BEFORE THE ILLINOIS POLLUTION

CONTROL BOARD

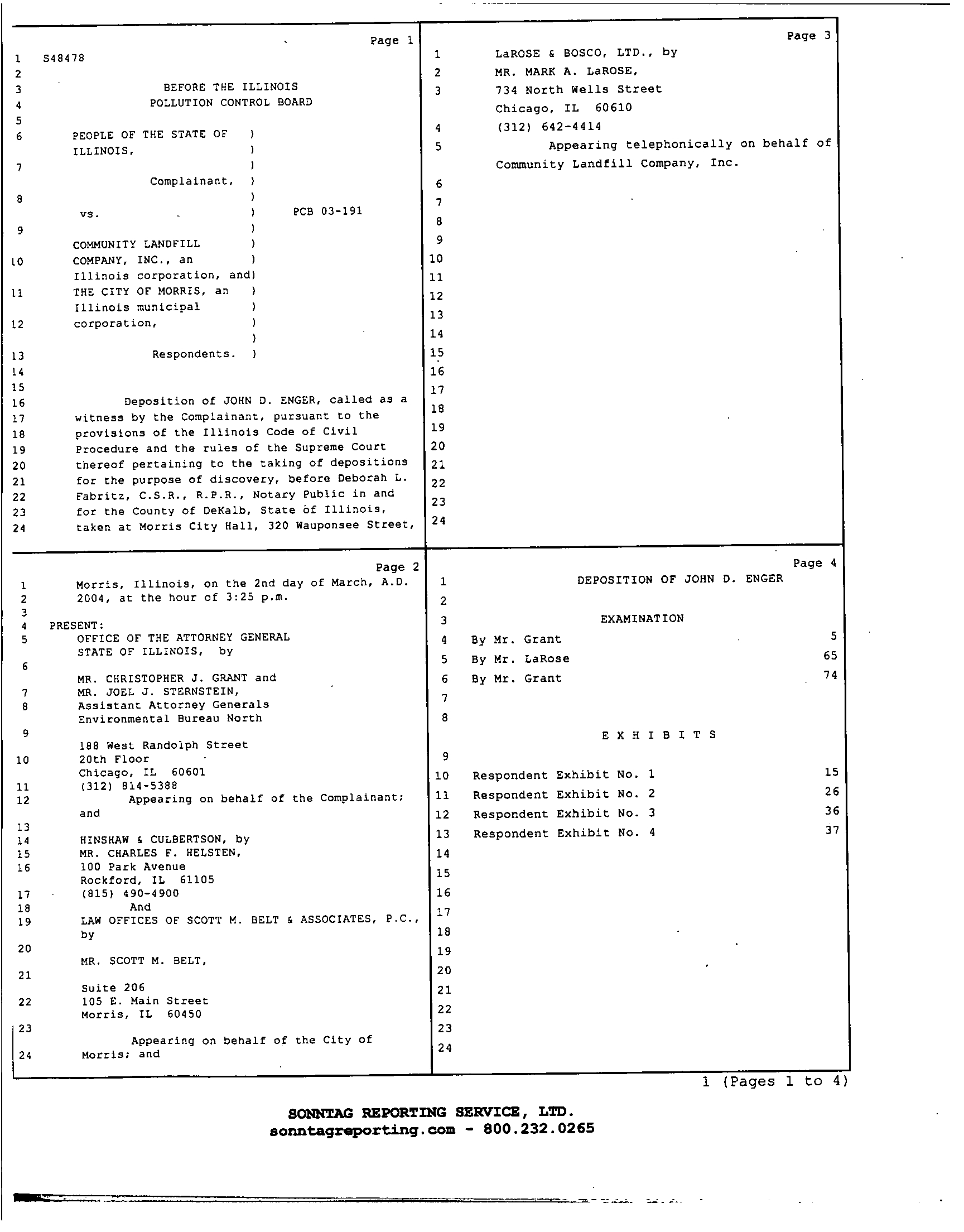

PEOPLE OF THE STATE OF ILLINOIS,

Complainant,

VS.)

PCB No. 03-191

(Enforcement-Land)

COMMUNITY LANDFILL COMPANY, INC.,

an Illinois corporation, and

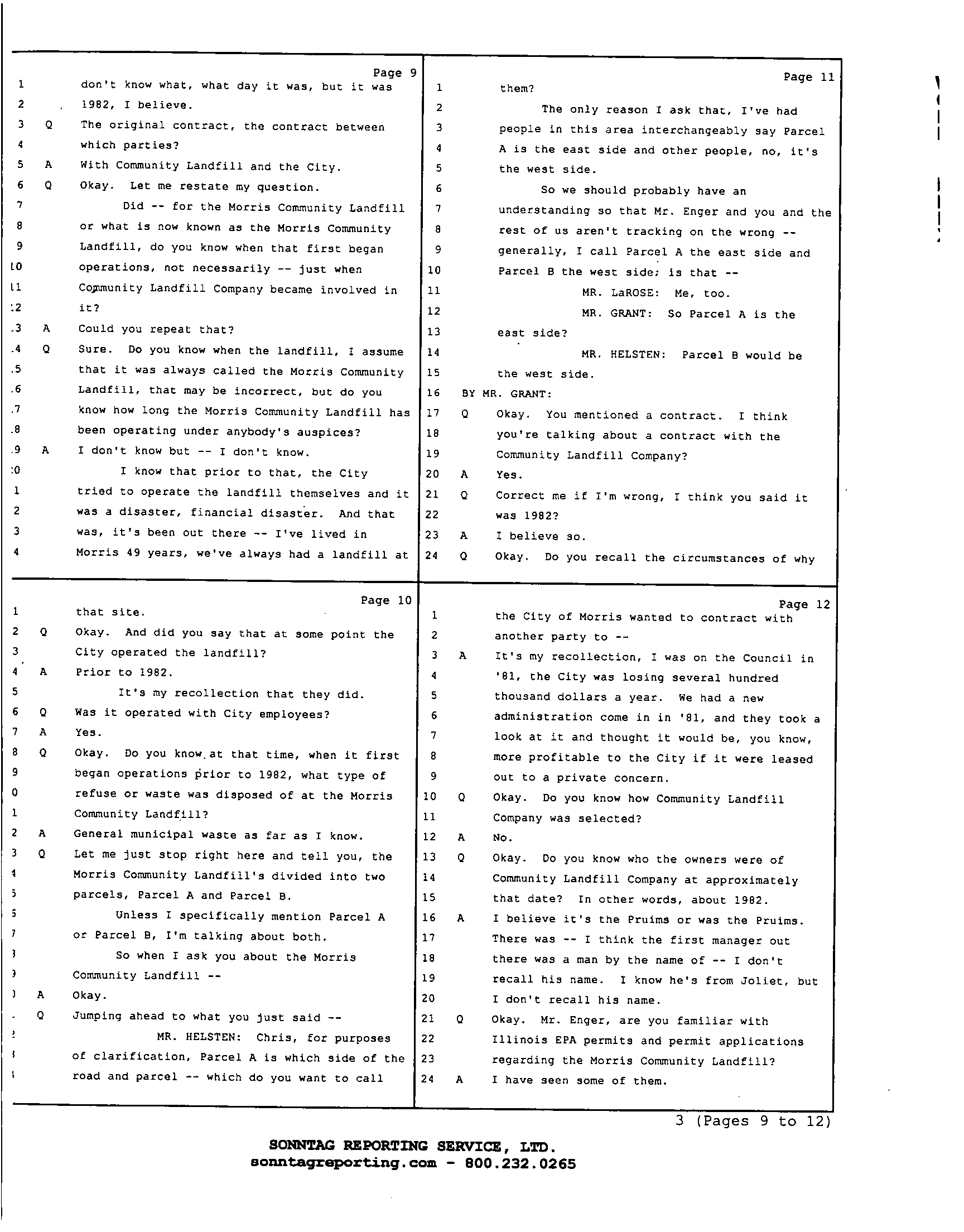

the CITY OF MORRIS, an Illinois

municipal corporation,

Respondents.

to: Mr. Mark La Rose

Mr. Bradley P. Halloran

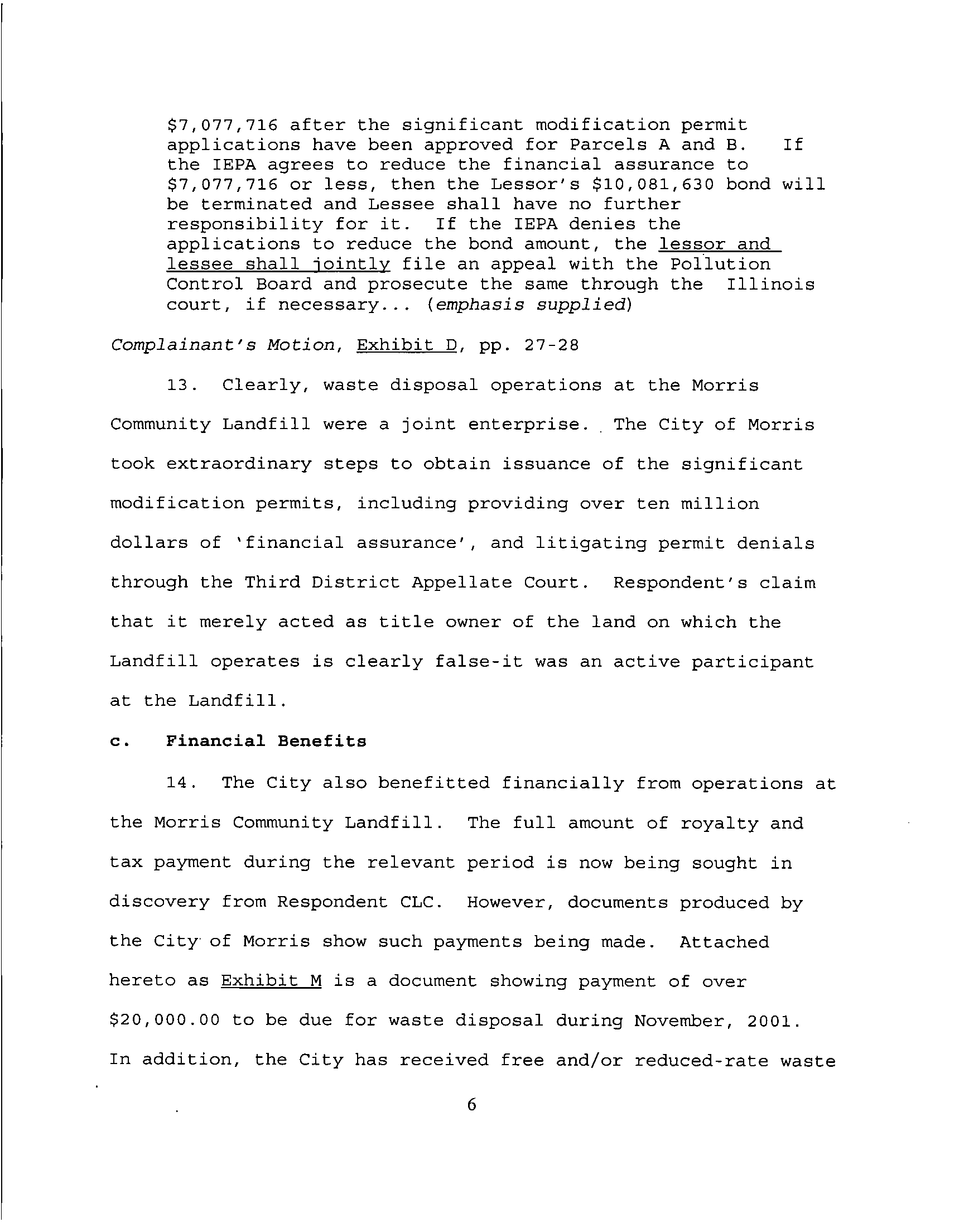

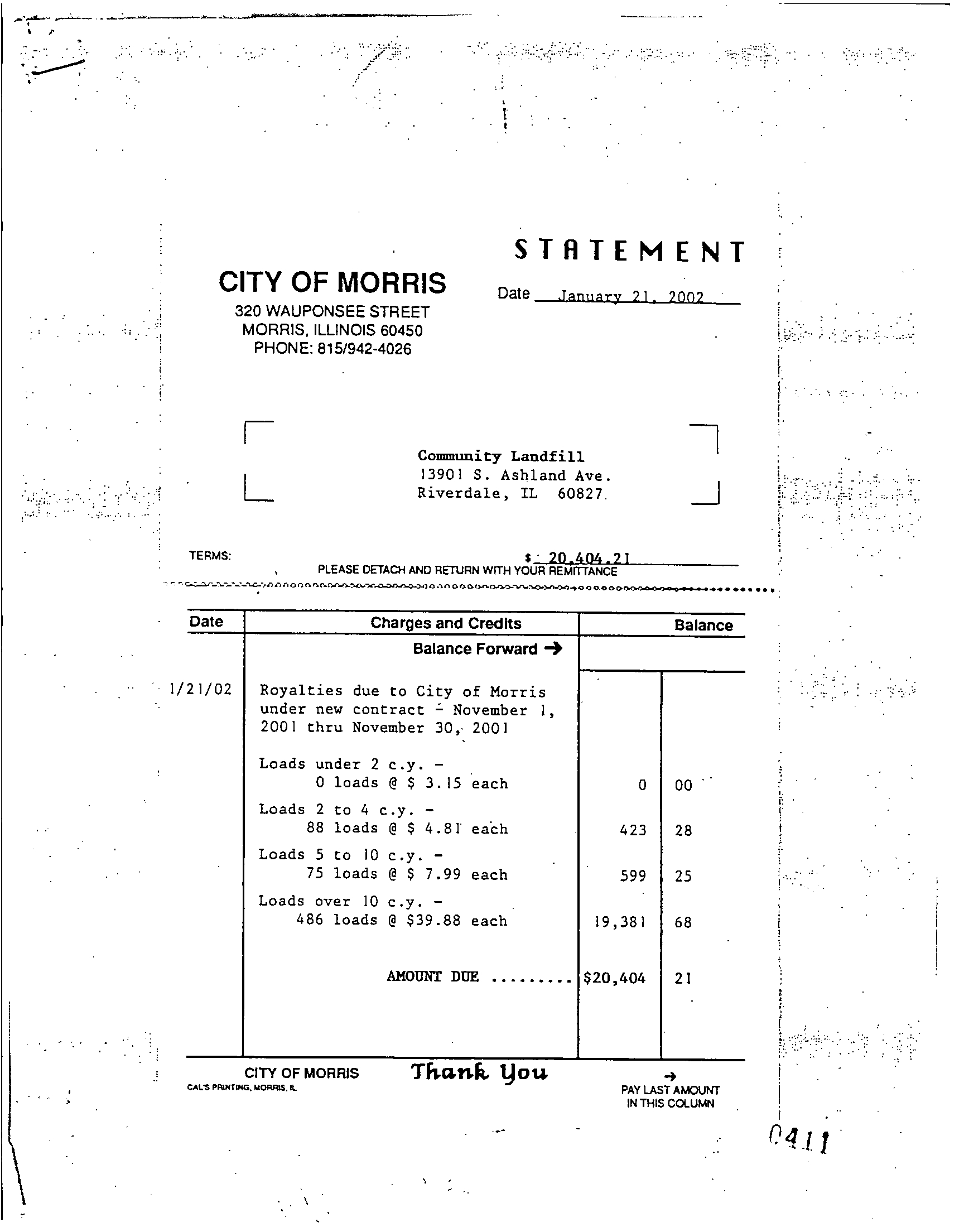

La Rose

& Bosco

Hearing Officer

200 N. La Salle Street, #2810

Illinois

Pollution

Chicago, IL 60601

Control

Board

100 W. Randolph Street

Chicago IL 60601

Mr. Charles Helsten

Hinshaw & Culbertson

100 Park Avenue

Rockford IL 61105-1389

NOTICE OF FILING

PLEASE TAKE NOTICE that we have today,

October 18, 2005,

filed with the

Office of the Clerk of the Illinois Pollution

Control Board, by electronic filing, Complainant's

Response to

the City of Morris' Cross-Motion for Summary

Judgment, a copy of

which is attached and herewith served

upon you.

Respectfully Submitted,

PEOPLE OF THE STATE OF ILLINOIS

ax rel.

LISA MADIGAN

BY:

A A -

A stant Attorneys General

Environmental

Bureau

188 W.

Randolph St.,

2 0

th

Flr.

Chicago, IL 60601

(312) 814-5388

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

BEFORE THE

ILLINOIS POLLUTION CONTROL

BOARD

PEOPLE OF

THE STATE

OF ILLINOIS,

Complainant,

VS.)

PCB

No. 03-191

(Enforcement-Land)

COMMUNITY

LANDFILL COMPANY,

INC.,

an Illinois

corporation, and

the CITY

OF MORRIS, an Illinois

municipal

corporation,

Respondents.

COMPLAINANT'S

RESPONSE TO THE

CITY OF MORRIS'

CROSS-MOTION FOR

SUMMARY JUDGMENT

NOW COMES

the Complainant, PEOPLE

OF THE STATE OF ILLINOIS,

through

its attorney, LISA MADIGAN,

Attorney General

of the State

of

Illinois, and hereby

responds to Respondent's,

THE CITY OF

MORRIS' ("Morris")

Response to Complainant's

Motion for

Summary

Judgment,

and Cross-Motion

for Summary Judgment

("Morris

Motion").

In support

thereof, Complainant states

as follows:

I.

THE CITY OF MORRIS IS

'CONDUCTING A WASTE DISPOSAL

OPERATION',

AND IS THEREFORE

SUBJECT TO 415 ILCS

5/21(d) (2)

AND 35 ILL.

ADM. CODE 811.700(f).

1.

Respondent's denial

of liability and

Cross-Motion relies

entirely on its argument

that it is not 'conducting

a waste

disposal

operation' at the Morris

Community Landfill

("Landfill")

,

and therefore

is not subject to either

415 ILCS

5/21(d)

(2) (2004) or 35 Ill.

Adm. Code 811.700(f).

This argument

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

defies common sense, and is

legally incorrect.

2. The City

of Morris has actively participated in

Landfill decisions

since at least 1974.

Morris has been

permitted as either 'owner' or 'operator'

since that time,

operated the Landfill until 1982, contracted

with Respondent

Community Landfill Company

("1CLC"1) for day-to-day operations,

acted in concert

with CLC on

all

permitting and financial

assurance

issues, and financially benefitted from Landfill

operations. Clearly,

the heavy involvement of the City

of Morris

in activities at the Morris Community

Landfill subjects it to the

regulations governing 'conducting

waste disposal operations'.

a.

Permitting

3. The City of Morris has

applied for and obtained at least

thirty five (35) Illinois Environmental

Protection Agency

("Illinois EPA") permits (including

modifications) covering waste

disposal

at the Morris Community Landfill.

See: Second Affidavit

of Cristina Roque, attached hereto

as Exhibit K. Copies of two

of these

permits are attached to Complainant's

motion for Summary

Judgment

("Complainant's

Motion")

as Exhibits

A and B.

4. The Board should find that,

as a matter of law, holding

an Illinois

EFA permit for waste disposal at a landfill

constitutes

'conducting a waste disposal

operation'

,

thereby

subjecting

the Fermittee to regulation

under the waste disposal

provisions of the Act, and

the relevant Board regulations.

2

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

5. Illinois EPA waste disposal permits are required for

those who conduct

waste disposal operations. Section 21(d) of

the Act, 415 ILCS 5/21(d) (2004),

provides, in pertinent part, as

follows:

Prohibited Acts. No person shall:

(d) Conduct any waste-storage, waste-storage, or waste

disposal operation:

(1) without a permit granted by the Agency or in

violation of any condition s imposed by such

permit ....

It is inconsistent to state that a party could obtain a required

waste disposal permit for a disposal site, but not conduct waste

operations. The application for and issuance of the permits

itself proves Respondent Morris, intent.

6. Permit No. 2000-155-LFM, allows both the City of Morris

and CLC to conduct solid waste disposal operations, specifically

approving:

Cc) Operation (i.e. waste disposal) within the

permitted boundaries off the existing landfill.

Complainant's Motion,

Exhibit A. po.2

7. Respondent Morris obtained

not one, but thirty five

such permits for the Morris Community Landfill, including

operating permits.

8. Morris attempts to mislead the Board by stating that

3

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

Illinois

EPA employee

Brian

White

"testified

that ...

the City

of

Morris

has

never been

the permitted

operator

of

the landfill.....

[Morris

Motion,

par.

8].

Mr.

White is

not responsible

for the

issuance

of

permits,

and could

not be expected

to have knowledge

of all

historical

permits

issued to

the City

of Morris.

However,

a list of

waste

disposal

permits

issued to

the Respondent

is

attached

hereto

as Exhibit

K, and

shows

that five

(5) permits

were

issued

to the

City of

Morris

as "owner

and operator".

9.

Moreover,

the City

of Morris

acknowledged

operating

the

Landfill

at its March

2,

2004 deposition.

Representative

deponent

John Enger

stated

that,

though he

did not

know exactly

when the

City opened

the

landfill,

the City

of Morris

operated

the landfill

until

1982,

and contracted

with

CLC because

it

had

been a 'financial

disaster'

for the

City.

Copies

of relevant

portions

of

the deposition

transcript

are attached

hereto as

Exhibit

L.

10.

Additionally,

the

City of

Morris submitted

interrogatories

to

Complainant

asking

for the

list

of Illinois

EPA permits

issued

to it

as 'owner'

and

'owner and

operator'.

The

information

provided

to

Morris in

response

was identical

to

that

contained

in Exhibit

K.

By asserting

that

an Illinois

EPA

employee

'testified'

that Morris

had

never been

a permitted

operator,

while

knowing

that

it had

obtained

permits

and operated

the Landfill,

the

City

of Morris

is attempting

to

mislead

the

4

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

Board.

b.

Joint Action

with Respondent

Community

Landfill

Co.

11.

The City of

Morris was

directly involved

in every

action

at the Morris

Community

Landfill which

resulted

in the

alleged violations.

It

contracted with

Respondent

Morris

Community

Landfill, applied

for and

was issued

joint waste

disposal permits,

provided

noncompliant

financial assurance

(in

the

form of a $10,081,630

Frontier

surety

bond), litigated

the

validity

of the Frontier

Bonds along

with CLC,

and failed to

replace

the Frontier

bonds with substitute

financial

assurance.

As owner,

it allowed

operation

of the landfill

from 2000

to the

present,

even after

the Frontier

Bonds were

determined to

be

noncompliant.

12.

Evidence

of the City

of Morris'

intention to

jointly

conduct waste

disposal operations

can

be seen in the

contract

addendum

negotiated

by the Respondents

in July,

1999. As

described

in PCB

01-48/PCB 01-49

(Consolidated)

,

this provision

provides,

in pertinent

part:

WHEREAS, while

the Lessor

and Lessee

disagree with

the IEPA

that...

.the proper financial

assurance

number

is $7,077,716,

in

an effort to

resolve the permit

appeals presently

pending

and the have

the significant

modification

permits

issued for

the landfill,

the Lessor

and Lessee

are willing

to post the

TEPA required

$17,159,346

in performance

bonds with

the

IEPA, and

have the TEPA

issue the significant

modification

permit

...

5. Lessor and

Lessee will

file an application

with

the

TEPA

to reduce the

financial assurance

from $17,159,346

to

5

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

$7,077,716 after

the significant modification

permit

applications

have been approved

for Parcels A and

B. if

the TEPA agrees to reduce

the financial assurance

to

$7,077,716

or less, then the Lessor's

$10,081,630

bond will

be

terminated and Lessee

shall have no further

responsibility

for it.

If the IEPA denies

the

applications

to reduce the

bond amount, the

lessor and

lessee shall lointly

file an appeal

with the Pollution

Control Board

and prosecute the same

through the Illinois

court, if necessary..

.

(emphasis supplied)

Complainant's Motion,

Exhibit D, pp. 27-28

13.

Clearly, waste

disposal operations

at the Morris

Community Landfill

were a joint enterprise..

The City of

Morris

took

extraordinary steps

to obtain issuance

of the significant

modification

permits, including

providing over ten million

dollars

of 'financial assurance',

and litigating

permit denials

through

the Third District Appellate

Court. Respondent's

claim

that it merely

acted as title

owner of the land on

which the

Landfill operates

is clearly false-it

was an active participant

at the

Landfill.

C.

Financial

Benefits

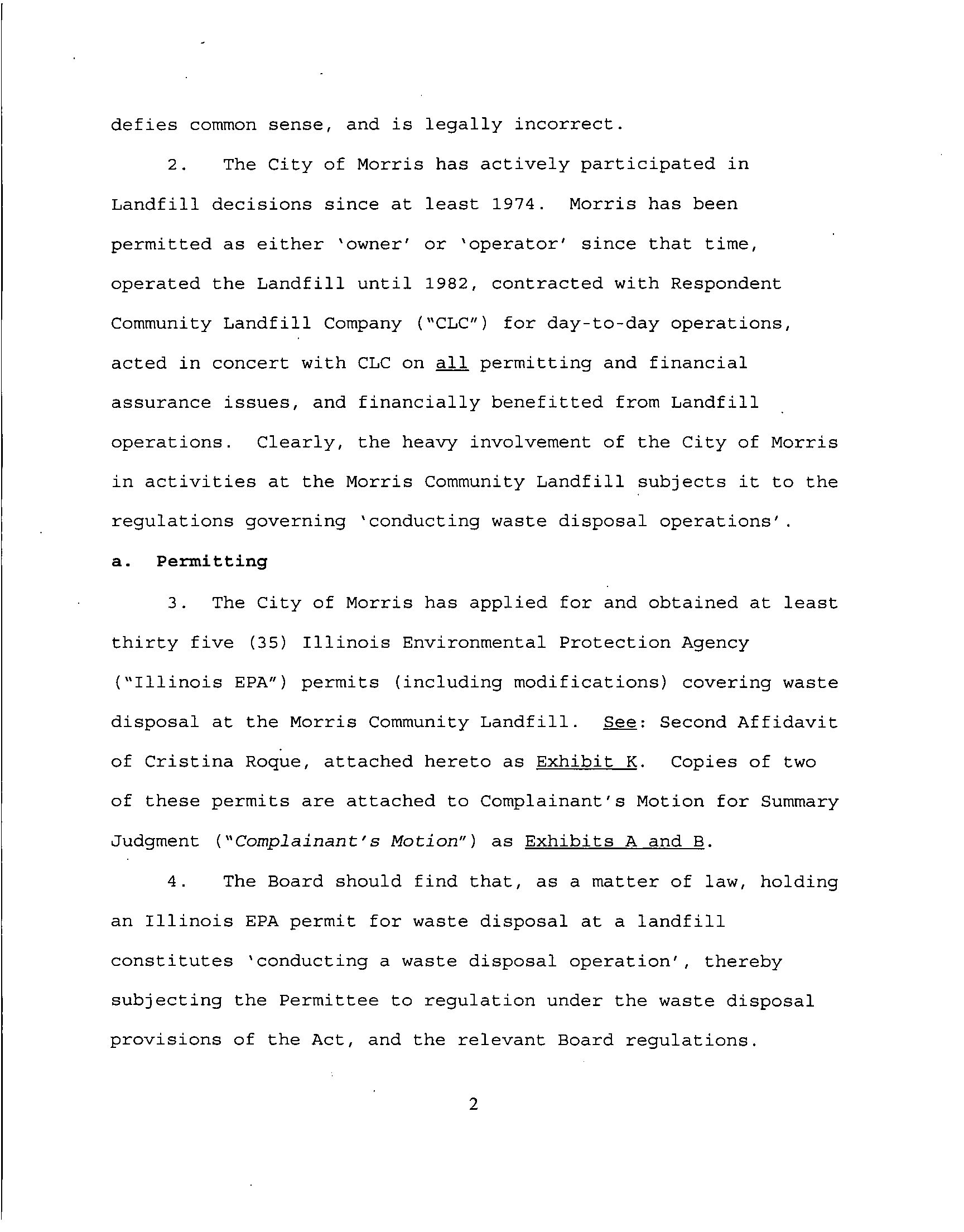

14.

The City also benefitted

financially

from operations at

the Morris Community

Landfill. The full

amount of royalty and

tax

payment during

the relevant period

is now being sought

in

discovery

from Respondent CLC.

However, documents

produced by

the

City of Morris show

such payments being

made. Attached

hereto as

Exhibit M is a document

showing payment

of over

$20,000.00 to

be due for waste

disposal during

November, 2001.

In addition, the City

has received free and/or

reduced-rate waste

6

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

disposal at the Landfill

[Complainant's Motion,

Exhibit

J, at 21-

22].

d. The Berger Case is Clearly Distinguishable

from our Case

15. In

People v.

Wayne Berger and Berger Waste Management,

PCB 94-373 (May 6, 1999),

the Board found that landowner Berger

Waste Management ("1BWM"1) did

not 'conduct a waste disposal

operation' by its mere ownership

of the landfill. In

Berger,

operator Wayne Berger had

transferred ownership of a landfill

after being cited for operational

and financial assurance

violations. However,

no permit was transferred by Wayne

Berger,

and BMW was never issued any Illinois EPA-issued

permits. The

Board

pointed to this fact in its ruling: "Significantly,

all

permits for

the landfill were issued to Wayne

Berger".

Berger,

slip op. at 8.

16. In our case, the City of Morris has been

covered by

thirty five separate permits (including

modifications) f or waste

disposal activities

at the Morris Community Landfill. Included

are four permits

issued to Morris as "owner and operator". The

two

Permits at issue in this case contain

numerous requirements

for the 'permittee', without specifying

'owner' or 'operator'.

Both Respondents are bound by these

conditions.

17.

Additionally, the City did not acquire the Landfill

after the violations

occurred. It has owned the Morris Community

Landfill

since its original development. And, as shown above,

7

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

Morris has

been actively involved in Landfill activities

throughout.

18. Clearly, the Berger decision should be limited to the

facts in that case, and not be read to limit the application of

415 ILCS 5/21(d) (2) (2004) only to

permitted landfill operators.

II.

THE ACT SHOULD BE CONSTRUED TO EFFECT ITS PURPOSE AND AVOID

ABSURD RESULTS

19.

Illinois

Courts are directed to construe statutes to

avoid absurd and unreasonable results. See, e.g.

Mulligan v.

Joliet Regional Port District,

123 Ill. 2d 303, 313 (1988)

.

The

Board has also determined that statutes are to be construed

according to their intent and meaning.

Lionel Trepanier et al,

v. Speedway Wrecking Company,

PCB 97-50 (January 6,

2000, slip

op. at 9)

.

In this case

the Board noted:

"Where the spirit and intention of the legislature in

adopting the acts are clearly

expressed and their objects

and purposes are clearly set forth, the courts are not

confined to the literal meaning of the words used, when to

do so will

defeat the obvious intention of the legislature

and result inr absurd consequences not contemplated by it.",

Trepanier,

quoting

People ex. rel. Barrett v. Thillens,

400

Ill. 224 (1948).

20. The goals of the general assembly are expressed in

Section 2 of the Act, 415 ILCS 5/2 (2004)

,

which provides, in

pertinent part:

(b) It is the purpose of this Act, as more specifically

8

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

described

in later sections,

to establish a unified,

state-wide program

supplemented by

private remedies, to

restore,

protect and enhance

the quality of the

environment,

and to assure that

the adverse effects

upon the

environment are

fully considered

and borne by

those who cause

them.

Cc)

The terms and provisions

of this Act

shall be liberally

construed so as to effectuate

the purposes

of this Act

as set forth

in subsection (b)

of this Section....

Reviewing

courts liberally construe

the provisions of the

Act.

See, e.g.

People

v. Conrail Corp,

251

Ill. App. 3d, 550

(4

1

Dist.

1993);

People v.

State Oil Company,

352 Ill. App. 3d

813 (2d Dist

2004).

21. Respondent Morris

is asking the Board

to interpret the

Act

and regulations in a way

that would lead to an

absurd

outcome. Two of

Morris' contentions

are particularly

unreasonable:

Its narrow

construction

of the term 'conduct'

,

and

its insistence

that the financial

assurance regulations

contained

in Part 811,

Subpart G, do not

apply to owners of

Landfills.

a. The Term 'Conduct

a Waste Disposal

Operation' Should

be

Broadly

Construed.

22. Morris urges the

Board to adopt a restrictive

interpretation

of 'conduct', and

limit its application

only to

Respondent CLSC, the

permitted operator.

On the facts of this

case, such an interpretation

would be

absurd. The City of

Morris

has

obtained thirty five

Illinois EPA waste

disposal permits.

The permits

contain numerous conditions

applicable to

both the

owner and operator.

9

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

23. Morris submits that it is merely the

"owner of/fee

title holder to property that has been used for

waste disposal

activities for Community

Landfill Company" (Respondent's Motion,

par. 7)

.

This

statement is incorrect. Respondent

not only owns

the land, it owns the Morris Community

Landfill. From its

initial development until

1982, it also operated its landfill,

using City employees.

See: Exhibit L, at 9-10 Because it was a

'financial disaster'

it decided to lease its landfill to

Community Landfill Company.

However it never conveyed title to

the Morris Community Landfill, and

has continued to be bound

under all subsequent permits.

Moreover, as described above,

it

has remained heavily involved in landfill matters,

including

providing surety bonds and its appeal of permit

denials.

24. Taking Respondent's

argument to its logical conclusion,

Section 21(d) of

the Act, and all regulations enforceable

thereunder, would only apply

to a person, present at the

landfill, who is physically involved in disposing

of waste. it

would also allow for permitted owners to

set up a shell

'operator' entity, and personally avoid all of the

consequences

of violating the

Board's landfill management regulations. Such a

consequence would

be absurd, and contrary to the intent of the

General Assembly.

b. Respondent's Interpretation Conflicts With

the Subpart G

Regulations.

25. Finding that

permitted owners do not 'conduct a waste

I0

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

disposal operation' would render the financial assurance

regulations meaningless.

26. Part 811, Subpart G, of the Board regulations

applies

to the Morris Community Landfill,

and includes 35 Ill. Adm. Code

811.700(f), violations of which are alleged in the complaint

against both

Respondents.

Section 811.700 provides,

in pertinent part,:

(a) This Subpart provides procedure by which

the owner

or operator

of a permitted waste disposal facility

provides financial assurance satisfying the

requirements of Section

21.1(a) of the Act.

(b) Financial assurance may be provided, as

specified

in Section

811.706, by a trust agreement, a bond

guaranteeing payment,

a bond guaranteeing payment

or performance,

a letter of credit, insurance or

self-insurance. The owner or operator shall

provide

financial assurance to the agency before

the receipt

of the waste.

Section 811.706

of Subpart

G

provides, in pertinent part as

follows:

(a) the owner or operator of a waste disposal site may

utilize any of the mechanisms listed

in

subsections

(a) (1) through (a) (10) to provide

financial assurance for closure and postclosure

care, and for corrective

action at an MSWLF unit.

An owner or operator of an MSWLF unit shall also

meet the requirements of subsections (b)

,

Cc)

,

and

(d)

.

The mechanisms are as follows:

Cc) The owner or operator

of an MSWLF unit shall

provide financial assurance utilizing one or more

of the mechanisms listed

in subsection (a) within

the following dates:

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

1)

by April 9, 1997, or such later date granted

pursuant to Section

811.700(g),

or prior to

the initial

receipt of solid waste, whichever

is later,

in the case of closure or post-

closure care;

(emphasis supplied)

27.

The provisions of Subpart

G

expressly apply to owners

or operators. obtaining

financial assurance is mandatory (i.e.

"shall")

.

In our case, neither 'owner' City of Morris

or

'operator' Community

Landfill Company have provided compliant

financial assurance. See: Brian White affidavit,

Complainant's

Motion,

Exhibit C.

28. Clearly,

the provisions of Subpart

G

must be

interpreted to require

owners and operators to provide financial

assurance, although either party

may arrange it. Otherwise, both

owners and operators could claim that they had

no mandatory

obligation because the other party was bound-an

absurd and

unreasonable

result.

29. The requirements

for "owners or operators" contained

throughout Subpart

G

would be rendered meaningless by

construing

811.700(f) to apply only to

permitted operators. As the Subpart

G

regulations require financial

assurance of "owners or

operators", and prohibit 'persons' from conducting

waste disposal

operations without financial assurance, the

regulations

implicitly include both owners and operators within

the group

12

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

that

'conducts

waste disposal

operations'.

30.

Respondent's

assertion

that

permitted

owners

of

landfills

do not conduct

waste

disposal

operations,

and therefore

are not bound

by

either Section

811.700(f)

or

415 ILCS

5/21(d)

(2004),

requires an

unreasonable

and absurd

interpretation

of these

sections.

III. THE

CITY OF

MORRIS HAS

NEVER ARRANGED

FOR,

OR OFFERED

TO

ARRANGE

FOR,

COMPLIANT

FINANCIAL

ASSURANCE

31. The

City of

Morris misstates

Complainant's

argument

regarding

the

application

of collateral

estoppel

in this

case.

Complainant

simply

asks the

Board to

recognize

its previous

ruling

that the

Frontier Bonds

submitted

by

the Respondents

do

not

comply

with 35 Ill.

Adm. Code

811.712.

The affidavit

of

Brian

White

shows that

neither

Respondent

has substituted

any

of

the ten mechanisms

listed in

35 Ill.

Adm. Code

811.706.

32.

The City

of Morris

again

attempts

to mislead

the Board

by

stating

that it has

offered

Illinois

EPA financial

assurance

in the

form of a

local government

guarantee.

In fact,

the City

of Morris

has steadfastly

refused to

provide compliant

financial

assurance

in any

form.

33.

To be compliant,

a financial

assurance

mechanism

must

meet

the requirements

of 35 Ill.

Adm. Code

811.706,

and fulfil

the

specific

requirements

of

the relevant

regulatory

section

[e.g.

811.712

for performance

bonds]

.

The amount

of financial

assurance

must total

at least

$17,427,366.00

for

the two

landfill

13

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

parcels, and must be updated annually [retroactive to 2000],

pursuant to 35 Ill. Adm. Code 811.701. Complainant's Motion asks

the Board to order the Respondents to provide financial assurance

meeting these requirements.

34. The City of Morris twists the meaning of 'local

government

guarantee' by claiming that it 'can and would' provide

such financial assurance

[Morris Motion,

par. 19].

35. There is no question that a Local Government Guarantee

meeting the requirements of 35 Ill. Adm. Code Section 811.717

would comply

with 811.706 and 811.700(f). Section 811.717

provides,

in pertinent part:

Section 811.717 Local Government Guarantee

An owner or operator may demonstrate financial assurance for

closure, post-closure, and corrective action, as required by

Section 21(a)

of the Act and 811, Subpart G by obtaining a

written guarantee provide by a unit of local government.

The guarantor shall meet the requirements of the local

government financial test in Section 811.716, and shall

comply with the terms of a written guarantee

An owner who fully complies with 811.716 and 811.717 has the

option to 'pay or perform' closure/post closure/corrective

action, or

establish a fully funded trust fund per 811.710.

36. 35 Ill. Adm. Code 811.716 imposes a number of

requirements on municipalities. First there is a financial

standard to be met (811.716(a)). Additionally, the municipality

must disclose its closure/post closure liability in its financial

14

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

report (811.716(b) and comply with record

keeping and reporting

requirements (811.716(c)). Further, the amount of closure/post

closure costs that may be secured

is limited and based on its

annual revenue

(811.716(d)).

37. Compliance with the Local Government Financial

Test was

repeatedly emphasized by Illinois EPA's Blake Harris at his

deposition

(Morris Motion,

Exhibit A, pp. 52, 54, 56-60.)

38. The City of Morris has

not described financial

assurance

compliant with Sections 811.716 and 811.717. As

described in

paragraphs 38-39 of its Motion, the City's proposal

is to:

*1 ...in fact comply with Section 811.706... .by posting

a local

government guarantee to "perform"

leachate collection and

treatment activities for the landfill at its local

POTW at

no cost to the State, to unconditionally res

erve that

capacity needed for 100 years to address this need,

and to

implement other closure/post closure measures as the need

arises over the applicable closure/post closure period.",

However, the City of Morris notes:

"...ITEPA has advised the City that the form would not be

accepted as adequate financial assurance"

The City of Morris offers no affidavit, or written

communication with Illinois EPA, to back

up any claim that it is

willing to provide financial.

assurance compliant with 811.716 and

811.717. If such an offer is now made in earnest, the

City of

Morris

should not object to a Board order requiring compliant

financial

assurance, as sought by Complainant.

39. However,

the 'financial assurance' described above

15

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

constitutes

no more than the same

proposal rejected by

the Board

in PCB 01-48/01-49.

In that case,

the Respondents sought

to

reduce the amount of

financial assurance

by

$10,000,000,

through

their agreement to

treat leachate from

the Morris Community

Landfill,

free or at a reduce

cost. Complainant's

Motion,

Exhibit

B, at 26. In rejecting

this proposal,

the Board

noted

that, in

the event of a failure

of Morris'

POTW, and treatment

was not covered

by financial

assurance, the

burden of treating

leachate could tall

to the State.

Cornplainant's Motion,

Exhibit

D, at

29.

40. Respondent's

'offer' is

to 'perform', by

treating

leachate

at its POTW, and provide

compliant financial

assurance

of approximately

$7,000,000.00.

However, Respondent

did not [and

perhaps can not] agree

to comply with

the Local Government

Financial Test contained

in 35 Ill.

Adm. Code 811.716.

It would

be illegal for Illinois

EPA to agree

to such a proposal,

which

would

violate the Act

and Subpart G regulations.

IV. THE CITY OF

MORRIS' VIOLATIONS

WERE WILFUL AND REPEATED

41. From

at least August 8,

2000 until the present,

no

compliant financial

assurance has

been in place for

the Morris

Community Landfill.

Since December

5, 2002, when

the Illinois

Supreme Court

refused to hear Respondent's

appeal,

there has been

no

question that the Frontier

Bonds would have

to be replaced

with

compliant financial

assurance.

And yet neither Respondent

16

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

has

done

so to

the date

of

filing

of this

Response.

42.

Not only

have

the Respondents

failed

to

provide

financial

assurance,

they

continued

to

cause

and allow

the

disposal

of

waste

at the

Morris

Community

Landfill.

The City

of

Morris

continued

to

accept

royalties

from

this

disposal.

Also,

it

is clear

that both

Respondents

have avoided

the cost

of

providing

compliant

financial

assurance

during

this

period.

43.

Despite

having

been

rejected

by the

Board

in its

attempt

to

substitute

treatment

of leachate

at

its POTW

for

$10,000,000.00

of financial

assurance,

the

City

of Morris

continues

to

attempt

to justify

this position,

demonstrating

an

absence

of good

faith.

44.

Despite

its

landfill

ownership,

multiple

waste

disposal

permits,

and the

clear

language

of Subpart

G applying

to

'owners

and operators',

the

City of

Morris

claims

that it

is exempt

from

Section

21(d) of

the Act,

415

ILCS

5/21(d)

(2004)

,

and thereby

also exempt

from

waste

disposal

regulations.

Complainant

believes

that

this position

represents

a failure

to

accept

responsibility,

and also

demonstrates

a

lack

of good

faith.

45.

The financial

assurance

requirements

of Subpart

C

are

clear

and

understandable.

Prior

Board and

Appellate

Court

decisions

relating

to the

Landfill

have

settled

any

question

as

to

the amount

and

type

of financial

assurance

required

of

the

Respondents.

Where,

as in

our case,

Respondents

continue

to

17

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

cause and allow landfill

operations in the absence of any

financial assurance, the Board should

find that such violations

are knowing

and wilful.

WHEREFORE, Complainant, PEOPLE OF THE STATE OF ILLINOIS,

respectfully requests that the Board grant

its Motion for Summary

Judgment against

the Respondents, COMMUNITY LANDFILL COMPANY and

the CITY

OF MORRIS, deny Respondent CITY OF MORRIS' Cross-Motion

for

Summary Judgment, and issue an order:

1. Finding that

the Respondents have violated 415 ILCS

5/21(d) (2) (2004), and 35 Ill. Adm. Code Sections 811.700(f)

and

811.712;

2. Finding that the Respondents' violations

were wilful,

knowing, and/or repeated;

3. ordering the Respondents to cease and

desist from

transporting

and depositing any additional material at the Morris

Community

Landfill until they are in full compliance with

their

Permits, and the Board's financial assurance regulations;

4. Requiring the Respondents to immediately provide

financial assurance as required by the Act, Part

811, Subpart G,

of the Board solid waste regulations, and the

Respondents'

Permits;

5. Requiring the Respondents to update

the

closure/postclosure

costs in accordance with the Subpart

G

regulations, Permits No. 2000-155-LFM,

2000-156-LFM, and

18

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

modifications

thereto;

6. Ordering

the Respondents to initiate closure of parcels

A & B of the Landfill;

and

7. Setting a date for

hearing on the issue of civil

penalty.

BY:

Assistant Attorneys General

Environmental

Bureau

188 W.

Randolph St.,,

2 0

th

Flr.

Chicago,

Illinois 60601

(312) 814-5388

(312) 814-0609

19

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

EXHIBIT

K

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

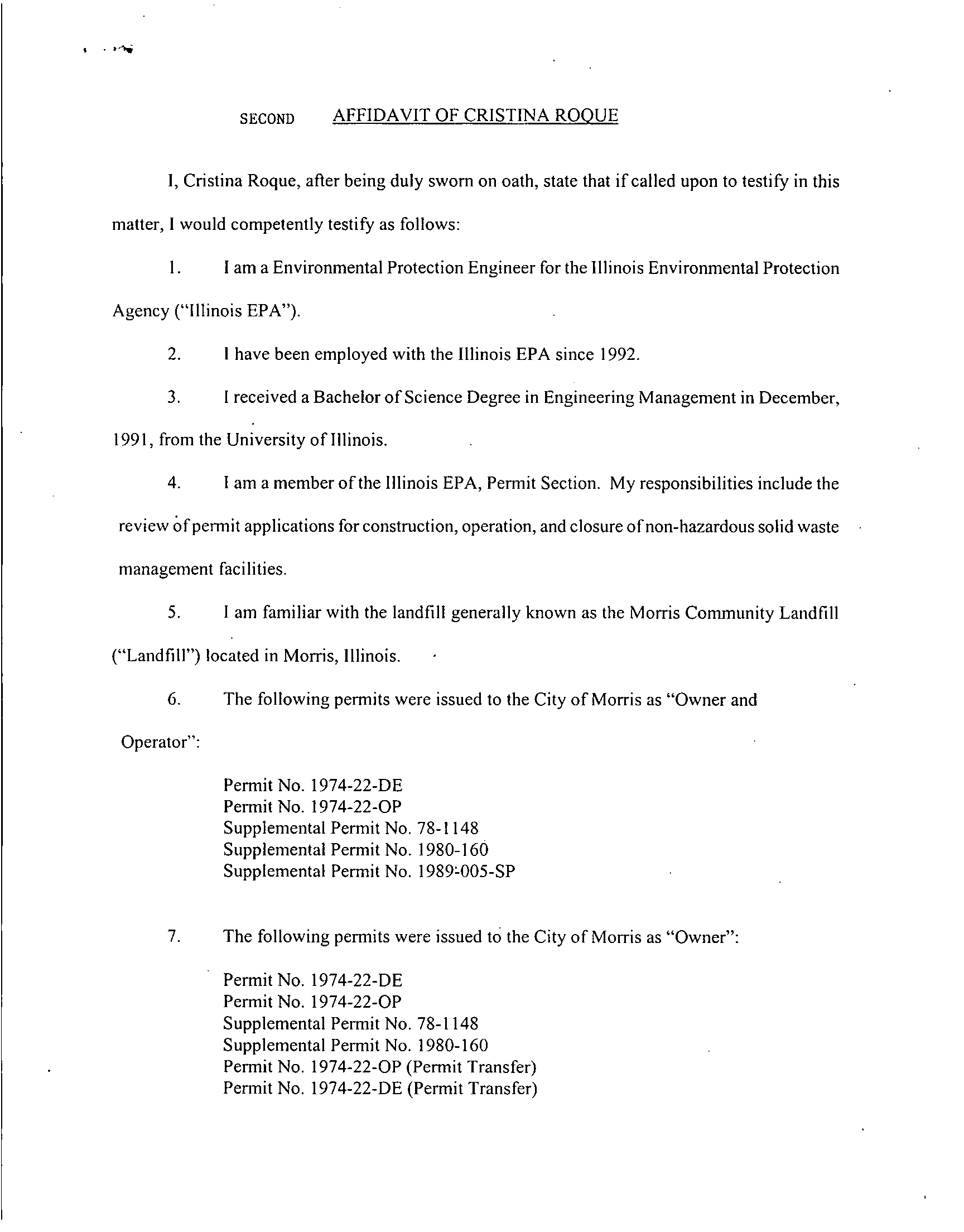

SECOND

AFFIDAVIT

OF CRISTINA

ROOUE

I, Cristina

Roque, after

being duly

sworn on oath,

state that if called

upon to testifyr

in this

matter, I would competently

testify as

follows:

I .

I am a Environmental

Protection

Engineer

for the Illinois Environmental

Protection

Agency

("Illinois EPA").

2.

I have

been employed

with the Illinois

EPA since

1992.

3.

1 received

a Bachelor

of Science Degree

in Engineering

Management

in December,

1991,

from the University

of Illinois.

4.

1 am a

member of the

Illinois EPA, Permit

Section.

My responsibilities

include the

review of pen-nit

applications for

constmuction, operation,

and closure

of non-hazardous

solid waste

management

facilities.

5.

1 am familiar

with the

landfill generally

known as the

Morris Community

Landfill

("Landfill")

located

in Morris, Illinois.

6.

The following

permnits were

issued to

the City of Morris

as "Owner

and

Operator":

Permit No.

1974-22-DE

Permit No.

1974-22-OP

Supplemental

Permit No.

78-1148

Supplemental

Permit No. 1980-160

Supplemental

Permit No.

1989L'0O5-SP

7.

The following

permits

were issued

to the City of

Morris as "Owner":

Permit

No. 1974-22-DE

Permit No. 1974-22-OP

Supplemental

Permit No. 78-1148

Supplemental

Permit

No. 1980-160

Permit No. 1974-22-OP

(Permit Transfer)

Permit

No. 1974-22-DE

(Permit Transfer)

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

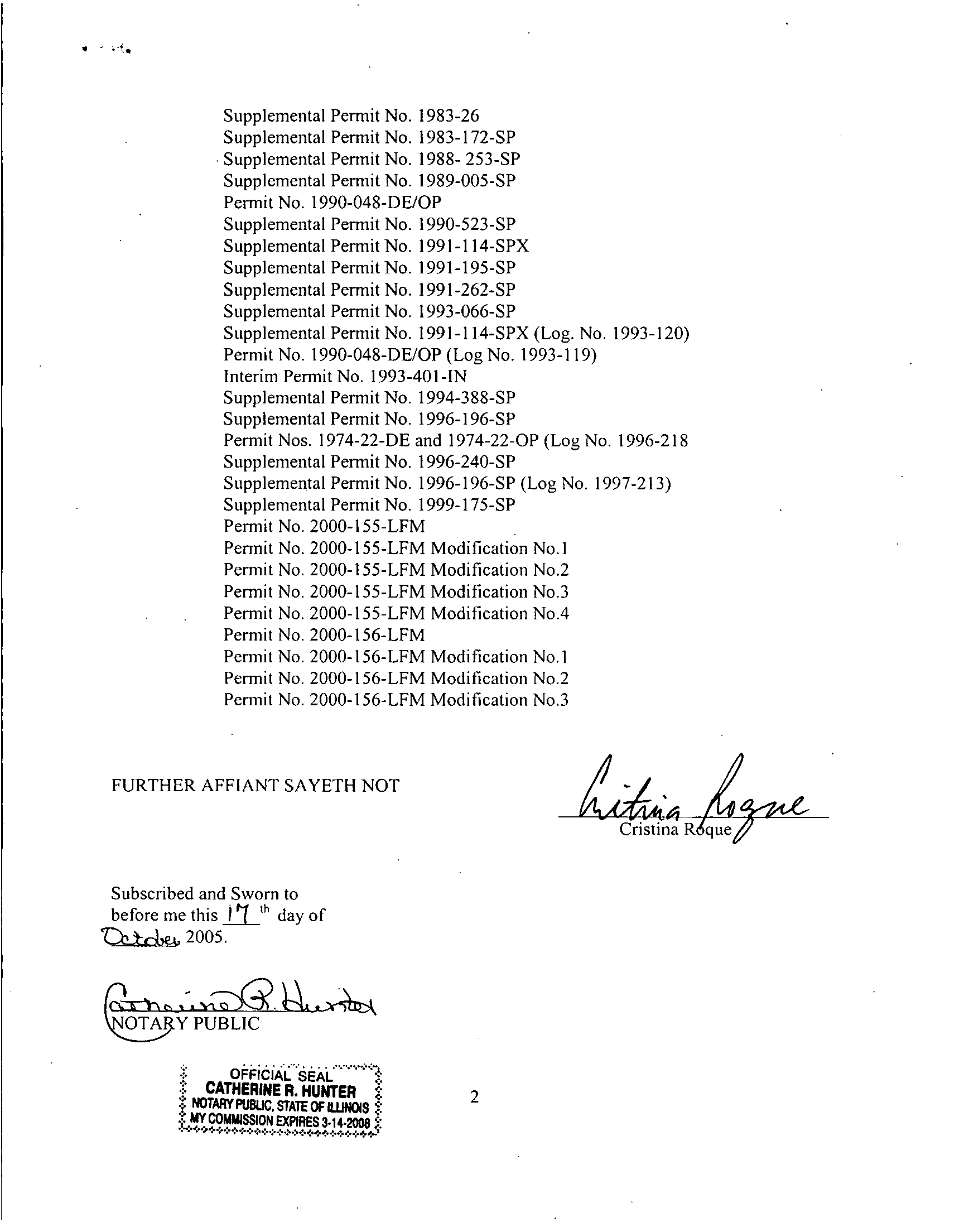

Supeeta

emtNo-932

Supplemental

Permit

No.

1983-126S

Supplemental

Permit No.

1983-1725-SP

Supplemental

Permit

No. 1988-0253-SP

Permit

No.

I1990-048-DE/OP

Supplemental

Permit

No. 1 990-523-SP

Supplemental

Permit

No.

1991-11

4-SPX

Supplemental

Permit

No.

1991-195-SP

Supplemental

Permit

No.

199 1-262-SP

Supplemental

Permit

No. 1

993-066-SP

Supplemental

Permit No.

1991-1

14-SPX (Log.

No.

1993-120)

Permit

No. 1990-048-DE/OP

(Log

No.

1993-119)

Interim

Permit

No. 1993-401-IN

Supplemental

Permit

No. 1994-3

88-SP

Supplemental

Permit

No.

1996-196-SP

Permit

Nos. 1 974-22-DE

and 1974-22-OP

(Log

No. 1996-218

Supplemental

Permit

No.

1996-240-SP

Supplemental

Permit

No. 1996-196-SP

(Log No.

1997-213)

Supplemental

Permit

No. 1999-175-SP

Permit

No. 2000-155-LFM

Permnit

No.

2000-155-LFM

Modification

No. 1

Permit

No.

2000-155-LFM

Modification

No.2

Permit

No. 2000-155-LFM

Modification

No.3

Permnit

No.

2000-155-LFM

Modification

No.4

Permit

No. 2000-156-LFM

Permit

No.

2000-156-LFM

Modification

No.1

Permit

No. 2000-156-LFM

Modification

No.2

Permit

No. 2000-156-LFM

Modification

No.3

FURTHER

AFFIANT

SAYETH

NOT

Cristina

qu

Subscribed

and Sworn

to

before

me

this

Jjh

day of

~ 2005.

OT PUBLIC

..

OFFICIAL

SEAL.

i

CATHERINE

R.

HUNTER

2

NOTARY

PUBUIC,

STATE OFaMNOS

'YCOMMISSION

EXPIRES

3-14

2W8

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

EXHIBIT L

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

Page

1

Page

3

1

S48478

1

LaROSE

&

BOSCO,

LTD.,

by

2

2

MR.

MARK

A.

LaROSE,

3

BEFORE

THE

ILLINOIS

3

734

North

Wells

Street

4

POLLUTION

CONTROL

BOARD

Chicago,

IL

60610

5

6

PEOPLE

OF

THE

STATE

OF

4

(312)

642-4414

ILLINOIS,

5

Appearing

telephonically

on

behalf

of

7

Community

Landfill

Company,

Inc.

Complainant,

)6

vs.

-)

PCB

03-191

9

8

COMMUNITY

LANDFILL

)9

LO

COMPANY,

INC.,

an

L

10

Illinois

corporation,

and)

11

[I

THE

CITY

OF

MORRIS,

an

)

12

Illinois

municipal

1

12

corporation,

1

14

13

Respondents.

)15

14

16

15

1

16

Deposition

of

JOHN

D.

ENGER,

called

as

a

w7itness

by

the

Complainant,

pursuant

to

the

1

18

provisions

of

the

Illinois

Code

of

Civil

19

19

Procedure

and

the

rules

of

the

Supreme

Court

20

20

thereof

pertaining

to

the

taking

of

depositions

21

21

for

the

purpose

of

discovery,

before

Deborah

L.

22

22

Fabritz,

C.S.R.,

R.P.R.,

Notary

Public

in

and

2

23

for

the

County

of

DeKalb,

State

bf

Illinois,

2

24

taken

at

Morris

City

Hall,

320

Wauponsee

Street,

24

Page

2

Page

4

1

Morris,

Illinois,

on

the

2nd

day

of

March,

A.D.

1

DEPOSITION

OF

JOHN

D.

ENGER

2

2004,

at

the

hour

of

3:25

p.m.

2

3

4

PRESENT:

3

EXAMINATION

5

OFFICE

OF

THE

ATTORNEY

GENERAL

4

By

Mr.

Grant

5

STATE

OF

ILLINOIS,

by

5

By

Mr.

LaRose

65

MR.

CHRISTOPHER

J.

GRANT

and

6

By

Mr.

Grant

74

7

MR.

JOEL

J.

STERNSTEIN,7

8

Assistant

Attorney

Generals

Environmental

Bureau

North

8

198

West

Randolph

Street

10

20th

Floor

9

Chicago,

IL

60601

10

Respondent

Exhibit

No.

1

15

11

(312)

814-5388

2

12

Appearing

on

behalf

of

the

Complainant;

11

Respondent

Exhibit

No.

2

2

and

12

Respondent

Exhibit

No.

3

36

13

14

HINSHAW

&

CULBERTSON,

by

13

Respondent

Exhibit

No.

4

37

15

MR.

CHARLES

F.

HELSTEN,

14

16

100

Park

Avenue

1

Rockford,

IL

61105

1

17

(815)

490-4900

16

is

And

1

19

LAW

OFFICES

OF

SCOTT

M.

BELT

&

ASSOCIATES,

P.C.,

1

by

18

20

19

MR.

SCOTT

M.

BELT,

21

20

suite

206

21

22

105

E.

Main

Street

Morris,

IL

60450

22

23

23

Appearing

on

behalf

of

the

City

of

24

Morris;

and

2

1

(Pages

1

to

4)

SONNTAG

RE

PORTINEG

SERVICE,

LTD.

sonntagreporting.com

-

800.232.0265

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

1

don't

know

what,

what

day

it

was,

but

Page~

9

them?Pae

1

2

1962,

I believe.

2

The

only

reason

I

ask

that,

I've

had

3

Q

The

original

contrac.t,

the

contrac.t

between

3

People

in

this

area

interchangeably

say

Parcel

4

which

parties?

4

A

is

the

east

Side

and

other

people,

no,

it's

S

A

With

Community

Landfill

and

the

City.

5

the

west

side.

6

0

Okay.

Let

mne

restate

my

quest

ion.

6

So

we

should

probably

have

an

7

Did

--

for

the

Morris

Cormounity

Landfill

7

understanding

so

that

Mr.

Enger

and

you

and

the

8

or

what

is

now

known

as

the

Morris

Community

a

rest

of

us

aren't

tracking

on

the

wrong

-

9

Landfill,

do

you

know

when

that

first

began

9

generally,

I

call

Parcel

A

the

eas

t

side

and

tO

operations,

not

necessarily

--

just

when

10

Parcel

B

the

west

side;

is

that

--

Li

COplnunity

Landfill

Company

became

involv1ed

in

11

MR.

LaROSE:

Me,

too.

~2

it?

12

MR.

GRANT:

So

Parcel

A

is

the

-3

A

Could

you

repeat

that?

13

east

side?

.4

0

Sure.

Do

you

know

when

the

landfill,

I

assume

14

MR.

HELSTEN:

Parcel

B

would

be

.5

that

it

was

always

called

the

Morr.is

Community

15

the

west

side.

.6

Landfill,

that

may

be

incorrect,

but

do

you

16

BY

MR.

GRANT:

.7

know

how

long

the

Morris

Coirrunity

Landfill

has

17

0

Okay.

You

mentioned

a

Contract.

I

think

.8

been

operating

under

anybody's

auspices?

18

You're

talking

about

a

contract

with

the

.9

A

I don't

know

but

--

I

don't

know.

19

Corrnunity

Landfill

Company?

:0

I

know

that

prior

to

that,

the

City

20

A

Yes.

I

tried

to

operate

the

landfill

themselves

and

it

21

0

Correct

me

if

I'm

wrong,

I

think

you

said

it

2

was

a

disaster,

financial

disaster.

And

that

22

was

1982?

3

was,

it's

been

out

there

--

I've

lived

in

23

A

I

believe

so.

4

Morris

49

years,

we've

always

had

a

landfill

at

24

0

Okay.

Do

you

recall

the

circumstances

of

why

Page

10

Page

12

1

that

site.

1

the

City

of

Morris

wanted

to

contract

with

2

0

Okay.

And

did

you

Say

that

at

some

point

the

2

another

party

to

--

3

City

operated

the

landfill?

3

A

It's

my

recollection,

I

was0

on

th

Council

in

4

A

Prior

to

1962.

4

'81,

the

City

was

losing

several

hundred

5

It's

my

recollection

that

they

did.

5

thousand

dollars

a

year.

We

had

a

new

6

Q

was

it

operated

with

City

employees?

6

administration

come

in

in

'81,

and

they

took

a

7

A

Yes.

7

look

at

it

and

thought

it

would

be,

you

know,

8

0

Okay.

Do

you

know,

at

that

time,

when

it

first

8

more

profitable

to

the

City

if

it

were

leased

9

began

operations

prior

to

1982,

what

type

of

9

out

to

a

Private

concern.

0

refuse

Or

waste

was

disposed

of

at

the

Morris

10

Q

Okay.

Do

you

know

how

Community

Landfill

1

Connunity

Landfill?

11

Company

was

selected?

2

A

General

municipal

waste

as

far

as

I

know.

12

A

No.

3

0

Let

me

Just

stop

right

here

and

tell

you,

the

13

0

Okay.

Do

you

know

who

the

owners

were

of

Morris

Community

Landfill's

divided

into

two

14

Community

Landfill

Company

at

approximately

5

parcels,

Parcel

A

and

Parcel

B.

15

that

date?

In

other

words,

about

1982.

Unless

I

specifically

mention

Parcel

A

16

A

I

believe

it's

the

Pruims

or

was

the

Pruims.

7

Or

Parcel

8,

I'm

talking

about

both.

17

There

was

--

I

think

the

first

manager

out

3So

when

I

ask

you

about

the

Morris

18

there

was

a

man

by

the

namea

of

--

I

don't

3

Community

Landfill

--

19

recall

his

name.

I

know

he's

from

Joliet,

but

A

Okay.

20

I

don't

recall

his

name.

Q

Jumping

ahead

to

what

you

Just

said

--

21

0

Okay.

Mr.

Enger,

are

you

familiar

with

MR.

HELSTEN:

Chris,

for

purposes

22

Illinois

EPA

permits

and

permit

applications

I

of

clarification,

Parcel

A

is

which

side

of

the

23

regarding

the

Morris

Community

Landfill?

road

and

parcel

--

which

do

you

want

to

call

24

A

I

have

seen

some

of

them.

3

(Pages

9

to

12)

SONNTAGZ

REPORTING

SERVICE,

LTD.

8ozmta9greport;ng.com

-

900.232.0265

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

EXHIBIT

Ml

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

CITY

OF

MORRIS

Date

?Jr~~r

91

0fl

320

WAUPONSEE

STREET

MORRIS,

ILLINOIS

60450

PHONE:

815/942-4026

Community

Landfill

13901

S.

Ashland

Ave.

r

1!Riverdale,

IL

60827.

TERMS:

20

2(404.-21

PLEASE

DETACH

AND

RETURN

WITH

YOUR

REMrrTANCE

-

arC~~.aoeo~o~~o~~,ono

c

'

~

.~

,

n

'oo.-

,,

oon~~

00000o~a~n..,.....

....

Date

Charges

and

Credits

Balance

Balance

Forward

4

1121102

Royalties

due

to

City

of

Morris

under

new

contract

-'November

1,

2001

thru

November

30,

2001

Loads

under

2

c.y.

-

O

loads

@

$

3.

15

each

0

00

Loads

2

to

4

c.y.

-

88

loads

@

$

4.81

each

423

28

Loads

5

to

10

c.y.-

75

loads

@

$

7.99

each

599

25

Loads

over

10

c.y.

-

486

loads

@

$39.88

each

19,381

68

AMOUNT

DUE............$20,404

21

C

flIHIIWtG.

CITY

MOMS.

OF

IL

MORRIS

Thiank

tjou4

PAY

LAST

AMOUNT

IN THIS

COLUMN

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005

BEFORE

THE

ILLINOIS

POLLUTION

CONTROL

BOARD

PEOPLE

OF THE STATE

OF ILLINOIS,

Complainant,

vs.)

PCB

No. 03-191

(Enforcement-Land)

COMMUNITY

LANDFILL

COMPANY,

INC.,

an Illinois

corporation,

and

the CITY

OF MORRIS,

an

Illinois

municipal

corporation,

Respondents.

CERTIFICATE

OF SERVICE

I, CHRISTOPHER

GRANT, an

attorney,

do certify

that

I caused

to be served

this

18th day

of October,

2005,

the

foregoing

Response

to

the City

of Morris'

Cross-Motion

for Summary

Judgment,

and

Notice of

Filing,

upon the

persons

listed

on said

Notice

by placing

same

in an envelope

bearing

sufficient

postage

with

the United

States

Postal

Service

located

a 100 W.

Randolph,

Chicago

Illinois.

CHRISTOPHER

GRANT

ELECTRONIC FILING, RECEIVED, CLERK'S OFFICE, OCTOBER 18, 2005