October 12, 2000

Dorothy Gunn,

clerk

Illinois Pollution Control

Board

100 West

Randolph’

St.

Suite 11-503

Chicago,

IL

Dear Ms.

Gwm:

RECEIVED

CLERK’S OFF!CE

OCT19

2000

STATE

OF IWNOIS

Pollution Control Board

At

last

week’s

“peaker”

plant

inquiry

hearings in Springfield, I

was asked

to. provide the

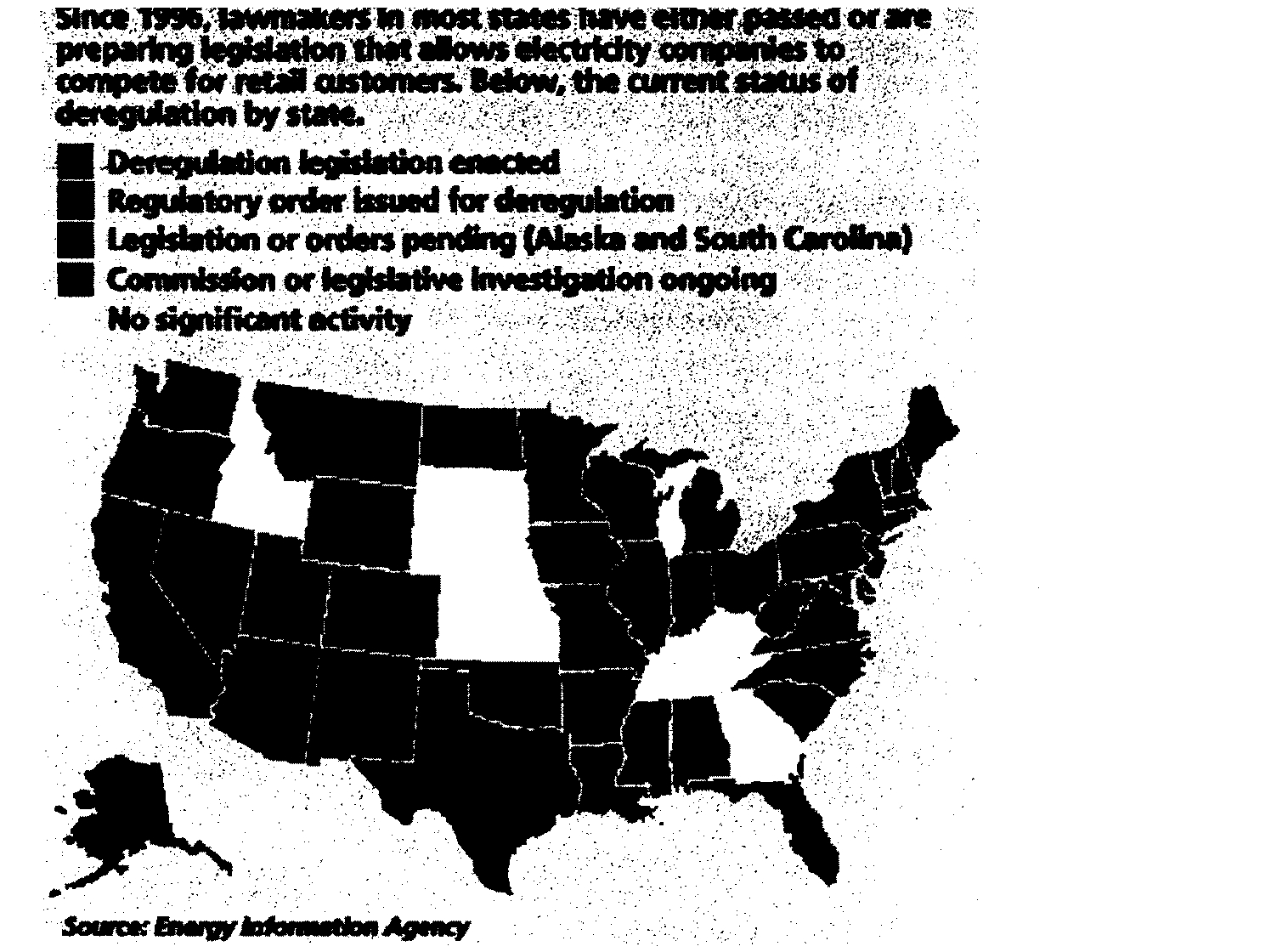

date ofthe article

that included the map

“The

Status

ofU.S. Electricity Deregulation.” It

originally appeared in the Wall Street

Journal

on August 14, 2000. A copy is enclosed.

Sincerely,

7~1ff1(~

Susan Zingle

Executive Director

LCCA

LAKE COUNTY CO~SEKVA1iONALLIANCE

P~O.Box

405,

Gr4yslake, IL 6003()

(847)

223.7178

Fa,c(847) 223.7482

huT SECTLO~

~

lUll!

&IIYESTIJG

TEll

IIT!t

S?OtTS

LEISONAIJIUINA~

U

VIEWS

U

FAVC~V~

• PO*TFOUO

In

this Section:

World-Wide

Asia

Eur~pe

The Americas

F!c~n~rnY

Earrings Fpcu~

Politics & Policy

Editojj~iP~g~

Leisure &

Arts

Voices

Weekend Journal.

WSJ.coiu Audio:

Business ~P4at~

Markets Recap

WSJ on Audible

LearnM~e

Journal Atlas:

Table of

Contents

Headlines

Business Index

Search

News_Search

Past Editions

Briefing Bo~!ç~

Quotes

Resources:

~~~ROHOMY

Quote!

~4

SEAROI

Compat

KTREIIIE

SUCCESS: W~CKEIILY

UIYRL CUSilImERS

August 14,2000

Democi

Vu

lP~Joina

with Go

adviser

Monda~

9’Join S

Comme

Mineta,

p.m. EU

T

l~Brid~

offered

I

million

second-)

in histoi

A SPI

Get

FRE

Per:

E-M

Your N

—1

II

~c~LP

E

Invo

Back to top

Volatile Electricity Market Forces Firms

To Find Ways to Cut Energy Expenses

By

JONATHAN FRIEDLAIlI)

Staff Reporter

of

THE WALL STREET

JOURNAL

Southern California’s electricity woes are sending a jolt ofanxiety

through corporate suites nationwide, underscoring how important

smart energy management is becoming in an era of deregulation.

Over the past few weeks, several ofthe 24 states that began opening

their electricity markets to competition in 1996 have been struck by

extreme price volatility and, in some cases, power shortages. At work

is a combination offactors: higher-than-expected demand, fewer new

generating plants than necessary to keep up with it and an interstate

transmission network that wasn’t built for a deregulated world.

Complicating matters is the chaotic jigsaw ofrules and regulations

governing the transition from fixed to free pricing across the nation.

Nowhere has the situation been more

Heating Bills Could

critical than in the San Diego region, the

Swell as Much as

first area ofthe country where retail

50 Thts Winter

electricity prices have been dictated solely

by market forces. Consumers therehave

(~Peco Ener~iAgrees

I_Jo Purchase

Assets

seen their bills double, setting offa pohtical

From Sithe Energies

firestorm and causing legislators and

for $682 Million

regulators to scramble for ways to mediate

the pain. Last week, a half dozen plans

* * *

were floated for rolling back rates, though

none of them seriously confronted the key ~~California Senate

question ofwho would end up footing the L!~.JClearSBill That

Will

bill forthe difference between wholesale

Curb Power Costs

market prices and those paid by the newly ~9.

11)

protecteduser.

1~T1Califomia’sGovernor

E!JOrders Regulatorsto

Working Out the

Kinks

Slash Electric Rates

in Southern

Areas (Aug.

http://interactive.wsj.com/articles/SB96620543583 1256200.htm

8/14/00

New Features

E-mail

Center

Your Account

t-mait

i,enier

Your Account

Contact Us

WSJ.com Gifts

Glossary

Special Reports

Weather

STOCK QUOTES

Select

exchange:

lus

Entersymbols:

Symbol

lockup

Free WSJ.com

Sites:

Careers

College

Homes

Online Investing

Opinion Journal

Personal Tech

Starting

a Business

Travel

Wealth of Choices

Web Watch

Wine

The

Print

Journal:

Subscribe

Customer

Service

More

Dow Jones Sites:

dowjones.com

Barron’s

Online

DJ

University

Publications Library

Reprints

~ne

Dow Jones & Co.

Corrections

~anuiego

s woes

--

as weu

as

iess acute

problems in the Northwest and Northeast

ofthe country

--

have driven

home to

corporate America that

it is

going

to

take awhile

--

perhaps

three

to five

years

--

to work the

kinks

out ofthe nation’s new

electricity regime. ‘Word has spread around

the

country,” says Dennis

three

to five

years

--

to work the

kinks

out ofthe

nation~s

new

electricity regime,

“Word

has spread around

the

country,” says Dennis

Moran, energy commodity team leader

for hotel

management

companyMarriott

International Inc. “It’s

been

such

a

shock.”

It

is a

shock that is

causing many

to question

their main assumption

about

deregulation

--

that

competition among power providers would

lead

to

cheaper prices

and

greater efficiencies. And, as such, it is

intensil~jingtheir search

for

solutions that will protect and, in

the best

ofworlds, even

enhance their bottom-line performance.

US OF U .S.

EL.

CTRIC ITV DE

REGUL~J

Those solutions range

from the

simple

--

like turning down the air

conditioning in

offices and convenience stores

--

to

the highly

sophisticated

--

such as

long-term

contracts with energy wholesalers

that include performance

incentives and a complex

array

~f

hedging

options.

Although many companies

give energy

planning

a higher

priority nowadays,

lots ofthem

--

including some very

big ones

--

are

still very

much in the

midst

of

figuring

out the

optimal combination for

their needs.

“We’ve been in a robust economy where the

primary focus has been

on

growing

the top

line,

not on controlling

expenses,” says

Craig

Sieben,

president of

Chicago-based energy consultants

Sieben Energy

Associates

LLC, which counts among its clients Starwood Hotels &

Resorts, Lucent Technologies and Aimco, a real-estate investment

http://interactive.wsj.com/articles/SB966205435831256200.htm

8/14/00

..~

‘.JL

..‘

rlIvds.y

ruj~~y

trust that owns thousands

of

apartment units. “We’re pretty amazed

at

how

few

firms have a comprehensive energy strategy,”

he adds.

That is changing fast

--

particularly

for

big

energy users, which run the

gamut

from

classic

Old

Economy companies like Kaiser Aluminum

Ltd. to such New Economy

stalwarts as chip maker Ii~iCorp. They

are throwing more

executives into the

task

ofstrategy design or

are

hiring

outside

consultants.

They

are all trying

--

in

many

cases through

trial and error

--

to

select

from a

smorgasbord

of

measures

to

limit

disruptions and damp

the

impact

of

higher prices.

Inte”s

Strategy

Intel is a good

case in point.

It

uses

a huge

amount

ofjuice to keep its

highly automated, temperature and humidity-sensitive semiconductor-

fabrication operations ticking along smoothly.

So, it

can’t

afford to

enter in

so-called interruptible

supply contracts with generators in

exchange for lower prices, an increasingly frequent arrangement in

Cali!brnia that is used

by more

flexible users like

the

city government

of

San Francisco.

For Intel, the

cost

ofelectricity pales in

comparison

to the benefits ofoperating around the clock to meet

demand.

Instead,

Intel

has

entered

into a

deal with its power suppliers to

voluntarily scale back consumption when

they request it,

mainly by

reducing

lighting

and

air-conditioning levels at the one million

square

feet ofoffice space it occupies at its Santa

Clara, Calif. headquarters.

It

also

works

closely

with equipment

suppliers

to design

factory

equipment that

consumes less energy.

Since

such

chip-making gear

becomes outdated every three

to five

years,

“the

opportunity

to build

more efficient

systems

is significant,” says spokesman Tom

Beermann.

Honeywell International Inc. is another companythat is adopting a

varied

approach. The big aerospace and automotive-systems

maker,

based in Morristown,

N.J., generally

modifies

its production processes

to

limit exposure

to hours when

demand and prices

are generally the

highest,

asking

power

companies

for

discounts in return.

It has

signed

long-term

fixed-price contracts

in some areas and

interruptible supply

agreements

in others.

Overall,

says

Bill Ramsey,

Honeywell’s vice

president, supply

chain,

the

company hasn’t seen any significant

increases

in electricity costs.

Ford Motor Co. has

been

able to do better

than

that, though not

without some

harrowing

moments. The company, which spends

around

$300

million

a year on power in North

America,

is entering

into more

expensive fixed-price

contracts with suppliers to avoid

having to rely on the

spot

market. But at the

same time,

it also

reckons

that continuing

conservation

measures

--

plus some

smart

fixed-rate deals early on in the deregulation era

--

means it

will

pay

less for electricity

than

it did back in the days before there was

http://interactive.wsj.com/articles/SB966205435831256200.htm

8/14/00

L41~#t1*1SSSJ

- -

TV

U.’

aA~,s*a,b.,

—,

competition.

Pete

Mehra,

Ford’s energy chief,

said

the auto maker has

learned some

hard

lessons.

Last

summer, it

was

forced to briefly

pay

one ofits

suppliers rates ofas much as $9,000

per

megawatt hour to keep the

lights on at its Kentucky truck plant, whichmakes the

company’s

hugely profitable big pickups and

sports-utility

vehicles. Accustomed

to paying around $40 per megawatt hour to power the plant,

“that

one

week killed us,” Mr. Mehra says.

Enron’s Business Booms

While companies like

Ford enter into long-term contracts only

reluctantly

--

a

bad

decision could put it at cost disadvantage to its

competitors

--

service companies

generally

have less qualms. Energy

trading

company

Enron Corp., which signed contracts to supply $3.8

billion in energy and energy

services

to customers last quarter alone, is

doing a bustling

business offering

security

in times of

uncertainty.

Depending on the client’s appetite for risk, it offers packages that mix

fixed and

indexed rates much as a mortgage does.

And

it provides

incentives to those firms

that

allow it to replace their energy

infrastructure

over

time

--

which, in turn,

gives Enron a better

sense

of

what the client

will

be spending. Among the companies

that

have

signed up

with

the Houston-based company

are

Prudential

Insurance

Co. of

America,

Chase

Manhattan

Corp. and ~jrn~i~Pro

e~Qr~p,

one of

the

largest U.S. REITs.

Companies for

whom

electricity is a make-or-break operating cost

have less

flexibility

--

and are the

ones that have been

hit

worst by

current market conditions. Copper company

~~p~j~!od

e Corp.,

Phoenix, has

boosted

in-house generation to reduce its reliance on

commercial suppliers

and

is juggling its production schedules to shut

down equipment at times when the cost ofpower outstrips the value

of the ore

being mined and

smelted.

Rod Prokop, investor-relations director, says higher energy costs

coupled with interruptions at its

operations in Arizona and

New

Mexico, both deregulated markets, shaved around $5 million off

Phelps’s second-quarter earnings, leading to a

$37.5

million

loss in the

period. Mr. Prokop adds

that

Phelps will likely feel the impact of

volatile markets for

the

foreseeable

future

--

no

matter

what it does.

While

the changed energy scenario has

spooked

executives, it

hasn’t

generally turned them

against

deregulation. If

anything,

they see

current problems resulting from the

fact that

legislators have been too

timid in

unleashing

market forces.

--

Staff

writers

Karen Jacobs in New York, David Hamilton in San

http://interactive.wsj.com/articles/SB96620543583l256200.htm

8/14/00

SJFLflfl~A*AJ

TV S.F.’

saa...aa~n.s

V W

Francisco, Susan

Warren

in Dallas, Gregory L. White in Detroit and

Andy Fasztor in Los Angeles contributed to this article.

Write to

Jonathan Friedland atjonathan.ffiedland(ä~wsj.com

Return to top of

paae I

Format for

painting

Copyright ©

2000

Dow

Jones &

Company,

Inc. All

Rights Reserved.

Copyright

and

reonnt

informatiot~.

http://interactive.wsj.com/articles/SB966205435831256200.htm

8/14/00