| 275.100 | Purpose and Introduction |

| 275.110 | Other Definitions |

| 275.120 | Definitions |

| 275.130 | Abbreviations and Acronyms |

| 275.140 | Incorporations by Reference |

| SUBPART B: ALTERNATE FUEL VEHICLE REBATES | |

| Section | |

| 275.200 | General Applicant and Vehicle Eligibility |

| 275.210 | Conversion Cost Rebate Eligibility |

| 275.215 | OEM Differential Cost Rebate Eligibility |

| 275.220 | Fuel Cost Differential Rebate Eligibility |

| 275.230 | Applications |

| 275.240 | Rebate Priorities and Rebate Amounts |

| 275.250 | Appeal of Agency Decision |

| SUBPART C: ELECTRIC VEHICLE CAR SHARING GRANTS | |

| Section | |

| 275.300 | Availability and Limitations of Grants |

| 275.310 | Grant Application Requirements |

| 275.320 | Agency Action on Grant Applications |

| 275.330 | Grant Agreement and Amendments |

| 275.340 | Access |

| 275.350 | Audit and Records |

| 275.360 | Grant Reporting Requirements |

| 275.370 | Final Inspection |

| 275.380 | Noncompliance |

| 275.390 | Project Suspension |

| 275.400 | Grant Termination by the Agency |

| 275.410 | Agency Recovery and Reimbursement of Grant Funds |

| 275.420 | Indemnification |

| 275.430 | Disputes |

| 275.APPENDIX A | |

| Annual Fuel Cost Differential For LDVs (Repealed) | |

| a) | This Part establishes procedures for applying for alternate fuel vehicle rebates and electric vehicle car sharing grants as authorized by the Alternate Fuels Act [415 ILCS 120]. Alternate fuel vehicle rebates include an original equipment manufacturer (OEM) differential cost rebate, conversion cost rebate, or fuel cost differential rebate. |

| "Alternate fuel" means liquefied petroleum gas (propane), natural gas, E85 blend fuel, hydrogen fuel, electricity when used as the primary external fuel source to power the vehicle excluding on-board electric generation, fuel composed of a minimum 80% ethanol or 80% bio-based methanol, or fuels that are at least 80% derived from biomass. | |

| "Alternate fuel vehicle" means any motor vehicle or engine that is capable of using an alternate fuel and is operated in the State of Illinois. | |

| "Conventional", when used to modify the word "vehicle", "engine", or "fuel", means gasoline or diesel or any reformulations of those fuels. [415 ILCS 120/10] | |

| "Covered area" means the counties of Cook, DuPage, Kane, Lake, McHenry, and Will and those portions of Grundy County and Kendall County that are included in the following zip code areas, as designated by the U.S. Postal Service on August 7, 1998: 60416, 60444, 60447, 60450, 60481, 60538, and 60543. | |

| "Domestic renewable fuel" means a fuel, produced in the United States or its territories, composed of a minimum 80% ethanol or 80% bio-based methanol, minimum 20% biodiesel fuel, or other fuels derived from at least 80% biomass. | |

| "E85 blend fuel" means fuel that contains 85% ethanol and 15% gasoline [415 ILCS 120/10] or any wintertime blend of at least 70% ethanol. |

| "Gross Vehicle Weight Rating" or "GVWR" means the total vehicle weight, including the maximum load, as designated by the original equipment manufacturer. | |

| "Heavy-duty vehicle" or "HDV" means a motor vehicle whose GVWR is more than 8,500 lbs. | |

| "Location" means: | |

| "Owner" means any person who has legal or equitable title to a motor vehicle. | |

| "Person" means any individual, business, corporation, organization, partnership, firm, association, trust, estate, public or private institution, group, municipality, political subdivision of a state, any agency, department, or instrumentality of the United States, and any officer, agent or employee of any of the above. A car dealer, car dealership or lessee of a motor vehicle is not a person for the purposes of this Part. | |

| "Private fueling operation" means any activity in which alternate fuel or domestic renewable fuel is transferred from a stationary or mobile source to a fuel storage system used to provide fuel to the engine or motor of that vehicle where the fuel is not available to the public. |

| "Proof of payment" means a copy of a cancelled check, an invoice or bill showing that the applicable amount has been paid or that no remaining balance exists, or other appropriate proof, acceptable to the Agency, that payment has been made for the related purchase. | |

| "Public fueling operation" means any site where alternate fuel or domestic renewable fuel is transferred from a stationary source to a fuel storage system used to provide fuel to the engine or motor of that vehicle, and is a retail operation. | |

| "Purchase costs" means the base MSRP of an electric vehicle. | |

| "Retail" means to sell directly to the ultimate consumer in small quantities (e.g., gallons) and deliver fuel to a fuel storage system used to provide fuel to the engine or motor of a vehicle. | |

| "Small fleet owner" means a person who owns or operates no more than 30 motor vehicles and employs 100 or fewer employees. | |

| "Supporting infrastructure" means equipment and installation of equipment for the recharging of electric vehicles purchased under a grant project. | |

| Agency | Illinois Environmental Protection Agency |

| ASTM | ASTM International |

| CARB | California Air Resources Board |

| FEIN | Federal Employer Identification Number |

| GVWR | gross vehicle weight rating |

| HDV | heavy-duty vehicle |

| MSRP | Manufacturer's suggested retail price |

| OEM | original equipment manufacturer |

| USEPA | United States Environmental Protection Agency |

| VIN | vehicle identification number |

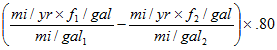

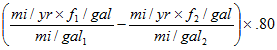

| f1/gal | =

|

price per gallon in dollars of the domestic renewable fuel or alternate fuel |

| f2/gal | =

|

price per gallon in dollars of the conventional fuel |

| mi/gal1 | =

|

number of miles to the gallon on the domestic renewable fuel or alternate fuel |

| mi/gal2 | =

|

number of miles to the gallon on the conventional fuel |

| mi/yr | =

|

number of miles driven in the applicable calendar year |