Janet

Peace,

Director

of

Markets

and

Business

Strategies,

Senior

Economist,

Pew

Center

on

Global

Climate

Change,

"Insights

from

Modeling

Analyses

of

the

Lieberman-Warner

Climate

Security

Act

(S.

2191

),"

PowerPoint

presentation

(May

2008),

<

www.pewclimate.org/docUploads/

Peace-PPT.pdf

>.

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

1. EIA, NEMS model

2. EPA, ADAGE and IGEM models

3. Clean Air Task Force, NEMS model

4. American Council for Capital Formation and the

National Association of Manufacturers,

NEMS

model

5. MIT, EPPA model

6. CRA International, MRN and NEEM models

2

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

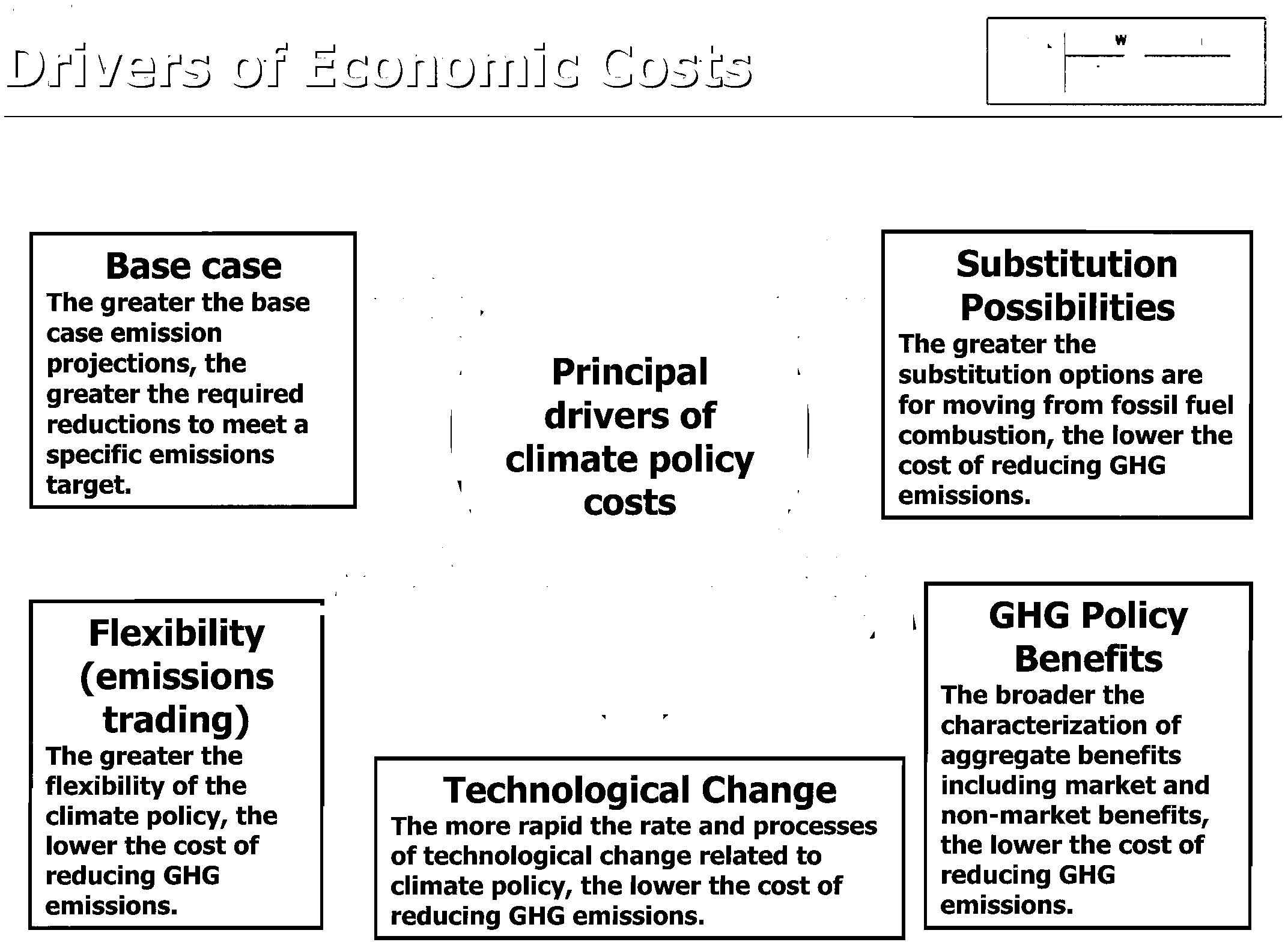

Substitution

PossitJilities

The greater the

substitution options are

for moving from fossil fuel

combustion, the lower the

cost of reducing GHG

emissions.

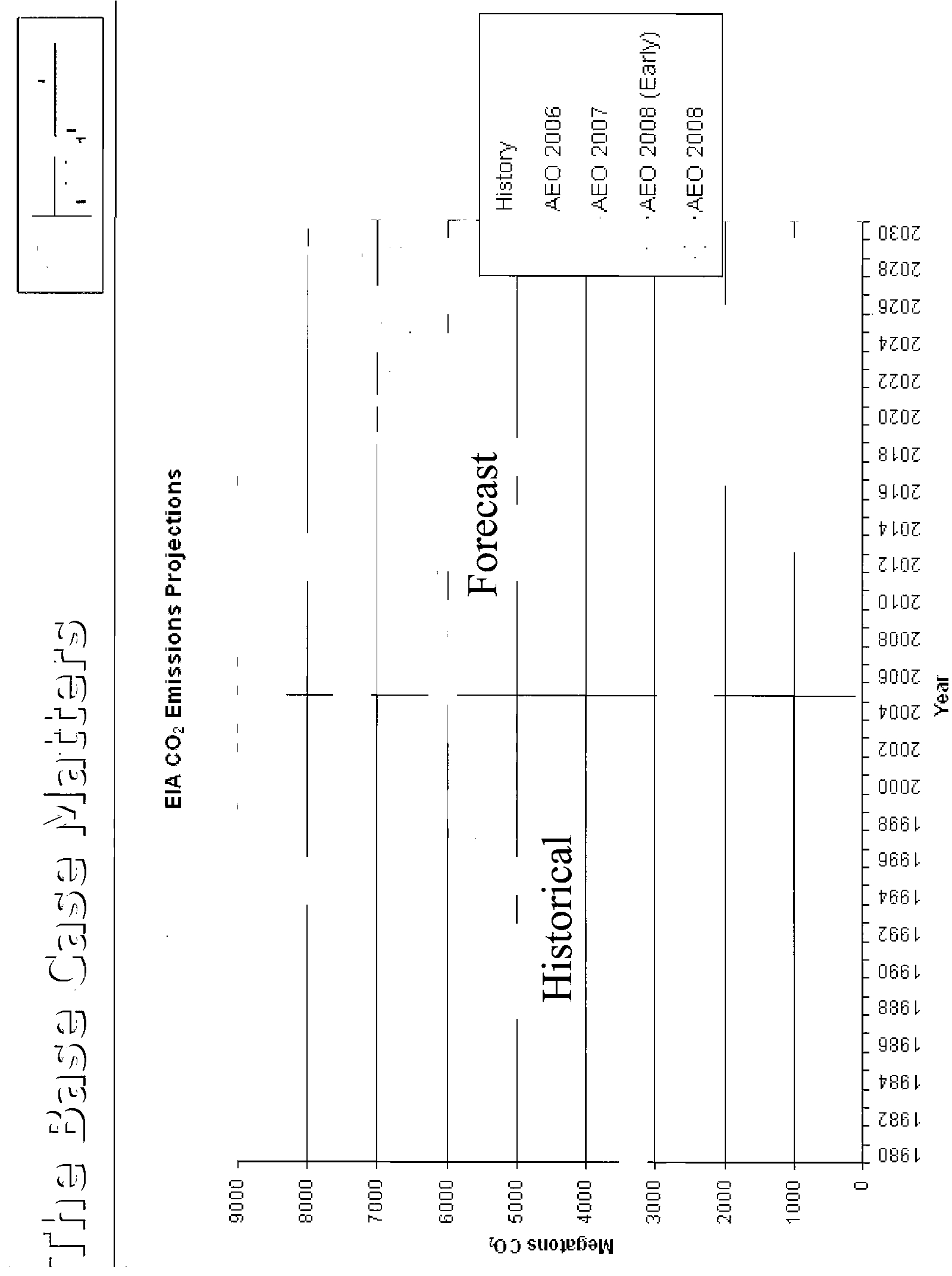

Base case

The greater the base

case emission

projections,

the

greater the required

reductions

to meet a

specific emissions

target.

f=le)(itJilit1r

(emissions

trading)

The greater the

flexibility of the

climate policy, the

lower the cost of

reducing GHG

emissions.

Technological Change

The more rapid the rate and processes

of technological change related to

climate policy, the lower the cost of

reducing GHG emissions.

GHG Policy

Benefits

The broader the

characterization of

aggregate benefits

including market and

non-market benefits,

the lower the cost of

reducing GHG

emissions.

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

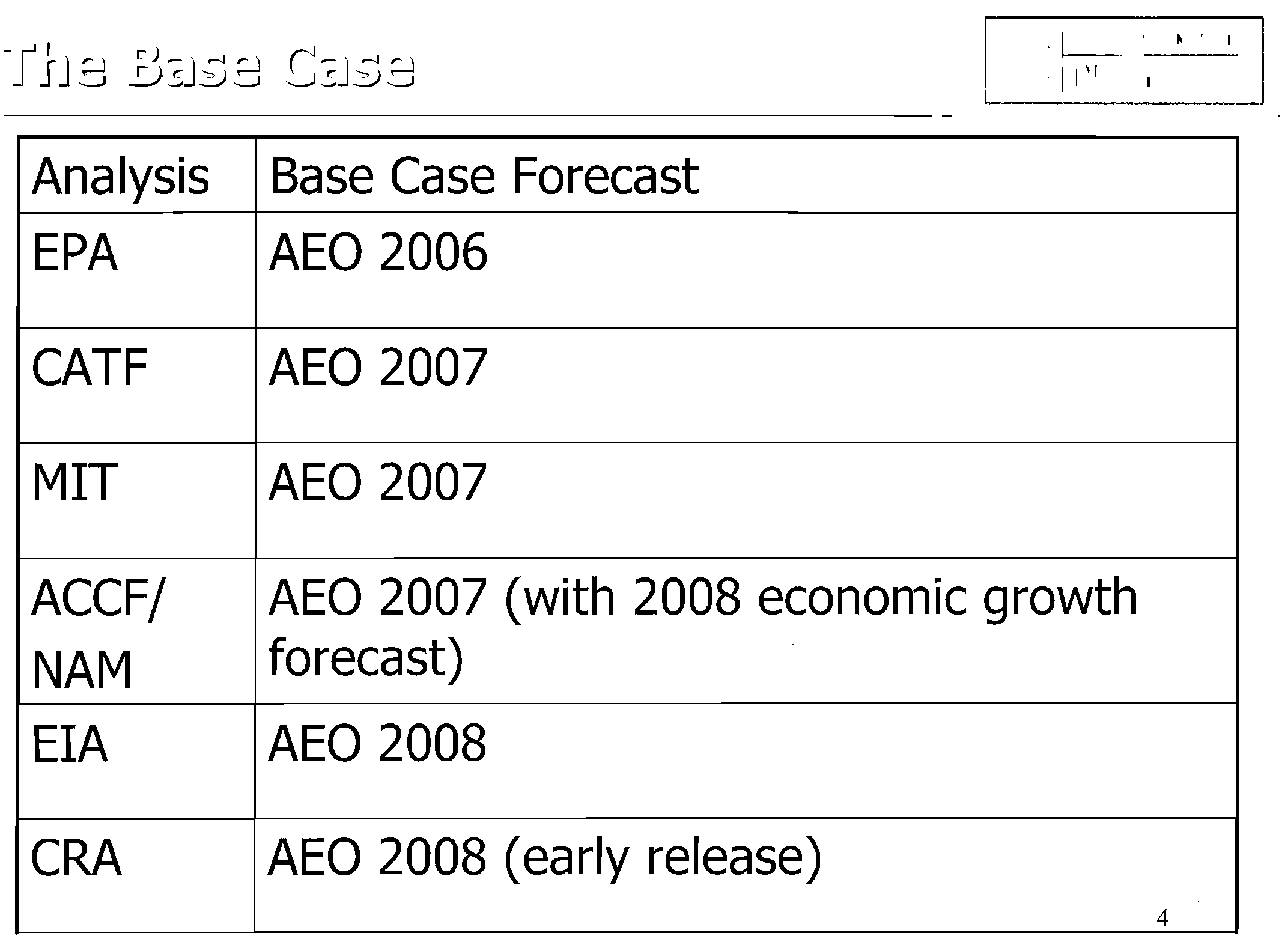

Analysis Base Case Forecast

EPA

AEO 2006

CATF

AEO 2007

MIT

AEO 2007

ACCFj

AEO 2007 (with 2008 economic growth

NAM

forecast)

EIA

AEO 2008

CRA

AEO 2008 (early release)

4

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

\

f-

f-

.

~~

I

f-

f-

-+->

f-

rrJ

c\j

f-

U

(l)

f-

~

f-

0

~

f-

f-

f-

f-

f-

I

j

-

f-

c\j

U

f-

•

....-I

~

f-

0

-+->

rrJ

•

....-I

::q

f-

~

f-

f-

)

f-

f-

f-

1()

J

SlIOWll;lW

1/1

£:

o

:0:;

u

f1I

.....

o

...

Q..

1/1

£:

o

1/1

1/1

E

w

N

o

o

<:(

w

0::>

0::>

0::>

m

0::>

0::>

0::>

00

0::>

0::>

0::>

~

0::>

0::>

0::>

(£!

0::>

0::>

0::>

LJ:)

0::>

0::>

0::>

.".

0::>

0::>

0::>

f'")

0::>

0::>

0::>

N

0::>

0::>

0::>

0::>

8W[

9W[

tW[

[W[

OW[

8~0[

9~0[

HO[

nO[

O~O[

800[

900[

...

«:

tOO[

~

WO[

OOO[

866

~

966

~

1'66

~

[66

~

066

~

886

~

986

~

1'86

~

[86

~

086

~

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

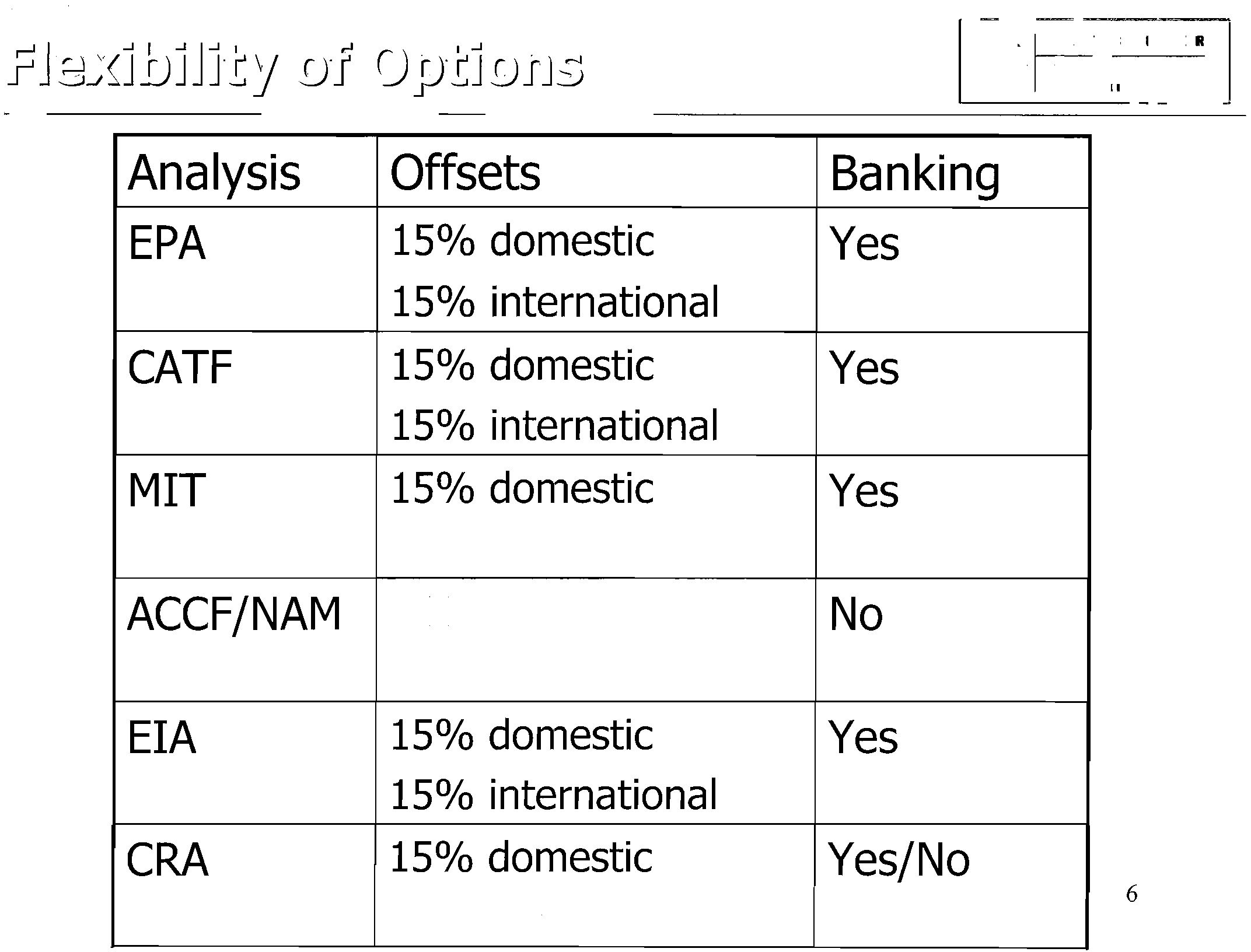

Analysis

Offsets

Banking

EPA

15% domestic

Yes

15% international

CATF

15% domestic

Yes

15% international

MIT

15% domestic

Yes

No international

ACCF/NAM

14% (high cost)

No

17% (low cost)

EIA

15% domestic

Yes

15% international

CRA

15% domestic

Yes/No

No international

6

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

PlOJXQ

P:lq!D-D

0.0

lffi~SPJ1OM

.S

"0

~

torn

(;j

.!:l

0

G

WN

0

Ol~BW-'1\0rnVJ'\l

-

0.0

V.Lto

(1)

.S

'0

"0

0

~

:!!:

WDS

....

><:

(l)

Vdd3:-.LIW

~

•

DIW-SW

mml3:w

0.0

.S

SW3:N

]

i

0

W3:.LD-ffiNlIV

o

~

~

~

8

~

8

~

~.~

N

N

~

~

(UO.1

;)!Jl;)W/S$066I)

~

.......-

I

J

I

~

r

I~

I

I

rl

I

I

I

rl

I

rl

I

I

I

-;::=r

I

I

~

[

~

I

I

lri

I

I

I

~

I

I

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

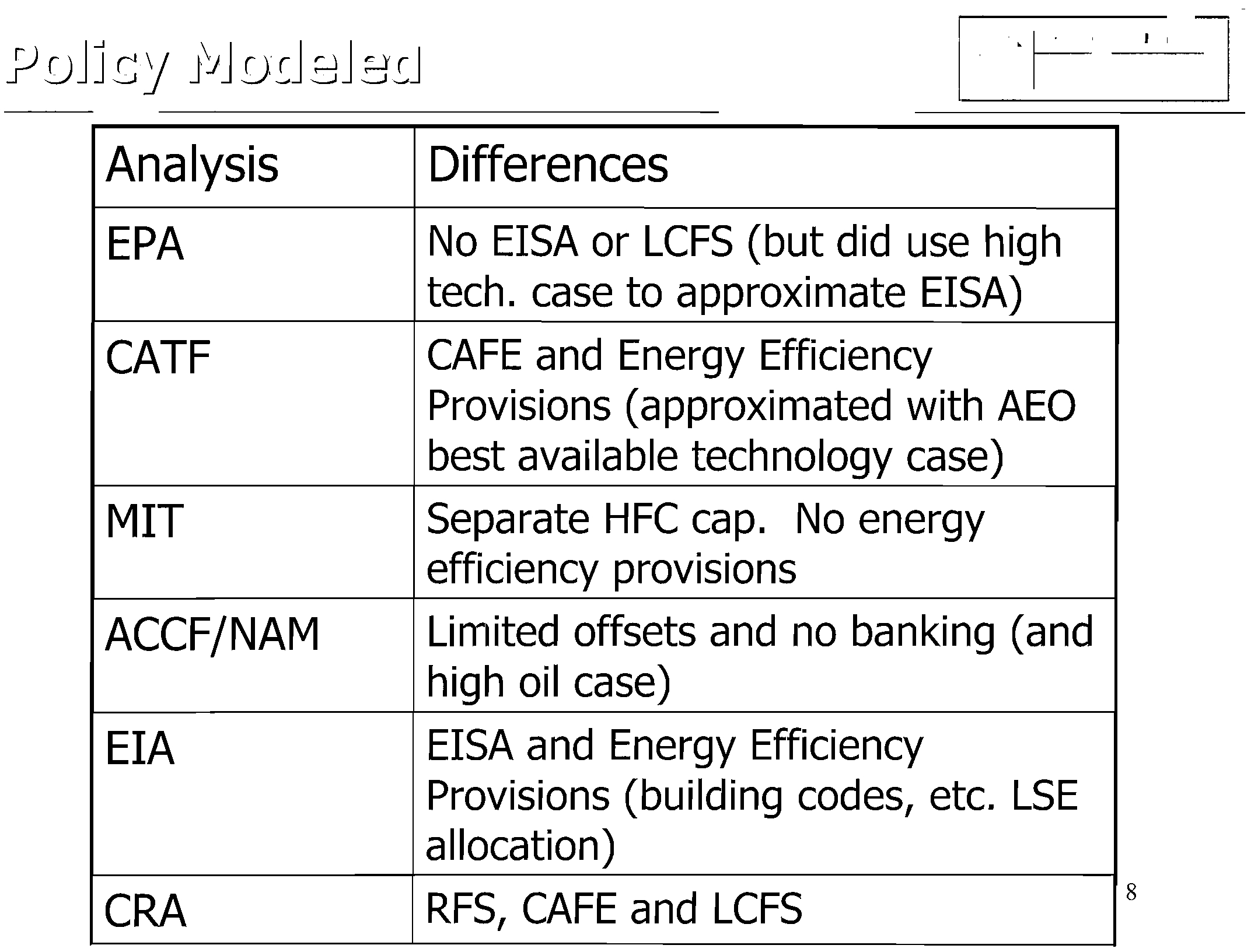

Analysis

EPA

CATF

MIT

ACCF/NAM

EIA

CRA

Differences

No EISA or LCFS (but did use high

tech.

case to approximate EISA)

CAFE and Energy Efficiency

Provisions (a pproximated with AEO

best available technology case)

Separate HFC cap. No energy

efficiency provisions

Limited offsets

and no banking (and

high

oil case)

EISA and Energy Efficiency

Provisions (building codes, etc. LSE

allocation)

RFS, CAFE and LCFS

8

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

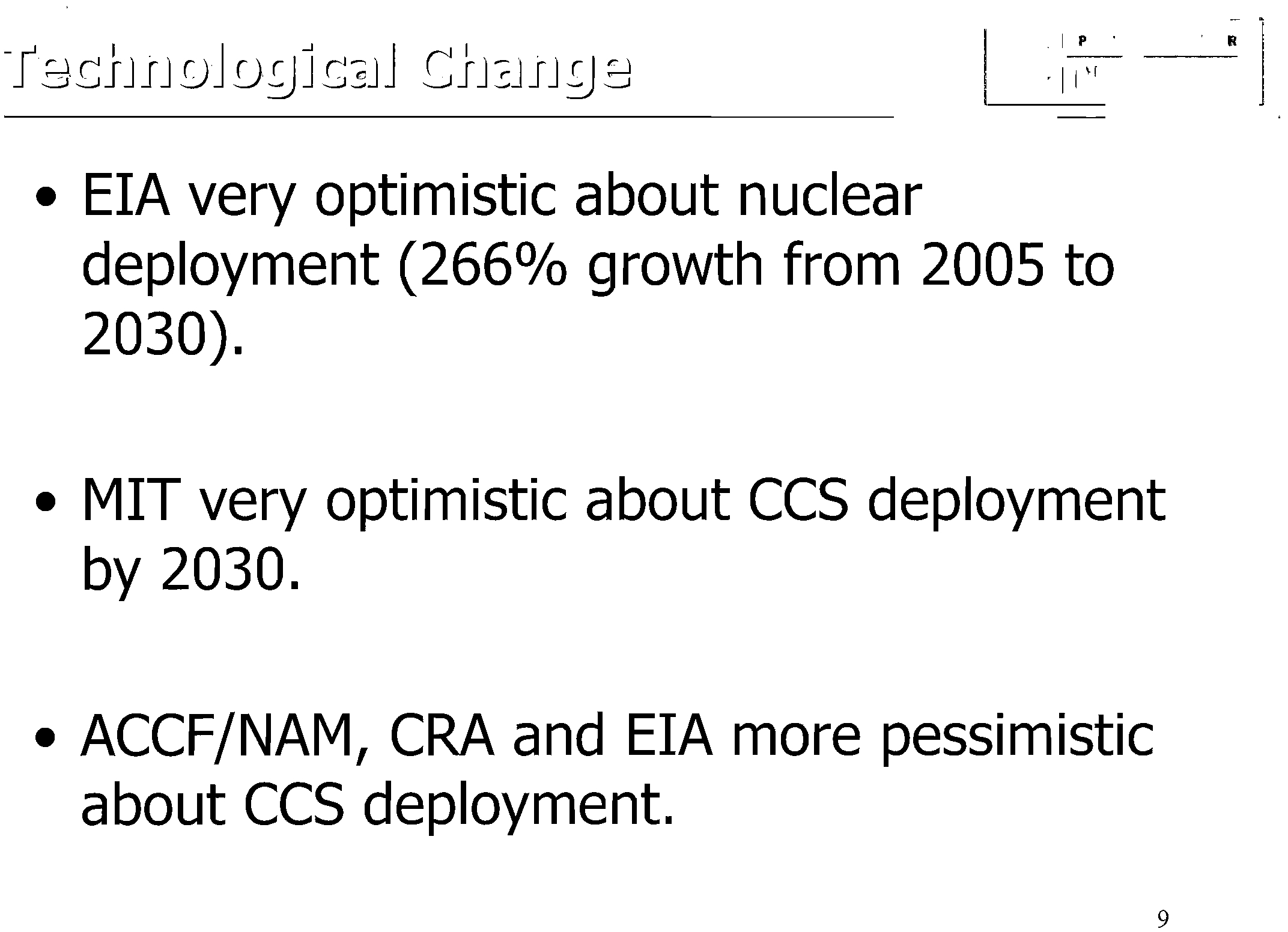

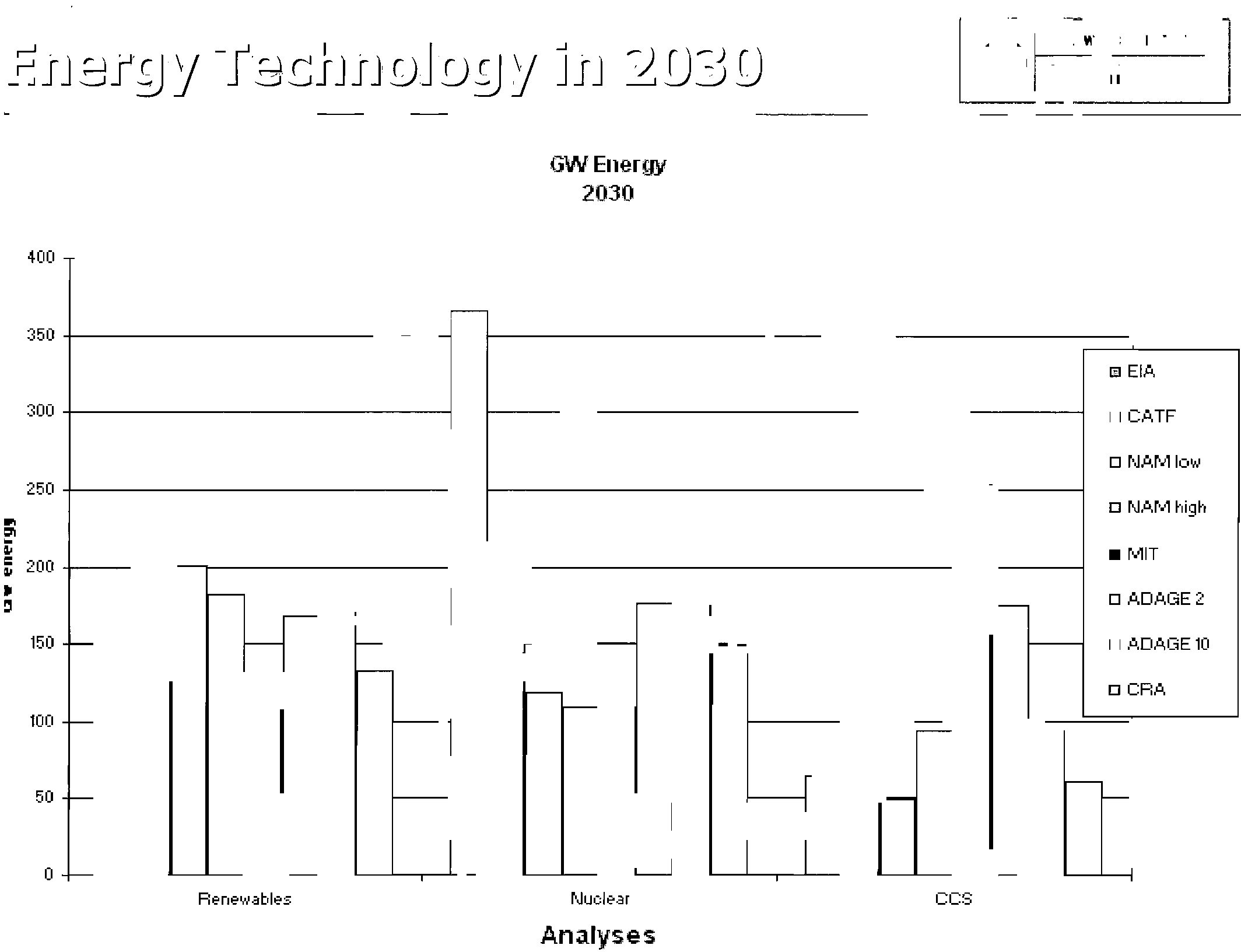

• EIA very optimistic about nuclear

deployment

(266%

growth from

2005

to

2030).

• MIT very optimistic about CCS deployment

by

2030.

• ACCFjNAM, CRA and EIA more pessimistic

about

CCS deployment.

9

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

GWEnergy

2030

400 1

I

o

I I

50

350

I

II

I

,

[] EIA

300

J

I I

I

• CATF

[] roJAM

low

II

II

250

--

-

..

c:l\

~

200 1

-

1

L-

-

1

[]•

MITNAM

high

II

!l

I I

-

r------J

1

-

1

[]ADAGE2

150

+-1,-':",_

I

I----l

I

I

I

,

I

• ,o.DAGE 10

[] CRA

I

li'.,._

I

- -

I

I

-

l

1

-

I

- -

1

1

100

RE"nE"\~<IbIE"S

NuolE"<Ir

CCS

Analyses

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

11

• Very uncertain.

•

Very dependent on policy

architecture/implementation.

•

We can put some very rough bounds on

cost estimates.

•

We have some general insights into how

to minimize

costs.

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

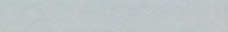

$300.00

I

I

$250.00

+I-----------------~

$200.00

, ,

,

, ,

[] 2015

,

I

I

I

.2020

GI

I

I

I

e

$150.00

~

;:

l.

$100.00

ACCF-NAM I ACCF.NAM IMIT - OffSE'ts

+1

EPA ADAGE

I

EP,o, ADAGE

CCS

SCE'nario 2

SCE'nario

10

$50.00 +1-----1

$0.00 1

'

EtA

CATF

Low Cost

High Cost

SCE'nario with

Ban~,ing

CRA.

Analyses

12

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

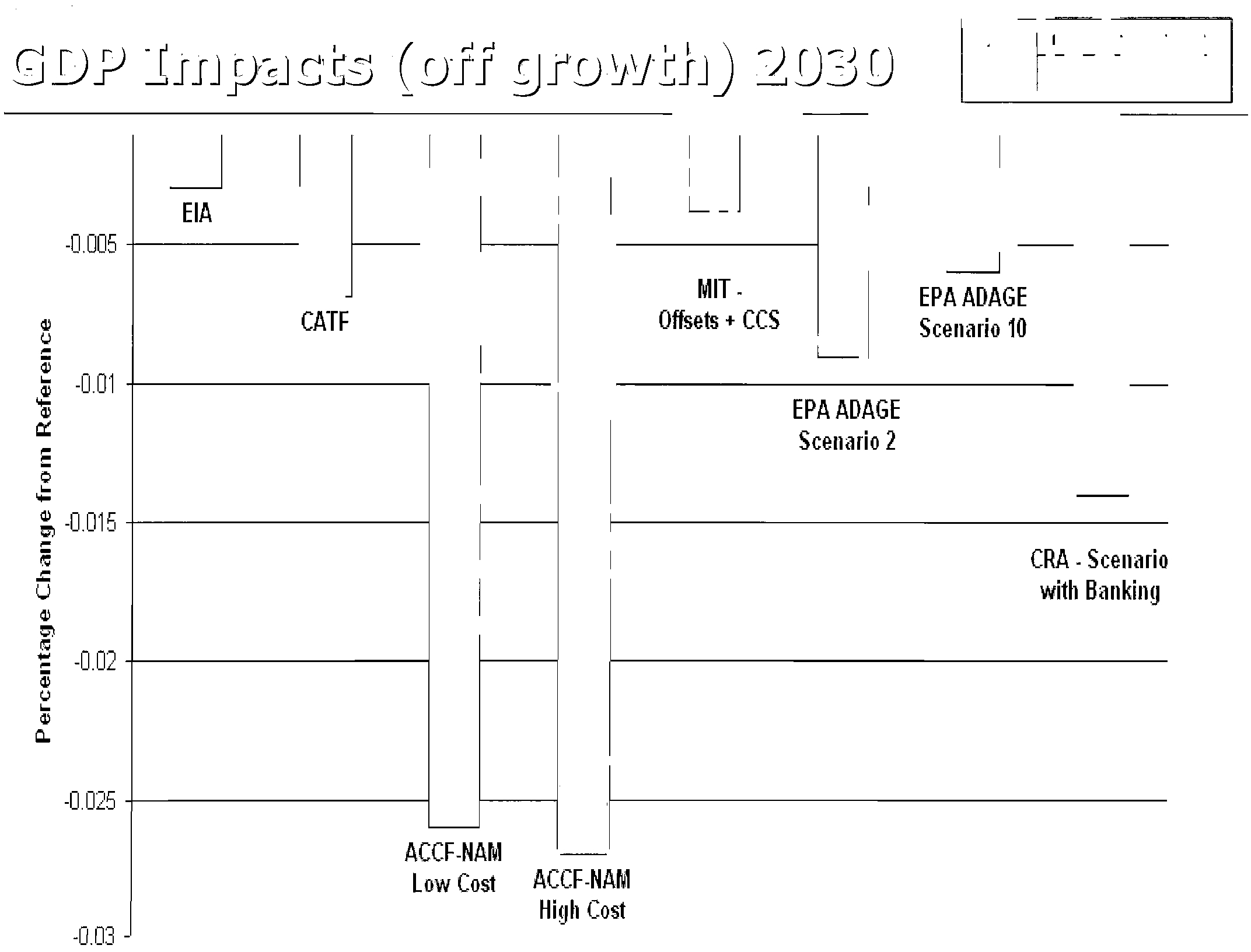

-0.005

ili

..

;V

()

~

-0.01

'a;

c::

..

:::

o

.;:

U

..

..

16

~

-0.015

ili

:='l

(ll

:: -0.02

ili

()

...

ili

Q.

-0025

-0.03

-0

EIA

D

f---,

Mil -

EPA ADAGE

CAlF

Offsets + CCS

Scenario 10

r--

EPA ADAGE

Scenario 2

CRA - Scenario

with Banking

;

ACCF-NAM

Low Cost

ACCF-NAM

High Cost

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

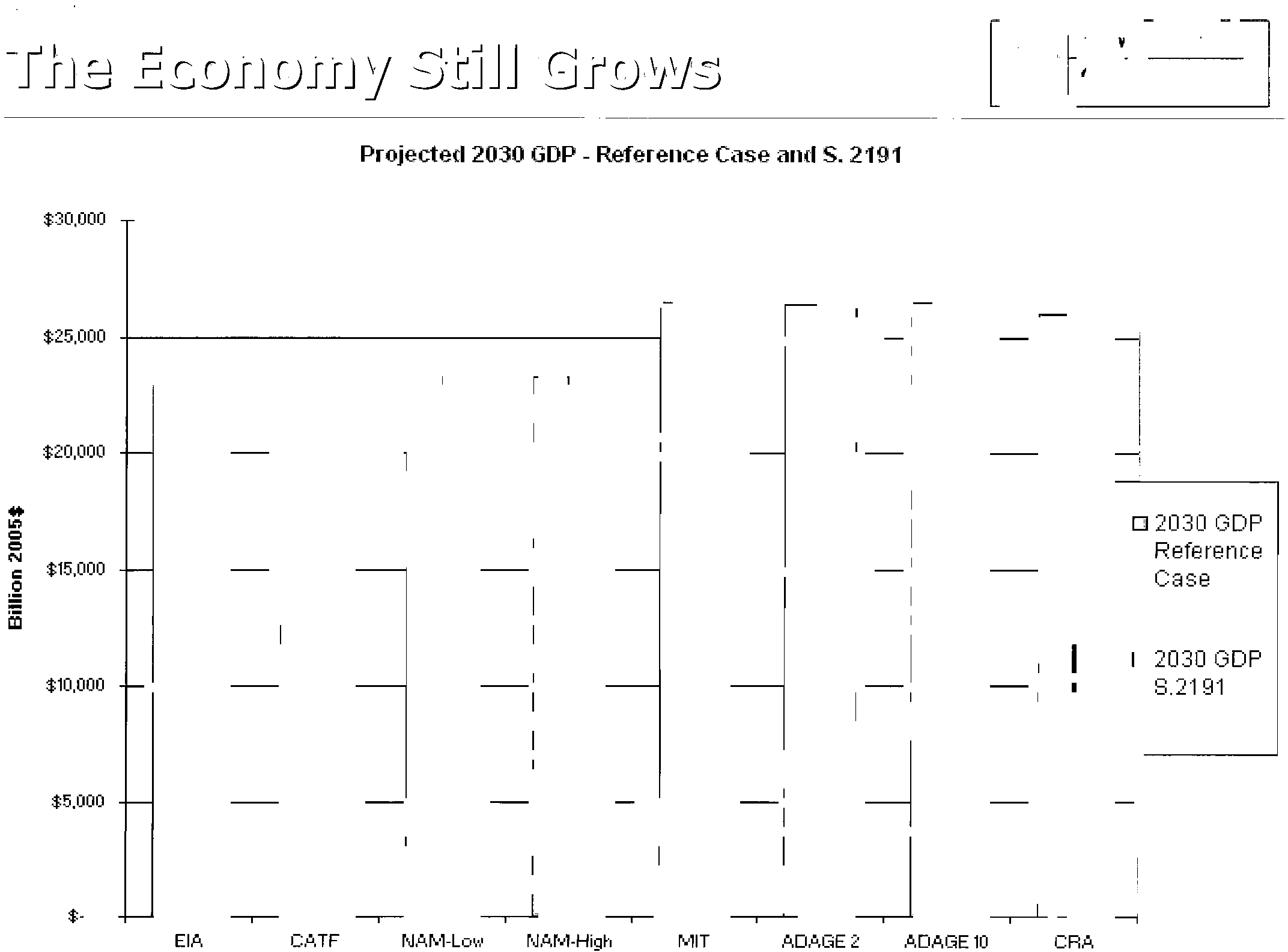

Projected 2030 GOP - Reference Case and S. 2191

$30,000 I

i

EIA

C,1l,TF

NAM-Low

NAM-High

MIT

ADAGE 2

P,DAGE

10

eRA

$-

$5,000

$25.000

I

I

$20,000

...

$15,000

W::,~

~ ~ ~ ~ ~ ~

It!

•

02030 GDP

N

==

Reference

c

Case

~

iii

II

-

I

-

I

-

I

-

I

-

I

-

I

-

I

-

.2030 GDP

$10,000 +-I

I

I

I

I

I

I

I

-

8.2191

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

• Very difficult to compare across models

~

these should not be interpreted as ranges.

These are apples and oranges because they

are all different analyses.

• While there is considerable variation

across models

in terms of the likely

price

of allowances, where low carbon

technology

is allowed to develop and

flexible policy

is included, the costs are

Back to top

modest.

15

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

16

• Organize our thinking

•

Put very rough bound on costs

• Prioritize our efforts

• Identify policy

and technology sensitivities

(the drivers)

•

Provide insights or benchmarks for "good"

policies

Models are not crystal balls and are only as

good as

the assumptions, the structure,

and

the data allow.

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

• A broad-based advanced technology portfolio is critical to

achieving climate goals at reasonable cost.

• A combination

of price signal and policies for end use

efficiency

can reduce program costs by decreasing energy

demand.

• Flexibility (banking and borrowing) can reduce costs.

• The more offsets

in a program, the lower the costs.

• Some sectors will show greater opportunities for reductions

in the short term.

•

In the medium to longer term, CCS plays a large role.

• Under reasonable climate policy, the economy will still grow

robustly.

17

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Janet Peace

Director of Markets And Business Strategy and Senior Economist

Pew Center on Global Climate Change

PeaceJ@pewclimate.org

www. pewclimate.org

18

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Moody's

Investor

Service,

"Rating

Action:

Ameren

Corporation"

(August

13,

2008).

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Approximately

$800

million

of

Debt

Securities

Downgraded

NewYork,

August

13,2008

-

Moody's

Investors

Service

downgraded

the

ratings

of

Ameren

Corporation

(Ameren),

induding

its

Issuer

Rating.

to

Baa3

from

Baa2,

and

its

short.tenn

rating

for

commercial

paper,

to

Prime-3

from

Prime-2;

and

the

senior

unsecured

debt

rating

of

AmerenEnergy

Generating

Company

(AmerenGenco)

to

Baa3

from

Baa2.

The

rating

outlooks

of

Ameren

and

AmerenGenco

are

stabla.

Moody's

also

downgraded

Union

Electric

Company's

(d/b/a

AmerenUE)

short-term

rating

for

commercial

paper

to

Prime-3

from

Prime-2.

Thesa

rating

actions

conclude

the

review

for

downgrade

initiated

on

May

21,

2008.

Thalong-term

ratings

and

outlooks

of

Central

Illinois

Public

Service

Company

(d/b/a

AmerenCIPS,

Bal

Issuer

Rating,

positive

outlook);

CILCORP

Inc.

(Bal

Corporate

Family

Rating,

positive

outlook);

Central

Illinois

Light

Company's

(d/b/a

AmerenCILCO,

Bal

Issuer

Rating,

posnive

oullook),

Illinois

Power

Company

(d/b/a

AmerenlP,

Bal

issuer

Rating,

posnive

outlook),

and

Union

Electric

Company

(d/b/a

ArnerenUE,

Baa2

Issuer

Rating,

stable

oullook)

are

unchanged.

'"The

downgrade

of

Ameren

reflects

dedining

consolidated

coverage

ratios

over

the

last

several

years

and

Moody's

expectation

that

ongojng

cost

pressures

and

the

lack

of

timely

regulatory

recovery

of

somecosts

will

prevent

ratios

from

returning

to

historical

levels

over

the

near

term-,

said

MichaeJ

G.

Haggarty

I

Vice

President

and

sena

Credit

Officer.

Ameren

has

experienced

higher

operating

and

maintenance

costs

and

increased

capital

spending

requirements

at

both

its

utility

and

nonutility

businesses.

Limited

rate

relief,

low

returns,

and

the

lack

of

automatic

rate

adjustment

dauses

has

led

to

regulatory

lag

In

recovering

costs

in

recent

years,

which

is

reflected

in

Its

lower

consolidated

coverage

metrics.

In

addition,

the

comblnatton

of

large

capital

expenditures

and

the

company's

high

dividend

payout

ratio

has

resulted

in

substantial

negative

free

cash

flow

in

2007

and

2008,

which

is

likely

to

continue

over

the

next

several

years.

Ameren's

lower

rating

is

also

prompted

the

downgrade

of

two

of

its

major

subsidiaries,

Union

Electric

(to

Baa2

on

May

21,

2008)

and

AmerenGanco

(wnh

this

rating

action),

which

will

decrease

the

quality

of

expected

cash

flows

upstreamed

to

the

parent

company.

Although

Moody's

maintains

positive

outlooks

on

the

ratings

of

Ameren's

Illinois

utility

subskUaries,

any

upward

movement

of

these

ratings

is

likely

to

be

modest

and

nol

significant

enough

to

offset

the

lower

ratings

of

Union

Electric

and

AmerenGenco,

which

represent

the

bulk

of

the

cash

flows

upstreamed

to

the

parent.

The

downgrade

also

considers

longer-term

challenges

facing

Amoren,

Induding

the

potential

passage

of

cerbon

control

legislation

next

year

and

the

possible

construction

of

a

new

nuclear

unit

at

Union

Electric.

which

just

submitted

a

combined

Construction

and

Oparatlng

Ucensa

Application

(COLA)

to

tha

Nuclear

Regulatory

Commission.

The

downgrade

of

AmerenGenco

reflects

higher

capital

expenditures

at

this

predominanUy

coal

fired

generating

subsidiary,

some

of

which

are

likely

to

be

financed

with

additional

long-term

debt;

and

the

likelihood

that

the

company

will

be

negatively

affected

over

the

long-term

by

the

implementation

additional

environmental

compliance

requirements

or

controls

on

carbon

emissions.

The

downgrade

also

considers

its

higher

business

and

operating

risk

profila,

as

Moody's

views

AmerenGenco

as

more

of

a

merchant

generating

company

sailing

Into

unregulated

power

markets

rather

than

a

complately

contracted

ganco

sailing

most

of

its

power

to

Ameren

affiliates.

Although

financial

metrics

have

Improved

since

the

expiration

of

thesa

below

market

affiliate

contracts,

this

Improvement

is

not

sufficient

enough

to

offset

its

incraased

business

risk

profUe.

The

downgrade

of

Union

Electric's

short-tarm

rating

for

commercial

paper

to

Prime-3

from

Prim&-2

Is

prompted

by

the

downgrada

of

Arneren's

short-term

rating

to

Prima.3.

Arneren

and

Union

Electric

share

the

same

bank

credit

facility,

wnh

Union

Electric

able

to

borrow

on

a

36+<lay

basis

under

the

facility.

The

two

entities

also

share

a

money

pool

arrangement

and

Union

Elactric

is

highly

dependant

on

the

parent

for

liqUidity

and

finenclal

support,

as

has

been

demonstrated

by

capital

contributions

from

Arneren

to

Union

Electric

and

a

$50

million

intercompany

note

payable

from

the

uUllty

to

the

parent

outstanding

as

of

June

30,

2008.

The

maintenance

of

8

positive

rating

outlook

of

Ameren's

Illinois

utilities

refleds

the

potential

tor

modest

upward

movement

in

their

ratings

in

the

event

there

is

8

supportive

outcome

of

their

pending

distribution

rate

cases,

resutting

In

an

improvement

in

some

of

their

relaUveIy

low

cash

now

coverage

metrics;

If

there

js

a

reduction

in

high

short-term

debt

levels

and

an

extension

of

their

bank

fadlltlas,

increasing

financial

ftexibllity;

or

If

there

is

a

sucx:essful

implementalion

of

new

power

procurement

policies

and

procedures

in

Illinois.

Ratings

downgraded

Include:

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

New

York

William

l.

Hess

Managing

Director

Infrastructure

Finance

Group

Moody's

Investors

Service

JOURNALISTS:

212-553-ll376

SUBSCRIBERS:

212-553-1653

New

York

Michael

G.

Haggarty

VP

-

Senior

Credit

Officer

Infrastructure

Finance

Group

Moody's

Investors

Service

JOURNALISTS:

212-553-Q376

SUBSCRIBERS:

212-553-1653

©

Copyright

2008,

Moody's

Investors

Service,

Inc.

and/or

its

licensors

including

Moody's

Assurance

Company,

Inc,

(together,

"MOODY'S").

All

rights

reserved.

ALL

[I'IiFORr-1ATJQN

CONTAlNED

HERf/N

IS

PROTECTED

BY

COPYRiGHT

LAW

AND

NONE

OF

SUCH

INFORMATION

1\1AY

BE

COPIED

OR

OTI1EFn'JlSE

REPRODUCED,

Fl!:_P

..

~CKAGED,

fURTHER

TRANSMflTIIJ,

TRANSFERRED,

DISSEMiNATED,

REDrSTRUlUTED

OR

RESOLD.

OI{

STORED

!'OR

SUBSEQUENT

USE

fOR

ANY

SUCH

PURPOSE,

IN

WHOLE

OR

IN

PART,

IN

ANY

FORM

OR

r.1ANNER

OR

BY

ANY

MEANS

WHATSOEVER,

BY

ANY

PERSON

wm~OUT

MOODY'S

PRIOR

WRITTEN

CONSENT.

AU

information

contained

herein

is

obtained

by

r-100DY'$

(1'00'

sources

believed

by

it

to

be

accu~ate

and

reliable.

Bec.a~lse

of

the

pO!'Slbihtv

of

human

lJf

mechanical

error

as

well

as

other

factars,

however,

such

information

IS

provided

~as

IS"

without

warl7lnty

Ol

any

kind

and

",OODY'S,

in

portieular,

ma!ces

no

repn~sp-ntatlon

or

warranty,

e"press

01"

inlpli~d,

as

to

the

accurll

...

-y,

timeliness,

c.olTlpleten~:;;!;,

rnen:himtablhty

0:-

fitness

for

dny

Pilr!icular

purpose

of

any

such

mformation.

Under

no

circum!:tClnc.es

shall

NODDY'S

have

6ny

liabIlity

to

any

perst:ln

or

entity

for

(,1)

any

loss

or

damage

tn

whole

or

In

part

caused

by,

resultmg

tronl,

cr

rel3t'ng

.0,

any

emJr

(ni:9Ii~ef'lt

or

otherwise)

or

o:h.:,.

circumstance

or

ccntingE'ncy

wit"in

or

outSide

tI~e

(ontrol

of

/10'000"('5

or

any

of

ItS

d!recrors,

officers,

employees

ar

agents

II'

COl'1nectlon

WIth

tt'le

procurement,

collection,

compllatlon,

analysis,

Interpo-et"tion,

communication,

publ:::ation

or

deli

....

ery

ot

any

such

Information,

or

(b)

any

direct,

indIrect,

spe:hll,

consequer:tJa!,

compensatory

or

inddc:ntal

damages

whatso~ver

(inclUding

Without

Hml~tlon,

lost

profits),

even

If

MooDY'S

IS

advised

in

advance

of

the

possibility

of

such

damagE'S,

resulting

from

the

uS('

of

or

inability

to

use,

any

such

information.

The

creche

ratings

and

financial

reporting

analYSIS

observations,

If

any,

constituting

part

of

the

informatIon

contained

herein

are,

and

must

be

construed

solely

as,

statements

of

opinion

and

not

statements

of

fact

or

recommendations

to

purchase,

sell

or

hold

any

seCUrities.

NO

WARRANTY,

EXPRESS

OR

IMPUEO,

AS

TO

ll1E

ACCURACY,

TI/Io1EL1NES5.

CO'<1PlETENESS,

MERCHANTABILITY

OR

FITNESS

fOR

ANY

PARTICULAR

PURPOSE

OF

ANY

SUCH

RATrNG

OR

OTHER

OPINION

OR

INFORMA,TION

IS

GIVEN

OR

MADE

BY

MOODY'S

IN

ANY

FORM

OR

MANNER

WHATSOEVER.

Each

rating

0,'

other

opinion

must

be

weighed

solely

as

one

factor

In

any

investment

decision

made

by

Of

on

behalf

of

any

user

of

the

information

contained

herein,

and

each

such

user

must

accordingly

make

Its

own

study

and

e

....

aluatlOn

of

each

security

and

of

each

issuer

and

guarantor

of,

and

each

pro

....

ider

of

credIt

support

for,

each

securIty

that

It

may

consIder

purchasing,

holding

or

selilng.

MOODY'S

hereby

discloses

that

most

I!;SllerS

of

debt

securities

(including

corporate

and

municipal

bonds,

debentures,

notes

and

commercial

paper)

and

preh~n'ed

stock

rated

by

MOODY'S

nave,

prior

to

assignment

of

any

rating,

agreed

to

pay

to

~400DY'S

for

appraisal

and

rating

$ervices

rendered

by

it

fees

ranging

from

$1,500

to

approlCimetely

~2,400,OOO.

Moody's

Corporation

(fl.1CO)

and

Its

Wholly-owned

credit

ratJl1g

agency

subsidiary,

Moody'S

Investors

Service

(MIS),

also

maintain

poliCies

and

proceCJures

to

address

the

independence

of

r-lIS's

ratings

and

ratIng

proce':ises.

Information

regarding

certain

affiliations

that

may

exist

belwei:n

directors

of

MeO

and

rated

entities,

and

between

entities

who

hold

ratings

from

,..US

and

have

also

publicly

reported

to

the

SEC

an

ownership

Interest

in

1\1C0

of

more

than

SOM,

Is

posted

annually

on

t-loody's

website

at

www.moodys.com

under

the

heading

'Shareholder

RelatIOns.

Corporate

Govemance.

Director

and

Shareholder

Afflhation

Policy.-

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Pew

Center

on

Global

Climate

Change,

"Insights

from

Modeling

Analyses

of

the

Lieberman-Warner

Climate

Security

Act

(S.

2191)"

(May

2008).

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Economic

models

establish

a

logical

and

consistcnr

higher

deployment

rates

of

energy

efficient

products

and

framework

for

considering

the

implications

of

different

programs

(e.g.,

allocation

to

stares

based

on

implementation

policies

and

have

been

extensively

used

to

evaluate

the

of

energy

effidenr

building

codes)

are

nOf

specifically

included.

consequences

of

different

policy

choices

for

addressing

This

does

not

mean

that

the

modeling

results

are

not

useful

bur

global

climate

change.

Yet

model

results

depend

upon

the

rather

illustrates

that

model

results

represenr

an

approximation

of

assumptions,

definitions,

and

structure

of

the

model,

30$

the

bill

and

not

the

bill

as

a

whole.

well

as

the

dara

that

are

used

for

input

into

the

model.

Few,

if

any,

of

the

expens

who

work

closely

with

models

For

example,

the

flexibility

of

the

economy

in

responding

to

believe

rhar

specific

model

ourpms

regarding

furure

energy

cosrs

change

or

the

flexibiliry

of

rhe

policy

being

modeled

can

or

GOP

impacrs

will

acrually

marerialize

under

any

given

policy.

borh

have

signiflcanr

implicarions

for

any

assessment

of

the

Bur

the

resulrs

are

inreresring

for

the

broadcr

insighrs

they

reveal.

costs

of

a

parricular

policy.

Funhermore,

there

is

enormous

In

the

effon

to

craft

and

implement

cosr~effcctive,

well-designed

unccrrainry

in

aucmpting

to

predict

outcomes

that

occur

srrategies

for

addressing

the

problem

of

climate

change,

it

is

in

50

years.

both

in

terms

of

technologics

that

might

be

critical

that

all

who

seek

to

understand

and

usc

modeling

results

available

and

the

costs

of

using

those

technologies.

In

the

share

a

realistic

view

of

their

proper

role

in

the

climate

policy

past,

prior

csrimarcs

of

the

COSts

of

regulation

were

often

debate.

(For

a

full

discussion

see

the

Pew

Center's

companion

many

times

more

rhan

the

actual

observed

COStS

once

a

paper,

"Insights

Not

Numbers."Z)

program

is

initiared.

l

This

In

Srir/cxamines

somc

of

rhe

models

rhat

have

been

Models

only

provide

a

simplified

view

of

our

used

ro

assess

the

economic

impacts

of

rhe

Lieberman-Warner

economy.

In

the

case

of

the

Lieberman-Warner

Climate

Climate

Security

Act

(as

reported

our

ofComminee

in

December

Security

Act

(5.

2191),

models

can

caprurc

many

of

the

key

2007)

and

puts

them

in

contexr

for

consumers

of

this

modeling

policy

clements

(e.g.,

the

impacts

of

targets,

riming.

and

information.

It

is

important

to

note

that

some

of

these

offsets)

but

cannot

incorporate

all

of

them.

For

example.

modeling

efforts

were

undertaken

in

advance

of

the

new

Energy

the

impact

of

the

Carbon

Market

Efficiency

Board.

Independence

and

Security

Act

of

2007

and

the

new

forecast

of

which

can

contain

COStS

by

adjusting

the

quantity

of

baseline

or

"business

as

usual"

(BAU)

emissions

through

2030.

borrowed

allowances

and

the

trigger

price

that

spurs

Because

the

more

recent

forecasts

reflect

lower

baseline

emissions

this

borrowing,

is

not

included

in

any

of

the

models.

than

previously

anticipated,

the

C05[S

of

[he

climate

proposals

Furthermore

many

of

the

provisions

designed

co

encourage

based

on

earlier

higher

projections

ofba5e1ine

emissions

are

likely

to

be

overestimated.

IN

BRIEF

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

taking

action

{such

as

avoided

impacts

of

sea-level

rise

and

ancillary

beneflts

of

improved

air

quality

or

energy

security}.

A~

such,

the

economic

models

promed

in

this

review

present

only

one

side

of

the

story-the

costs

of

policy,

not

the

benefits

of

that

policy.

The

following

section

summarizes

key

policy

insights

that

can

be

gleaned

from

these

analyses

of

potential

program

COStS

of

S.

2191.

The

economic

modeling

studies

reviewed

for

this

analysis

are

rhen

briefly

discussed,

including

key

assumptions

and

resulrs.

Modeling

Insights

The

availability

of

advanced,

low-carbon

technologies

is

cnlciat

to

minimizing

the

costs

of

achieving

GHG

reductions.

Models

thar

constrain

the

use

of

potential

technologies

dramatically

increase

the

costs

of

reducing

emissions.

For

example,

the

ACCF/NAM

model

constrains

the

future

deployment

of

nuclear

energy

so

that

less

electricity

is

delivered

from

nuclear

facilities

in

the

High

Cost

Scenario

than

is

projected

under

business

as

usual

forecasts

{developed

by

DOE's

Energy

Information

Administration

3

}.

Similarly,

rhe

amount

of

electricity

delivered

by

wind

power

is

also

constrained

to

an

annual

deployment

level

lower

than

was

actually

delivered

in

2007.

The

ACCF/NAM

model

restricts

additional

wind

capaciry

to

5

GW/year

for

the

Low

Cost

Scenario

and

3

GW/year

in

the

High

Cosr

Scenario.

According

to

the

American

Wind

Energy

Association,

rhere

was

an

addirional

5.244

GW

of

wind

capacity

added

in

2007.

4

The

resule

of

these

restrictions

is

that

the

costs

from

this

model

fall

far

outside

the

range

of

other

modeling

dforts.

The

ceorral

policy

insight

is

that

we

need

to

take

steps

to

ensure

that

advanced

low

carbon

technologies

are

deployed

{and

not

JUSt

developed}.

Ifby

2030

we

do

not

have

greater

deployment

of

2

IN

BRIEF

simulate

the

bill's

energy

efficiency

provisions

{for

example,

EIA

and

CATP}

anticipate

lower

allowance

prices

and

consumer

energy

bills.

Flexibility

in

the

timing

ofGHG

reductions

through

approachcs

such

as

banking

and

borrowing

keeps

costs

down

over

time.

Those

modeling

efforts

that

do

not

incorporate

the

banking

and

borrowing

provisions

provided

for

in

S.

219\

(such

as

ACCF/NAM

and

CRA's

no-banking

analysis)

result

in

higher

overall

impacts

on

GOP.

Modeling

efforts

that

do

incorporate

the

banking

provisions

often

show

higher

near~term

allowance

prices

because

firms

hold

additional

allowances

in

anticipation

of

higher

future

prices;

however,

this

ability

to

bank

allowances

reduces

overall

program

COStS

in

the

longer

term.

The

more

offsets

includcd

in

a

program,

the

lower

the

costs.

All

of

the

models

consistently

demonstrate

that

one

of

the

most

important

drivers

of

carbon

allowance

prices-in

some

modeling

exercises,

the

most

important

driver-is

the

availability

of

offsets.

The

model

scenarios

that

limit

offsets

below

the

total

of

30%

(international

credits

plus

domestic

offsets)

provided

for

in

S.

2191

show

signiflcantly

higher

cosrs.

EPA's

sensitivity

analysis

using

IGEM

found

that

if

international

credits

were

not

allowed

and

domestic

offsets

were

held

at

15%,

allowance

prices

increased

by

34%.

Further,

when

international

credits

and

domestic

offsets

were

not

allowed

at

all,

allowance

prices

in

the

model

increased

by

93%

above

estimates

that

included

the

full

30%

offsets,

as

in

the

bill.

Some

sectors

will

provide

greater

oppornmities

for

reductions

than

others

in

the

short

term.

Across

the

models,

the

largest

share

of

near-term

emissions

reductions

come

from

the

electricpower

sector

(through

efficiency

improvemcnrs

by

industry

and

consumers

and

through

fuel

switching).

Across

most

models,

fuel

switching

in

the

ncar

to

medium

term

creates

winners

(natural

gas

and

renewable

generation)

and

losers

{coal};

however,

in

the

longer

term,

the

loss

to

the

coal

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

(CCS)

plays

a

potentially

large

role

assuming

adequate

provisions

are

made

for

its

use.

Analyses

that

assume

a

rapid

deploymem

orces

andlor

improved

capilal

cons

over

time

(such

as

MIT's

EPPA,

EPA's

ADAGE,

and

CATF's

NEMS)

rypically

result

in

more

coal

usc

over

the

longer

term

and

a

lower

economic

impact

ro

the

electric

power

generating

secmr

and

the

broader

economy.

Those

that

restrict

this

deploymclH

(such

as

EIA's

High

COSt

and

Limited

Alternatives

Cases

5

and

ACCF/NAM)

rcsult

in

more

fuel

switching

to

natural

gas.

largcr

impacts

on

coal

production

and

ultimately

higher

overall

impacts

on

the

economy.

Climate

policies

such

as

S.

2191

will

still

allow

the

economy

to

grow

robustly.

It

is

imponanr

to

note

that

projections

of

changes

in

Gross

Domestic

Product

(GDP)

across

all

of

the

models

reflect

a

reduction

in

future

expected

growth-never

an

absolute

reduction

(see

Table

I).

For

2030,

reductions

from

BAU

forecasts

of

GDP

vary

across

models

from

0.3%

ro

2.7%

bur

the

ACCF/NAM

analysis

(which

is

not

fully

representative

of

the

key

policy

elements

of

S.

2191)

is

a

clear

outlier.

In

all

of

these

cases,

including

the

most

pessimistic,

the

by

2050.

Thus,

decreases

from

future

GOP

are

quite

small

compared

ra

the

overall

economic

growth

over

the

time

period

considered.

For

example,

in

ETA's

analysis,

GOP

grows

183%

from

2005

ro

2030

in

the

S.

2191

core

(policy)

scenario

compared

to

184%

in

the

reference

case.

For

context,

this

means

that

the

economy

would

be

less

than

2

months

behind

BAU

levels

in

2030

wirh

GHG

caps.

Consideration

of

the

range

of

uncertainty

in

the

model

is

important

for

putting

the

potential

cost

impacts

of

a

policy

in

perspective.

Uncertainty

abom

the

types

of

technology

that

will

be

available

in

20,

30,

or

even

50

years

is

significant.

Who

would

have

predicted

back

in

the

1950s

rhe

computing

or

communications

capabilities

we

have

raday?

Further,

predicting

how

our

economy

will

grow

is

also

rife

wirh

uncertainty.

In

rhe

six

modeling

exercises

rhar

we

examined.

rhe

difference

benveen

referencc

case

GOP

(that

is,

furure

GOP

in

the

absence

of

climate

policy)

in

2030

was

almost

3

trillion

dollars,

represenring

a

difference

of

morc

than

10

percent.

Predicted

impacts

(for

example,

the

0.44%

reduction

in

2030

GOP

from

BAU

suggested

by

the

MIT

model)

in

lighr

of

rhis

large

uncertainry

seems

insignificant.

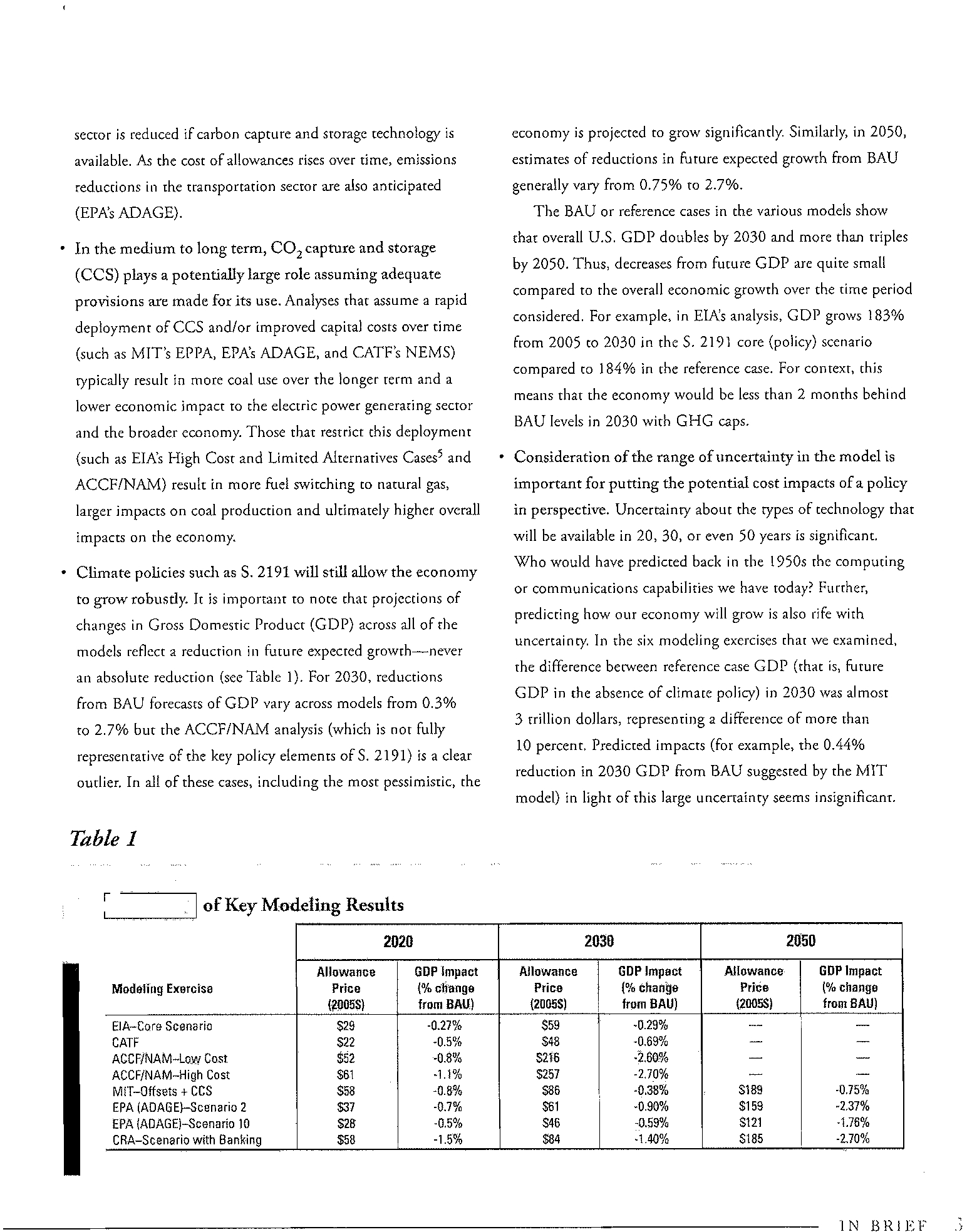

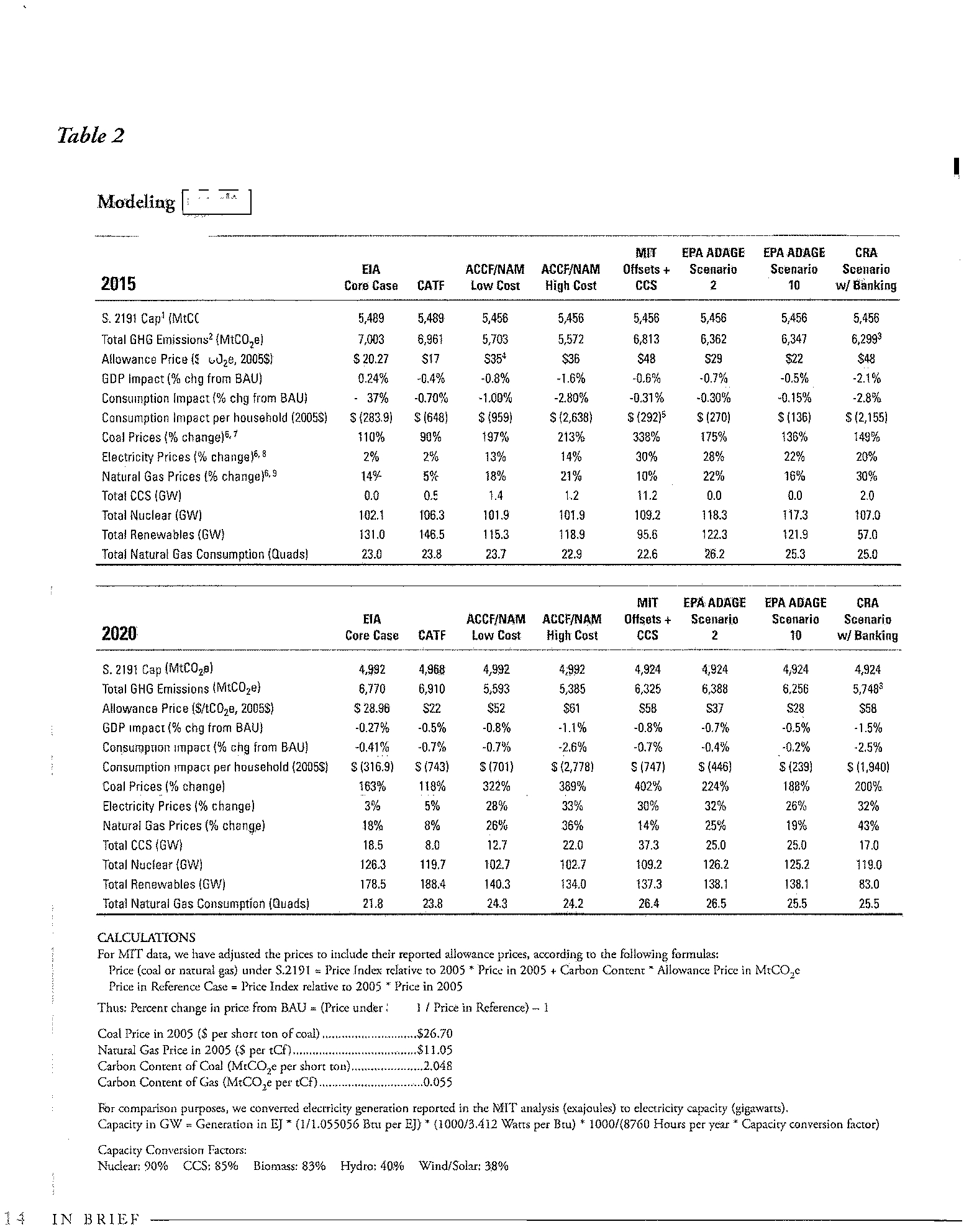

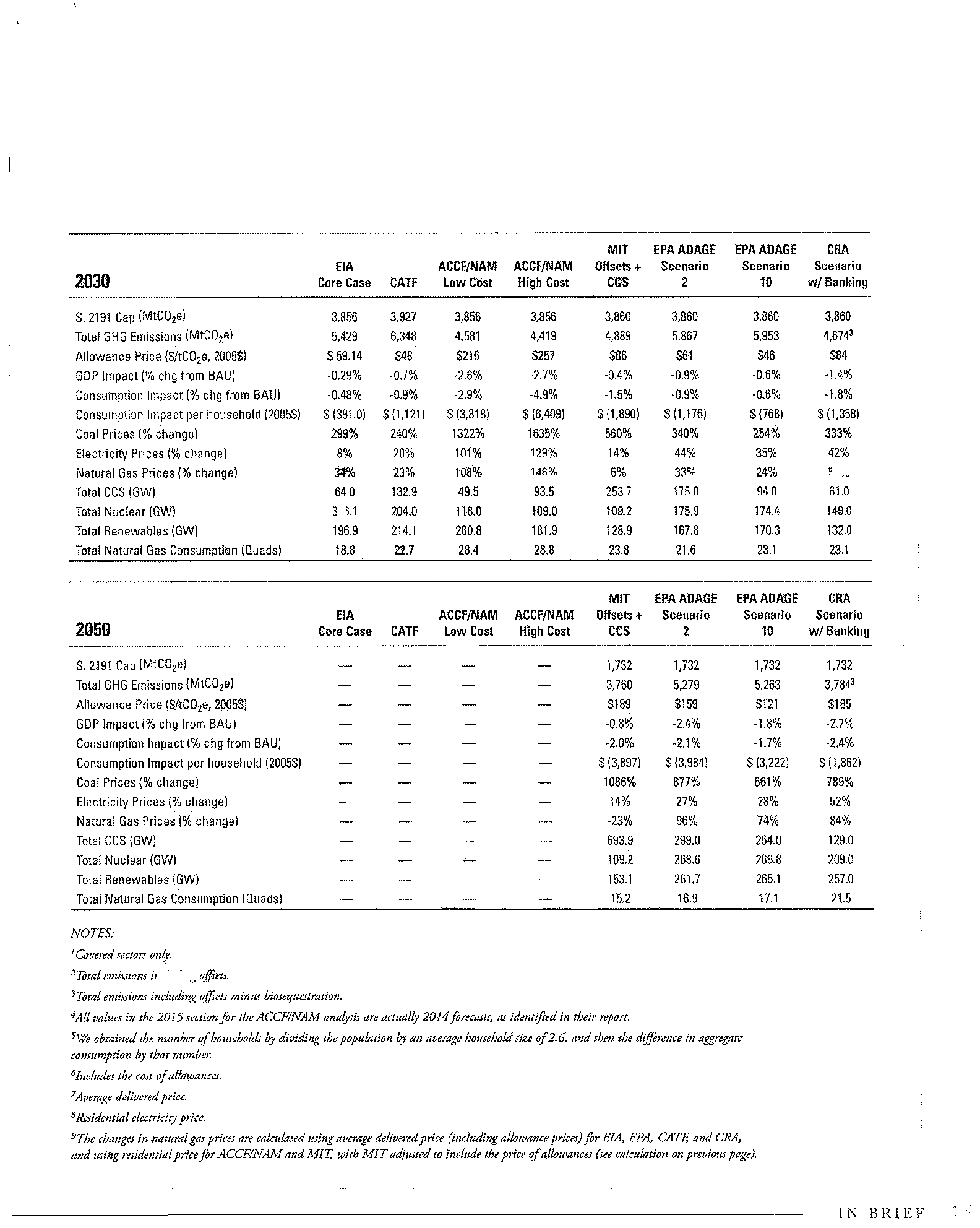

Table

1

2020

2030

2050

Allowance

GOP

Impact

Allowance

GOP

Impact

Allowance

GOP

Impact

Modeling

Exercise

Price

la~

change

Price

(~'a

change

Price

(%

change

I200SS)

from

BAU)

12005S)

from

BAUI

12005S1

from

BAUI

EIA-Core

Scenario

$29

1-

-0.27%

S59

-0.29%

-

-

CATF

S22

.0.5%

S48

-0.69%

-

-

ACCF/NAM-low

Cost

512

.0.8%

5116

I-

-2.60%

-

-

-

ACCF/NAM-High

Cost

S61

n

-1.1%

5157

-2.70%

-

-

MIT-Qffsets

+

CCS

S58

.0.8%

S86

-0.38%

-

S189

.0.75%

EPA

IAOAGE)-Scenario

2

S37

-0.7%

S61

-0.9Q%

S159

-2.37%

EPAIADAGE)-Scenanol0

528

.0.5%

S46

-0.59%

S121

.1.76%

eRA-Scenario

with

Banking

S58

-1.5%

S84

.1.40%

S185

.2.70%

I

Summary

I

of

Key

Modeling

Results

IN

BRIEF

.,

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Out

co

2030.

NEMS

explicitly

represents

the

decisions

involved

in

the

production,

conversion,

and

consumption

of

energy

products.

It

consists

of

separate

modules

that

represent

various

aspects

of

energy

markets

and

macroeconomic

activity:

four

supply

secrors

(oil

and

gas,

natural

gas

transmission

and

distribution,

coal,

and

renewable

fuels);

twO

conversion

processes

(electricity

and

petroleum

refineries);

fouf

modules

for

end-use

demand

(residential,

commercial,

transportation,

and

industrial);

one

co

simulate

energy/economy

interactions

(macroeconomic

activity);

one

module

{Q

simulate

world

oil

markets

(international

energy

activity);

and

an

integrating

module

that

provides

the

mechanism

co

achieve

a

general

market

equilibrium

among

all

the

other

modules.

6

The

analysis

applies

the

version

of

NEMS

used

for

the

2008

Annual

Energy

Outlook

projections,

which

includes

the

impact

of

the

Energy

Independence

and

Security

Act

of

2007,

as

well

as

revised

expectations

about

economic

growth.

ELA's

reference

case

(called

"BAU"

here)

includes

current

laws

and

legislation

in

addition

co

energy

market

changes

over

time,

including

compliance

with

future

Corporate

Average

Fuel

Economy

(CAFE)

and

efficiency

standards,

andthe

continucd

penetration

of

more

efficient

energy

technologies

to

meet

new

demand

for

appliances,

vehicles,

buildings,

and

othcr

facilities,

cogethcr

with

advances

in

cncrgy

production

facilitics.

4

IN

BRIEF

residential,

commercial

and

industrial

natural

gas

and

petroleum

use

(upstream)i

Domestic

and

international

offsets

can

each

be

used

to

meet

up

to

15%

of

the

compliance

obligation;

There

are

no

limits

on

the

number

of

allowances

that

can

be

banked

for

future

years.

For

covered

entities

co

be

able

to

meet

more

stringent

caps

post-2030,

EIA

assumes

that

the

bank

will

have

a

balance

of

S

billion

metric

tons

at

the

end

of2030.

Although

the

bill

has

a

borrowing

provision,

EIA

assumes

that

covered

entities

comply

without

borrowing;

BOrIl

natural

gas

and

coal

would

be

eligible

for

the

CCS

credit

and

bonus

allowance

allocations

from

Title

III

of

the

bill;

To

simulate

the

energy

efficiency

provisions

in

the

bill,

EIA

reduccd

the

cost

of

energy-efficient

appliances

for

end-uscrs

by

half

and

tightened

residential

building

codes

by

30%

in

2015

and

50%

in

2025;

and

EIA

also

assumed

that

the

10%

of

allowances

allocated

to

Load-Serving

Entities

(LSEs)

and

rural

electric

cooperatives

were

used

to

reduce

electricity

prices.

The

analysis

does

not

include

the

separate

caps

for

HFCs

(Tide

X)

or

the

Low

Carbon

Fuel

Standard

(LCFS)

(Tide

XI).

Allowance

allocations

ro

fossil

fuel

generacors

are

also

nor

covered

in

rhe

model.

For

the

S.

2191

core

scenario,

the

bill

is

analyzed

based

on

rhese

assumptions.

ElA

also

examines

the

effects

of

varying

international

offsets

and

the

cosrs

and

availability

of

electricity

generating

rechnologies,

through

four

alternative

scenarios.

8

While

ElA

ran

a

number

of

scenarios

for

the

sake

of

model

comparison,

(he

focus

here

is

on

cases

representative

of

S.

2191.

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

ErA

forecasts

that

GHG

caps

will

have

limited

impacts

on

the

U.S.

economy

compared

to

ocher

analyses

discussed

in

this

brief.

The

key

resulrs

from

the

modeling

analysis:

In

the

S.

2191

core

scenario,

total

greenhouse

gases

(including

offsets)

are

7,003

MtC0

2

e

in

2015

and

decrease

to

5,428

MtC0

2

e

by

2030.

Allowance

prices

are

S20/tC0

2

e

in

2015

and

rise

to

559lcC0

2

e

by

2030

(20055).

GDP

is

0.24%

lower

in

the

core

scenario

than

the

UAU

scenario

in

2015

and

0.3%

lower

in

2030.

Under

S.

219\,

G

DP

grows

183%

from

2005

ro

2030

compared

to

184%

in

the

reference

casc;

this

means

that

the

economic

growth

would

be

less

than

2

months

behind

BAU

levels

in

2030

with

GHG

caps.

Electricity

prices

increase

by

about

8%

in

2030

from

BAU

levels

in

the

core

scenario

(this

includes

the

cost

of

allowances).

This

is

lower

than

projections

from

the

other

models,

perhaps

due

to

more

optimistic

assumprions

abom

the

benefit

of

allowance

allocations

to

LSEs

and

electric

cooperatives

in

reducing

COSts.

Electriciry

demand

is

about

5%

lower

in

2030

from

the

reference

case.

]n

terms

of

electricity

generation,

the

analysis

predicts

that

new

coal

builds

without

CCS

are

almost

eliminated.

For

the

S.

2191

core

scenario,

64

GW

of

new

coal

generation

with

CCS

is

built

by

2030,

and

overall

coal

consumption

is

74%

lower

than

the

reference

case.

The

introduction

of

coal

wirh

CCS

is

largely

driven

by

the

bonus

allowance

provision

which

makes

CCS

more

economically

viable.

86%

over

the

time

period.

Renewable

capacity

more

than

doubles

from

2005

to

2030

(an

increase

of

more

than

100

GW),

mainly

due

to

an

expansion

in

wind

generation,

followed

by

biomass.

In

the

Limited

Alternatives

Case.

where

nuclear

growth

is

constrained

to

BAU

levels

(17

GW

over

the

time

period),

the

increase

in

renewable

capaciry

is

much

greater,

above

300

GW.

Under

dle

S.

2191

core

scenario,

nanlral

gas

generation

is

17%

lower

than

the

reference

casc,

due

to

a

reduction

in

encrgy

demand

and

increase

in

renewable

and

nuclear

capacity.

Total

natural

gas

consumption

decreases

over

the

time

period

of

the

analysis,

and

gas

prices

increase

by

aboU(

35%

from

the

BAU

level

in

2030

(this

includes

the

COSt

of

the

carbon

allowances).

In

the

Limitcd

Altcrnatives

Case,

which

constrains

both

CCS

and

nuclear

technologies.

natural

gas

consumption

is

12%

above

reference

case

levels

in

2030,

due

co

fuel

switching

and

increased

natural

gas

generation.

Offsets

playa

key

role

in

reducing

costs

in

the

program.

In

the

core

scenario,

the

15%

Iimir

on

offsets

becomes

binding

in

2016

for

international

allowances

and

2025

for

domestic

offsets.

In

an

alternate

scenario

with

no

international

credits,

allowance

prices

are

much

higher

than

the

other

scenarios

from

2012

co

2016,

as

covered

enriries

rely

on

fuel

switching

and

early

investments

in

efficiency

and

carbon~neutral

technologies.

The

analysis

demonstrates

that

inrernational

offsets

play

an

importanr

role

in

mitjgating

COStS

in

the

early

years

of

the

program.

IN

BRIEF

:;

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

uses

data

from

ErA's

Annual

Energy

Oudook

2007

but

also

includes

the

new

Corporate

Average

Fuel

Economy

Standards

enacted

in

December

2007.

The

CATF

analysis

captures

the

following

provisions

of

rhe

bill:

Emissions

from

the

following

sources

arc

covered:

coal-fired

electrical

and

industrial

boilers,

petroleum

use

in

transportation

(upstream),

and

residential,

commercial

and

industrial

natural

gas

and

petroleum

use

(upstream),

all

of

which

represent

about

86%

aftatal

U.S.

GHG

emissions;

Offsets

can

be

used

to

meet

up

to

30%

of

the

compliance

obligation

(the

bill

allows

for

15%

offsets

and

15%

from

international

allowance

markets);

There

are

no

limits

on

the

number

of

allowances

that

can

be

banked

for

future

yearsj

The

various

provisions

for

the

use

of

auction

revenues

arc

included

in

the

model

via

a

production

tax

credit

for

CCS

and

a

wind

production

tax

credit

to

2030j

and

To

simulate

the

energy

efficiency

provisions

in

the

bill.

CATF

uses

EIA's

Best

Available

Technology

easc,

which

assumes

that

consumers

choose

the

highest

efficiency

equipment,

regardless

of

cost.

to

The

analysis

does

not

consider

the

impact

of

the

LCFS,

the

effects

of

the

Carbon

Market

Efficiency

Board,

or

the

provisions

which

allow

borrowing

(included

in

the

bill

to

contain

costs).

The

CATF

analysis

uses

the

standard

NEMS

technology

assumptions

for

the

electricity

market,

II

but

limits

the

introduction

of

biomass

power,

due

to

competing

uses

for

biomass

from

rhe

transportation

sector

and

the

uncertain

GHG

benefits.

There

are

no

constraints

on

other

technologies,

including

nuclear

power.

(,

IN

BRIEF

modeling

analysis:

Total

greenhouse

gas

emissions

(including

offsets)

are

6,961

MtCO,e

in

2015

and

decrease

to

6,348

MtCO,e

by

2030.

Allowance

prices

arc

SI7/tC0

2

e

in

2015

and

rise

to

S48/tCO,e

by

2030

(20055).

With

S.

2191,

GDP

is

about

0.4%

lower

from

the

BAD

scenario

in

2015

and

0.7%

lower

in

2030.

GOP

grows

102%

from

2005

to

2030

compared

to

104%

in

the

reference

case;

the

slower

growth

ratC

under

S.

2191

means

that

the

economy

would

be

ahollt

4

months

behind

BAU

levels

in

2030.

Electricity

prices

increase

by

20%

and

natural

gas

prices

by

about

23%

in

2030

from

BAD

levels

(these

price

increases

include

the

cost

of

allowances).

This

is

lower

than

projections

from

most

of

the

other

models,

perhaps

due

to

more

optimistic

assumptions

about

the

ratc

of

efficiency

improvements

and

decrease

in

electricity

demand.

The

model

predicts

a

considerable

drop

in

energy

use

due

to

increases

in

both

energy

efficienc)'

and

the

response

to

higher

electricity

prices.

This

translates

to

a

20%

decrease

in

electricity

generation

compared

to

the

reference

case

in

2030.

Thus,

at

the

consumer

level,

monthly

electric

bills

are

on

average

lower

relative

to

the

reference

case

(although

in

three

electricity

regions

price

impacts

are

slightly

higher

than

in

the

reference

case).

In

terms

of

the

generation

mix,

the

model

shows

no

switching

to

natural

gas

as

a

"bridge

fuel"-a

combined

effect

of

the

production

incentives

for

CCS

along

with

the

reduced

energy

use.

Coal

generation

drops

by

14%

from

current

levels,

with

a

total

133

GW

of

IGCC

with

CCS

built

by

2030.

The

model

also

predicts

new

nuclear

generation

of

abollt

104

GW

by

2030,

increasing

cotal

capaCity

to

about

204

GW,

and

an

expansion

of

renewable

generation

to

2]4

GW

of

total

capaciry.

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

The

analysis

of

S.

2191

conducted

by

Science

Applications

International

Corporation

(SAle)

on

behalf

of

the

ACCF

and

NAM

uses

the

Energy

Information

Administration's

(ETA)

NEMS

moddY

This

analysis

incorporates

many

of

the

provisions

in

the

bill

in

estimating

both

a

Low

and

a

High

Cost

Scenario,13

but

also

includes

several

key

constraining

assumptions

regarding

rhe

cost

and

availability

of

new

energy

technologies

and

other

factors.

In

particular,

banking

is

not

included

in

the

analysis,

even

{hough

it

is

allowed

in

S.

2191.

Furthermore,

both

the

Low

and

the

High

Cost

Scenarios

involve

limited

availability

of

offsets.

Iii

The

ACCF/NAM's

analysis

contains

the

following

assumptions

abom

availability

of

technology:

The

constraint

on

nuclear

allows

only

10-25

GWof

additional

capacity

by

2030.

Limited

use

of

renewables:

both

scenarios

limit

new

technology

builds

for

both

biomass

and

wind.

For

example,

the

Low

Cost

Scenario

assumes

a

maximum

5

GW/year

of

new

wind

power

deployment,

which

is

lower

than

the

actual

amount

of

wind

power

built

in

2007

(5.244

GW).

Finally,

the

analysis

does

not

explicitly

model

the

CCS

bonus

allowance

provision

or

the

funds

generated

by

the

bill's

auction/allocation,

but

does

assume

that

the

revenue

from

the

sale

of

allowances

is

redistributed

to

the

individual

energy

sectors.

15

Key

Results

The

ACCF/NAM

model

shows

relatively

high

allowance

prices,

in

part

due

to

limitations

on

offsets,

constraints

on

technology,

and

the

elimination

of

the

banking

provision

contained

in

the

bill.

2020

and

2.6%

and

2.7%

lower

for

the

two

scenarios

in

2030.

GDP

grows

by

183%

under

the

S.

2191

scenarios

versus

188%

in

the

reference

case;

this

correlates

toabout

a

13-month

lag

in

GDP

ftom

BAU

levels.

Electricity

prices

arc

projected

to

increase

by

28%

and

33%

by

2020,

and

101%

and

129%

by

2030,

fot

the

Low

and

High

Cost

Scenarios}

respectively.

These

increases

include

the

cost

of

carbon

allowances.

Coal

generation

without

CCS

declines

significantly

by

2030

in

both

cases.

In

the

Low

COSt

case,

there

is

about

50

GW

of

CCS

capacity

added

by

2030

(93.5

GW

for

the

High

COSt

case).

The

analysis

limits

nuclear

deployment

in

both

cases.

By

2030,

there

is

an

additional

18

GW

of

nuclear

capacity

built

in

the

Low

Cost

Scenario

and

only

9

GW

for

the

High

COSt

Scenario.

In

comparison,

ElA

assumes

that

the

business

as

usual

growth

in

nuclear

generation

will

add

an

additional

15

GW

of

capacity

by

2030.

16

With

the

constraints

on

nuclear

and

slower

deployment

ofCeS,

natural

gas

becomes

the

predominant

fuel

for

electricity

generation

after

2025.

Natural

gas

prices

increase

by

108%

and

146%

from

BAU

levels

in

2030,

for

the

Low

and

tbe

High

Cost

Scenarios,

respectively.

Natural

gas

consumption

increases

by

more

than

20%

from

2015

to

2030

in

both

scenarios.

Renewable

generation

shows

strong

growth

in

bodl

the

Low

and

the

FIigh

Cost

Scenarios

despite

the

limitations

imposed

on

both

wind

and

biomass

of

5

GW

(Low

Cost)

and

3

GW

(High

Cost)

per

year.

Renewable

generation

capacity

nearly

doubles

by

2030

in

both

cases.

Gasoline

prices

increase

50.43-51.46

per

gallon

in

2020

and

51.78-53.35

pet

gallon

in

2030.

IN

BRIEF

Electronic Filing - Received, Clerk's Office, October 1, 2008

* * * * * PCB 2009-021 * * * * *

Policy

of

Global

Change

(Paltsev

et

al.)

investigate

the

economic