Black

&-

Veatch

Pathfinder

(August

2008).

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

A

Word

from

the

Editor-in-Chief

Inside

This

Back to top

Issue:

Back to top

August

2008

Court

Decision

Throws

Cap-

and-Trade

into

a

Tizzy

Page

2

CAIR

Decision

Could

be

Costly,

Billions

at

Stake

Page

4

Western

Climate

Initiative

Releases

Draft

Plan

Page

6

RGGI

Carbon

Market

Could

Get

Shot

of

Transparency

from

Futures,

Options

Page

7

Have

Energy

Prices

Peaked?

Page

8

European

Industry

Feats

Economic

Fallout

from

Emissions

Trading

Page

9

Watet

in

Pleasantville

Page

11

Summer

doldrums.

Everyone

is

away.

Nobody

reads

serious

stuff.

Not

much

is

happening.

Well,

not

this

summer.

I

don't

know

what

the

political

conventions

will

bring,

but

the

courts

have

delivered

one

big

bit

of

confusion

on

the

emissions

control

front

in

the

United

States.

What

might

this

imply

for

future

carbon

legislation?

Meanwhile,

in

Europe,

industry

complains

about

carbon

credits

and

does

what

it

usually

does;

threatens

to

leave

for

someplace

else.

Back

to

the

political

front,

the

UK

government

wrestles

with

the

impact

of

high

energy

prices

on

low-income

households

and,

in

the

United

States,

Presidential

candidates

concentrate

on

oil

prices,

offshore

drilling

and

the

petroleum

reserve.

In

the

midst

of

it

all,

AI

Gore

made

proposals

that

caused

uproar

among

energy

bloggers,

but

not

among

the

general

public.

Not

to

be

outdone,

T.

Boone

Pickens

made

his

own

appeal.

No

summer

doldrums

in

this

business.

Elsewhere

in

this

issue,

Brent

Franzel

tells

the

tale

of

how

the

U.S.

Court

of

Appeals

threw

one

high

and

inside,

to

use

a

baseball

analogy,

to

the

utility

industry

and

participants

in

the

emissions

allowances

markets

when

they

invalidated

the

Clean

Air

Interstate

Rule.

Our

Sam

Glasser

looks

at

the

financial

impact

of

the

decision

since

utilities

are

now

faced

with

potentially

billions

of

stranded

dollars

for

emissions

allowances

that

they

hold

as

well

as

for

completed

or

under-

construction

emissions

control

equipment

which

might

not

be

allowed

into

the

rate

base.

Andy

Byers

from

Black

&

Veatch

lays

out

the

draft

plan

of

the

Western

Climate

Initiative,

a

collaborative

effort

of

seven

western

states

and

four

Canadian

provinces,

for

controlling

greenhouse

gas

emissions.

The

group

is

considering

introducing

a

cap-and-trade

program

beginning

in

2012.

Meanwhile,

the

Regional

Greenhouse

Gas

Initiative

of

10

northeastern

states

is

further

along,

as

their

first

CO

2

allowance

auction

is

scheduled

for

late

September.

Sam

Glasser

also

notes

that

corresponding

exchange-

traded

furures

and

options

contracts

are

to

be

launched

a

month

before

the

auction

which

are

intended

to

bring

a

measure

of

transparency

and

provide

a

means

of

risk

management

to

the

marketplace.

One

would

think

that

after

the

CAIR

decision,

risk

management

would

be

a

hot

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

World

Power

2008

To

contact

our

Economic

and

Financial

Analysis

Practice

or

for

a

copy

of

these

new

simply

Click

on

this

Ad,

or

e-mail

your

request

to

PetersonDL@bv.com

commodity.

The

relative

prices

of

oil,

gas,

and

coal

-

always

important

to

utility

managers

-

will

take

on

increased

significance

with

the

coming

climate

change/carbon

legislation

and

regulations.

Hua

Fang,

an

economist

and

market

analyst

at

Black

&

Veatch,

takes

a

look

at

the

recent

slide

in

primary

energy

prices.

As

for

the

concerns

in

Europe

that

cap-and-trade

is

rendering

some

areas

industrially

uncompetitive,

Chris

Scott

in

the

UK

discusses

the

issue

and

how

energy

prices

are

affecting

the

market

for

allowances.

I

note

that

venture

capitalists

have

been

putting

substantially

more

money

into

alternative

energy

investments,

so

there

must

be

real

opportunities

there.

Lastly,

it

seems

that

history

has

shown

that

crusaders

for

a

cause

have

a

persistent

streak

that

typically

pays

off

in

the

long

run.

In

that

vein,

the

energy

industry

could

do

much

worse

than

to

devise

solutions

to

the

problems

identified

by

the

greens

(other

than

just

saying

"it

can't

be

done.")

There's

an

example

there

that

will

open

your

eyes.

Read

this

stuff

carefully

at

the

office,

not

at

the

beach.

It

involves

big

money

and

some

real

zig

zags

in

policy.

Not

summer

reading

for

sure.

Sorry

about

that,

but

enjoy

the

rest

of

the

summer.

As

always,

let's

hear

any

comments,

corrections,

and

questions.

-

Leonard

S.

Hyman,

C.F.A

.

•

Decision

by

the

U.S.

Court

of

Back to top

Appeals

Back to top

Throws

Back to top

Cap-and-

Back to top

Trade

Back to top

Regulations,

Back to top

Market

into

a

Back to top

Tizzy

The

U.S.

Court

of

Appeals

for

the

District

of

Columbia

ruling

on

July

11

in

NOlth

Carol

ilia

vs.

EPA,

issued

a

decision

that

wiped

away

the

Environmental

Protection

Agency's

Clean

Air

Interstate

Rule

(CAIR),

scheduled

to

take

effect

in

January

2009

for

nitrogen

oxide

(NO,)

and

a

year

later

for

sulfur

dioxide

(SO,).

The

unanimous

ruling

by

a

three-judgepanel

surprised

a

wide

range

of

groups

following

the

issue,

from

utilities

to

environmental

organizations.

Most

of

these

groups

had

supported

the

rule

as

a

way

of

bringing

certainty

to

the

regulation

of

power

plant

emissions.

The

court

found

several

problems

with

the

rule

which

was

issued

in

2005.

The

judges

found

that

the

rule

was

not

authorized

under

the

Clean

Air

Act.

Specifically,

the

panel

found

fault

with

EPA's

method

for

allocating

emissions

allowances

for

downwind

versus

upwind

states.

Page

2

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

To

contact

our

Rate

and

Regulatory

Support

Practice

or

to

obtain

copies

of

these

papers

simply

Click

on

this

Ad,

or

e.

mail

your

request

to

PetersonDL@bv.com

CAIR

covered

28

states

and

the

District

of

Columbia;

it

was

put

into

place

to

reduce

SO,

and

NO,

emissions

by

implementing

a

cap-and-trade

system

to

essentially

protect

downwind

states

on

the

East

Coast

from

power

plant

emissions

originating

in

rhe

Midwest.

The

state

of

North

Carolina

brought

suit

against

EPA,

arguing

that

rhe

rule

failed

to

provide

adequate

protections

to

downwind

states.

EPA

and

its

supporters

had

argued

that

the

rule

would

save

as

many

as

17,000

lives

per

year.

Even

though

CAIR

was

invalidated,

a

cap-and-trade

program

remains

in

force

that

allows

the

trading

of

SO,

allowances

under

the

Clean

Air

Act

amendments

of

1990

and

the

seasonal

NO,

trading

under

the

EPA

NO,

Budget

Trading

Program.

After

the

decision,

the

markets

for

the

affected

allowances

fell

out

of

bed.

The

nominal

price

of

SO,

allowance

futures

quoted

by

the

New

York

Mercantile

Exchange

fell

from

$300

per

ton

on

July

10

to

$130

on

July

11,

and

dipped

further

before

recovering

to

$132

per

ton

by

the

end

of

the

month.

The

nominal

price

for

the

2009

annual

NO,

allowance

futures

contract

dropped

from

$4,850

per

ton

on

July

10

to

$2,500

on

July

11,

and

to

$1,000

by

July

31.

EPA

officials

have

until

rhe

end

of

August

to

decide

wherher

to

appeal

the

Court

of

Appeals

ruling

or

attempt

to

modify

the

rule

to

comply

with

the

court's

objections.

In

the

alternative,

Congress

can

pass

new

legislation

to

address

the

problem

-

either

specifically

aimed

at

rhe

CAIR

rule

or

as

a

modification

to

the

Clean

Ail:

Act.

That

is

almost

certain

not

to

happen

during

the

current

session

which

is

scheduled

to

end

in

early

October.

Additionally,

Congress

adjourned

on

August

1,

not

to

return

to

the

Capitol

until

after

Labor

Day.

In

a

related

development

on

the

same

day

as

the

court

decision,

the

Bush

Administration's

release

of

a

proposed

rule

making

would

also

seem

to

indicate

that

any

action

under

the

Clean

Air

Act

is

unlikely

until

the

new

president

takes

over.

The

EPA

asked

for

public

COmment

on

a

proposed

rulemaking

in

which

it

stated

the

Clean

AU:

Act

is

not

the

appropriate

vehicle

for

regulating

greenhouse

gas

emissions.

The

proposed

rule

was

issued

in

response

to

the

Supreme

Court's

Massachusetts

v.

EPA

decision

in

which

the

court

ruled

that

the

regulation

of

greenhouse

gases

from

motor

vehicles

falls

under

the

aurhority

of

rhe

EPA

via

rhe

Clean

Ail:

Act.

The

Bush

Administration

disputes

rhar

position

and

White

House

officials

argued

rhat

using

rhe

law

to

regulate

greenhouse

gas

emissions

would

harm

rhe

U.S.

economy.

Envil:onmenral

groups

and

Democrats

in

Congress

were

severely

critical

of

rhe

President

and

EPA

Administrator

Srephen

Johnson

following

the

announcement,

which

was

a

reversal

of

conclusions

in

a

draft

EPA

study

completed

last

year.

Regardless

of

what

the

Bush

Administration

decides

to

do

on

this

issue,

Congress

and

the

next

president

will

be

forced

to

address

it.

At

a

July

29

Senate

hearing,

members

on

both

sides

of

the

aisle

called

for

action

to

reinstate

the

goals

of

the

CAIR

rule.

Clean

Ail:

&

Nuclear

Safety

Subcommittee

Chairman

Tom

Carper

(D-DE)

pushed

for

passage

of

a

bill

he

has

introduced

to

provide

even

wider

coverage

of

emissions.

Sen.

Page

3

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

To

contact

our

Litigation

Support

Practice

simply

Click

on

this

Ad,

or

e-mail

yourrequesttoPetersonDL@bv.com

Carper's

Clean

Air

Planning

Act

would

go

beyond

the

rule's

coverage

of

NO,

and

SO"

and

would

also

regulate

emissions

of

mercury

and

carbon

dioxide.

''I'm

not

going

to

wait

another

eight

years

to

do

what

we

should

have

done

eight

years

ago,

and

that

is

pass

a

strong,

comprehensive

clean

air

bill

that

makes

deep

and

meaningful

reductions

in

mercury,

nitrogen

oxide

and

sulfur

dioxide,"

he

said.

Environment

&

Public

Works

Committee

ranking

member,

James

Inhofe

(R-OK)

at

the

hearing

basically

said,

"I

told

you

so."

He

pointed

to

his

statements

of

three

years

ago

that

passage

of

the

administration's

proposed

Clear

Skies

Act

would

have

been

preferable

and

that

the

CAIR

rule

was

vulnerable

to

court

intervention.

He

urged

committee

members

not

to

use

the

court

ruling

for

political

benefit

and

to

find

a

way

to

reinstate

a

rule

that

had

"direct

and

measurable

health

benefits."

Witnesses

at

the

hearing

representing

both

states

and

utilities

called

for

quick

action

to

address

the

court's

move

so

that

going

forward

there

will

be

certainty

in

terms

of

what

is

required

of

industry

under

the

new

emissions

standards.

-

Brent

Franzel,

Cardinal

Point

Partners

LLC

--

-

--

CAIR

Decision

Back to top

Could

Have

Back to top

Severe

Back to top

Financial

Back to top

Repercussions;

Back to top

Billions

of

Back to top

Dollars

Back to top

Potentially

at

Back to top

Stake

The

u.s.

Court

of

Appeals

decision

invalidating

the

Clean

Air

Interstate

Rule

(CAIR)

leaves

utilities

with

billions

of

dollars

in

stranded

costs

for

capital

equipment

and

severely

discounted

emissions

allowances

for

sulfur

dioxide

(SO,)

and

nitrogen

oxide

(NO,,).

The

decision

provides

a

lesson

to

lawmakers

and

regulators

alike

who

will

be

tackling

climate

change

issues

under

the

next

administration

that

legislation,

as

well

as

subsequent

regulations,

must

be

drafted

with

care

and

clarity.

The

Court's

decision

also

reminds

us

that

the

uncertainty

and

financial

risks

associated

with

the

adjudication

of

future

climate

change

legislation

could

be

substantial.

Climate

change

legislation

targeting

greenhouse

gases

is

also

expected

to

rely

heavily

on

fmancial

instruments

-

carbon

dioxide

allowances

bought

and

sold

under

various

cap-and-trade

proposals,

along

with

furures

and

options

contracts

that

could

be

traded

on

established

commodity

exchanges

or

over-the-

counter.

The

lesson

with

CAIR

is

that

transactions

in

the

emerging

CO,

emissions

market

could

be

subject

to

considerable

risk

and

market

volatility_

The

potential

for

stranded

compliance

assets,

such

as

carbon

capture

and

sequestration

investments,

could

be

high,

as

well.

P;,t.gc

4

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

He

noted

that

without

the

regulations,

utilities

typically

cannot

be

forced

to

run

the

costly

pollution

control

units

and

if

they

voluntarily

operatedthem

it

was

not

clear

that

they

would

be

allowed

to

recover

the

costs.

The

Financial

Times

reported

that

the

estimated

total

loss

of

value

for

50

2

emission

allowances

ranged

from

15

billion

to

20

billion.

NO,

allowances

issued

under

CAIR

which

are

now

invalid

had

been

valued

at

21

billion.

Additionally,

the

newspaper

reported,

at

least

75

billion

had

been

invested

in

pollution

abatement

equipment

for

power

plants

in

order

to

meet

the

NO,

and

50

2

emissions

requirements

that

were

to

take

effect

in

2009

and

2010,

respectively.'

One

power

company,

PPL

Corp.

of

Allentown,

PA,

said

in

a

filing

with

the

Securities

and

Exchange

Commission

a

few

days

after

the

court

decision,

that

its

combined

book

value

for

the

affected

50

2

and

NO,

emission

allowances

was

approximately

100

million

as

of

the

end

of

June.

The

company

said

that

it

anticipates

that

all

of

the

annual

NO,

allowances

may

be

impaired

and

noted

that

the

market

price

of

50

2

allowances

had

fallen

dramatically.

The

looming

end

of

the

current

session

of

Congress

(October),

the

inauguration

of

a

new

administration

Oanuary

2009),

and

an

appeal

to

the

U.S.

Supreme

Court

by

the

Environmental

Protection

Agency

still

uncertain

means

that

"those

industries

that

must

do

long-term

compliance

planning

for

emissions

arc

in

a

quandary,"

Mr.

Hart

said.

Any

decision

that

they

make

regarding

the

use

of

allowances

or

capital

investment

is

a

"gamble,"

he

said,

since

they

do

not

know

what

the

final

rules

may

look

like.

Some

utilities

may

consider

strategies

such

as

deferring

the

completion

of

scrubbers

and

thus

saving

capital

dollars

or

they

may

look

to

the

use

of

higher

sulfur

coals,

Mr.

Hart

said.

He

noted

that

steam

coal

prices

have

increased

dramatically,

this

year,

largely

driven

by

export

demand

for

metallurgical

coal,

so

the

court

ruling

and

the

low

50

2

allowance

prices

could

benefit

the

high-sulfur

coal

market.

States,

however,

may

begin

to

me

petitions

with

the

EPA

regarding

emissions

transport

issues

from

upwind

which

"could

put

a

damper

on

the

use

of

higher

emitting

coals,"

Mr.

Hart

said.

Shifting

values

for

high-sulfur

vs.

low-sulfur

coal

are

also

likely

to

have

an

impact

on

the

carbon

allowance

markets.

Legislators,

industry

regulators,

and

all

market

participants

must

realize

that

the

efforts

to

deal

with

climate

change

involve

a

series

of

intricate,

interwoven

factors;

each

can

affect

the

other

and

carries

its

own

measure

of

risk,

which

can

sometimes

be

substantial.

-

Samuel

Glasser,

Black

&

Veatch

1

John

Dizard,

"A

Costly

Cap

on

Utilities'

Cap-and-Trade

Programme,"

Fifloflcio/Time.I,]uly

29,

2008.

Page

5

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Originally

established

by

the

Western

Governor's

Association

in

February

2007,

the

WCI

is

a

collaborative

initiative

by

seven

western

states

(Arizona,

California,

Montana,

New

Mexico,

Oregon,

Utah,

and

Washington)

and

four

Canadian

provinces

(British

Columbia,

Manitoba,

Quebec,

and

Ontario)

to

reduce

emissions

of

six

GHGs

(carbon

dioxide,

methane,

nitrous

oxide,

hydro

fluorocarbons,

perfluorocarbons,

and

sulfur

hexafluoride)

in

their

power

generation,

industrial,

petrochemical,

and

transportation

sectors.

The

scope

of

this

current

WCI

program

includes

approximately

20

percent

of

the

United

States

economy,

and

73

percent

of

Canada's

economy.

Draft

Design

Recommendations

Under

the

WCI

draft

plan,

entities

and

facilities

annually

emitting

10,000

metric

tons

or

more

of

the

regulated

GHGs,

measured

in

carbon

dioxide

equivalents,

,vill

have

to

begin

reporting

their

2010

emissions

in

early

2011.

The

cap-and-trade

program

will

begin

in

2012

for

power

generation,

industrial

and

petrochemical

companies

emitting

25,000

metric

tons

or

more

of

carbon

dioxide

equivalent

GHGs

each

year.

The

regulation

of

transportation

sector

emissions

would

not

begin

until

2015.

The

proposed

reach

of

the

emissions

trading

program

would

extend

outside

of

the

partner

state

boundaries

to

include

regulation

of

"fIrst

deliverers"

of

electricity

into

the

region,

but

would

exclude

sources

that

combust

biomass

or

biofuels.

Regulated

sources

would

have

compliance

periods

of

three

years

in

which

to

retire

allowances

equal

to

their

carbon

dioxide-equivalent

GHG

emissions.

Although

the

draft

plan

did

not

specify

an

emissions

cap

for

the

initial

year

of

the

program,

it

provides

for

the

total

number

of

allowances

that

comprise

the

cap

to

decline

on

a

straight

line

basis

through

2020.

In

2015,

the

regional

cap

will

include

expected

actual

emissions

from

transportation

fuels

as

well

as

residential,

commercial

and

industrial

fuels.

Distribution

and

Use

of

Allowances

and

Credits

The

apportionment

of

allowances

to

each

member

state

and

province

has

yet

to

be

determined,

but

\vill

likely

be

based

on

their

production

and

consumption

of

electricity,

as

well

as

projected

population

growth

and

economic

activity

among

other

factors.

Each

WCI

partner

will

decide

how

best

to

distribute

allowances

to

regulated

entities

within

its

own

jurisdiction.

Although

recommendations

for

establishing

a

minimum

percentage

of

allowances

that

must

be

auctioned

was

deferred

until

the

fall

of

2008,

the

current

draft

does

provide

for

a

minimum

percentage

of

auction

proceeds

to

be

directed

towards

energy

effIciency

and

renewable

energy

development

and

incentives,

research

and

development

of

carbon

capture

and

storage,

and

promoting

reductions

and

carbon

sinksin

agriculture

forestry

and

other

unregulated

sectors.

Each

partner

will

have

discretion

to

award

credits

for

early

actions

undertaken

in

advance

of

2012,

however

WCI's

draft

plan

specifIes

that

all

such

early

reduction

credits

will

come

out

of

that

partner's

allowance

budget.

Offsets

from

reductions

achieved

outside

of

the

regulated

program

may

be

used

for

up

10

percent

of

a

covered

facility's

compliance

obligation.

Banking

of

allowances

and

credits

will

be

unrestricted,

however

borrowing

from

the

future

will

not

be

allowed.

Page

6

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

While

the

final

design

of

the

WCI

program

has

significant

implications

for

the

partner

states

and

provinces,

it

has

particular

importance

to

California,

which

is

hoping

to

merge

its

own

GHG

program

into

the

WCI

regime.

Delaying

regulation

of

transportation

fuels

until

2015

and

the

absence

of

any

set-aside

allowances

for

early

reduction

efforts

is

clearly

inconsistent

with

the

mandates

of

California's

Global

Warming

Solutions

Act.

Nevertheless,

the

California

Air

Resources

Board

remains

optimistic

the

two

programs

can

be

linked

or

united

at

some

point

in

the

future.

If

the

WCI

is

successful

in

keeping

all

its

partner

states

and

provinces

fully

committed

to

the

regulatory

regime

when

its

design

is

fmafued,

it

could

set

a

precedent

for

a

national

GHG

program

and

beyond.

With

an

additional

six

states,

two

Canadian

provinces,

and

six

Mexican

states

signed

on

as

observers,

the

\x/CI

has

the

potential

to

grow

into

a

North

American

market

for

trading

of

GHG

credits.

WCI

is

accepting

written

comments

through

August

13,

and

expects

to

finalize

its

draft

design

recommendations

by

the

end

of

September,

when

it

will

issue

a

roadmap

of

activities

and

milestones

through

2009.

-

Andrew

C.

Byers,

Black

&

Veatch

RGGI

Carbon

Back to top

Market

Back to top

Could

Get

Back to top

Liquidity

Back to top

Boost

from

New

Back to top

Futures

and

Back to top

Option

Back to top

Contracts

The

New

York

Mercantile

Exchange,

Inc.,

announced

that

it

will

launch

a

futures

contract

for

Regional

Greenhouse

Gas

Initiative

(RGGI)

carbon

dioxide

allowance

futures

with

the

opening

of

the

August

25

trading

session,

just

one

month

before

the

first

quarterly

RGGI

auction

scheduled

for

September

25.

RGGI

is

a

cooperative

effort

of

10

northeastern

states

to

reduce

CO,

emissions

through

a

regional

cap-and-

trade

system.

Even

though

the

first

auction

will

not

be

held

until

early

fall,

over-the-counter

(OTC)

trades

of

physical

allowances

were

reported

as

early

as

last

March.

Other

OTe

trades

previously

occurred.

NYMEX

will

also

launch

a

related

options

contract

on

August

26.

The

new

futures

contract

will

provide

for

physical

delivery

of

CO,

allowances

to

the

RGGI

CO,

Allowance

Trading

System

and

will

be

available

for

trading

nearly

around

the

clock.

The

size

of

the

futures

contract

will

be

1,000

RGGI

allowances

with

a

minimum

price

fluctuation

of

.

0.01

per

allowance.

The

options

contract

can

be

exercised

into

the

underlying

futures

contract.

-

Samuel

Glasser

Page

7

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

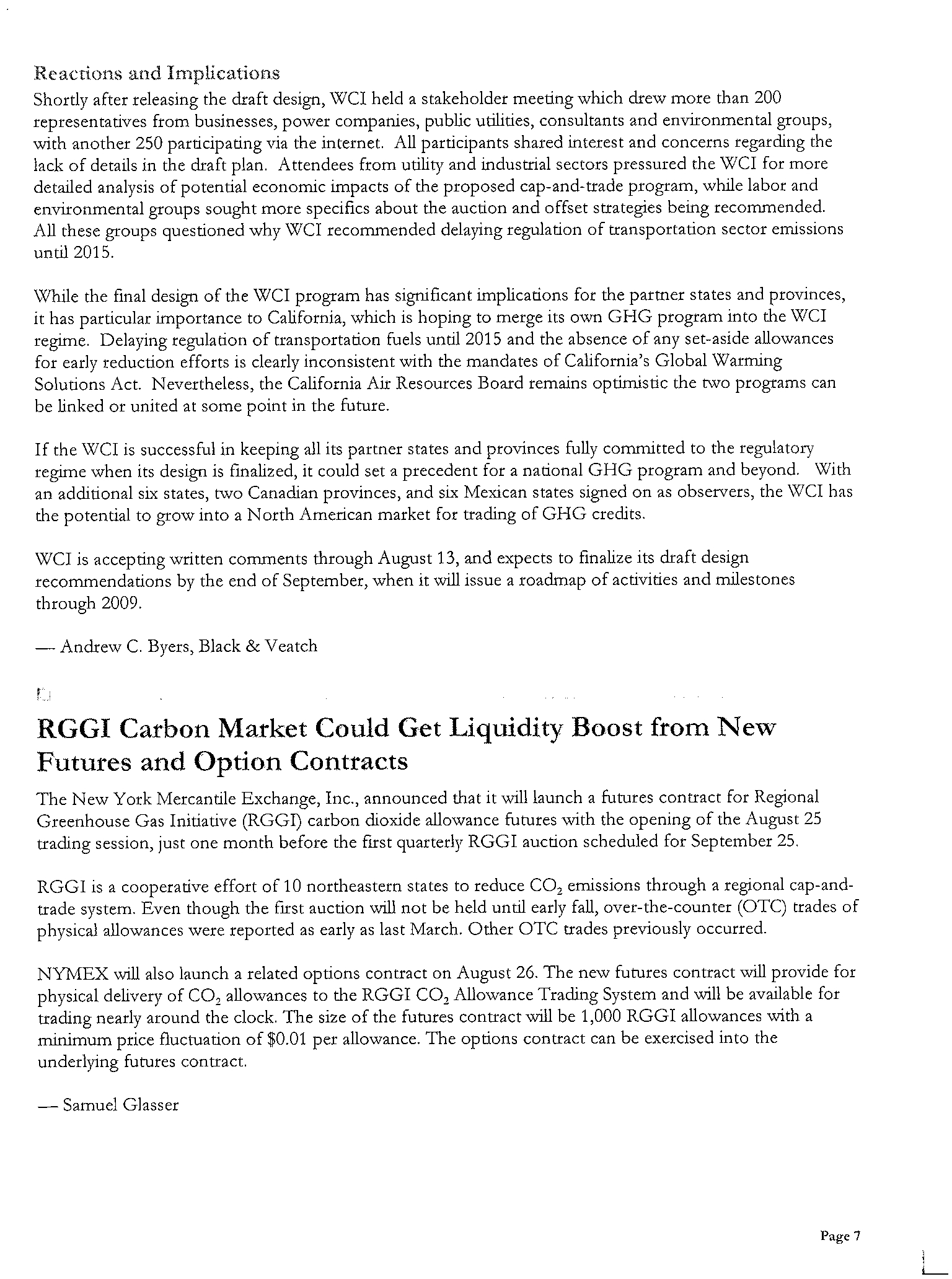

The

relative

long-term

prices

of

primary

energy

-

oil,

natural

gas,

and

coal

-

coupled

with

the

severity

and

cost

of

new

climate

change

legislation,

will

be

of

the

utmost

importance

to

utility

planners

who

will

need

to

decide

how

to

fuel

new

generating

capacity.

If

gas

prices

go

too

high,

coal

becomes

the

fuel

of

choice

even

with

carbon

legislation.

In

tum,

increased

coal

use

increases

the

demand

for

CO

2

allowances,

driving

allowance

prices

up.

If

the

potential

carbon

rules

are

too

onerous

or

the

government

fails

to

send

clear

signals

on

where

the

rules

are

headed,

gas

will

likely

be

chosen

as

at

least

an

interim

solution

in

order

to

keep

the

lights

on.

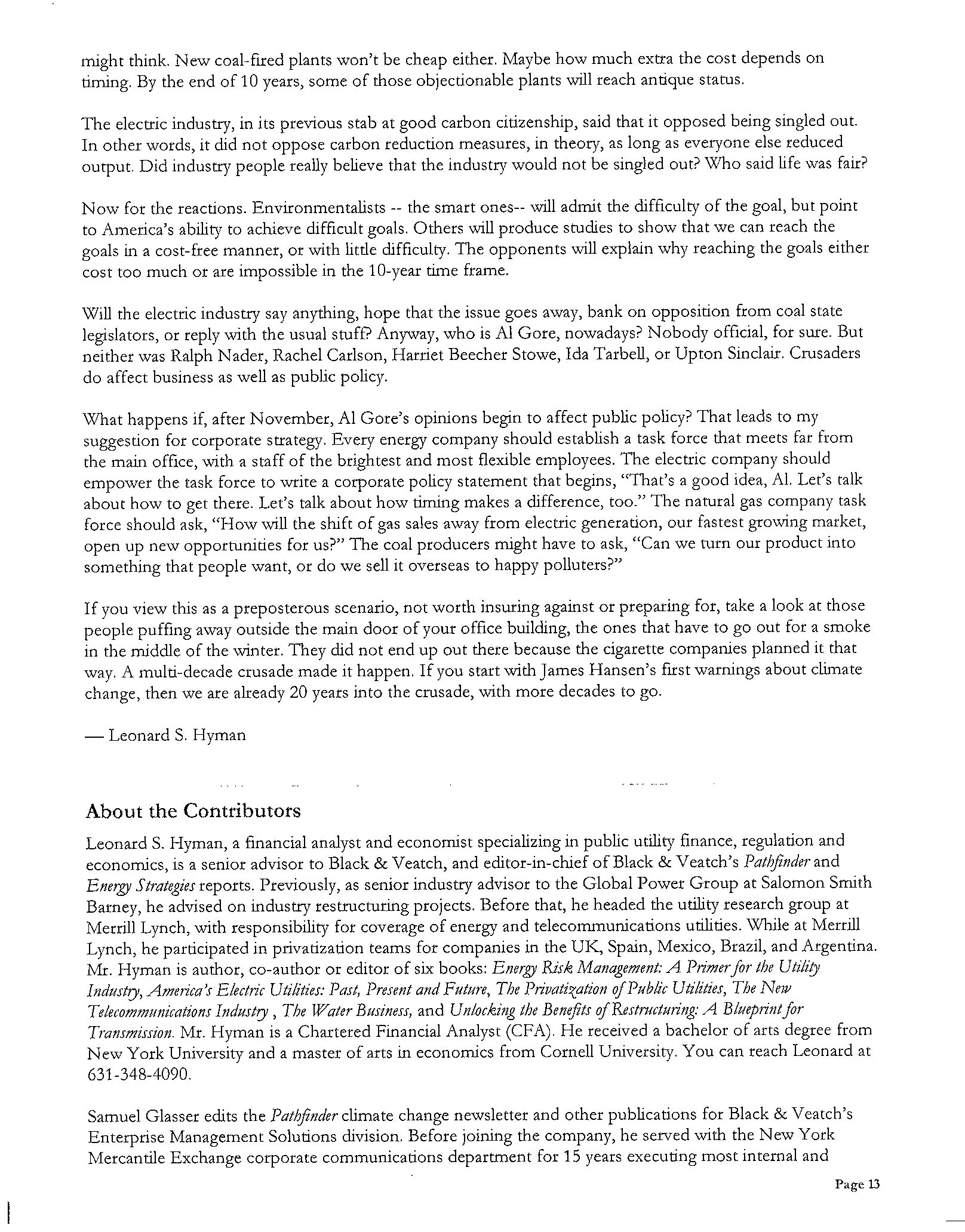

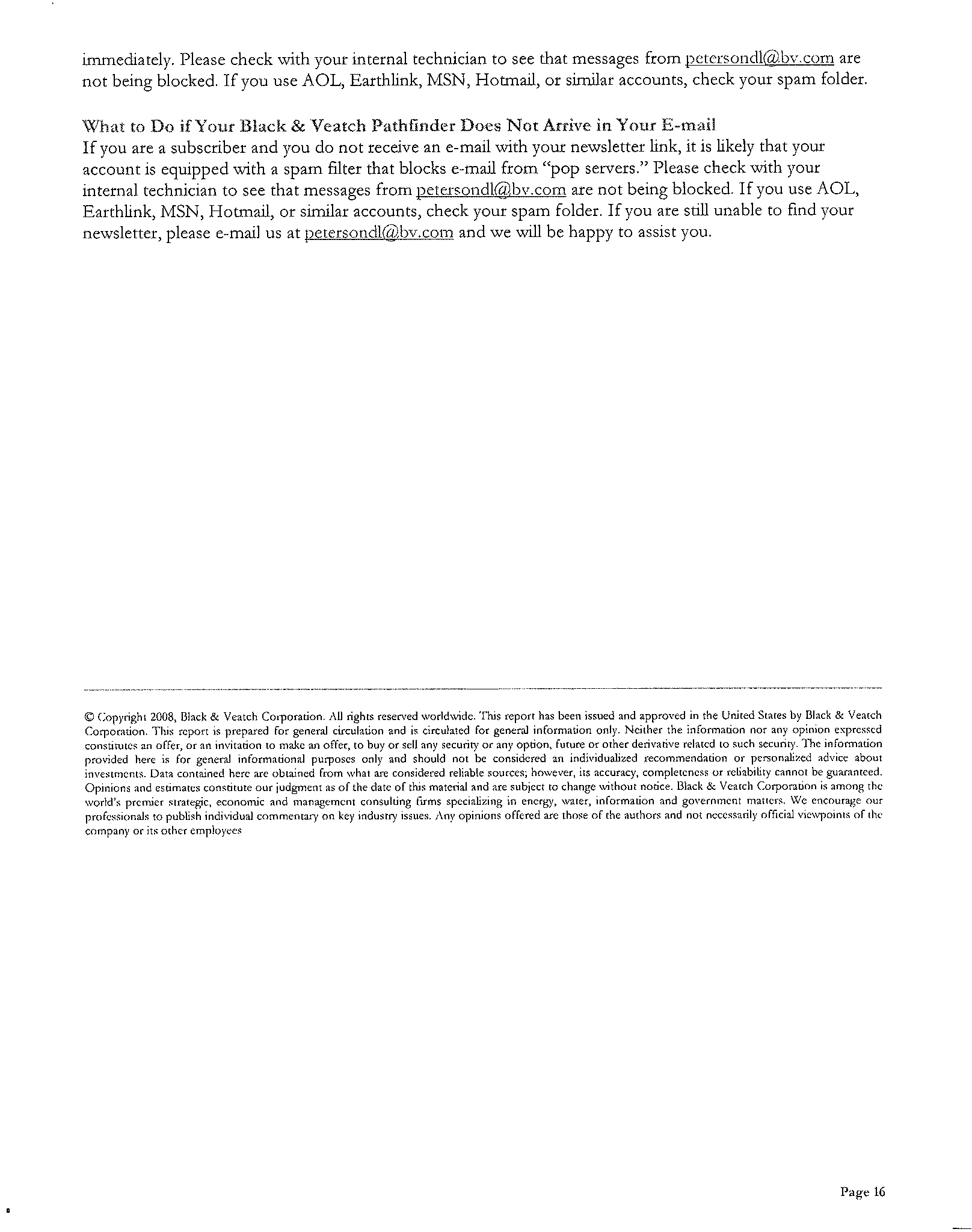

West

Texas

Intermediate

Crude

Oil,

Natural

Gas,

Coal

Spot

Month

Futures

Prices

Source:

New

York

Mercantile

Exchange

$30.00

,--------------------------------...,

-WTI

Crude

Oil

-

Natural

Gas..Henry

Hub

$25.00

1---L:::=-:.C"'A~P~P~C~O~.~I

j_----------:_-__:__;:;"

$20.00

.1----------------7"""

"

iii

E

$1S.00

1---'-""

.E

-

$10.00

j------------,~""-"7"'"......<:.---------------_\_--1

$5.00

t===::::====:::===~:::=::::::::::===:::::=:::::;:::::;:::;="""":C:'::::\--.,o:

It

is

too

early

to

draw

any

conclusions

about

oil

price

direction,

but

it

seems

that

the

market

has

finally

caught

up

with

the

profound

impact

of

demand

destruction:

a

renewed

and

strong

demand

for

smaller

cars,

less

driving,

and

a

looming

U.S.

recession

that

could

spread

to

the

rest

of

the

world.

The

oil

market

has

even

shrugged

off

supply

events

that

otherwise

would

have

likely

lifted

prices

--

tropical

storms

in

the

Gulf

of

Mexico

and

an

oil

pipeline

explosion.

Natural

gas

prices

reversed

the

upward

trend

prior

to

the

decline

that

we

have

experienced

in

oil

prices.

Actually,

the

run-up

in

natural

gas

prices

had

little

fundamental

evidence

to

support

it.

The

2007

hurricane

season

was

mild;

the

winter

was

not

cold;

and

U.S.

natural

gas

production

actually

rose

in

2007.

These

Page

8

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

1)

what

wiU

oil

prices

do?

and

2)

do

we

expect

the

oil-to-gas

relationship

to

widen

or

tighten

as

North

American

natural

gas

supplies

realign?

Even

though

volumes

of

liquefied

natural

gas

stayed

away

from

U.s.

shores

due

to

high

oil-linked

prices

for

LNG

elsewhere,

there

is

much

optimism

with

regard

to

the

prospects

for

shale

gas

and

other

non-conventional

production

in

the

United

States.

Central

Appalachian

coal

prices

have

seen

increased

volatility

since

they

crossed

the

$5

per

mmBtu

line

in

mid-June.

After

spending

the

first

three

quarters

of

2007

in

sub-$2

territory,

prices

began

moving

upward

in

2008,

almost

hitting

$6

per

mmBtu

early

this

summer.

Since

July

1,

when

energy

prices

were

at

or

near

their

peak,

to

the

first

week

of

August,

coal

has

faUen

by

approximately

$1.00

per

mmBtu

or

17

percent,

oil

is

down

nearly

$4

per

mmBtu

or

16

percent,

and

natural

gas

is

off

by

$4.74

per

mmBtu,

or

35

percent.

-

Hua

Fang,

Black

&

Veatch

•

European

Industry

Back to top

Fears

Back to top

Economic

Back to top

Fallout

from

Back to top

Emissions

Trading

How

is

the

European

Union

Emissions

Trading

Scheme

(EU

ETS)

affecting

companies

in

Europe

in

the

wake

of

the

increases

in

energy

costs

over

the

past

year?

Is

the

cap-and-trade

system

driving

the

desired

behaviors?

A

report

in

the

German

magazine

Der

Speigel

on

July

17'

gives

some

insight.

"The

price

of

European

emission

permits

is

rising

so

rapidly

that

German

companies

are

threatening

to

leave

the

country.

Thousands

of

jobs

could

be

lost.

And

the

environment

may,

in

the

end,

be

no

better

off.

"According

to

calculations

by

Point

Carbon

--

a

Norwegian

company

that

specializes

in

analyzing

global

power,

gas,

and

carbon

markets

--

this

price

hike

would

drive

up

the

marginal

cost

of

energy

from

an

old

brown

coal

power

plant

by

the

entire

price

of

carbon.

For

modern

natural

gas

power

plants,

it

would

increase

prices

by

a

third.

Energy

company

RWE,

which

is

based

in

the

German

city

of

Essen,

reckons

it

alone

will

have

to

pay

€9

billion

(

14.2

billion)

for

its

own

electricity

production,

which

it,

of

course,

,viti

pass

on

in

higher

electricity

prices.

So

carbon

trading

,viti

have

a

direct

impact

in

which

countries

firms

chose

to

locate,"

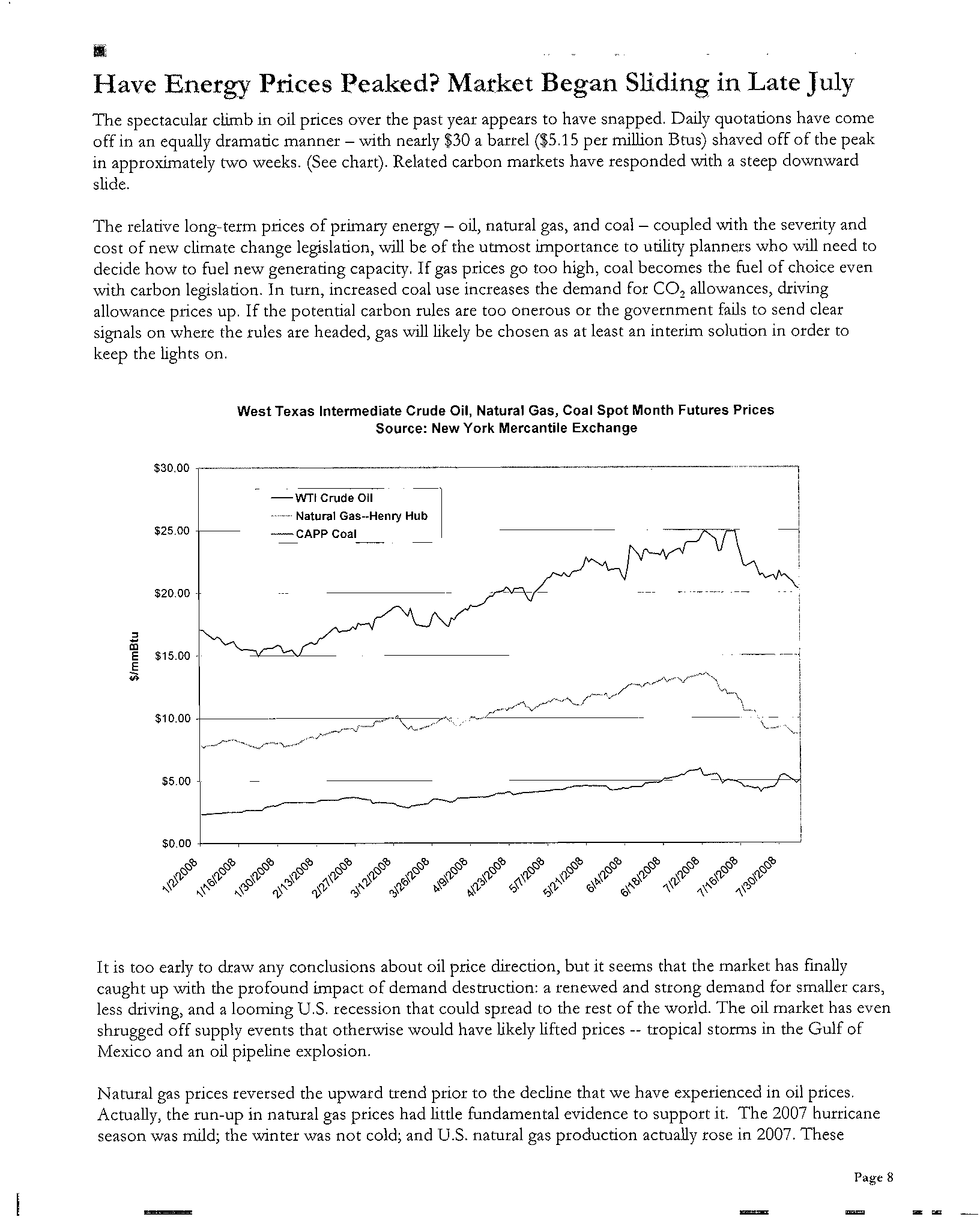

The

market

for

EU

carbon

aUowances

(EUAs)

has

always

been

heavily

influenced

by

energy

prices

and

their

daily

fluctuations

-

particularly

natural

gas,

coal,

and

electricity

prices.

The

market,

however,

this

year

has

taken

a

more

direct

day-to-day

lead

from

the

soaring

oil

prices

and

their

impact

on

operating

costs

for

business

and

industry.

Of

course,

much

of

the

impact

of

oil

is

felt

via

the

price

of

natural

gas.

Gas

closely

foUows

oil

and,

when

rising,

it

becomes

cheaper

for

power

companies

to

switch

from

gas

to

coal.

This,

in

turn,

requires

more

emission

permits

for

every

unit

of

power

produced,

thus

raising

demand

for

EUAs.

2

http://w\V\\',spicgcl.c1c

linternational

/busincss/O

1

j

t

8

5(J04-ll

aO.hrml

Page

9

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

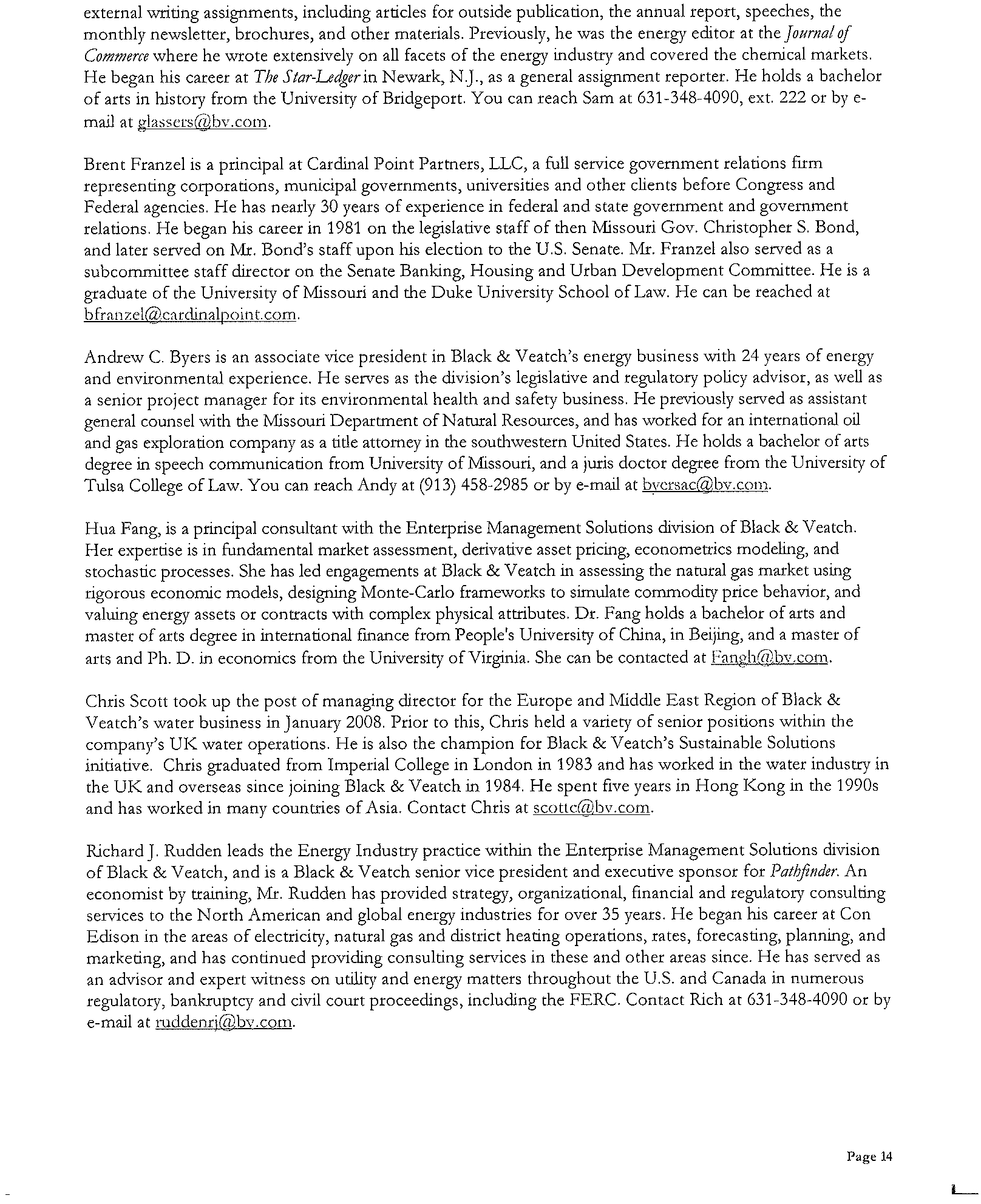

€2.00

,-----------------------------------,

€

1.50

+------------------------------------1

€

1.00

-

--1--------------------------

a

€

0.50

-

----

-1-,--11--11

o

'0

c

~

'+I

eo.oo

(€

0.50)

-

--1/-------'---"--------------------

-

--

---

(€

1.00)

j--------------------------------I-----]

(€

1.50)

1-

--_---_--_---_--_--_------_--_--'

3/17/2008

3/31/2008

411412008

4/28/2008

5/1212008

5/26/2008

6/912008

6/23/2008

7f71200B

7/21f2008

8/4/2008

The

excerpts

from

the

Ver

Speigel

article

confIrm

fears

voiced

at

the

rime

of

the

inception

of

the

EU

ETS.

A

report

published

in

2007

by

Carbon

Strategies',

a

research

group

comprising

the

Centre

International

de

Recherche

sur

l'Environnement

et

Ie

Developement

and

the

Electricity

Policy

Research

Group

at

the

University

of

Cambridge

suggested

that

the

EU

ETS

faces

challenges

that

potentially

undermine

its

environmental

effectiveness

and

credible

survival

beyond

2012.

The

report

said

that

the

most

signifIcant

of

the

challenges

to

the

EU

ETS

is

addressing

the

issue

of

industrial

competitiveness

relative

to

companies

based

outside

the

EU.

Concern

about

loss

of

industrial

competitiveness

is

one

of

the

main

obstacles

to

governments

adopting

stringent

climate

policies,

the

report

stated.

Governments

fear

that

policies

applied

to

domestic

energy-intensive

industries

which

must

compete

against

companies

located

in

regions

without

similar

climate

policies

could

result

in

the

loss

of

profitability

and

market

share.

As

the

move

from

a

block

allocation

of

permits

to

the

auctioning

of

permits

draws

closer

these

concerns

are

only

likely

to

increase.

Starting

in

2013,

the

inception

of

the

third

trading

period

of

the

EU

ETS,

every

European

company

will

have

to

acquire

pollution

permits

from

a

central

marketplace

similar

to

a

stock

or

commodity

exchange.

So

far

the

permits

have

been

handed

out

for

free,

or

largely

free

with

companies

using

the

market

to

either

sell

excess

permits

to

purchase

the

additional

permits

that

their

operations

.1

http://'\vw,,\'.climat(,-srr::l[e~Ties..o.r~~!uploads(C()mp(,r

rcp01:t

070S30.pdf

Page

10

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

•

Water

in

Pleasantville

(and

Other

Points

oflnterest)

That

upholder

of

conventional

values,

The

Rtader's

Digest,

with

the

idyllic

post

office

address

of

Pleasantville

(the

magazine

is

located

elsewhere

but

the

founder

liked

the

sound

of

Pleasantville)

asks,

"Is

America

running

out

of

water?"

-l

The

picture

on

the

opposite

page

shows

an

orange

sunset

over

a

depleted

reservoir,

in

which

a

boat

sits

atop

a

cracked

mud

bottom.

Lake

Mead

could

run

dry

by

2021

the

article

says.

Climate

change

in

the

southwest

would

lead

to

more

evaporation

and

more

demand

for

water.

The

governor

of

Georgia

and

a

250-voice

chorus

prayed

for

rain

during

a

recent

drought.

Less

religious

officials

have

launched

water

conservation,

recycling

and

supply

management

programs.

What's

the

big

deal,

you

ask?

You've

heard

most

of

this

before.

True.

The

big

deal

is

that

a

mass

circulation

publication

thinks

that

this

is

something

to

write

about.

Industry

people

tend

to

talk

to

each

other.

Mass

media

gets

the

message

out.

Financial

Corner

Venture

capital

firms

have

turned

their

attention

to

alternative

energy,

which

received

about

10

percent

of

venture

capital

dollars

in

2007,

twice

the

average

of

the

previous

five

years.;

That

number,

probably,

does

not

include

investment

in

firms

that

will

produce

new

communications

and

metering,

or

other

services.

A

sample

of

three

top

VC

firms

shows

that

alternative

energy

investment

deals

in

17

months

from

January

2007

exceeded

every

other

sector

in

volume.

They

believe.

Follow

the

money.

Mmmfacturing

Opinion

Many

moons

ago,

the

public

relations

chief

of

Mobil

Oil

decided

that

if

the

newspapers

would

not

pay

attention

to

Mobil's

views,

he

would

present

those

opinions

to

the

public

as

advertisements.

Mobil

put

its

views

into

an

advertisement

that

always

appeared

in

the

lower

right

corner

of

the

page

opposite

the

editorials

in

the

New

York

Times.

Mobil

provided

serious

commentary,

undisguised.

The

reader

knew

who

furnished

the

opinion,

who

paid

for

it,

and

nobody

pretended

orhe!\vise.

Businesses

today

set

up

fronts,

instead,

maybe

a

"grass

roots"

organization

or

a

"think

tank,"

usually

adorned

with

a

patriotic

and

high

sounding

name,

such

as

Americans

for

the

Cleanest

Possible

Economically

Competitive

Energy.

The

organizations

have

web

sites,

and

they

issue

predictable

opinions

and

predictable

studies.

Some

of

them

hire

prominent

people

to

do

public

relations

and

bear

witness.

Let's

say

that

your

firm

emits

toxic

"gunk"

that

pollutes

rivers.

You'd

like

to

encourage

the

idea

that

gunk

enriches

the

environment.

You've

convinced

the

ex-president

of

the

International

Society

for

the

Prevention

of

Cruelty

to

lliver

Catfish

that

gunk

makes

catfish

healthier

and

want

to

get

him

on

the

road

telling

your

side

of

the

story,

but

who

would

believe

him

if

you

sponsored

the

presentations?

What

to

do?

-l

Joseph

K.

Vetter,

"Dry

Times,"

Reader's

Digut,

May

2008,p.120.

5

"Technology

Strategy:

What

Does

VC

Activity

Suggest

about

Future

Growth

Opportunities?:'

Bernstein

Research,June

19,

2008,

p.3.

Page

11

.1:

;.

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Last

year,

I

heard

a

presentation

in

which

the

speaker

advocated

something

he

and

his

old

organization

had

opposed

vigorously.

Nothing

wrong

with

that.

But

being

of

a

suspicious

turn

of

mind,

I

asked

myself,

"Who

funds

him?"

It

appears

that

the

industry

whose

product

he

now

advocates

put

up

a

bundle

to

establish

his

grass

roots

organization.

Aren't

people

entitled

to

know?

Last

month,

after

Al

Gore's

latest

presentation

(more

on

that

later)

I

noticed

two

anti-Gore

comments,

one

in

an

op-ed

piece

and

one

in

a

news

story,

each

from

an

impressively

named

think

tank.

I

found

that

a

lot

of

the

same

people

and

organizations

contribute

to

both

think

tanks,

and

their

charters

are

such

that

they

do

not

even

make

a

pretense

of

looking

at

issues

objectively.

Shouldn't

the

news

organizations

tell

us

this

before

accepting

the

quote?

Several

years

ago,

a

distinguished

economist

and

I

proposed

to

do

a

study

for

a

well-known

Washington

think

tank,

on

a

topic

of

interest

to

the

organization.

The

think

tank

people

rejected

the

proposal,

they

said,

because

we

did

not

tell

them

what

the

study

would

conclude.

We,

innocently,

thought

that

the

purpose

of

the

study

was

to

find

the

answer.

They

seemed

to

view

the

study

as

a

decoration

to

hang

on

a

pre-

determined

answer.

We

found

other

things

to

do.

So

back

to

Mobil.

It

was

an

ad.

But

it

was

an

honest

ad.

The

AI

Gore

Effect

He

did

it

again.

He

made

a

speech

in

Washington,

D.C.

in

which

he

advocated

that

the

electric

industry

get

off

carbon

fuels

within

10

years.'

(I

think

that

T.

Boone

Pickens

has

come

out

for

something

similar,

but

he

gets

more

respectful

treatment.)

Reporters

did

what

they

always

seem

to

do

nowadays:

get

a

quote

from

someone

affiliated

with

an

environmental

group

("We

need

to

change

the

debate

...

from

what

we

can't

do

to

what

we

can'')

and

from

a

representative

of

one

of

those

think

tanks

that

also

hasa

predictable

line

(''We

couldn't

come

close

...

")'

Right

after

that,

the

internet

blog

attack

began,

apparently

sponsored

by

another

think

tank

that

receives

support

from

the

same

sources

that

support

the

think

tanker

that

didn't

like

the

idea.

The

attackers

produced

a

Michael

Moore-style

film

clip

that

showed

that

the

Gore

family

and

many

attendees

at

the

speech

did

not

take

public

transit

to

the

Gore

presentation.

That

made

for

an

amusing

show,

but

did

not

advance

the

discussion.

After

all,

Al

Gore

is

a

retired

politician

turned

venture

capitalist,

not

Mother

Teresa,

so

let's

not

criticize

him

for

not

being

what

he

isn't,

and

stick

to

the

issues,

please.

From

an

environmental-political

strategy

standpoint,

Al

Gore

chose

the

right

target.

Electric

companies

account

for

one-third

of

carbon

emissions,

and

they

make

easier

targets

than

vehicles

owners

or

industrial

concerns.

Most

of

the

time,

they

can

pass

on

costs

to

consumers,

and

renewable

portfolio

standards

have

put

the

industry

on

the

path

to

less

carbon,

anyway.

Considering

the

costs

of

new

generation

already

facing

the

industry,

the

renewable

standards

and

the

age

of

facilities

already

in

operation,

maybe

going

off

carbon

altogether

would

not

make

as

big

a

difference

as

one

6

Dina

Cappeilo,

"Gore

Calls

for

Historic

U.S.

Effort

to

Switch

to

New

Energy

Sources,"

The

jouJ'!/a/

NeWI,

July

18,

2008,

p.

5B.

7

Fiona

Harvey,

"Gore

Seeks

100%

Green

Energy,"

Fiflallcia/Times,july

18,2008,

p.3.

Page

12

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

goals

in

a

cost-free

manner,

or

with

little

difficulty.

The

opponents

will

explain

why

reaching

the

goals

either

cost

too

much

or

are

impossible

in

the

10-year

time

frame.

Will

the

electric

industry

say

anything,

hope

that

the

issue

goes

away,

bank

on

opposition

from

coal

state

legislators,

or

reply

with

the

usual

stuff?

Anyway,

who

is

Al

Gore,

nowadays?

Nobody

official,

for

sure.

But

neither

was

Ralph

Nader,

Rachel

Carlson,

Harriet

Beecher

Stowe,

Ida

Tarbell,

or

Upton

Sinclair.

Crusaders

do

affect

business

as

well

as

public

policy.

What

happens

if,

after

November,

Al

Gore's

opinions

begin

to

affect

public

policy?

That

leads

to

my

suggestion

for

corporate

strategy.

Every

energy

company

should

establish

a

task

force

that

meets

far

from

the

main

office,

with

a

staff

of

the

brightest

and

most

flexible

employees.

The

electric

company

should

empower

the

task

force

to

write

a

corporate

policy

statement

that

begins,

"That's

a

good

idea,

AI.

Let's

talk

about

how

to

get

there.

Let's

talk

about

how

timing

makes

a

difference,

too."

The

natural

gas

company

task

force

should

ask,

"How

\.vill

the

shift

of

gas

sales

away

from

electric

generation,

our

fastest

growing

market,

open

up

new

opportunities

for

us?'l

The

coal

producers

might

have

to

ask,

HCan

we

turn

our

product

into

something

that

people

want,

or

do

we

sell

it

overseas

to

happy

polluters?"

If

you

view

this

as

a

preposterous

scenario,

not

worth

insuring

against

or

preparing

for,

take

a

look

at

those

people

puffing

away

outside

the

main

door

of

your

office

building,

the

ones

that

have

to

go

out

for

a

smoke

in

the

midclle

of

the

,vinter.

They

did

not

end

up

out

there

because

the

cigarette

companies

planned

it

that

way.

A

multi-decade

crusade

made

it

happen.

If

you

start

,vith

James

Hansen's

first

warnings

about

climate

change,

then

we

are

already

20

years

into

the

crusade,

with

more

decades

to

go.

-

Leonard

S.

Hyman

•

About

the

Contributors

Leonard

S.

Hyman,

a

financial

analyst

and

economist

specializing

in

public

utility

finance,

regulation

and

economics,

is

a

senior

advisor

to

Black

&

Veatch,

and

editor-in-chief

of

Black

&

Veatch's

Pathfind,rand

E/lergy

Strategies

reports.

Previously,

as

senior

industry

advisor

to

the

Global

Power

Group

at

Salomon

Smith

Barney,

he

advised

on

industry

restructuring

projects.

Before

that,

he

headed

the

utility

research

group

at

Merrill

Lynch,

,vith

responsibility

for

coverage

of

energy

and

telecommunications

utilities.

While

at

Merrill

Lynch,

he

participated

in

privatization

teams

for

companies

in

the

UK,

Spain,

Mexico,

Brazil,

and

Argentina.

Mr.

Hyman

is

author,

co-author

or

editor

of

six

books:

E/lergy

Risk

Ma/lagem"'t:

A

Primer

for

the

Utility

I/ld/lstry,Am"ica~

Electric

Utilities:

Past,

Pres",t

a/ld

F/lt/lre,

The

Privatizatio/l

ojP/lblic

Utilities,

The

New

Telec01/lf/lll1licatio/ls

I/ld/lstry

,

The

Water

B/lsi/less,

and

U/llocki/lg

the

Bmejits

ojRtstrtlct/lri/lg:

A

BI/leprint

for

Transmissio/l.

Mr.

Hyman

is

a

Chartered

Financial

Analyst

(CFA).

He

received

a

bachelor

of

arts

degree

from

New

York

University

and

a

master

of

arts

in

economics

from

Cornell

University.

You

can

reach

Leonard

at

631-348-4090.

Samuel

Glasser

edits

the

Pathfi/lder

climate

change

newsletter

and

other

publications

for

Black

&

Veatch's

Enterprise

Management

Solutions

division.

Before

joining

the

company,

he

served

with

the

New

York

Mercantile

Exchange

corporate

communications

department

for

15

years

executing

most

internal

and

Page

13

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Federal

agencies.

He

has

nearly

30

years

of

experience

in

federal

and

state

government

and

government

relations.

He

began

his

career

in

1981

on

the

legislative

staff

of

then

Missouri

Gov.

Christopher

S.

Bond,

and

later

served

on

lvIr.

Bond's

staff

upon

his

election

to

the

U.S.

Senate.

lvIr.

Franzel

also

served

as

a

subcommittee

staff

director

on

the

Senate

Banking,

Housing

and

Urban

Development

Committee.

He

is

a

graduate

of

the

University

of

Missouri

and

the

Duke

University

School

of

Law.

He

can

be

reached

at

bfr:\Ilzcl@cardinalpoint.com.

Andrew

C.

Byers

is

an

associate

vice

president

in

Black

&

Veatch's

energy

business

with

24

years

of

energy

and

environmental

experience.

He

serves

as

the

division's

legislative

and

regulatory

policy

advisor)

as

well

as

a

senior

project

manager

for

its

environmental

health

and

safety

business.

He

previously

served

as

assistant

general

counsel

with

the

Missouri

Department

of

Narural

Resources,

and

has

worked