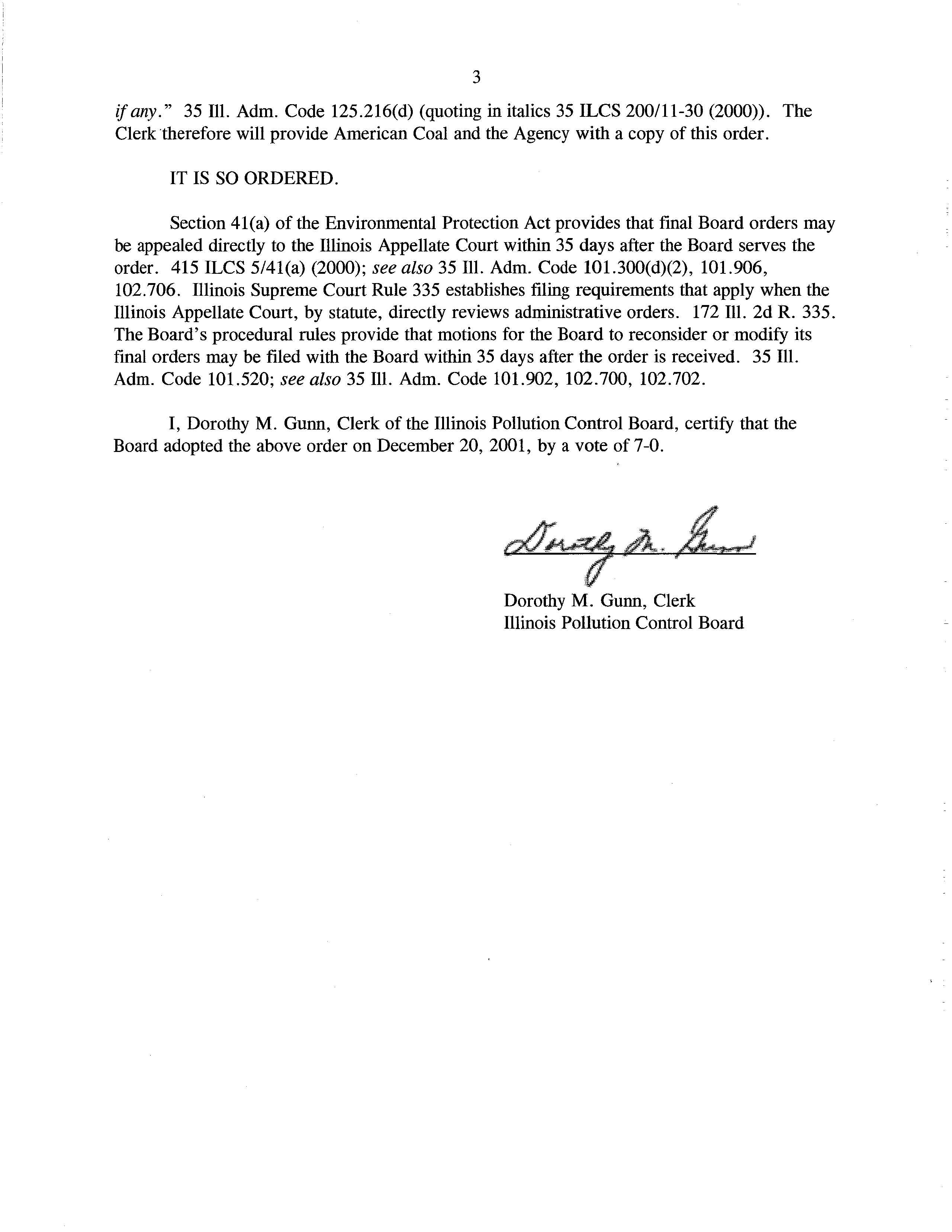

The proposed water pollution control facilities

in this request are located at:

SW

1

of Section

17,

E

1

of the

NE

14 of Section 19 and NW and

the

N

Y2of

the

SW

1/4

of Section 20 Township

8 South-Range

6

East ofthe

3rd

P.M. and

consist of:

A)

The perimeter ditch of the new 472-acre coal cleaning refuse landfill.

(This facility is further described

in

Exhibit A.)

B)

The 472-acre coal cleaning

refuse landfill and addition of agricultural lime.

(This facility is further described

in

Exhibit A.)

4.

Section

11-10 of the Property Tax Code, 35 ILCS 200/11-10 (2000), defines

“pollution control facilities” as: “any system,

method, construction, device or

appliance appurtenant thereto or any portion of any building or equipment, that is

designed, constructed, installed or operated for the primary purpose of:

(a)

eliminating, preventing, or reducing air or water pollution

.

.

.or (b) treating,

pretreating, modifying or disposing of any potential solid,

liquid or gaseous

pollutant which if released without treatment, pretreatment modification or

disposal might be harmful, detrimental or offensive to human,

plant or animal

life,

orto property.”

5.

Pollution control facilities are entitled to preferential tax treatment, 35 ILCS

200/11-5 (2000).

6.

Based on the information

in the application

and the purpose of the facilities, the

perimeter ditch,

described

in

paragraph 3(A) is conveying water back to a pond

system.

The pond system. collects all water at the site and

is used as slurry

water.

The Illinois EPA’s engineering judgment that the

described facilities may

be considered “pollution control facilities,” pursuant to 35

III. Adm. Code

125.200(a), with the primary purpose of eliminating, preventing, or reducing

water pollution, or as otherwise provided in

35

Ill.

Adm..

Code

125.200.

Therefore, the perimeter ditch described

in

paragraph 3(A)

is eligible for tax

certification from the

Board.

7.

The 472-acre coal cleaning refuse landfill and the addition or agricultural lime

described

in paragraph 3(B)

is a disposal facility for coal cleaning refuse, a

byproduct of mining, and not a water pollution control device, 35

Ill. Adm. Code

125.200.

8.

Therefore, pursuant to Section

125.204(a) the

Illinois

EPA recommends that the

Board issue the requested tax certification for the perimeter ditch described

in

paragraph 3(A) and deny the requested tax certification for the 472-acre coal

cleaning refuse landfill described

in paragraph

3(B),

35

III. Adm. Code

125.204.

9.

The applicant may file a petition with the

Board to contest the Agency denial

recommendation.

The applicant has 35 days after the date of service of this

recommendation to file its petition.

Illinois

Environmental

Protection Agency,

By:________

Connie

L. Tonsor

Associate Counsel

December 10, 2001

1021

North Grand

Ave.

E.

P.O. Box 19276

Springfield,

Illinois 62794-9276

217/782-5544

‘—rr_~0

—r~~

Tax Certificationfor Pollution Control

Facilities

Page

I of2

8/00

This

Agency

is

authori~ed

to

request

this

information under Illinois Revised

Statues.

1979.

~

~on5O2~5.Disclosure ofthis

J

n~tj4~’s~F~utary.

However,

failure

to

~or~iy~~il

~p/e

nt

your

application

from

beingproce

ouId result in denialofyour

1application for certification.

I.

°PL1cATi0NFOR CERTIFICATION

(PROPERTY TAX TREATMENT)

POLLUTION CONTROL

FACILITY

AfRO

WATER

IXI

ILLINOIS

ENVIRONMENTAL PROTECTION ~

P. 0. Box 19276, Springfield, IL

62794.9276

FORAGENCY USE

“~“~

~J

I

~UUi

ILLINOIS ENVIRUF4MENTAL

No.

Date Received

Certification No.

~

AN(s~ate

A

Company Name

~OW/WPC/PEi~MIT

SECTION

The

American Coal Company

PersonAuthorized to Receive Certification

Person to Contact for Additional Details

Ms.

Linda

Canton

Ms.

Linda

Canton

StreetAddress

Street Address

P 0 Box 727

P 0 Box 727

I...

Municipality, State & Zip Code

Municipality, State & Zip Code

~

Harrisburg,

IL

62946

Harrisburg,

IL

62946

Telephone Number

Telephone Number

~

618/268-6535

618/268-6535

Location

of Facility

Municipality

Township

QuarterSection

Township

Range

1.2

miles

East

Pt.

Sec

17,

19,

20

8S

6E

Galatia,

IL

Raleiih

StreetAddress

County

Book Number

9085 Hwy 34 N, Galatia,

IL

Saline

Property identification Number

Parcel

Number

11—1-083—01; 1—1-088—01. 03, 04; 11—1-093-01.02. 03. 05.06. 07;

11-1-095-01.02

B

Nature

of Operations Conducted atthe Above Location

472

acre

surface

site

designed

and

approved

for permanent containment of coal

waste

materials

to

meet surface runoff and groundwater

environmental

compH ance.

IDNR-Land Reclamation Div. Permit No.

306

Issued 11/20/1997

Water Pollution Control Construction Permit No.

.

~

NPDESPERMIT No.

IL0061727—Sediemtn Pond #002

Date Issued

~

Date Issued

Expiration

Date

8/15/96 (current)

8/15/2001

Air Pollution Control Construction Permit No.

Date

Issued

Air Pollution Control Operating Permit No.

Date Issued

C

Describe Unit Process

Coarse refuse generated from coal

cleaning is placed on the prepared site and

compacted to ensure stability for permanent containment.

Fine refuse

is place

inside the coarse refuse and dewatered for permanent containment.

~

Materials Used in Process

Self propelled compactor,

bulldozers,

roadgraders and haultrucks.

Agricultural grade limestone and calcium hydroxide are used as needed to ensur

proper pH control for surface runoff prior to final

reclamation.

D

Describe Pollution Abatement Control Facility

Coarse refuse

is compacted to stablize the containment structure which enclose

fine refuse to prevent pollution of surface water and groundwater.

Topsoil removed from affected

area,

stored and protected on site for use in

fi

site reclamation.

Surface site drainage control

is established

to capture all

site runoff and

directed to

an NPDES sediment pond-NPDES Permit

No.

1L0061727.

IL 532-0222

APC

151

(Rev. 8/00)

a

0)

I—

z

z

z

0

-0

I.-

~1

0

U-

-J

0

I-

z

0

0

z

0

I-

_1

._l

~—

0

CD

z

I-

z

0

0

0

7~ix

(‘erti/Icationfor Pollution Control Facilities

Page 2 of2

8/00

Sec.E

(1)

Nature of Contaminants or

Pollutants

Contaminant or

Pollutant

Coarse

refuse

Fine refuse

DESCRIPTION

(2)

rnck

ch~1a

cii1f~

Material Retained, Captured or Recovered

r/

-I

mn

nvmito

r1~ic

Point(s) of Waste Water Discharqe

DISPOSAL OR USE

0

Pov’m~nc~n1-

cr~nc~~1

sulfates.

irnn

nvritp

r1.,vc~

g~f

~

m~t~’ri~1~

Perm~nonfdi’~i1

nF

~

t-t’.~cI

~

Plans and Specifications Attached

Yes

x

No

j~ Are contaminants (or residues) collected by the control facility?

Yes

y

No

(4)

Date installation completed

1998

status of installation

on date of application

operati

ng

(5)

a.

FAIR CASH VALUE IF CONSIDERED REAL

PROPERTY:

$

283.200.00

b.

NET SALVAGE VALUE IF CONSIDERED REAL

PROPERTY:

$

283,200.00

c.

PRODUCTIVE GROSS ANNUAL INCOME OF CONTROL FACILITY:

$

N/A

d.

PRODUCTIVE NET ANNUAL INCOME OFCONTROL FACILITY:

$

N/A

e.

PERCENTAGE CONTROL FACILITY BEARS TO WHOLE FACILITY VALUE:

Sec.

F

The following information is submitted in accordance with the Illinois Property Tax

Code, as amended, and tothe bestofmy

knowledge, is true and correct.

The facilities claimed herein are “pollution control facilities’ as defined in Section 11-10 ofthe

Illinois

roperty Tax

od

I—

~

CD

a

General Manager

‘—i

Signat

re

Title

Sec.

G

J

~

INSTRUCTIONS

FOR COMPILING AND

FILING APPLICATION

General:

Sep~Iateapplications must be

completed for each control facility claimed.

Do not mix types (water and air).

Where both air and

water operations are related, file

two

applications.

If attachments are needed,

record them consecutively on an index sheet.

Sec. A

Sec. B

Sec.

C

Sec. 0

Information refers to

applicant as listed in the

tax records and the person to be contactedforfurtherdetalls or for ins pection of

facilities.

Define facility location by street address or legal description.

A plat map location is required forfacilities located

outside of municipal_boundaries._The_property_identification_number is_required.

Self-explanatory.

Submit copies of all permits issued by local pollution control agencies.

(e.g. MSD Construction

Permit)

Refers to manufacturing processes or materials on which pollution control facility is used.

Narrative description

ofthe pollution control facility,

indicating that its primary purpose is to eliminate, prevent or reduce pollution.

State the type of control facility.

State permit number,

date, and agency issuing permit.

A narrative description

and a process

flow diagram describing

the

pollution control

facility.

Include a

listing of each major piece ofequipment included

in the claimed

fair cash value for real property.

Include

an average analysis

ofthe

influent and

effluent of the control facility stating the

collection efficiency.

Sec. E

List air contaminants,

orwater pollution substances released as effluents to the manufacturing processes.

List also the final

p

~

disposal ofany contaminants removed from the manufacturing processes.

Item (1)—

Refers to pollutants and

contaminants removed from the process by the pollution

control facility.

Item (2)

—

Refers to water pollution but can apply to water-carried wastes from

air pollution control facilities.

Submit drawings,

which clearly show (a) Point(s) of discharge to receiving stream, and (b) Sewers and process piping

to and fromthe control

facility.

Sec.

F

Item (3)

—

If the collected contaminants are disposed

of other than as wastes, state the disposition of the materials,

and the vaiue

in

dollars reclaimed by sale

or reuse of the coIlec~d

substances.

State the cost of reclamation and related expense.

Item (4)

—

State the date which the pollution control facility was first placed in

service and operated.

If not, explain.

Item (5)

—

This information is essential to the certification and

assessment actions.

This

accounting data must be

completed to

activate project review prior to certification by this Agency.

Self-explanatory.

Signature must be

a

corporate authorized signature.

Submit to:

Attention:

Attention:

Illinois

EPA

Thomas McSwiggin

Donald

E. Sutton

P.O.

Box 19276

Permit Section

Permit Section

Springfield, IL

62794-9276

Division ofWater Pollution

Control

Division ofAir Pollution Control

RALEIGH

L~3S—R.~

E.

.~r47

£R

Eldorado

Locker Company

U.S. Route 45

South

-

P.O.

Box

88

ES

BLUE

FLAME

~TAT

GAS,

INC.

BULK

& BOTTLE GAS

SPACE

&

WATER HEATERS

GRAIN

DRYING & HOME HEATING

(618)

273-9056

Home:

(618)

962-3121

BOB

& JUDY

STEINBROOK

Eldorado, Illinois 62930

I7ALE

TATE:

(618)

26&-4S48

~U~INE9~

PHONE:

(018)

20&4000

P.O.

BOX

36

GALATIA, ILLINOIS 62935

.

I